Robotic process automation (also known as RPA) refers to the use of software robots (or similar virtual assistants) which are programmed to complete repetitive and labor-intensive tasks. This makes them ideal for numerous applications in banking. “RPA-friendly” tasks include sending emails, opening applications, and copying and pasting information from one banking system to another. Implemented effectively, RPA can drastically reduce manual work, so that human employees can focus on more complex banking operations work, human interaction, and decision-making. In fact, robotic process automation in banking can reduce the need for repetitive manual work tasks, data reconciliation, and transcription—up to 70 percent.

https://youtu.be/KrrLrxzPnEM

Today, RPA is poised to change the way banks conduct business—and to make this change faster than any other technology currently available. That’s because robotics in banking represents the “consumerization” of banking automation: Instead of being forced to rely on complex codes and IT department intervention, front-line banking employees can automate their own work, once trained properly.

Table Of Contents (click to jump to chapter)

-

1. What is RPA in banking?

-

2. Benefits of Robotics in Banking

-

3. What is a Banking RPA Use Case?

-

4. Banking RPA Use Case Examples

-

5. Banking RPA Case Studies

-

6. How to Implement RPA in a Bank

-

7. Robotics in Banking Infographic

-

8. How to Implement RPA at Your Bank

-

9. Risks of RPA in Banking

Robotic process automation in banking: Underutilization and opportunities

RPA is growing rapidly. Recent RPA trends and forecasts anticipate that the market for robots in knowledge-work processes will reach $29 billion by 2021. That’s a dramatic increase from the $250 million it had commanded back in 2016, when it first made its mark as a mainstream process-improvement tool.

Search trends on Google show just how much the demand for robotics in banking has grown since 2016.

For the banking industry, robotics represents a new—and wholly underutilized—way to increase productivity, while minimizing traditional repetitive, manual-labor-intensive processes. RPA in banking threatens to disrupt business-process-outsourcing models, as it provides a lower-cost, higher-productivity model.

Still, RPA for banking operations is not a “silver bullet.” It cannot fix processes that are broken in the first place, despite the claims of some consulting firms. Indeed, it’s important to realize that many firms have a tendency to over-promise on RPA’s abilities, while failing to mention that simply layering RPA on top of suboptimal banking processes will neither address nor fix the root cause of organizational process problems.

The key to successful RPA in banking is scaled process standardization. In this article about RPA in banks, we will review exactly what RPA is, how it can be used, the risks of using it, and how to implement it while standardizing processes at scale.

For a deep dive into knowledge work standardization, be sure to read The Lab’s long-form explainer here: Standardization in Business

1. What is robotics process automation in banking?

Robotics in banking is defined as the use of robotic process automation software like UiPath, Automation Anywhere, or Blue Prism, to install desktop and end user device level software robots, or an artificial intelligence workforce, or assistants, to help process banking work that is repetitive in nature. Once set up and implemented, banking robots take control of mouse and keyboard actions such as opening applications, clicking, copying and pasting information from one banking system to another, sending emails and other labor-intensive “low-value add” tasks. These robots work at the individual data field level and act similar to an Excel macro across banking software systems.

Want to learn how The Lab can help standardize your processes for RPA implementation, or even implement robots for you? Click here.

Established banking institutions have historically relied on multiple legacy core systems. But the operational benefits of these systems were typically oversold at the time of acquisition; more often than not, the implementation under-delivered and fell short of automation promises. The result is a banking industry in which large amounts of manual work still must be performed daily within, outside of, and in between multiple core banking systems, all in an effort to reconcile and transcribe data to process transactions. Thus in an industry rife with large-scale white-collar work processing, the result tends to snowball, as banks and their IT departments struggle to merge different legacy systems into a coherent workflow.

Robotics enables the banking industry to integrate “the last mile” across business units like never before. RPA in banking use cases apply to a wide range of processes, including retail branch processes, commercial lending, consumer lending, loan processing, underwriting, and anti-money-laundering, just to name a few.

While the prospect of implementing robotics into banking operations may seem daunting, it’s actually easier than most companies selling it would lead you to think. Buyer beware: If the same big technology consulting company that sold your bank legacy systems with the promise of “straight-through processing” is now trying to sell you RPA, you might want to consider other options.

Here, then, are numerous RPA banking use cases that show how surprisingly easy it is to implement robotics—provided you do the required front-end process analysis and work standardization first.

Three Real Life Video Examples of Robotic Process Automation Bots Implemented by The Lab Consulting on Common Banking Processes

Banking RPA Video Use Case and Case Study # 1 – ACH Stop Payment Processing

Banking RPA Video Use Case and Case Study # 2 – Debit Card Fraud Processing

https://www.youtube.com/watch?v=phh75Gjz-3Y

Banking RPA Video Use Case and Case Study # 3 – Regulation D Violation Letter Processing

2. Top 7 Benefits of Robotic Process Automation in Banking

Retail and commercials banks alike are facing increased pressure from management, shareholders, and external competition (such as fintech companies) to reduce costs, increase product quality, and accelerate the processing of back-office work. When paired with the right type of process analysis, robotics can help banking operations management tackle most large-scale and routine data-movement tasks. They can also implement it with unprecedented speed—on the order of weeks, not months or years.

The financial benefits of robotics in banking are matched by the improvement it yields in both back-office processes and the customer experience. In short, banks can save money on labor—while doing more with less—with RPA.

Consider the top seven benefits of robotics in banking, especially when compared to traditional automation:

- Banking RPA does not require new core IT infrastructure change or upgrades. To the contrary, it’s a low-cost layer that sits on top and across all currently-installed banking applications.

- There is no coding requirement. Robotics in banking does not require coding experience.

- Implementation is fast. RPA for the banking industry is nimble; robots can be tested in short cycle iterations.

- It’s easy to change. A banking robot can be installed or updated in less than a week when banking processes change.

- Minimal IT intervention is required. Front-line employees can be trained to maintain and “manage” their own banking robots.

- RPA boosts morale. Contrary to popular opinion, banking robotics can actually increase (and not decrease) the morale of human workers by reducing the burden of boring data-entry work.

- Robots don’t need breaks. Banking robots can work 24/7—365 days per year. Banks don’t have to pay robots overtime or health insurance, or worry about them quitting.

3. What is an RPA Use Case in Banking?

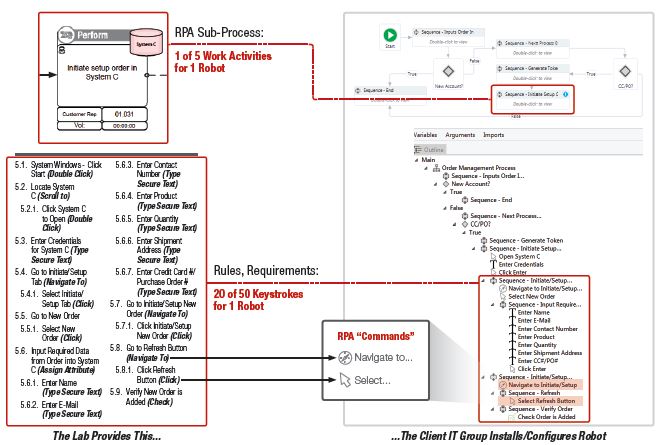

A banking robotic process automation use case is defined as the process of documenting a list of banking operations actions or steps that take place on front-line employee level computers, or other electronic devices, that is used to automate information movement across banking applications. Banking RPA use cases are used as process “blueprints” by IT consultants (or your own staff) to implement automated scripts that run across multiple data-processing IT systems simultaneously.

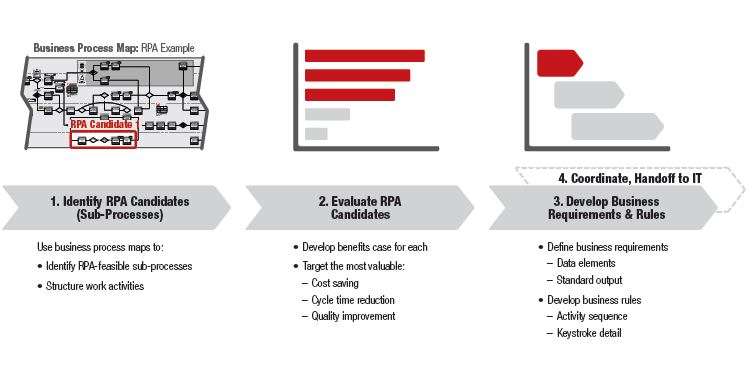

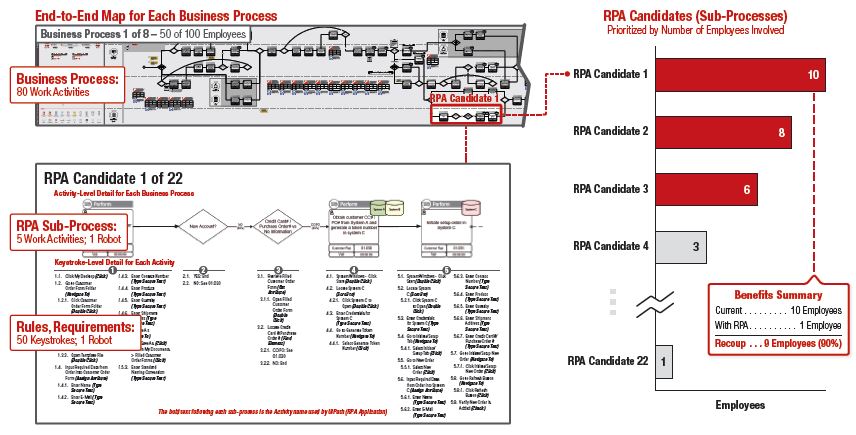

How, then, do you develop RPA banking use cases? Simply follow the three-step process is detailed in the infographic below.

RPA in Banking Use Case Implementation Step 1: Identify sub-processes on process maps where banking robots can be implemented.

RPA in Banking Use Case Implementation Step 2: Prioritize and evaluate all of the banking sub-processes, targeting those candidates which will yield the most benefits.

RPA in Banking Use Case Implementation Step 3: Develop and document the use-case requirements, rules, and keystrokes that the banking robot must perform.

4. Three Examples of Robotic Process Automation Use Cases in Banking:

RPA in banking yields the most benefits when led with deep front-line process analysis and a desk-level work standardization plan across the organization. RPA in banking yields the greatest value when preceded by deep front-line process analysis and a desk-level work-standardization plan across the organization; consider these three high-level examples of RPA in banking:

Three high level examples of RPA in banking are below:

- Robotic Process Automation Use Case 1: Consumer loan-processing time can be reduced from 30 minutes to just ten minutes by eliminating the copying-and-pasting of customer information from one banking system to the next.

- Robotic Process Automation Use Case 2: It is now possible to boost the accuracy of new-bank-account-opening requests, replete with reduced downstream errors, and improved system data quality. All of this can be achieved by eliminating data-transcription errors from inbound new-bank-account-opening-request emails into the core banking system.

- Robotic Process Automation Use Case 3: Banks can radically boost the speed of customer verification during the processing of auto loans by automatically validating customer data on government websites such as DMV, tax payment, or property-appraisal sites.

A Detailed Use Case of Robotics in Banking Operations—RPA in Consumer Loan Processing

In this robotics-in-banking use-case example, we’ll follow Cathy, a consumer loan processor who’s getting ready to do her daily job: handling the application from a prospective borrower.

Normally, this takes Cathy at least 20 minutes, per customer, per loan application. That’s because 80 percent of the work she does is manual: She needs to copy and paste information between email, multiple loan-processing systems, credit bureaus, and several government websites. It’s difficult, demanding, time-consuming, and tedious work; consider the pre-RPA banking use case process:

- When a customer requests a new consumer loan or line of credit, a call center representative, branch employee, or website captures the data into Loan Processing System 1.

- Once Cathy receives the information, she runs a manual credit check. She does this by transcribing data from the loan-processing system into an external website to pull the credit report.

- Cathy then saves the credit report as a PDF and attaches it to Loan Processing System 1.

- Cathy then copies and pastes the credit score into a field in Loan Processing System 1.

- Once the credit check is complete, Cathy transcribes the data from Loan Processing System 1 into two other core banking systems.

- Cathy then logs into a government website to the validate customer address and appraisal from supplied documents. She does this, not surprisingly, by copying all of the information from Loan Processing System 1 and pasting it into the website to validate the address of the customer requesting the credit.

- Once the information is confirmed, Cathy prints it as a PDF, attaches it to Loan Processing System 1.

Again, all of this is done by hand. Cathy runs through these exact same steps about 20 times a day: that’s her maximum capacity. Of course, 80 percent of her capacity is spent—or perhaps “wasted”—on manual copying-and-pasting.

Now consider the exact same scenario, upgraded through the implementation of banking robotics. The banking RPA use case is transformed, almost magically, for a diligent worker like Cathy:

- Cathy receives the loan package in the system just as she did before.

- Cathy launches her UiPath robot. It then logs into Loan Processing System 1 and automatically pulls all the information needed to process the credit check.

- The robot opens the credit-reporting website. It runs the credit check by pulling the information out of Loan Processing System 1.

- The robot creates a PDF copy of the credit report, attaches it to Loan Processing System 1, and copies the credit score into the “Credit Score” field in the system.

- The robot then pulls the loan data received in Loan Processing System 1 and transcribes it into the other two core banking systems.

- The robot logs into the government website, enters the necessary data to run the address check, and validates the property appraisal and customer address.

- Finally, the RPA bot saves the address check and appraisal PDF to Loan Processing System 1.

What used to take Cathy 80 steps to complete now requires a single mouse-click. What used to eat a full 20 minutes of her day now takes just five. Importantly, Cathy is not only faster; she’s now free to focus on delivering an exceptional banking customer experience—instead of just moving data around. It’s little wonder that loan processors like Cathy consider robotics in banking to be such a boon to their productivity, and a morale booster, too.

To see a banking RPA use case for the commercial lending process, please review this link: Commercial Lending – Banking RPA Use Case.

Additional RPA use case examples in financial services can found below:

- Property and Casualty Insurance – Claims RPA Use Case

- How to Automate CARES Act and Paycheck Protection Program (PPP) SBA Loans for Banks and Credit Unions with Robotic Process Automation

- How to Improve Lending Customer Experience with Standardization and Robotic Process Automation

5. Seven Case Studies of Robotic Process Automation in Banking

According to P&S Market Research, the global robotic process automation market is projected to reach $8.6 billion by 2023. In the banking industry, robotics process automation (RPA) is gaining traction, with adoption rates increasing pace since mid-2016. And while implementation of this technology is still relatively new in the financial-services sector, there are many processes, operations, transactions, and work tasks which can benefit from RPA.

To help you understand—and gain inspiration from—the way RPA is being implemented in the banking industry, consider the following seven case studies, all involving U.S. and European banks that are adopting the technology. (Note that the stories below are ranked in order of total assets, in USD, as noted in the banks’ 2017 annual reports.)

Robotic process automation in banking Case Study 1: BNY Mellon

Clearing trades, boosting accuracy

- $371.8 billion in assets

- More than 30 professionals with RPA experience, per LinkedIn

BNY Mellon is among the more outspoken proponents of robotic process automation in the banking industry. The bank began adopting RPA in 2016; as of 2017, it reportedly had 250 bots in production.

BNY bots are being used, for example, to streamline the firm’s trade-settlement procedures. Tasks include clearing trades, conducting order research, and resolving discrepancies. While human staff require five to ten minutes to reconcile a failed trade, the BNY bot can perform the same procedure in a quarter of a second.

Other RPA benefits noted by the bank include an 88-percent improvement in transaction-processing times and account-closure validations—across five different systems—with an impeccable accuracy rate of 100 percent.

The deployment of the RPA bots at BNY Mellon has allowed banking employees to devote more time to operational quality control and outliers; consider this quote from the bank’s 2017 annual report:

“We have been improving our processes and applying automation tools, such as robotics for routine processing… these tools are increasing efficiency, reducing costs and improving speed and accuracy, which benefits us and our clients. And, our work progresses as we continue to invest in our technology platform and capabilities to advance and enhance our client service.”

Robotic process automation in banking Case Study 2: BB&T Corporation

Big investments in fintech; robotics a priority

- $221 billion in assets

- Operations across 15 states and Washington, D.C.

- 2,200 retail branch locations

- Seven employees with RPA expertise, per LinkedIn

Media reports have discussed this Winston-Salem, North Carolina-based financial institution’s interest in intelligent automation, such as RPA, to improve the efficiency of its operations. This is evidenced by the bank’s reported $50 million investment in fintech companies, making it clear that digitization of company services is a bank priority.

While specific use cases have not yet been shared, similar to SunTrust Bank (case study below), Pega lists BB&T as one of its RPA clients. And according to BB&T’s 2017 annual report, the bank lists “robotics” among eight initiatives to improve its profitability.

Robotic process automation in banking Case Study 3: SunTrust Bank

Speeding training, slashing errors

- $205.96 billion in total assets

- 21 professionals with RPA experience, per LinkedIn

Headquartered in Atlanta, SunTrust Bank operates primarily throughout the Southeast and Mid-Atlantic regions. In an October 2016 presentation, we can find evidence of the bank’s implementation of robotic process automation: At that time, the bank reportedly formed a group within its IT department to support the deployment of banking RPA technology. SunTrust has implemented Pega Robotic Desktop Automation in payment-operations areas such as Consumer Bank Cards, Wires, and ACH.

Among the results delivered by robotics, the bank noted that average transaction speed improved 3.8x, average training time improved 4x, and the average error rate was reduced by an impressive 65 percent.

Other areas where the bank plans to expand RPA integration include wholesale lending, mortgages, treasury implementations, and image services. At the time of the 2016 presentation, the bank had delivered 19 projects, with seven more in progress.

SunTrust’s 2017 annual report notes that the bank is “making significant investments in various forms of automation” including robotics, with a goal of improving effectiveness and giving employees more time to focus on “higher value-added work.”

Robotic process automation in banking Case Study 4: Danske Bank

RPA speeds opening, and closing, of accounts

- $153 billion USD earnings, according to its 2017 annual report

- 40 RPA professionals

A September 2016 presentation to Deloitte Finance Agenda reveals evidence of RPA implementation at Danske Bank. In this presentation, the European banking firm describes a few examples of RPA applications reportedly in development at the time:

- Use-case examples in this RPA implementation include automation of a customer account onboarding process. The purpose is to develop a robot that automates the process of transferring information collected during an onboarding meeting between a bank advisor and a customer. Normally, information is first entered into an onboarding platform; next, the advisor types this information into a customer portal platform. The typing and information transfer takes approximately 20-30 minutes at each meeting.

- Upon review of the impact of this RPA implementation, the bank estimated a development period of just weeks—and efficiency savings of six to seven FTEs, equivalent to 27,300 cases per year. Other projected benefits include reduced errors and a payback of just five days, although the timeframe for this payback (is it, say, over the course of one year?) is unclear.

- Another example is integration of RPA in the process of closing accounts for customers selling a home. The software can be used to “validate if loans have been redeemed and collateral has been deleted” and to complete the closing accounts process and releasing money due to customers. The bank estimates a four-week development period, a return of 1.7 FTEs, and seven months of total time saved.

Currently, Danske Bank has not provided updates on the progress of these initiatives on their website; however, evidence of implementation can be found on LinkedIn: A search for “robotic process automation” yields roughly 40 professionals including software engineers, consultants, operations personnel, and analysts, all indicating expertise in robotic process automation.

Robotic process automation in banking Case Study 5: KAS Bank

Automating activities at scale

- $4.8 billion in assets

- Just a few RPA professionals, per LinkedIn

According to its website, Amsterdam-based KAS Bank first implemented RPA in 2016. Its bots are currently focused on the automation of copy-and-paste activities at scale. In its 2017 annual report, KAS Bank indicates that robotics are involved in roughly 15 processes. The firm reports that the RPA initiatives have delivered cost savings and good results; however, specific details are not included.

In the four-minute video below, you can see how KAS Bank robots assist with the assignment of opening a client curator account:

Robotics are gaining traction at KAS Bank. They’re part of its strategic priorities, as evidenced by a 1.7 million EUR (approximately $1.9 million USD) investment in its “restructuring provision,” which includes robotics and digitalization.

Robotic process automation in banking Case Study 6: Deutsche Bank

Reducing errors and costs

- Over 20 million clients

- $1.68 billion USD in total 2017 assets

- 44 professionals with robotic-process-automation expertise, per LinkedIn

German-based Deutsche Bank is deploying RPA to more efficiently manage repetitive tasks. It has reported 30- to 70-percent automation in areas where the software is integrated—and noted a decrease in the time required for employee training. In its 2017 annual report, Deutsche Bank highlights some specific examples of automation:

“We are modernizing our IT and pursuing the digitalization of our business. Today, our private clients can open an account online in a matter of minutes – and not seven days as before…We have launched robo-advisers (WISE) in the asset management business and in the Private & Commercial Bank (ROBIN). WISE and ROBIN use algorithms to compile a suitable portfolio for our clients. In our other businesses, too, we are utilizing robotics and artificial intelligence to automate what were previously manual processes – this will minimize errors and lower costs.”

While some 2017 reports suggest that Deutsche Bank will replace a significant number of jobs with robots, the bank itself has projected that robots are more likely to complement human employees than replace them outright.

With a new CEO on board as of April 2018, evidence suggests that the bank is attempting to push into a new era—and automation is a priority in its strategy.

Robotic process automation in banking Case Study 7: CB&S Bank

Helping manage the burden of newly-acquired branches

- Headquartered in Russellville, Alabama

- Operates more than 50 branches in Alabama, Mississippi, and Tennessee

- Currently reports over $1.6 billion in assets

- A LinkedIn search for bank employees listing RPA expertise yields no results

Alabama-based CB&S Bank is a client of Orlando, Florida-based EnableSoft—the company behind Foxtrot robotic process automation software since 1995. According to an EnableSoft case study, CB&S was challenged with finding an efficient solution for moving large volumes of data to its core banking system. After purchasing several branches, the community bank had amassed an additional 20,000 customer accounts and 2,500 loans—all of which needed to be moved into the core banking system.

EnableSoft’s RPA software empowered the bank to automate processes on a daily, weekly, and monthly basis. For example, Foxtrot enabled CB&S to load and fund 25 to 40 lines of credit, and close and add addendums to 40 to 50 accounts per week.

You can see how the Foxtrot software works in the three-minute video EnableSoft demo video below:

EnableSoft claims impressive results for its CB&S Bank case study: By deploying its RPA software, the bank was able to reduce the required time for processing lines of credit and addenda from two to three hours to just one hour. EnableSoft further claims that its software helped this community bank save 900 employee-hours over the course of one year.

As you can see from the seven examples above, there are numerous opportunities for RPA in banking. It’s already accelerating the lending process and rendering operations far more cost-effective, saving the banks and their customers time and money.

6. Implementing RPA Use Cases in the Banking Industry – Work Standardization Must Come Before Robot Installation

To help you navigate the process of implementing RPA use cases into your bank, we have listed here the four key steps you must take, either on your own, or with the help of a professional.

Implementing RPA Use Cases in the Banking Industry Step 1: Keep the scope manageable

The first step to an effective RPA use case implementation in the banking industry is determining a manageable scope.

While it may be tempting to set your initial sights on an enterprise-wide scope, but don’t fall into that trap. Despite what some consulting firms might tell you (or try to sell you), starting a robotic process automation banking project on a large scale will only increase your odds of failure.

Instead, think of your initiative as an introductory test drive; you can broaden your scope to include more after you’ve learned your first RPA lessons.

Processes where RPA can be implemented in banking include:

- Account maintenance

- Trial balancing

- Accounting onboarding

- Account closing

- Loan origination

- Account reconciliation

- Account processing

- Commercial banking operations

- Card services

- Exception processing

- Fraud and risk review

- Item processing

- Lockbox operations

- Print and statements

- Wire administration

- Direct loan underwriting

- Loan servicing

- Collateral management and imaging

- Mortgage lending

- Escrow

Financial institutions have multiple divisions in the back office that process and transcribe data all day long, including credit operations, loan servicing, fraud prevention, collections, and loan operations. Of the multiple functions that banking RPA helps with, we’d recommend starting loan or deposit operations.

Benefits of piloting your RPA in banking project with loan or deposit operations

Loan-operations employees deal with vast amounts of data spread across a panoply of systems, fields, and forms. Loan officers, processors, and credit analysts are typically (over)loaded with manual work and customer information, and must deal with redundant data processing from multiple core systems. This makes them ripe candidates for RPA. Thus, start your RPA use-case project with a group of five to 50 employees whom you know are open to change.

7. Robotics in Banking Infographic

We’ve learned through experience that it’s best to limit your pilot scope. This will reduce both the learning curve and risk of project failure. In practical terms, this means identifying use cases for RPA in the banking sector for just a few tasks to start—rather than for each and every process that a bank executes all at once. Remember that organizational change is less painful when served in small doses. Furthermore, our experience shows that once your employees see a banking robot in action, they won’t be threatened. To the contrary, they will be delighted with the possibilities it holds for making their jobs, and their lives, easier.

8. How to Implement Robotic Process Automation at Your Bank

Implementing RPA Use Cases in the Banking Industry Step 2: Determine baseline operational cost

To realize the full scope of financial benefits that could be realized from banking RPA use case implementation, it’s essential to have a baseline for operational costs before you attempt to add robots to your bank. Make sure to allocate the time for this task; it will usually require a week or two. And you’ll need to coordinate with your bank’s HR department to get the cost for each employee in scope.

Remember that you’ll want to measure the costs after your initial attempt to implement RPA, as well as subsequent attempts in the future. This will allow you to show the costs and savings achieved over time with the use of RPA. The best way to make a case for robotic process automation in banking is by demonstrating solid ROI to those who will recognize its benefits most, i.e., senior management. So make sure you have the proof of resulting cost savings before you try and “roboticize” everything.

Implementing RPA Use Cases in the Banking Industry Step 3: Analyze current-state processes

Now comes the time to undertake deep-dive process mapping in your bank. Too many people, unfortunately, want to skip this step. Don’t. It’s the most important one. You’ll need to map all of the systems and people to which you’re considering adding banking RPA use cases. A thorough process analysis of all front- and back-office tasks required for daily operations is essential for determining how RPA can help your bank. You’ll truly need to get down to the “grain of sand at the beach” level of detail to properly document the use cases down to the individual mouse-click.

This can be accomplished by conducting “day in the life of” observations via screen-sharing software. (Alternatively, it can be done via face-to-face observations in person.) You should ideally watch workers perform tasks for a whole week, all day long, to document where banking RPA can be used. Popular platforms for off-site observation include GoToMeeting, Webex, and Team Viewer. Clearly, off-site analysis reduces the cost of having an on-site consultant to analyze the current daily banking operations processes.

Once you’ve completed your shadowing, use a process-mapping program, such as Microsoft Visio, to help you visually represent your steps and build your banking RPA use cases. Every detail that goes into the workflow (down to mouse-clicks and keystrokes) must be represented. A good way to document this for your IT department or RPA vendor is to use BPMN 2.0 stencil, as this is the “coding-level standard” way to represent process flows. Then, you get to repeat it all over again with the next employee, and so on and so on, until you have a sample size large enough to validate your findings.

The next part is admittedly difficult: You’ll need to standardize your manual banking processes before robotic process automation implementation—not after. It’s an essential prerequisite.

Banking processes may differ across financial institutions, but they also vary among employees internally. Successfully rolling out banking RPA to scale means everything must be standardized and planned out before implementation so that it’s executed properly and efficiently.

Find project managers with lean project experience focused on transactional and white-collar process work. Their previous project-management experience of standardizing processes at scale will serve your RPA banking use cases well.

Implementing RPA Use Cases in the Banking Industry Step 4: Hire a banking-focused RPA vendor

Once you have your workflows standardized and properly mapped, it’s time to implement your new banking RPA processes. We recommend using UiPath over Blue Prism or Automation Anywhere. That’s because UiPath is the easiest to use—and there’s a free Community Version that we think every business should try. You may also find it beneficial to research use cases, to help reduce the learning curve for the new technology. Another option is to become RPA certified so you can do it yourself; this will save you money, while adding a skill to your CV.

Of course, the easiest option is to hire a banking RPA consultant to both consult and handle the mapping and process standardization. They can then hand off the installation of the actual RPA technology once everything is sent to the implementation team. Prices vary among consulting firms; you’re safer to keep costs, and risk, at a minimum.

9. Risk of RPA and Robotics in Banking

Has an Excel macro ever brought down your IT systems? Most likely not. And neither will a robot—if you confine its purview to data-transcribing and -scraping tasks.

Any process change or technology update comes with risk. Yet compared to long-term core technology implementations, the operational risk of RPA is far lower. This is because a robot can be turned off instantly if you choose to—and thus won’t shut down your core banking processes. Also, robots don’t change entire processes. They don’t require organization-wide change management. All they affect are individual users’ desktop settings.

Consider the four top risks of RPA in banking:

1) Operational risk

2) Compliance risk

3) Data-quality risk

4) Ethical risk

Risk of RPA in Banking 1: Operational risk

Any RPA initiative will be met with some degree of pushback from internal staff. They may be intimidated by the prospect of a “robot coming for their job.” The reality, however, is exactly the opposite: Robots are tools to help staffers reduce the work they struggle with daily: simply moving data between systems and applications.

Surprisingly, you may encounter the most pushback not from front-line staff (whom, we have found, quickly embrace robotic assistance once they see it in action), but rather from your own IT department. There may be various stated reasons for this, but one of the biggest may well go unsaid: RPA in banking, unlike traditional IT projects, can be undertaken without the help of the IT department. As we’d mentioned earlier, it’s like installing a macro in Excel. So this lack of control, and visibility, of the total robots deployed can prove unsettling—even threatening—to IT staffs who are accustomed to taking the lead on these types of projects. We’ve actually seen instances wherein IT departments have ripped out and disabled banking RPA robots that were installed without their knowledge or blessing—despite the very real productivity gains they had been providing to front-line staffers.

In addition to potential employee dissonance, there’s the risk of robot downtime and operations disruption, if the project goals aren’t clearly communicated upfront. A robot could stop working due to operating-system updates, hence the need for operational readiness to update and repair robots as needed. Fortunately, RPA robots can be updated within a matter of hours, should they require reconfiguration.

Risk of RPA in Banking 2: Compliance risk

While banking RPA is end-user-friendly, its management and inventory requires discipline. Robotic processes require foolproof audit trails—just like human workers do.

And when it comes to compliance checkpoints and confirmation of required process steps with banking RPA—that is, the way the robots are being implemented—it’s most important to track robotic work tasks. In that regard, it’s just like tracking human work tasks.

Put another way: The unchecked proliferation of banking bots across the organization—especially those whose processes include regulatory checkpoints—can become problematic, should process managers lack an inventory of installed banking robots and the processes they perform. RPA bots that aren’t built to adhere to strict compliance processes can lead to major compliance issues, if they grow to populate the majority of a bank’s process workforce. That’s why it’s essential that banking bots act merely as extensions of humans, and not attempt to undertake any decision-making on their own.

Risk of RPA in Banking 3: Data-quality risk

“Big data” standardization processes are often overlooked during RPA scoping and implementation at banks. Yet with every terabyte that’s loaded into a banking system, the odds of poor-data proliferation increase. Certainly a robot can reduce a back-office employee’s errors when transcribing data from a spreadsheet to a system. But what if the data received from the front office is already in bad order? What happens if that bad data gets loaded into the system? Now imagine that same back-office employee—now with the ability to load 100 times more bad data into the system, “thanks” to the help of his or her robot. That adds up to a lot of poor-quality data that will eventually need to be cleaned, downstream.

Risk of RPA in Banking 4: Ethical risk

The discussion of “ethics” and “robots” conjures up images of Terminator movies. But that future has already arrived: Today’s enterprises must balance their investments between people and technology. Simply attempting to outsource or replace staff can take its toll on morale. Thankfully, RPA allows for the best of both worlds: an optimum combination of humans and technology.

Outside of the organization, the ethical considerations of robotics in banking spill over into society at large: What would the fallout from the 2009 financial crisis have been if, say, bad-actor banks had been able to process 100 times more mortgages and sub-prime loans per day?

Benefits of choosing The Lab for analyzing, developing use cases, and supporting the implementation of banking RPA

One great option for implementing RPA into your financial services operations is to use the “a la carte” RPA mapping offered by our team at The Lab. Our model is designed around starting small, earning our client’s trust, proving our competence, then increasing efforts over time. We offer a variety of template IP options to speed up banking RPA analysis and implementation. We provide RPA solutions for financial institutions who want to step up their game, or simply keep up with the rapidly changing industry. We would love to chat with you further about our banking RPA solutions, methodology, and mapping if you’d like to learn more.

For this year we have updated our bank client offering. Much of these findings and implementation results can be reviewed in the 3-part-series of “Big Rocks for Banks” below. Find out how to strategically lower costs, increase operating leverage, improve customer experience, and automate what previously wasn’t automatable in your bank.

Find them all here: