RPA in Insurance - Robot Process Automation in Insurance Claims Processing

07/03/2018

Robotics process automation, or RPA—that is, the use of front-end, desktop-level, no-coding required software bots to handle routine keystroke-level processes—is revolutionizing insurance. From personal and commercial insurance line underwriting and onboarding, to policyholder services and claims processing, RPA is already making drastic changes in the way that insurers operate, improving customer service and reducing cycle times while reducing overhead.

Are you tasked with reducing and minimizing insurance claims leakage? Find out how to accelerate those efforts here: How to minimize claims leakage with bots

RPA is also the fastest-moving technology in the field today: Current trends indicate that the market for RPA, valued at $199.1 million in 2016, is on track to grow at a compound annual growth rate (CAGR) of 60.5 percent through 2024. According to P&S Market Research, the global robotic process automation market will reach . At the same time, it’s projected that demand for software robots in knowledge work will continue to grow.

RPA is impacting all industries: New jobs will be created as large-scale RPA software is implemented. Companies will need to strike the proper balance between robotics and up-skilling existing employees.

But what about the insurance industry in particular? In this article about how RPA will affect insurance, we will define what RPA is, how and why it is used, actual case studies of its impact in the insurance industry, the risks involved, and how to scale process standardization to ensure a successful RPA implementation.

Table of Contents

What is robotic process automation in insurance?

Top seven benefits of RPA in the insurance industry

What are RPA insurance use cases?

Six examples of robotic process automation use-cases in insurance

An in-depth insurance underwriting RPA use-case

A detailed RPA in insurance case study: Robotic process automation in insurance claims processing

Six examples of RPA insurance in action worldwide

Five steps for implementing RPA use cases in the insurance industry

The risks of robotics and RPA in insurance

What Is Robotic Process Automation (RPA) in Insurance?

In insurance, RPA is defined as implementing software robots that can be custom configured for each computer, without the use of code. (That “without the use of code” is huge; we’ll talk more about that soon.) These software robots help their real-life knowledge-workers with the monotonous and repetitive chores in insurance work, such as data entry.

RPA effectively brings to insurance operations an AI (artificially intelligent) workforce, i.e., robotic assistants that are able to take over employees’ basic computer commands, handling a variety of “low-value-add” tasks that currently drain these workers’ time, energy, and morale.

Insurance robots operate similarly to Excel macros. But unlike Excel macros (which only work, obviously, in Excel), RPA bots can work across multiple systems, instead of being confined to just one. Thus these robots can work at the individual-data-field level across all insurance systems.

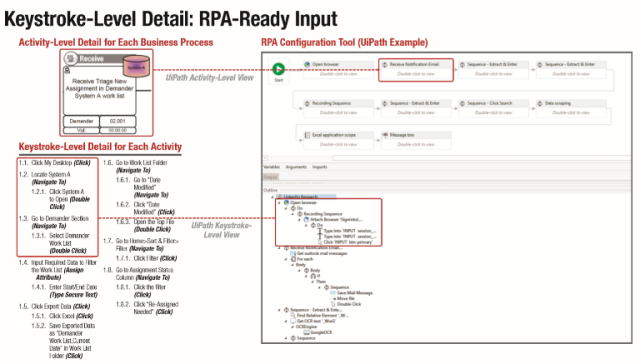

RPA platforms such as UiPath, Automation Anywhere, and Blue Prism can process actions right down to the mouse and keyboard levels. Once they’re set up properly (more on that in a minute), they can do everything from opening applications to clicking, copying, and pasting information from one application to another, sending emails, and similar activities.

For established insurance providers, operations have traditionally (and heavily) relied on outdated legacy systems (with intricate moving parts), that don’t communicate well with each other. This has resulted in the need for highly-paid knowledge workers to effectively provide the “bridge” between these disparate systems—in what amounts to grueling days spent transcribing and reconciling data: opening emails, copying and pasting information between legacy systems, generating PDFs, and so forth. Thus the “Tower of Babel” problem—the inability of the legacy systems to “talk to one another” without manual human intervention at the keystroke level—has created an impassably-high hurdle for streamlining existing technologies, without a wholesale (and costly) reinvention of the entire company’s IT infrastructure. So it’s never happened.

For newer insurance providers, the bar is lower. They face fewer challenges, given their ability to leverage a largely cloud-based infrastructure from the get-go. Contrast their situation to that of well-established insurance providers, and you can see that it gets expensive to reinvent core systems that routinely fall short on the promise of automation.

This is precisely why insurance companies—perhaps especially the entrenched ones—are so excited about RPA. It finally lets them use robotics in the insurance industry to “connect the last mile” of their legacy insurance systems in a way that improves the customer experience and back-office efficiency. It’s little wonder that RPA is changing the way insurance companies conduct business operations.

As you surely know, insurance operations require intricate process and system connections for conducting business across underwriting, managing insurance claims, and analyzing risk. Yet insurance companies using RPA can make these processes more efficient—sometimes by a stunning 50 percent—by reducing mountains of mundane and time-consuming data-entry and transcription tasks across legacy systems.

What are the uses of robotic process automation in insurance?

With robotic process automation, all types of insurance sub-processes can be sped up. Common work tasks that can be automated via robotic process automation include:

- Open, log in, and toggle between different applications and systems.

- Copy and paste data from spreadsheets to core systems.

- Move data from core systems to spreadsheets.

- Move information from Core System A to Core System B.

- Pull data from invoices into a core system.

- Open an email and move its data into a core system.

- Move files and folders from desktops to servers.

- Scrape information from the internet and websites.

- Calculate data automatically to create reports.

Top seven benefits of RPA in the insurance industry

Robots can help you link disparate legacy systems, on the front-end, with no coding, to conduct insurance operations faster, reduce labor costs, expedite new business onboarding, underwriting, customer service, and claims processes… all at the same time. With the shifting demographics of customers, customer interaction preferences are moving towards the digital and speed of transaction. Customers today expect consistent service levels and convenience while working with their insurance company – the same ease of service and cycle time that they might experience shopping online or while using online banking.

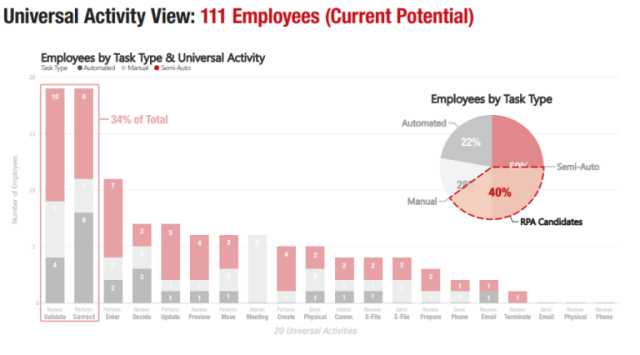

The only way your insurance company can tap the maximum benefits of RPA in an insurance use-case is by first standardizing as much of the manual work as possible. Deep, front-line process analysis and desk-level work standardization across the entire organization are, simply, essential for RPA. They’re what makes RPA in insurance worth the investment and the only way to build a business case with real return-on-investment.

As we’ve noted, the benefits from RPA in insurance can be both financial and operational in nature, improving back-office processes and the customer experience while saving money on labor. Basically, robotic process automation lets you do a lot more with what you have, or less.

When compared to traditional automation, robotic process automation in insurance has specific benefits, including:

- Faster claims processing. Claims processing requires employees to gather information from various documents and copy/move that information into various systems. It’s a time-consuming process, which delays the timely response that customers desire when they file a claim. RPA can move large amounts on claims data with one mouse click.

- Easier policy cancellation. The process of cancelling policies is time-consuming due to having to interact with email, a policy administration system, a CRM, Excel, and PDFs. RPA can toggle through all of these interactions at the same time and eliminate the need to move data through all of them manually.

- Simplified new business on-boarding. Sometimes companies grow faster than they can manage. Robots can abet growth with minimal growing pains: manual inter-departmental data movement from new clients being on-boarded can be reduced by at least 50% – within weeks.

- Increased data accuracy. Using RPA increases the reliability of data. That’s because, unlike humans, robots are unable to key in data incorrectly; nor will their “minds” wander while performing repetitive tasks. But, you must resolve bad data being received on the front end for it to work right.

- Standardized processes. A side effect of using robots is the necessary standardization of processes. In order to start using a robot, a company’s process all need to be standardized, which in turn increases worker efficiency, and then greatly increases the speed at which the robots can do their work as well.

- Legacy-systems compatibility and new system implementation friendly. Robots can be configured to use old systems that might be replaced in the next few years, and updated to work with the new ones. Robots are easily reconfigured within days to point to new systems as they get implemented.

- Easy transition. Working at the familiar desktop level, robots are easy for employees to understand and to use. They can be installed quickly (unlike traditional IT projects), and work with existing technology.

What Are RPA Insurance Use Cases?

We’ll start with the detailed definition:

A robotic process automation use case in the insurance industry is defined as the process of first documenting a list of insurance operations/steps that take place at the front-line employee level. These actions and steps—which are taken on computers or other electronic devices—are then used to automate information movement across the insurance applications. Insurance RPA use cases are utilized by IT consultants, or your own staff, as “blueprints” to implement automated scripts that run across multiple systems to process data. Tip: Don’t buy RPA software until you know exactly how many robot licenses you need from the use cases you develop to keep cost down.

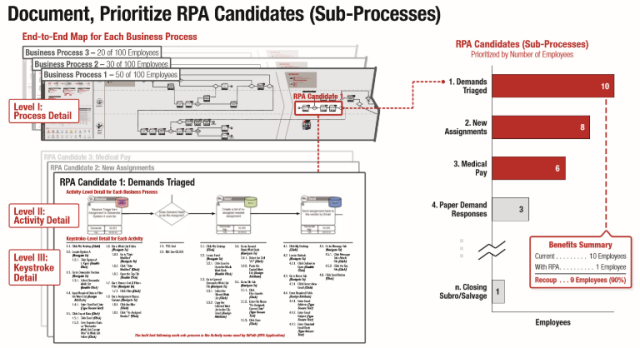

That may sound complicated, but it’s not. The three-step process is detailed in the infographic below.

Step 1: Identify sub-processes on process maps where insurance robots can be implemented.

Step 2: Prioritize and evaluate all of the insurance sub-processes and use cases to see which yield the most benefits.

Step 3: Finally, develop and document the use-case requirements, rules, and keystrokes which the insurance robot must take over.

Six examples of robotic process automation use-cases in insurance

Given this new frontier—and their legacy ways of doing business—most insurance companies struggle to find places to get started with RPA. Use-cases can help. They’ll give you ideas of where you can install your insurance robots first. Consider these six examples of RPA in insurance use-cases:

- Insurance underwriting RPA use-case example. At one company, underwriting processing time was slashed by 80 percent—thanks to the elimination of manual copying and pasting of client information from inbound customer emails into one cloud-based underwriting system and two on-premises core insurance systems.

- Insurance quoting RPA use-case example. One insurance company used RPA to turbocharge policy-quoting speed by automatically copying contact data from requests on the company website and validating it on government websites such as DMV and third-party databases like SambaSafety.

- P&C insurance claims analytics and reporting RPA use-case example. Another insurer increased the speed of its analytics insights by automatically moving automotive claims transaction volume data into its business-intelligence application… without human wrangling or intervention!

- Life insurance claims RPA use-case example. One insurance company slashed the cycle time of its life-insurance claims processing by 40 percent. They were able to automate what had been the manual entry of claims data by empowering their bots to validate death certificates on government websites.

- Insurance premium accounting RPA use-case example. Another insurer reduced home-office error correction for payments set up at agencies—by a staggering 50 percent. How? They were able to automatically copy and move information from the new policy applications into the core insurance system, eliminating manual transcription of data by agencies.

- Life insurance in-force customer-service RPA use-case example. Another life-insurance firm reduced the overhead of customer service by 25 percent by automatically transcribing data from emailed policy-change requests into core systems.

An in-depth insurance claims RPA use-case

In this example of a robotic automation use case in insurance, “Cathy” processes insurance claims through the company’s numerous systems. Each claim takes 20 to 40 minutes to process. She normally has a queue, or backlog, of pending claims. This queue is the reason a customer claim can take several days to process and why it takes so long for policyholders to receive their money after an insurance claim.

The pre-RPA insurance use case process is as follows:

- Cathy receives an email with a new claim. Each claim form—a PDF—includes a new claim number. Her Outlook is set up to find these emails and send them automatically to a dedicated claims folder.

- She transfers each claim form into a queue folder on a shared network drive to be processed in order of receipt. This generates a backlog of 10 to 20 claims, or more.

- Cathy opens the oldest claim in the queue. First, she copies the account number from the form into the company’s system and finds the policyholder’s account.

- Then she opens the company’s insurance claims program and compares the information in the claim and policyholder’s account to make sure everything matches.

- She tediously copies the policyholder’s name, date of birth, social security number, address, claim number, account number and any other required information into the claims system. Then she attaches the PDF to the claim in the claims system.

- She moves the PDF from the queue folder to the finished folder. She then emails the claim payment processing department, notifying them that this claim is complete and ready to be paid.

- Cathy processes a few more claims before she breaks for lunch. When she returns, 10 more claims have arrived in her email. Consequently, Cathy never catches up; the queue continues to grow, causing a bottleneck in the claims process.

This whole process is done manually. And all of that manual processing reduces productivity and increases avoidable costs because the company’s claims processors are devoted to mind-numbingly repetitive tasks rather than making better use of their skills.

Now let’s look at the same process using robotics and see the difference in productivity. The post-RPA insurance use case processes the work as follows:

- Cathy receives the claim email, just as before. This time, however, she opens all the relevant systems and runs the robot.

- UiPath searches Cathy’s claims folder in Outlook. It finds the new email and saves the attachment to the network drive folder.

- UiPath opens the oldest claim in the queue, searches for policyholder’s account in the company’s system and compares the information. If it finds any discrepancies between the claim information and the account, the robot stops and saves the claim to a new folder called “Needs Review.” Cathy can concentrate her efforts on these “exceptions.”

- Because this robot runs on a loop, it continues to the next claim. If the information in that claim matches the account information in the system, the robot copies all of the claim information into the claims system and attaches the PDF.

- Next, UiPath uses a prebuilt (template) email to send the claim to the claim payment processing department, notifying them that it is complete and ready to be paid.

- Cathy goes to lunch but leaves the robot running.

- When she returns, the robot has finished processing claims. It received, saved and processed all 10 new claims that arrived while she was out.

- After lunch, Cathy opens the “Needs Review” folder to fix any discrepancies between these claims and the associated accounts.

Each of the claims that previously took Cathy 20 to 40 minutes now takes the robot only 4 minutes. Because the robot works continuously until all claims are processed, the queue is finished within about an hour. Also note that the robot processed claims while no one was being paid to do the work.

UiPath eliminated the bottleneck, removed repetitious, manual work and accelerated claims processing. Policyholders consequently receive their much-needed claim payment faster.

This sounds like something that you might want to try out, right?

RPA in Insurance Case Study: Robotic Process Automation in Insurance Claims Processing

To illustrate robotics in the insurance industry at work for an auto insurance provider, we’re going to walk you through a robotics in insurance claims case study. Let’s call it “A day in the life of Dan, an auto insurance claims processor.”

Today, much of Dan’s work day is spent copying and pasting claims-form data from PDF files into a web-based data-management system. Dan must retrieve the PDF claims file from an email, then copy-and-paste all fields from the PDF into the doc-management system. Once this is done, Dan next must create a new document and import all of the information from an invoice into it—and then attach it to the management system. Finally, Dan sends this to management for approval.

Not too bad, right? Dan is a good employee who does good work. But, with a robot at his side, Dan can be better. Much better.

Dan’s work life could be easier with RPA.

Let’s replay the scene, but with the UiPath RPA installed. Now, the RPA software can log into Dan’s email app and retrieve the PDF claims form. The bot navigates through different screens and actually controls Dan’s mouse and keyboard to copy-and-paste all of the individual fields of data from the PDF file into the doc-management system.

In this robotic process automation in insurance case study, the RPA insurance software then creates a new Word document, copies the information from an invoice, pastes it onto the new document, and attaches it to the document-management system. The insurance robot then sends the claim to the back office for approval. Just like that, Dan is now able to focus on more important jobs around the office, without the backlog of mundane tasks that drain his time and energy.

Consider the before-and-after: Dan used to spend 15 minutes per claim on the above tasks. Now, with his robot running all the data-transcribing work, it only takes him four minutes per claim. Just imagine the benefits of this robotic process automation in insurance use-case, once rolled out at large scale across the organization!

Six examples of insurance companies using robotic process automation

To help you understand, appreciate, and draw inspiration from the ways that RPA is being implemented in the insurance industry, here are six examples of insurance companies adopting this technology in the United States, Europe, and Asia.

United States

RPA in Insurance Companies – Example 1: Prudential Financial

Achieving accuracy, efficiency, and cost management

- Headquartered in Newark, New Jersey

- In business nearly 145 years

- Services institutional and individual clients spanning more than 40 countries

- $53.6 billion in total revenue, per to its 2017 annual report

Ann Delmedico, Prudential’s VP of Robotic Process Automation, leads the insurer’s Robotic Process Automation Center of Excellence. In September 2017, she gave a presentation describing how her company deployed a global RPA solution.

RPA was one component of a larger company-wide “transformation program” with objectives to foster strategic growth, improve the customer experience, and to manage costs. Prudential selected Blue Prism as its RPA software solution.

In her talk, Delmedico emphasized that the company approached its decision to implement RPA with careful consideration in terms of value proposition—and not industry trends. The insurer aimed to achieve three main goals: accuracy, efficiency, and cost management.

The four-minute video presentation below includes some tips to consider when implementing RPA, such as balanced messaging when introducing it to company staff, and identifying RPA talent opportunities.

Video: https://www.youtube.com/watch?v=5mpbipz2CR0

Prudential’s first application of RPA was to help process payment mismatches. Possible solutions identified using automation to determine if there were two policies for the same individual, looking for an inversion of the policy number, and checking to see if there was a loan on the policy. If no positive matches could be identified from these categories, the company would then contact the bank.

The infrastructure to begin the process was established in July 2016; the first implementation was deployed in October—just three months later! By the end of 2016, Delmedico reported that ten automation processes were in production, resulting in $500,000 in run-rate savings.

RPA in Insurance Companies – Example 2: Safe-Guard

Faster document processing, higher customer-satisfaction scores

Based in Atlanta, Georgia

- In business 25 years

- Processes nearly four million contracts per year

- Serves more than 11 million consumers

Safe-Guard provides products and solutions for the motor vehicle industry, and counts Ford, Harley-Davidson, and BMW among its partners.

Irvine, California-based Kofax, a global RPA software supplier, published a case study describing how it helped Safe-Guard transition from paper-heavy claims processing to a more efficient and automated routine. According to Tim Dewey, Safe-Guard’s former Vice President of Operations Technology:

“We sell a large proportion of finance and insurance products through car dealerships, which routinely rely on pen and paper. Claims processing was a similarly paper-heavy process. In each of those areas we have to collect a significant amount of documentation from external stakeholders and customers. Our administrative teams spent considerable time and effort scanning and processing hard-copy documents, as well as reviewing and sorting email attachments into folders.”

Using Kofax’s suite of products, the company implemented a series of automated solutions. One of the first steps entailed automation of the contract and claims-submission process. Paper documents are first scanned and uploaded to a centralized portal. Documents can then be received via mail, email, or fax. They’re identified by document type, and then sent to a work queue for further processing.

Next, using an automated extraction process, categories of information deemed pertinent by Safe-Guard are pulled from the documents and stored in the system. Each step is tracked and analyzed to determine efficiency high points and opportunities for improvement.

As a result, Kofax reports that its document-capture process time was reduced from a maximum of two hours down to just 10 or 15 minutes. Document handling was reduced from as much as five times to just once—a reduction of some 80 percent. Overall productivity increased by 30 percent, contributing to a 15-percent increase in customer satisfaction.

RPA in Insurance Companies Example 3: Farmers Insurance Group

Improving satisfaction for both agents and customers

- In business over nine decades

- Services more than 10 million households

- Handles more than 19 million individual policies

- Spans all 50 states

Woodland Hills, California-based Farmers Insurance writes policies for vehicles, homes, and small businesses; it also offers a wide range of other insurance and financial-services products.

Evidence of Farmers’ RPA efforts can be found in a case study published by Pegasystems. Founded in 1983 and based in Cambridge, Massachusetts, Pegasystems (“Pega”) develops software for operational and customer-engagement solutions.

In order to provide agents servicing small-business clients with real-time support and a more intuitive feel, Farmers worked with Pega to deploy an automated software solution. The goal was to accelerate the agents’ ability to respond to the unique needs of Famers’ small-business customers.

After one year of implementation, Pega reports that its Business Process Management (BPM) technology enabled the insurer to double its market share, although the exact number is not specified in the case study.

The cited improvements are impressive:

- Quote-generation time was cut from 14 days to 14 minutes.

- Umbrella-policy sales increased by 70 percent.

- A new policy system was deployed in less than five months.

- Agent and client satisfaction both improved.

Other efficiency tools and time-savers embedded in the automation protocol—such as a pre-fill application option for agents onboarding new clients—are discussed by Mhayse Samalya, President of Commercial Business Insurance in this three-minute video.

In June 2018, additional evidence of RPA implementation at Farmers was mentioned in a Wall Street Journal feature on the company. According to the article, RPA is being used in a pilot program specifically to “automate a complex and routine process for claims adjusters.” Rehan Ashroff, Director of Innovation Lab and New Ventures at Farmers Insurance, explains that the goals of the pilot are to accelerate processing times, improve efficiency, and decrease the disbursement turnaround from weeks to days—or just hours.

RPA in Insurance Companies Example 4: New York Life

Automation at the hands of business administrators, not IT specialists

- Nearly 175 years in business

- Strong in mutual and life insurance

- National and global

- $2.06 billion in operating earnings, per its 2017 annual report

- Its 2017 operating earnings were the largest in the insurer’s history to date, per a March 2018 press release

When New York Life realized that it was processing over a million back-office transactions a year, it sought a smarter way to improve its processes and efficiency. And so New York Life worked with Pega, to develop an automated back-of-office application called Processflow.

With Processflow, business administrators are able to quickly change processes, modify steps, or change the order of steps. In this three-minute video, Miguel Suarez, Vice President, New York Life Direct and Jason O’Brien, TBC, New York Life Direct, deliver a presentation discussing the case study. At the time of their presentation, 84 of 128 tasks in a given workflow were either updated or added to the system by a business administrator, as opposed to an IT specialist.

Europe

RPA in Insurance Companies Example 5: Zurich Insurance

Blue Prism RPA saves effort, speeds processes

- Nearly 150 years in business

- Serves more than 210 countries

- $64 billion in total revenue, per its 2017 annual report

- $207 billion investment portfolio

- Ranked number four among the top 10 writers of commercial auto insurance by direct premiums in 2016, per the Insurance Information Institute

Based in Switzerland, global multi-line insurance company Zurich Insurance offers property and casualty, and life insurance products and services. It’s also the parent company of Farmers Insurance Group.

The company has reportedly ventured into RPA implementation by engaging London-based RPA software developer Blue Prism. In September 2017, Blue Prism released a case study describing how it helped the global insurer improve its process for managing international insurance contracts.

Prior to RPA, Zurich’s procedure for executing and closing international contracts involved a substantial commitment of staff time—specifically, four to five hours of transaction time per policy—and more than 1,000 steps and sub-steps from start to finish. Property and general-liability insurance were especially ripe for RPA implementation, due to their high volume and their overlap with other lines of business.

Zurich targeted the initial rollout of the automation process to five countries, including the United Kingdom and Germany. At the time of case study, these two countries had Blue Prism robots actually running in production.

The results are impressive. To date, RPA implementation has reduced policy transaction times from nearly five hours to between 40 minutes and 1.5 hours. Additionally, Blue Prism claims that “exception” processes were able to reduce effort 20 to 30 percent, while straight-through processing saw its required effort reduced by 70 percent.

The complete case study is presented in the video below; it includes remarks from Joyjit Gorain, MBA, Head of Operational Performance Management, Enterprise Transformation, Operations & Technology at Zurich Insurance. It’s just six minutes long:

https://www.youtube.com/watch?time_continue=80&v=UZSxtlr_xg8

Asia

RPA in Insurance Companies Example 6: Aegon Life Insurance

Automation of 120 core tasks

- Founded 2007

- Headquarters in Mumbai, India

- Services an international clientele with tools for asset management, life insurance, and pensions

A case study published by Pega provides evidence of how Aegon Life Insurance implemented RPA: The insurer first identified opportunities for improvement in its management of the customer-service experience. For example, manual legacy business processes often required “multiple steps to verify information regarding user identities, policies, compliance, and checklist requirements,” according to the case study.

These time-consuming tasks were ripe targets for transitioning to an automated framework. At the time of the case study, Pega worked with Aegon to manage and automate approximately 120 core business tasks.

Examples of these business processes include transfer quotes and transfer settlements, payroll payment, and claims management. At just under three minutes, the following video features a presentation from John Davidson, Head of IT Strategy and Architecture, describing the results which Aegon achieved via RPA implementation.

[Insert video frame grab here]

Reported results include:

- Accelerated claims-settlement—with processing time reduced by 60 percent

- A 20-percent improvement in net promoter score (NPS), a vital measure of customer and employee satisfaction

- Total savings of 84 percent

By utilizing RPA, Aegon has saved time that had been previously spent on staff training or manual completion of tasks. The time saving has translated to customer-service improvement, too: The insurer’s contact center was able to boost its “first-call resolution” rate from 50 percent to 80 percent.

Robotic process automation in insurance claims: Standardize that work before you throw a robot at it!

The earlier use case (remember Dan, the auto insurance claims processor?) and real-world corporate examples mentioned above represent just a few instances of how RPA is making the insurance operations quicker and more cost-effective, saving companies money while boosting the customer experience.

So how does the process of RPA implementation work? We’ve laid out a path, with key steps that must be completed when jumping into RPA on your own, or with the help of a professional.

Step 1: Scope the RPA in insurance implementation project

The most effective way to begin an RPA insurance project is to first determine a manageable scope.

Start small, then roll out at scale. Don’t swing for the fences with an enterprise-wide scope; pilot a test across a single business unit first. No matter what anyone else says, starting huge with RPA never works.

Processes where RPA can be implemented within insurance include:

- Underwriting

- Onboarding

- Changing customers’ information

- Processing payroll

- Customer complaints

- Cross-system information transfer

- Processing forms

- Billing

A key part of building an insurance RPA scope is identifying which areas in your company are good candidates for RPA. Claims is a great place to start. Why? Claims departments are rife with customer interactions, manual work, and usually revolve anywhere from four to seven different systems that claims reps must toggle through as they move data every day.

To get started, select a group of 100 to 500 employees whom you know will be open to change. Start your mapping exercise with them. See how the group responds. Learn your lessons about the cultural response to insurance RPA. Then scale up.

Starting with a pilot project reduces both the risk of project failure—and the learning-curve costs. Organization changes aren’t as painful when they’re implemented incrementally.

You can start the process yourself, if you’ve identified your “manageable scope” with your team or a professional. The Community Version of UiPath is free, and RPA certification courses can be completed in one month online. But once you graduate to larger-scale projects, you’ll need Six Sigma training if you’re going to be the one in charge.

Step 2: Determine baseline operational costs to calculate the total benefits realized from implementing your insurance RPA use cases

You can reap a diversity of financial benefits from insurance RPA use-case implementation, so it’s essential that you know your baseline operational costs before you attempt to introduce robots into your processes.

Generally, it takes about a week or two to get the numbers for your baseline operational costs, so be sure to budget that time into your plans. This will also require coordination with HR, so you can get the cost for each employee in scope.

Don’t forget to measure the costs after your initial attempt at implementing RPA, as well as subsequent attempts. This data will allow you to show costs and savings achieved over a range of time attributable to RPA use. You’ll want to have proof that insurance RPA will deliver strong financial benefits before you implement it into every process—and numbers don’t lie.

Step 3: Analyze current state processes to determine your robotics in insurance use cases

This is the hard part, but it’s also the most important, so be sure not to skip it! This is the time to take a deep dive into process-mapping in your insurance agency. You’ll need to map out each and every system and person you’re considering for RPA assistance. Thus you’ll need to make a thorough process analysis of all front- and back-office tasks needed to carry out operations; this step is essential for determining how RPA can help.

And this isn’t just mapping at the surface level. This steps requires that you map processes all the way down to the mouse-click level.

One way to do this is by performing “day in the life of” observations; that’s what we do here at The Lab. These are carried out face-to-face or via screen-sharing software. We’ll watch workers perform tasks for an entire week, all day long, to document all that are ripe for RPA implementation. GoToMeeting, Webex, and Team Viewer are our favorites for off-site observations.

After you’ve determined all the areas where RPA can be implemented, you’ll need to use a process-mapping software (such as Microsoft Visio) to visually represent the steps to build your insurance RPA use cases. Every detail that goes into the workflow (down to mouse-clicks and keystrokes) must be represented.

A good way to document this is by using BPMN 2.0 stencil, a “coding-level standard” way of representing process flows. This allows for easy handoff to the IT department of your RPA vendor. The entire process will need to be completed for each employee until you have a large enough sample size to verify your findings. It might not be easy, but remember that the payoff is well worth the effort.

Step 4: Standardize insurance processes

To successfully and efficiently roll out insurance RPA to scale means that everything must first be thoroughly planned out and standardized. And so it’s now time for the next crucial step: Standardizing insurance processes prior to robotic process automation implementation. Remember: If you’re not prepared to analyze and standardize your current manual processes, you shouldn’t be jumping into RPA.

Step 5: Hire an insurance focused RPA vendor who can develop use cases for you

Now that you’ve gotten through the hardest part of mapping out all your workflows and standardizing your manual workflows, it’s time to implement your new insurance RPA processes. We recommend UiPath over Blue Prism or Automation Anywhere, because it’s the easiest to use—and there’s a Community Version you can try, which is free.

Your easiest option is to hire an insurance RPA consultant to do all the hard parts: mapping, standardizing processes, and consulting. They can then hand off the installation of the actual RPA technology, once everything is ready, to the implementation team. Prices vary among consulting firms, but we’re a firm believer in lower cost and lower risk.

Alternatively, you could become RPA certified, allowing you to implement it yourself. This has the advantages of saving you money, while developing new skills to bolster your CV.

The risks of robotics and RPA in Insurance

New technology always comes with risks. However, when compared to the long term technology implementations, the operational risk of RPA is rather low. Since RPA is like a layer that runs in the background, shutting down a robot won’t harm your core insurance processes, if you choose to do so. Nor do robots require organization wide change management, they only affect individual user desktop setting. If your robots are only data transcribing and scraping, they won’t bring down your IT systems if something goes wrong.

Risk categories of RPA in banking include:

- Operational Risk

- Compliance Risk

- Data Quality Risk

- Ethical Risk

Operational Risk

Everyone has probably heard something along the lines of “robots are going to steal your job!” in one way or another. Beginning any RPA project will probably come with a risk of push back from internal staff. Be sure to clearly communicate the goals of the project, letting staff know that the robot is simply a tool to help them reduce the amount of work required to move data. Aside from pushback from staff, operating system updates could also cause robot downtime. RPA robots will need to be updated and repaired from time to time, luckily robots can be updated within a few hours should they need to be reconfigured.

Compliance Risk

Project managers should always have an inventory of installed insurance robots, so that unchecked robots don’t become problematic. Robots that aren’t built to adhere to compliance processes can lead to massive issues within compliance. This is why insurance robots should only act as an extension of humans, not replacing them, unless it has been fully thought out. Insurance RPA is end user-friendly, but management of the technology requires discipline and decision making abilities.

Data Quality Risk

Robots certainly help to cut down in the amount of bad data in back-office transcribing operations, but not if the data is already in bad order when it’s received from the front office. A robot is transcribing 100x more data into the system and if that data is sent to the robot in bad quality – we’ve landed in quite a problematic situation with bad data flooding into the system. “Big data” standardization processes are an element that should never be overlooked during RPA implementation.

Ethical Risk

Ethics is in the forefront of a lot of conversations recently. Companies must balance investments into people and technology. If an enterprise only invests in technology and neglects their human workforce, moral will quickly plummet. Thankfully RPA combines humans and technology, allowing a balanced investment in your human workforce and technology while boosting profits and cutting costs.

Benefits of choosing The Lab for RPA insurance analysis, use-case development, and implementation

So, you’ve looked at your choices and have a solid plan for implementing RPA. Now what?

If your decision is “Hire someone to help,” we’re pleased to present a variety of solutions for robotics in insurance industry. Interested in using the power of RPA for your insurance company? Feel free to get in touch with us to learn more.

Click HERE to find out more about how insurance companies use RPA to reduce operating costs and improve policy holder experience!

For 2021: We have updated our insurance client offering. Much of these findings and implementation results can be reviewed in the 4-part-series of “Big Rocks for Insurance” below. Find out how to strategically lower costs, increase operating leverage, improve customer experience, and automate what previously wasn’t automatable in your insurance company.

Find them all here: