Process Mapping and Improvement for Banks and Credit Unions

Constant macro-economic shifts, increased merger activity from higher interest rates, limited functionality of core banking technology, and goal posts always being moved by regulators means that a continuous improvement effort to streamline operations is a strategic imperative for financial institutions. Process mapping should always be the starting point for transformation, continuous improvement, automation, or analytics efforts.

Maximizing the value of your existing systems

Process Mapping Services and Improvement for Banks and Credit Unions

At The Lab Consulting, we don’t just process map in the financial sector; we specialize in it and all things process improvement—with a strong emphasis on putting process before technology. Our expertise in process mapping features a keen focus on maximizing the value of existing technology and systems already in place at our clients. That’s because most banking organizations have already invested heavily in all the database-driven technology systems that they need—but they have not yet pushed operational improvement far enough to realize the ROI from these systems and existing processes.

As a C-suite executive, you understand the importance of operational efficiency. You’re constantly looking for ways to enhance your operations and drive success. In this article, we will explore the benefits, services, and real-world examples of process improvement, showcasing how The Lab can help your bank or credit union improve operations, increase cross-selling, and improve margins—in the near-term.

What to expect in this long-form explainer

Understanding the Value of Process Mapping in Financial Institutions

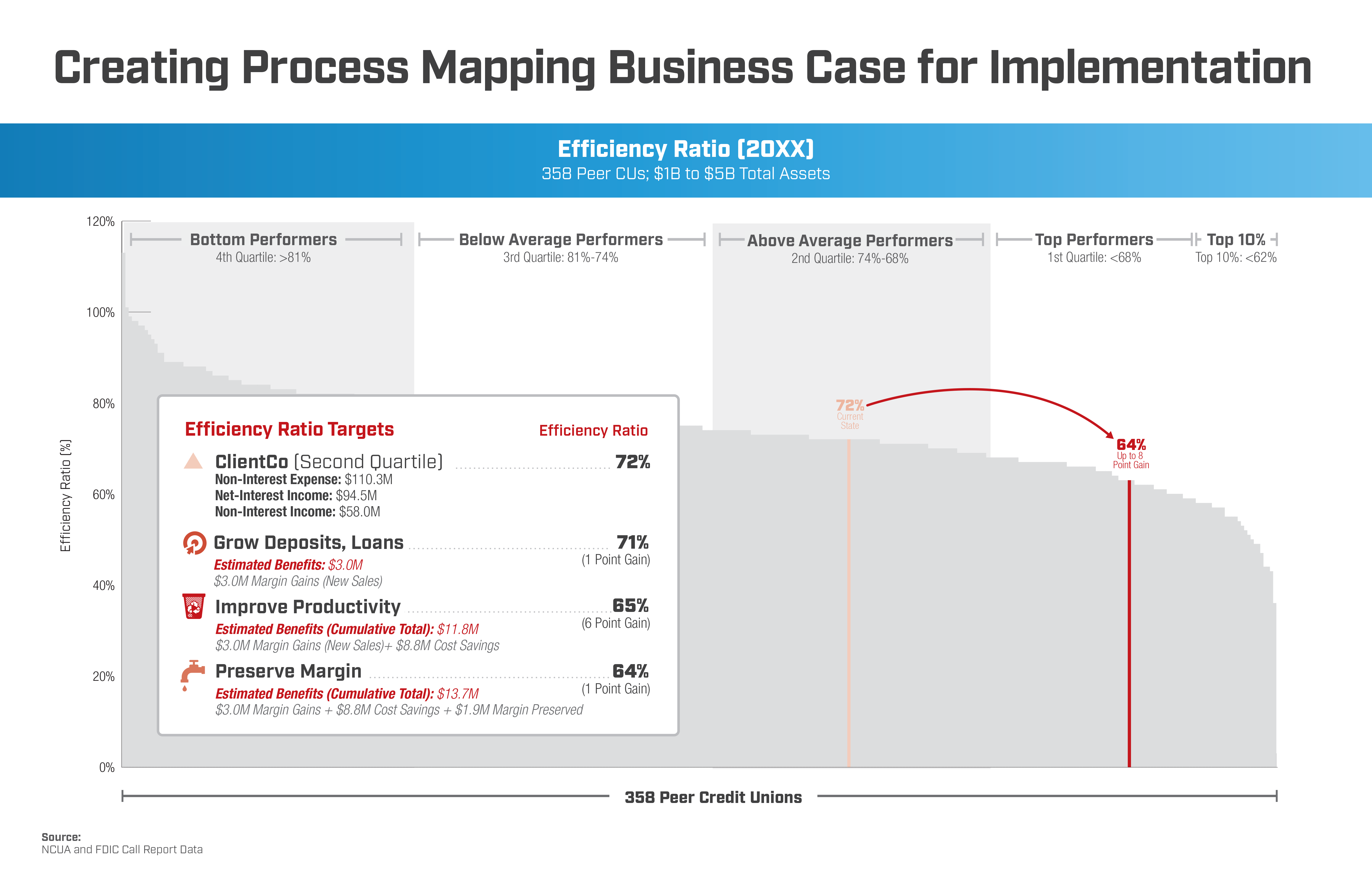

End-to-end, cross-department process mapping is not just a tool or method of documenting current-state operating procedures; it’s the transformation jumping-off point for financial institutions. Process-mapping capabilities, whether delivered by an in-house team, or by an outside vendor or consulting partner, enable organizations to analyze, visualize, and identify opportunities for improvement, automation, and KPI measurement in existing workflows while driving to a more valuable future state that maximizes operational performance. By identifying inefficiencies and opportunities for improvement, banks and credit unions can make significant strides in reducing costs, enhancing customer service, maximizing the value of technology investments, and ultimately driving enterprise value improvement.

In this long-form explainer about process mapping and improvement in banks and credit unions, we will deeply detail not only how to map business processes, and what tools are used and common pitfalls to avoid, but also how to generate an opportunity-rich process-improvement roadmap that will lift your financial institution’s efficiency ratio, and other strategic executive-level KPIs, by entire quartiles, in less than a year. How do we know? At The Lab, we have been providing solutions with a proven track record of success and measurable results for banks and credit unions since 1993.

Banks & Credit Unions: Process Improvement Catalogs from The Lab's Library

The Lab's Financial Institution Knowledge Base

What is it and how do you do it?

Definition and Explanation of Process Mapping for Banks and Credit Unions

Process mapping is defined as a business workflow analysis method deployed to visually depict the steps involved in a specific process from start to finish.

These diagrams, or flowcharts, provide a visual representation and a clear picture of how processes operate—and how they can be improved. By breaking down even the most complex processes into manageable steps, process mapping helps organizations understand their operations better.

End-to-end process mapping involves not only the activity of drawing process maps (the fun part), but all the strategic organizational activities that lead up to the final process maps (the difficult, long-term work).

These major activities often take months or years to come to fruition for organizations, but consist of the following:

Strategic Planning

Timeframe: 3 – 18 months

- Identify an org-wide, or business-unit-level problem that needs solving

- Champion a C-Suite-level project sponsor

- Define strategic outcomes of the process-mapping project

- Identify a cross-functional, end-to-end, benefit-rich scope

- Generate organization and department buy-in

Mapping and Analyzing

Timeframe: 6 – 12 weeks

- Gather existing organization operating procedures (even if outdated)

- Identify all business systems in use and types of data available for analysis

- Meet with subject matter experts

- Lay out detailed workflow diagrams and document each task at the one- to five-minute activity level of detail

- Conduct a Map Fair to crowdsource additional improvements

- Identify, catalog, and taxonomize process improvements available for implementation

- Generate a business case and future-state transformation work plan

Implementing Improvements and Transformation

Timeframe: 3 – 12 months

- Establish implementation and support teams

- Standardize business processes

- Reduce and eliminate redundant processing

- Improve bad quality data

- Implement automation and analytics

- Sustain capabilities by implementing KPIs that manage progress

Real-life bank and credit union process improvement projects from The Lab

Banking Efficiency Case Studies: Process Mapping, Standardization, Automation, Analytics

Creating a process mapping capability and/or hiring from outside

Who or What Team Conducts Business Process Mapping in Banks and Credit Unions?

The largest U.S. banks often rely on outside consulting firms to map processes when implementing process improvements, merging organizations, or implementing new systems. They rarely have a fully mature internal team that can conduct organization-wide end-to-end mapping. Similarly, 70 percent of community/regional banks and credit unions today lack mature business-process-mapping capabilities that can manage enterprise-wide mapping initiatives.

Internal improvement and Lean Six Sigma teams

For financial institutions that have invested in internal improvement and developed a mature capability, business-process-mapping teams typically sit as part of internal improvement teams in organizations. Rarely do process-mapping teams sit within IT. The most common job position that fulfills the process-mapping duty is a business analyst or a process engineer. As data-driven process-improvement trends continue to grow, the best choice for banks and credit unions is to seek data scientists with process experience, and then back them into the traditional business analyst role.

External consultants

Specialized process-mapping consulting services, like those from The Lab Consulting, accelerate and improve the process-mapping capabilities of banks and credit unions by running projects, developing maps, and providing teaching methods that were deployed at hundreds, even thousands of other organizations and past client engagements. At The Lab Consulting, we have turned our 30 years of process maps into standardized tools and templates that we use to accelerate process mapping for our clients.

Flowchart and Workflow Software Options

What Tools and Software are Commonly Used in Process Mapping in Banks?

Common tools used include:

- Whiteboards

– Provide the quick and most basic high-level summaries

– Commonly used in group meetings to sketch out summary flow - White/brown paper rolls

– Large, wall-pasted handwritten/drawn diagrams with Post-it notes

– Commonly used by “old-school” consultants - Microsoft Visio

– Most widely accessible and most frequently used process-mapping software in the world for the past ten years

– Readily available and easy to install, thanks to MS Office 365 - IBM Blueworks

– Proprietary process-mapping software from IBM

– Has lost market interest in the past years - Signavio

– Cloud-based

– Viable alternative to MS Visio

30 Years of experience

The Lab’s Process Mapping and Improvement Strategy for Banks and Credit Unions

At The Lab, we offer a unique approach for process improvement that overcomes the limitations of traditional methods. This includes:

- More improvements. Gain a comprehensive understanding of end-to-end processes at the activity level, identify avoidable rework, automation and AI opportunities, control points, and more.

- Greater benefits. Measure capacity requirements for each business process or department to create a detailed benefits case that guides and supports improvement implementation.

- Extreme analysis speed. Our process analysis is designed to be efficient, requiring only one hour per week of your staff’s time over a six- to eight-week period. This allows you to focus on your core responsibilities while we refine and validate our analysis.

- Enhanced outcomes. By benchmarking your operations against industry best practices, we can identify competitive gaps and design an improved future state for your institution.

Have a look at The Lab’s process-map catalog for banks and credit unions

Scoping Best Practices

How We Scope a Banking Process-Mapping Project

Banking organizations and business processes are strikingly similar, regardless of institution size; thanks to this fact, scoping an engagement becomes relatively simple. Key stage gates of the commercial lending process at “Bank A” will bear an 80-percent resemblance to those at “Bank B.” The major differences (lack of standardization) become apparent at the level of the core and ancillary systems being used, all of which have workflows that have been configured differently by the original implementation teams.

When scoping a process-mapping engagement, consider the following best practices:

- Identify a benefit-rich scope with proven ROI: map across all business functions and departments

- Focus on end-to-end business processes, for example:

– Loan prospecting all the way through loan servicing

– Wire processing from inbound request to OFAC check through release - Do not get trapped in silos of the organization

– Capture the customer journey, the sales process, the back-office operations steps, and all regulatory check-points

along the way - Require sponsorship from top executives; otherwise, organizations will very often opt out

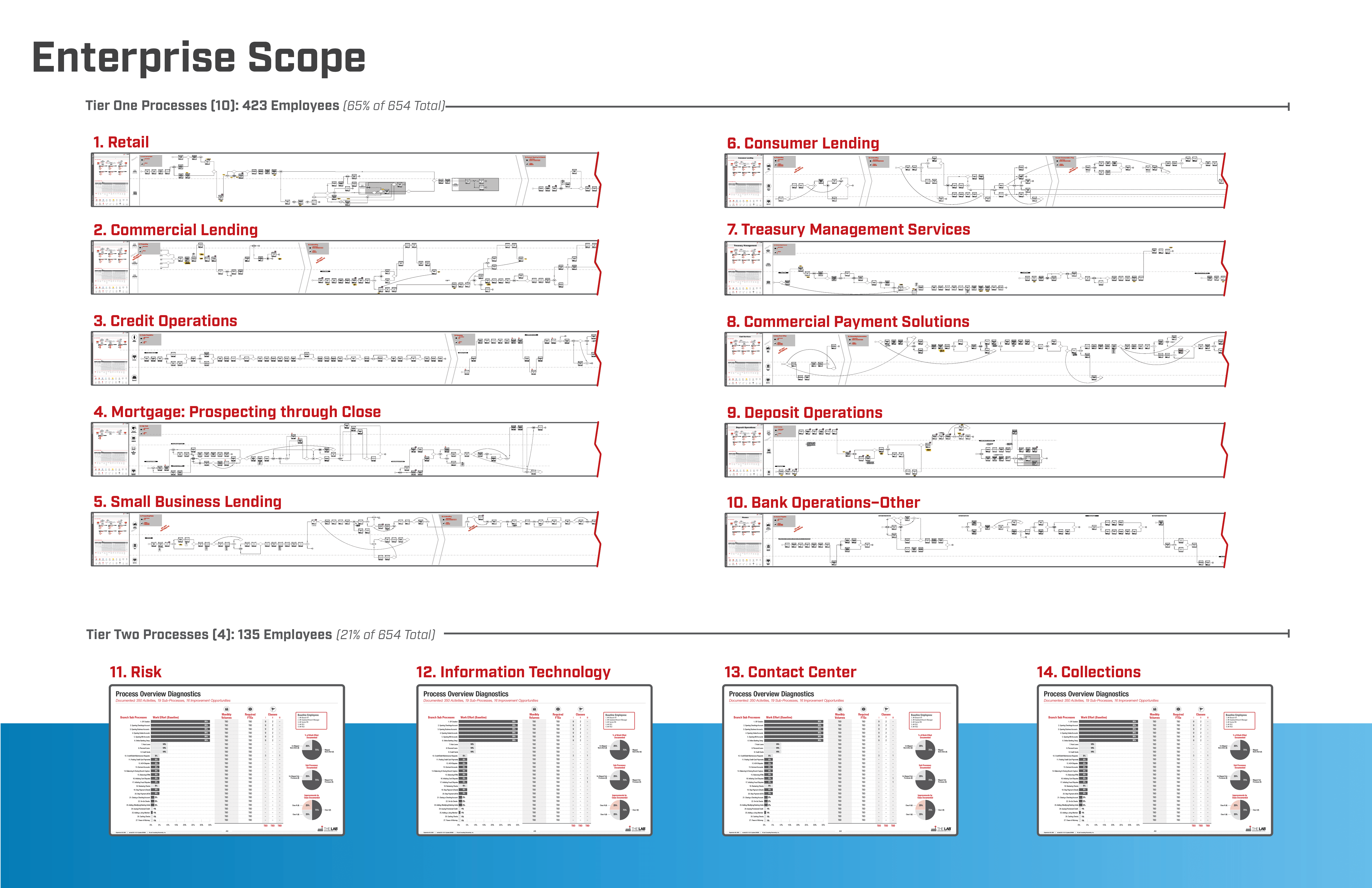

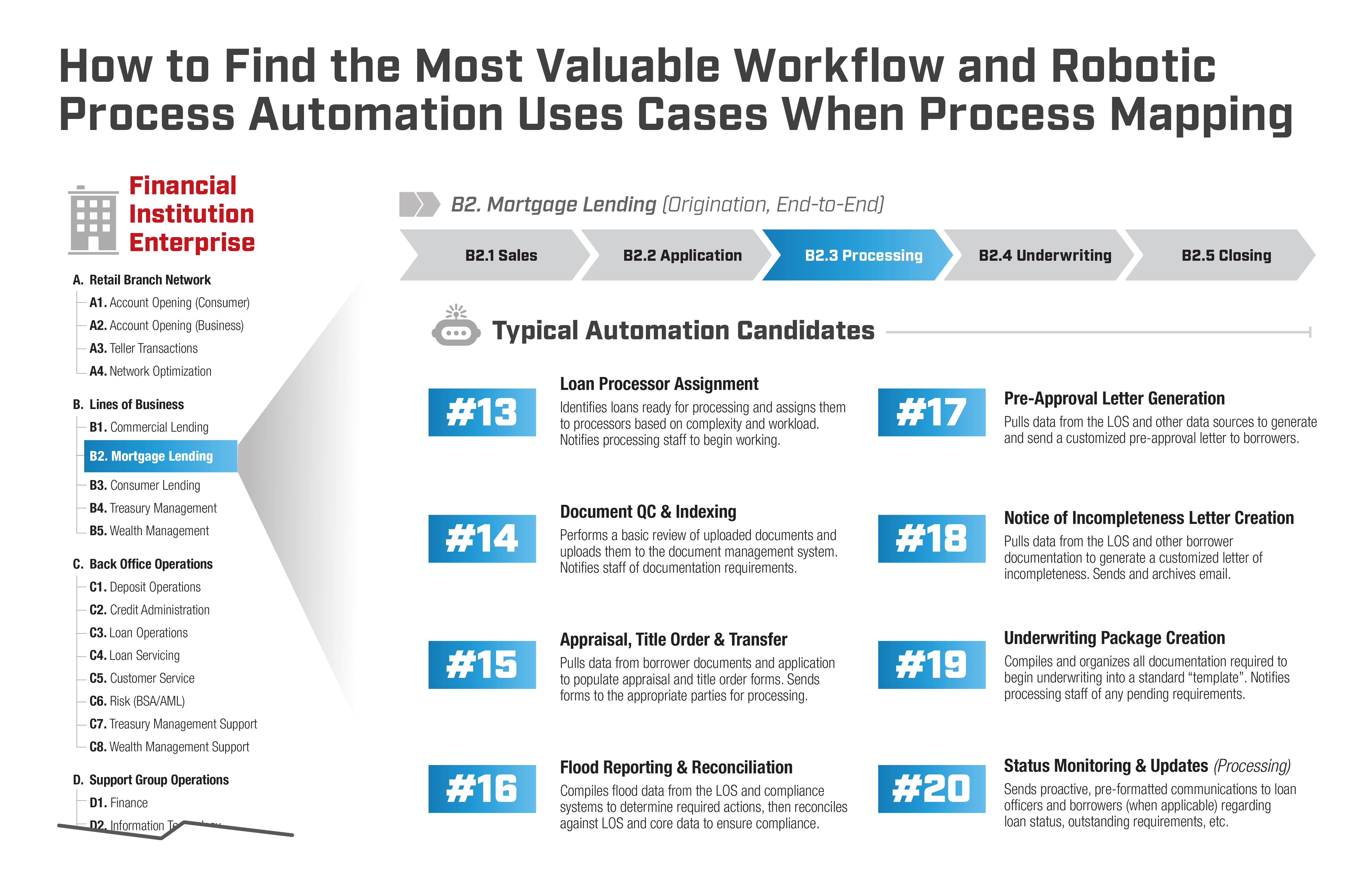

While process-mapping project scopes will vary slightly by organization, a common example end-to-end scope can be seen below.

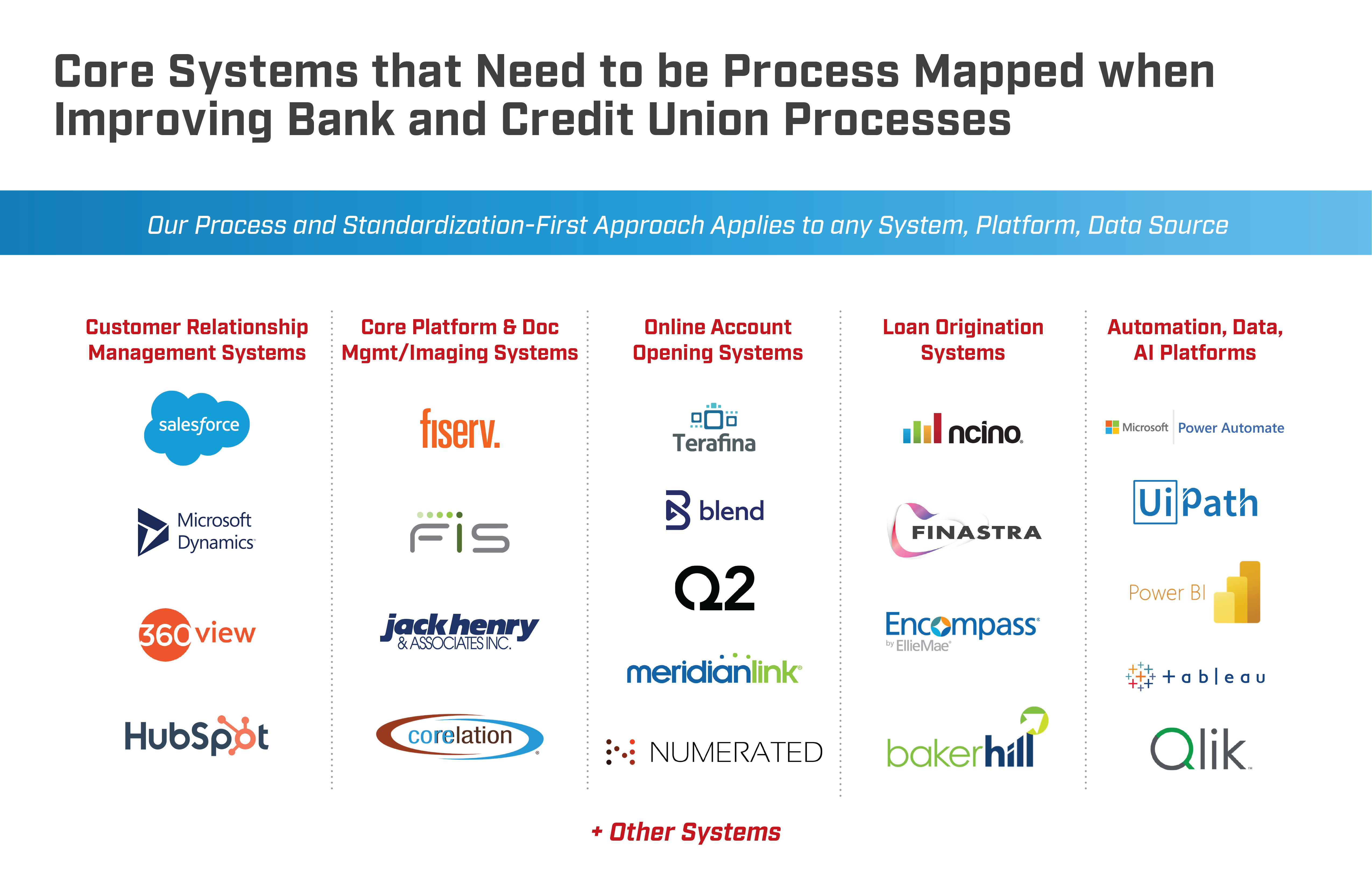

Be sure to map processes across all banking systems

You shouldn’t just map inside one system, any more than you shouldn’t map inside just one department. It’s imperative to look across all systems, from the CRM, through the LOS, the core, the imaging system, the fraud-detection system, and others, to get a true end-to-end perspective. Defining workflows inside just a single system will dramatically reduce the “lift” of a dramatic end-to-end approach.

We document your organization in 6-8 weeks

How The Lab Process Maps Your Bank or Credit Union

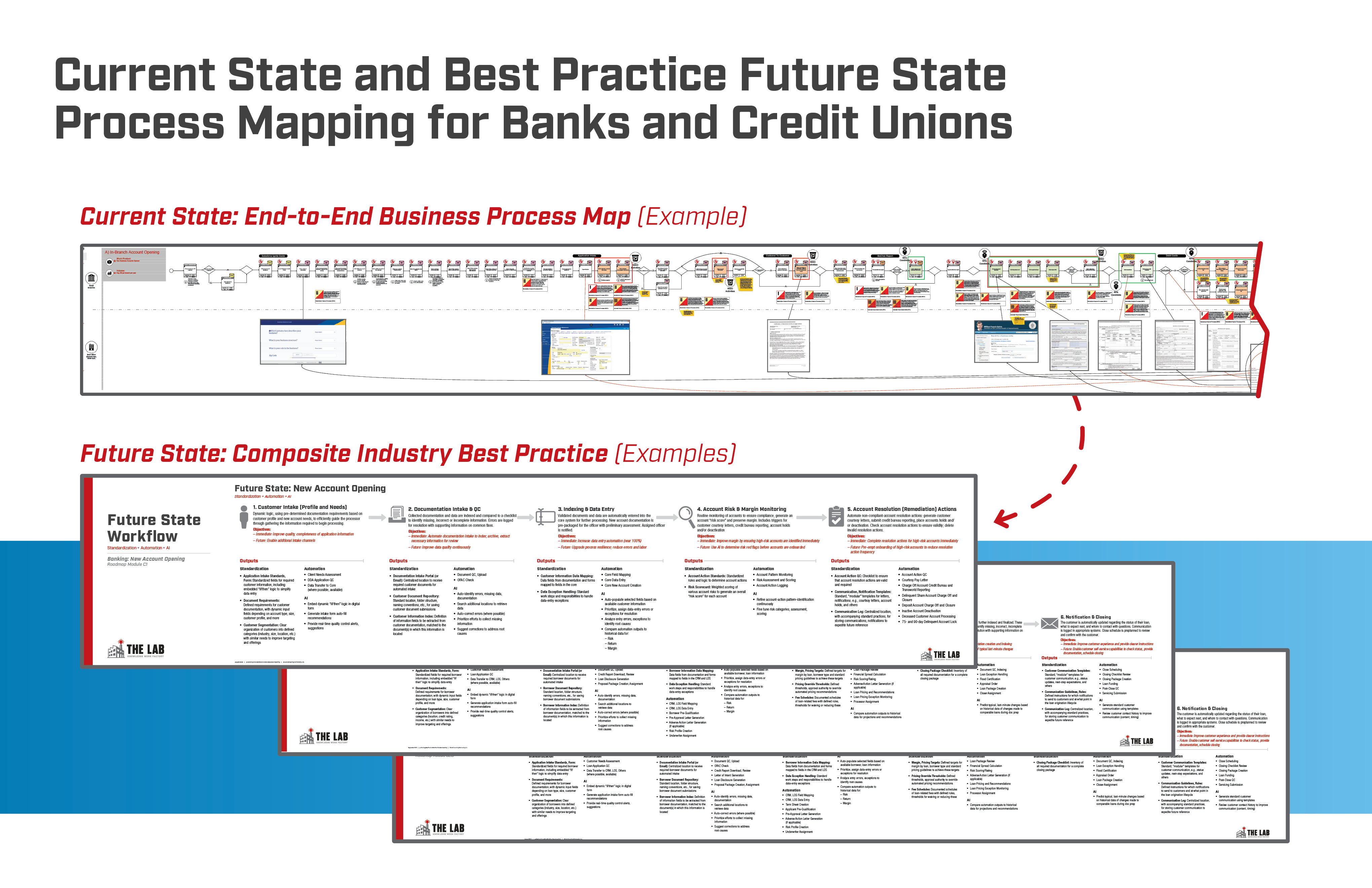

The Lab’s standardized process-mapping approach, best-practice future-state templates, and process-obsessed team greatly reduce the time required from clients to document and analyze their businesses.

We construct clients’ current-state process maps—in just six to eight-weeks—documenting end-to-end business processes in activity-level detail (i.e., one to five minutes in duration). Valuable operations and improvement detail are layered on top of each map: customer touchpoints, system use, job roles, wasted effort, automation use-cases, standardization opportunities, and more.

We have designed our client-facing process-mapping methodology to ensure that you don’t need to “shut down your business to map your business.” Throughout the duration of an engagement, The Lab only needs one to two hours of time per week per subject matter expert. We appreciate that your organization is already strained for time just keeping the lights on. We can’t be a drag on your team—and they wouldn’t be willing to work with us if we were.

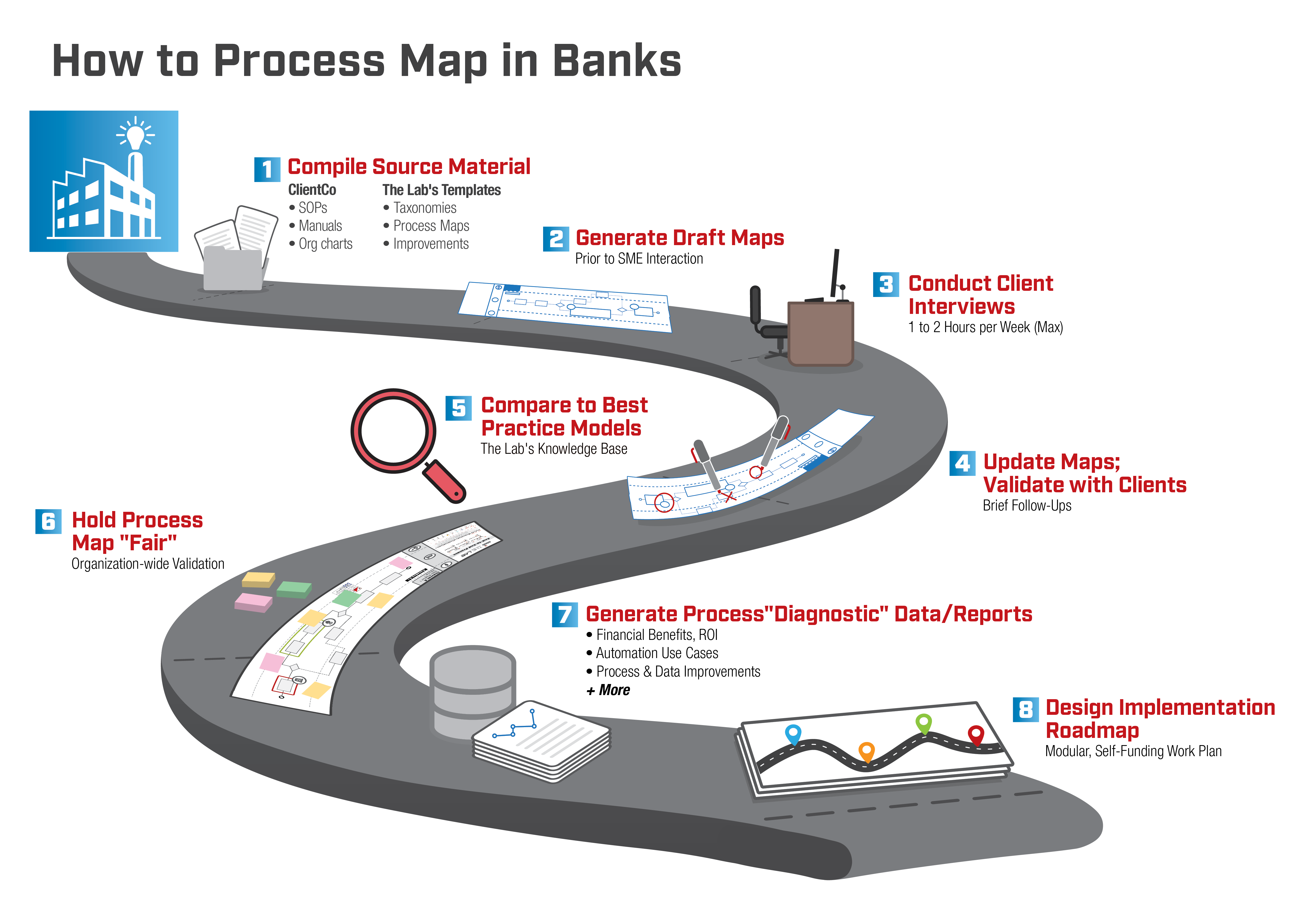

When engaging The Lab for process mapping in your bank or credit union, you can expect the following best-practice methodology and cadence:

1. Compile client source material and data

When kicking off an engagement, we first ask that you simply “dump truck” all of your existing process information, manuals, and procedures on us—even if they’re five years out of date and 50 percent complete. We don’t care; we want to analyze and consider all your past process documentation efforts We then do our research before we engage with and interview your teams. What do we want to review? We’ll ask you to share:

-

SOPs

- Manuals

- Org charts

- Operational reporting (even if your KPIs are in clunky Excels or PowerPoints)

In addition to SOP and existing process material, The Lab will need big data extracts from all of the supporting systems behind these processes. However, not to worry: We only require scrubbed and redacted data, purged of PII and CSI. We do not want or need customer-sensitive data to find trends of things like loan-cycle times, payment-processing rework, or the volume of not-in-good-order information moving through an account-opening or loan-origination process.

This data will then be paired against the process maps to aid in the generation of a current-state capacity model and to quantify all improvements for an implementation business case; after all, at its heart, The Lab is an implementation firm.

While reviewing the current-state materials which you provide, we compare them to our library and knowledge base of previously analyzed processes to begin to plug gaps. Remember, your bank or credit union isn’t that different from others.

We maintain a knowledge base that contains IP and templates, such as:

- Taxonomies

- Process maps

- Improvements

– Automation use-cases

– KPIs

– Standardization opportunities

– Reorg

– Benchmarks

– Best practices

2. Generate draft Version 1 process maps

After conducting the above due diligence, we then create Version 1 process maps. We do all this work prior to engaging subject matter experts in order to be as frugal as possible when asking your team for their time. All of The Lab’s process-mapping work and layout are performed in Microsoft Visio. Why? We do this so that we can easily hand off the post-project completed maps to your teams for future maintenance and updating without the need for you to onboard an additional software vendor. Because no matter how great our work is, and no matter how much our clients love us, no one wants consultants around forever!

3. Conduct client interviews

After we have completed the Version 1 maps, we then directly engage your frontline banking subject matter experts (SMEs) who are performing the day-to-day tasks. Via Zoom and/or MS Teams meetings, we present the Version 1 maps to them. We ask them very pointed questions about the gaps that we see in the process, and work to build out further details with them. This activity only requires one to two hours per week of engagement with the SMEs, so we are respectful of their time.

4. Update maps and iterate validation of them with clients

After we have completed the first round of fact-building and process-mapping generation with your team, we iterate over four weeks, using a lather-rinse-repeat approach to building out further details in those maps. We have found, over 30 years of experience, is that no one ever remembers every step of a process in one sitting; thus, coming back multiple times to review in short bursts over several weeks builds out the best level of detail that the organization can them improve upon.

5. Compare clients’ refined and validated process map to peer organizations and The Lab’s best-practice knowledge base models

Upon completion of the current-state process maps, The Lab’s team then compares the clients’ drafted process maps to industry best-practice models, and reviews peer comparatives. This step is integral in building out the most value-rich future state for implementation.

The Lab’s knowledge base and best-practice models contain:

The Lab’s knowledge base and best-practice models contain:

- Improvements

- Automation use-cases

- KPIs

- Benchmarks

- Job descriptions

- Process and data-standardization opportunities

- Reorg opportunities

6. Hold process “Map Fair” to crowdsource maximum improvement opportunities and gain organization-wide validation

After completion of all process-mapping, generation, and validation activities, this is when The Lab brings all process maps forward to the entire organization. These “Map Fairs” are best held in person, in common areas in the organization’s headquarters, where staff of your bank or credit union can come and contribute at their leisure throughout a two-day period.

Map Fairs allow organization team members to contribute anonymously and further validate the process fact-base that the organization has helped create. The Map Fair also socializes process-mapping findings, and readies the organization for upcoming process change, generating buy-in by ensuring that everyone has an opportunity to contribute. Organization team members “mark up” the map with Post-it notes that are color-coded thus:

- Green Post-it’s mean: “I strongly agree.”

- Yellow Post-it notes mean: “There’s missing information,” or “Here’s an additional process step or improvement that needs to be added.”

- Red Post-it notes mean: “I strongly disagree.”

After completion of the Process Map Fair, The Lab then further analyzes all Post-it note contributions, and reconciles them into a final version of the workflows. At this point in time, the maps are considered final.

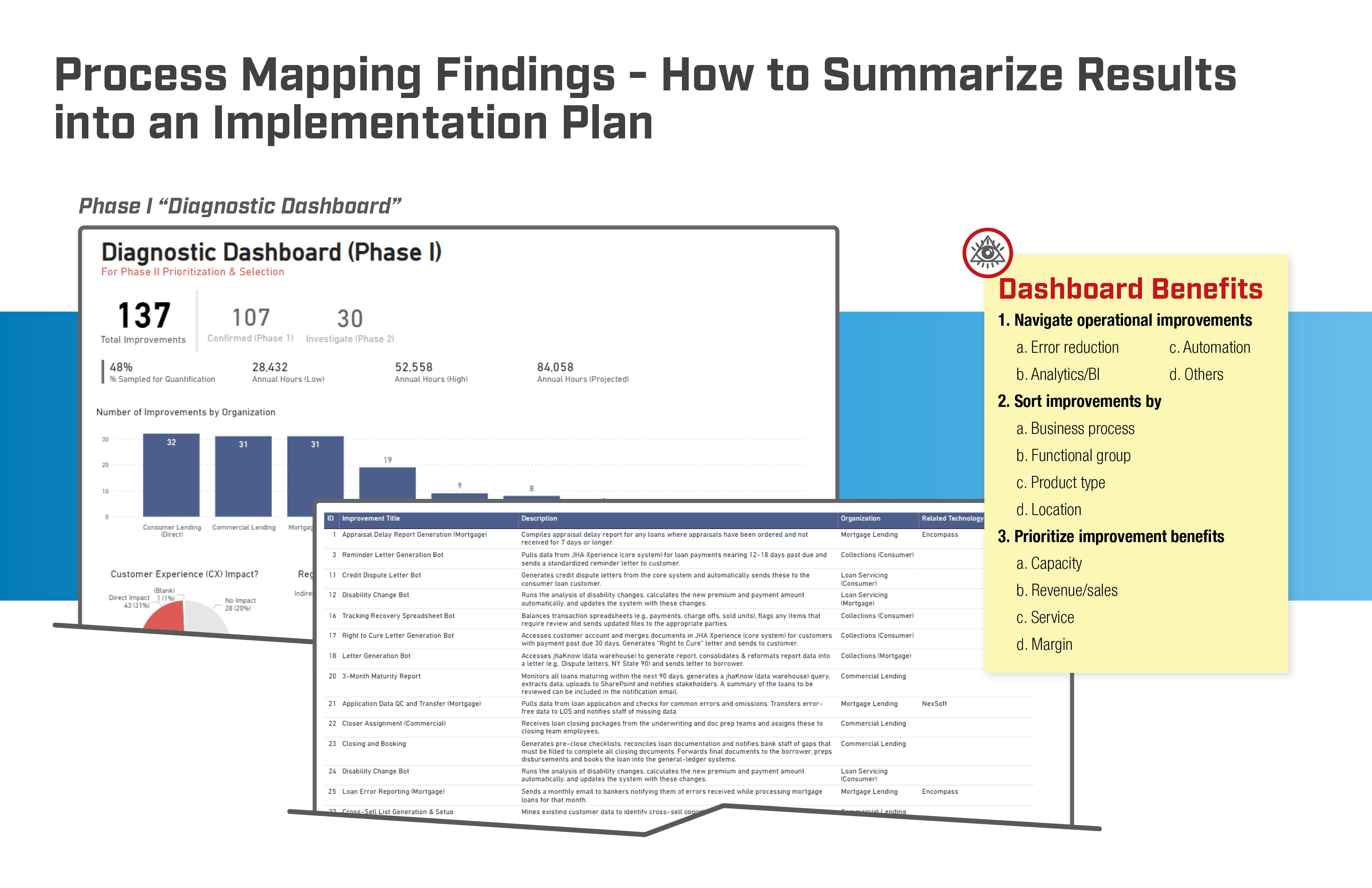

7. Capacity model: Generate process “diagnostic” data/reports

Upon completion of the Map Fair, validation, and analysis, hundreds of improvements will be found; here are some typical numbers:

- 150-250 standardization opportunities

- 100-200 automation use-cases

- 50-100 analytics use-cases

These will all need to be centralized into a database that is navigable, and a Power BI dashboard that can be viewed to prioritize and plan which opportunities to implement first.

Each of these use-cases and improvements will be quantified in terms of financial benefits, time saved, customer-experience improvement, platform/technology (under-)utilization, and other benefits categories. Following the compilation and quantification of the individual improvements, The Lab is then able to generate an overall organization capacity model that serves as a baseline for calculating the business case and value of implementation, work plans, and modules. Outputs include:

- Financial benefits, ROI

- Automation use-cases

- Process and data improvements

- More

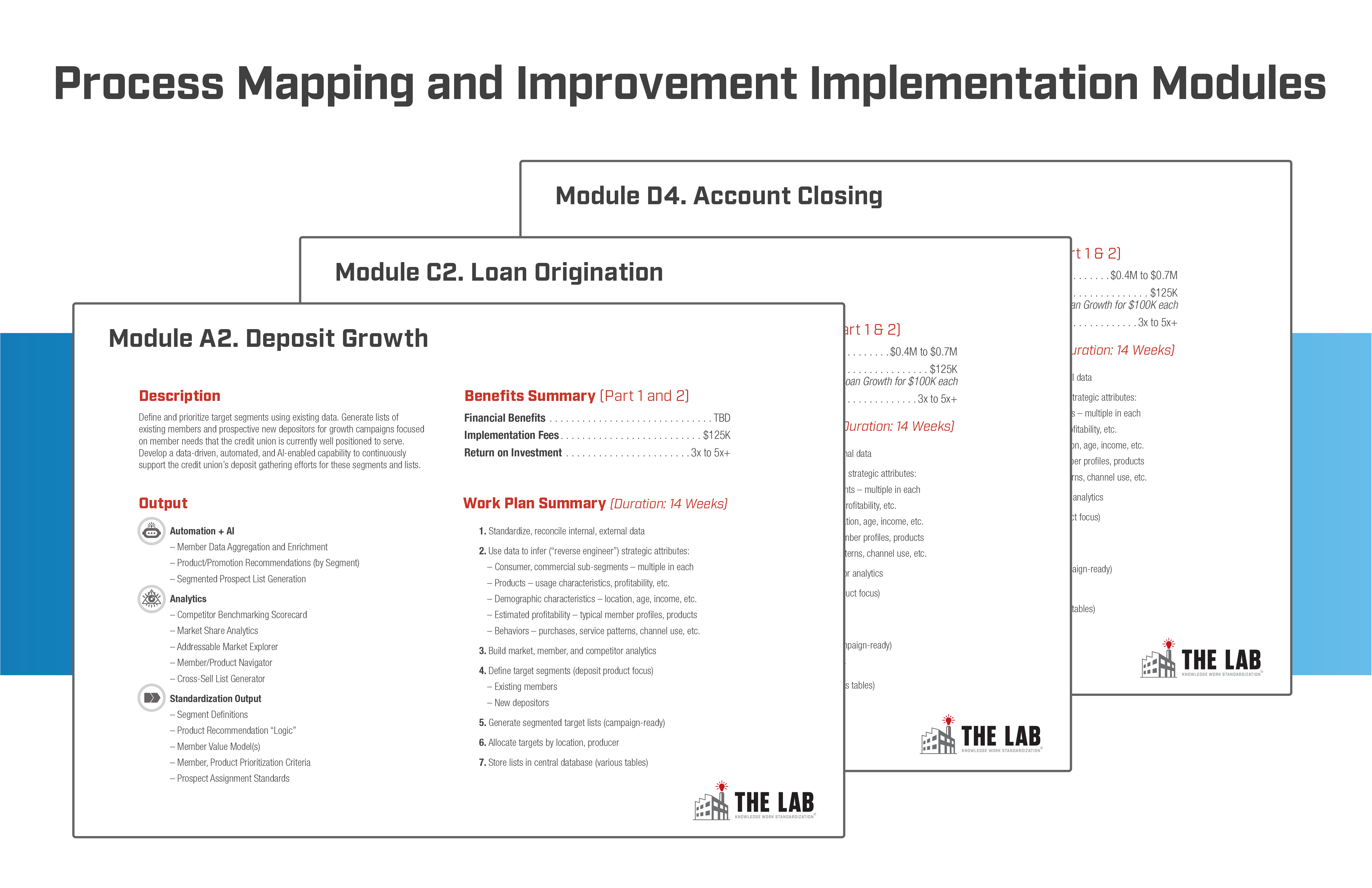

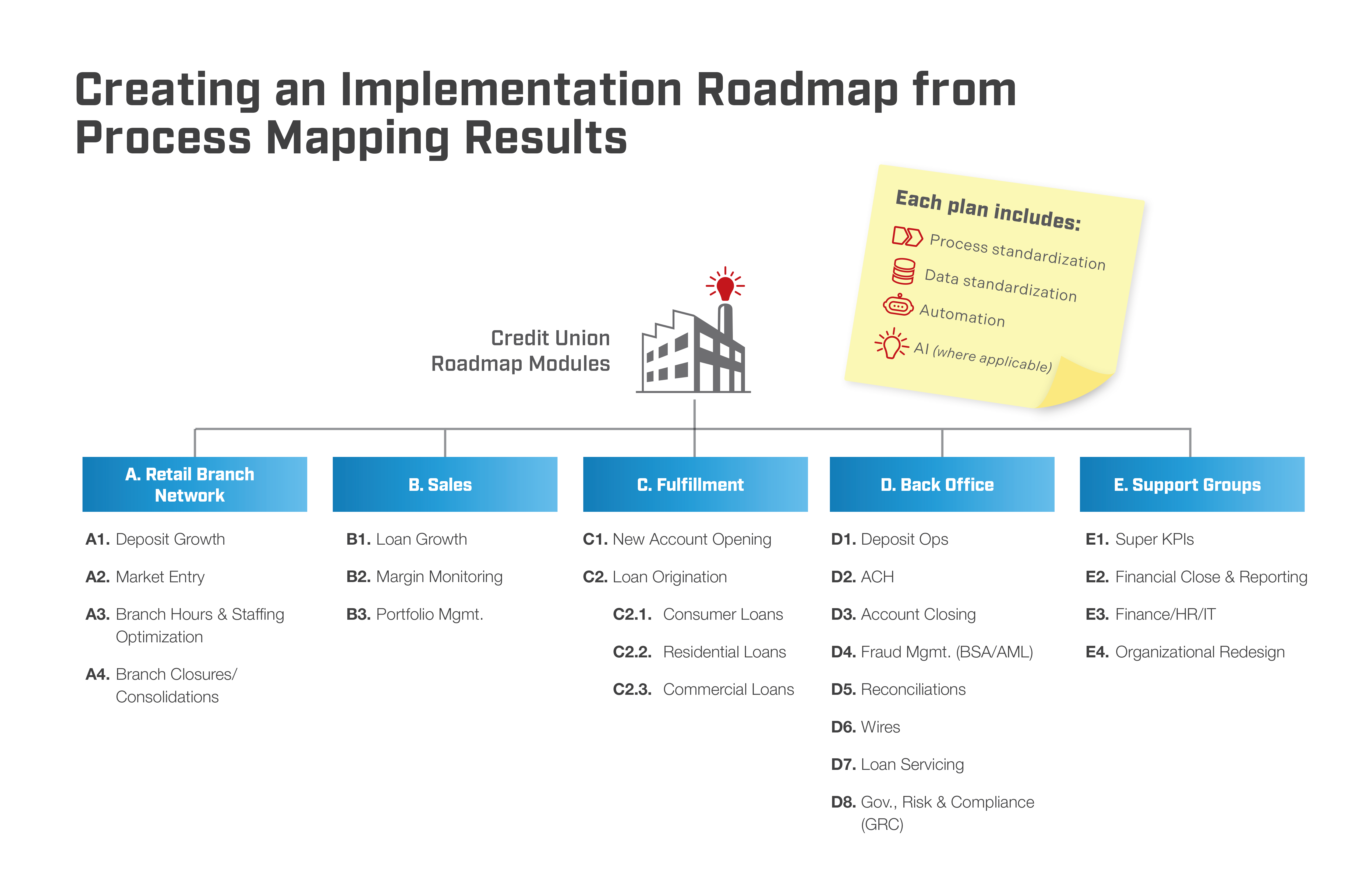

8. Design implementation roadmap

A bank or credit-union organization will not be able to implement all identified improvements in one big bang; choosing to do so will usually doom the transformation implementation project to failure. The Lab has learned that our clients are best served by developing bite-sized, smaller, digestible implementation “modules” that can be aligned to a short-, mid-, and long-term strategic plan for the client to implement with The Lab in the beginning—and on their own in the end. A continuous-improvement approach will always yield longer-term benefits than a short-term all-in-one attempt.

Outputs of this stage include:

- Modular, self-funding work plan

- Scheduled by different business-calendar quarters

- Combinations of process improvements, automation, and KPI analytics

- Jointly designed by The Lab and executive steering committee to meet the bank or credit union’s strategic objectives

Despite the “bite-sized” advice we just offered, the reality is that, sometimes, there are business situations which actually warrant a big-bang approach. The Lab has supported some of the world’s largest reorganizations in these challenging events when needed.

Cost Saving Operational Efficiency for an Enhanced Experience

Benefits of Process Mapping for Banks and Credit Unions

Benefit 1: Improved operational efficiency and cost saving

Process mapping helps banks and credit unions identify inefficiencies and bottlenecks in workflow. Once you visualize each step, you can quickly pinpoint redundant tasks and areas where resources are wasted. This comprehensive analysis enables you to streamline processes and improve productivity. Pretty soon, it will be possible to:

- Decrease errors and related rework

- Automate value-added activities

- Reduce individual performance variance

Benefit 2: Enhanced customer experience and satisfaction

Customer satisfaction is a slippery measure of success because you can very easily “overstaff to overserve” a customer. You can say adios to your efficiency ratio if you try to hire your way out of customer services issues. Process mapping allows banks and credit unions to refine their customer-facing processes, ensuring a seamless and efficient experience for clients. By eliminating customer pain points such as long wait times, redundant call-backs, or tedious paperwork, institutions can provide a smoother experience that leads to greater customer loyalty and allows for smooth cross-selling to existing customers and members.

- Seamless, more “Amazon-like” customer experience

- Improved net promoter scores

- Boosted social-media presence

- Increased commercial referrals

- Resulting opportunities for new products/services, with increased odds of customer/member acceptance and uptake

Benefit 3: Better regulatory compliance and risk management

Given the highly-regulated environment in which banks and credit unions operate, non-compliance can result in severe penalties and reputational damage. Process mapping helps financial institutions ensure that workflows adhere to regulatory requirements by defining each step and highlighting all compliance checks. Additionally, process mapping enhances risk management by spotlighting areas where controls are weak or absent. This allows for the implementation of stronger safeguards.

- Thoroughly documented and gated compliance process

- Improved audit trail

- Ensured best-practice risk mitigation throughout all processes

- Reduced variance/increased uniformity of all risk- and compliance-related processes

Benefit 4: Facilitation of technology integration and innovation

As the financial world rapidly evolves, new technologies emerge to improve efficiency and customer service. Process mapping aids in integrating these technologies by providing a blueprint of existing workflow. Clarity like this makes identifying where new tech can be implemented easier.

- Easily see where existing technology is under-utilized/no upgrade needed

- Minimize investment in new technology; maximize its benefits and ROI

- Speed institution-wide adoption and integration of new technology as needed

Benefit 5: Improved merger and acquisition activity

Given the opportunities they present for rapid growth, mergers and acquisitions are only on the rise among banks and credit unions. Whether you’re looking to acquire another company, or grooming your own institution to become a top-value acquisition target, process mapping and improvement allow you to identify all as-is business processes and customer journeys, paving the way for the most scalable future-state roadmap for both organizations. The same activities which yield benefits for a single entity are worth even more in an M&A situation:

- Single vs. combined organization design

- Consolidation opportunities easily identified

- Best-practice “overlay” reveals gaps existing in both parties

- Speeds 100-day integration plan

Contact Us Today!

Conclusion

The Lab has helped bank and credit-union C-suite executives, technology and business-unit leads, and internal improvement teams to map their organizations’ business processes and customer journeys, while streamlining operations, enhancing customer satisfaction, and achieving significant cost savings. We identify (and implement) automation opportunities, and advanced analytics, improving process resiliency, while hedging against employee turnover. Our comprehensive solutions deliver measurable results and drive success.

Ready to transform your bank or credit union? To book your 30-minute screen-sharing demo, simply call (201) 526-1200 or email info@thelabconsulting.com today.