The Client

This company is a leader in life insurance products for direct-marketing channels in North America. A subsidiary of a top-ten global multiline insurance company, this subsidiary was built through acquisitions.

Although operations of the acquired insurers were consolidated and centralized, their brand identities were maintained for marketing and sales.

The scope of the assignment for this direct-marketing operation included approximately 2,000 employees across three contact-center locations.

The Challenge

On the surface, the client struggled to retain customer service reps or CSRs. But that masked deeper problems beyond extended wait-times for callers.

Specifically, nearly half of all inbound calls involved intense efforts by CSRs to reinstate lapsed policies and prevent customers from canceling existing policies.

Numerous attempts to attract and retain CSRs—including increased base compensation and incentives, flex time, and tech updates to support work-from-home—had all fallen short.

Yet the head of contact-center operations had a suspicion: Would it be possible to reduce “upstream” issues in policyholder onboarding and communications? Could repetitive tasks be automated?

He contacted The Lab for answers.

In just eight weeks, taking advantage of The Lab’s database of life insurance policyholder services templates (KPIs, process maps, industry benchmarks, and more), all processes were mapped and analyzed, including, for example:

- Inbound call processing

- Reinstatements

- Customer issue resolution

- Beneficiary changes

Working with the client, The Lab identified more than 120 activity-level improvements across the three call centers.

Approximately 60 percent of these were standardizations that required no technology at all; the others could all be implemented with the client’s existing systems.

Phase I Findings

As it turned out, problems—including missed payments, processing error rates, and lapsed policies—were underreported by some 30 percent. Meanwhile, average handle

time for similar call types varied, from CSR to CSR, by 5x.

Most of the missed payments and policy lapses could be traced to conflicting identities from all of the different acquired brands when it came to policies, websites, invoices, and emails.

This brand confusion squandered the firm’s extensive investment in direct marketing—the lifeblood of its revenue engine.

A single simple example: Policyholder self-service options were under-promoted, driving up inbound call volume unnecessarily—simultaneously damaging customer experience with long wait times.

The Lab consolidated the 120+ improvements uncovered in Phase I into a self-funding eight-month implementation plan. Examples:

1. Upgraded performance reporting. The Lab not only standardized the existing key performance indicators (KPIs); we also reduced the quantity of existing management reports by two-thirds. The KPI redesign enabled automation of reporting tasks, while alerting managers to the performance of outlier employees, good and bad.

2. Standardized, automated correspondence. Standardized templates were developed for hard copy, email, texts, and CSR scripts. Predictive analysis (AI) anticipated correspondence needs, prompting employees with suggested vehicles, timing, and messages. Bots even custom-populated templates for the CSRs.

3. Lapse-prevention intervention. The Lab helped identify, refine, and ultimately automate preemption of the “root causes” of in-force policy lapses.

Non-tech improvements included updated CSR scripts to emphasize automatic premium payments, while bots flagged upcoming payments, credit-card expirations, and more.

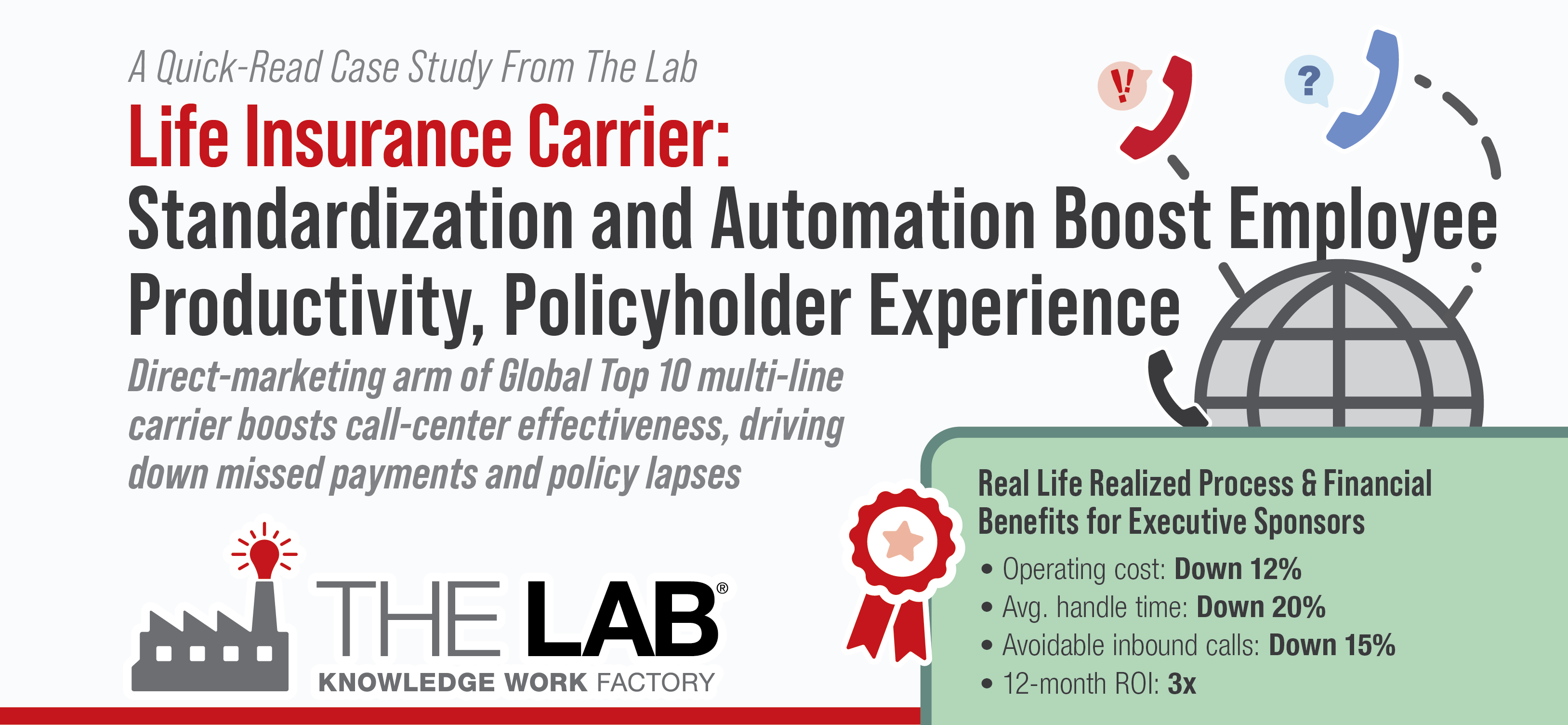

REAL LIFE REALIZED FINANCIAL BENEFITS FOR EXECUTIVE SPONSORS

Client: Top 10 Global Multi-Line Insurer North America

Sponsor: Chief Operating Officer

Project Summary

• 8-week Analysis and Discovery

• 8-month Implementation

• Self-funding

• No new technology required

Project Objectives

• Upgrade customer experience

• Increase CSR productivity

• Reduce operating expense

• Preempt policy lapses

Project Scope

• Call handling

• Issue resolution

• Lapse prevention

• Reinstatements

• Workforce management

• Call forecasting and planning

Implementation Results

• Operating costs: Down 12%

• Average handle time: Down 20%

• Avoidable inbound calls: Down 15%

• Policy lapse rate: Down 5%

• Break-even point: 6 months

• ROI (12 month): 3x

Learn more about how The Lab has been helping life insurance carriers for nearly 30 years; we invite you to schedule your free, no-obligation 30-minute screen-sharing demo.

You’ll learn more about our patented approach to Knowledge Work Standardization®. You’ll see actual E2E process maps and RPA bots in action. You’ll learn how we are able to do all this, remotely, from our U.S. offices in Houston, with nothing outsourced or offshored, ever. And you’ll get all your questions answered by our friendly experts.

Simply call (201) 526-1200 or email info@thelabconsulting.com to book your demo today!