Executives at the global energy provider were upbeat when they authorized a new, state-of-the-art corporate campus in the U.S. Over the course of construction, volatile oil prices periodically gave them mild cases of buyer’s remorse. More importantly, the unstable energy markets prompted them to review every aspect of Corporate Services. The objective was twofold:

• Review spending and reduce unnecessary expense across all Corporate Services

• Increase the speed, effectiveness, and flexibility of the Facilities Management group

As the new campus was approaching completion, the executive management team internally recruited a new Senior Vice President of Corporate Services. In addition to strong operating experience in refining, she had spent several years early in her career in Finance. Along the way, she had also obtained a law degree while continuing to work. Her new position would draw upon every aspect of her experience.

In addition to opening the campus, she faced a flood of additional issues. Costly office and research facilities around the world required lease renewals, remediation, and maintenance. The property tax bills for all facilities were growing 50 percent faster than planned. The recently-installed technology for worldwide maintenance management was not delivering the promised performance. Other corporate services slated for review seemed immune to the most basic management methods: courier delivery, daycare, employee health and food services—even the internal move-management operations.

The SVP knew that she would need outside help to assess these disparate, far-flung organizations, but did not know where to start looking. Then she came upon materials from The Lab that described their work in these areas—along with standardization templates to accelerate assessment, standardization, and automation. She was intrigued by the notion of “standardization” especially since the managers of these organizations avoided comparisons, claiming that the various facilities, tax authorities, and internal organizations were each “unique.” Anxious to learn more about how standardization might help, she contacted The Lab.

Client Description, Project Scope, Objectives

The company is a Top 25 global energy provider with diverse subsidiaries in chemicals and gas liquids. It maintains an extensive internal consulting capability with a successful track record optimizing conventional asset-based energy operations. However, these teams historically struggled to succeed at improving knowledge, or office-worker, operations. The organizations involved in the Corporate Services scope included almost 5,000 employees across global locations.

The Corporate Services Initiative (CSI) began with joint development of a Phase I, “frugal footprint” scope plan. The Lab works with clients to identify the minimum number of broadly representative sites to visit (in person or remotely), analyze, and sample test. The goal of this frugal-footprint work plan is to save time and analysis cost during Phase I—while avoiding the risk of false precision or “analysis paralysis.”

Phase I, Analysis and Discovery

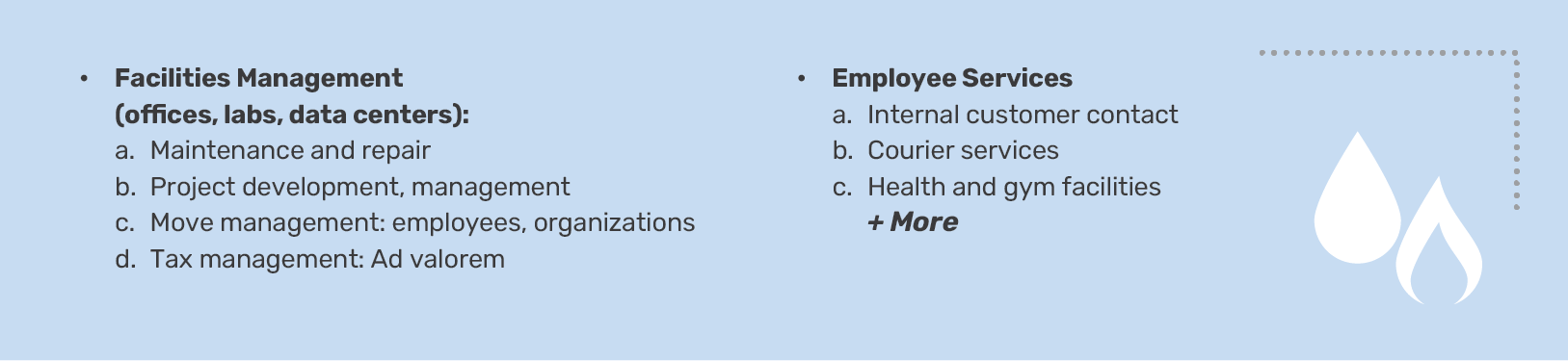

The CSI Phase I Analysis and Discovery effort began with an eight-week Phase I analysis covering most of the corporate services organizations and over 80 percent of the employees:

The Lab’s database of corporate services templates—including standard KPIs, process maps, benchmarks, best practices, automation “use cases,” and more—enabled rapid activity-level documentation and analysis of the in-scope organizations, while only requiring one hour per week of any subject matter expert’s (SME’s) time.

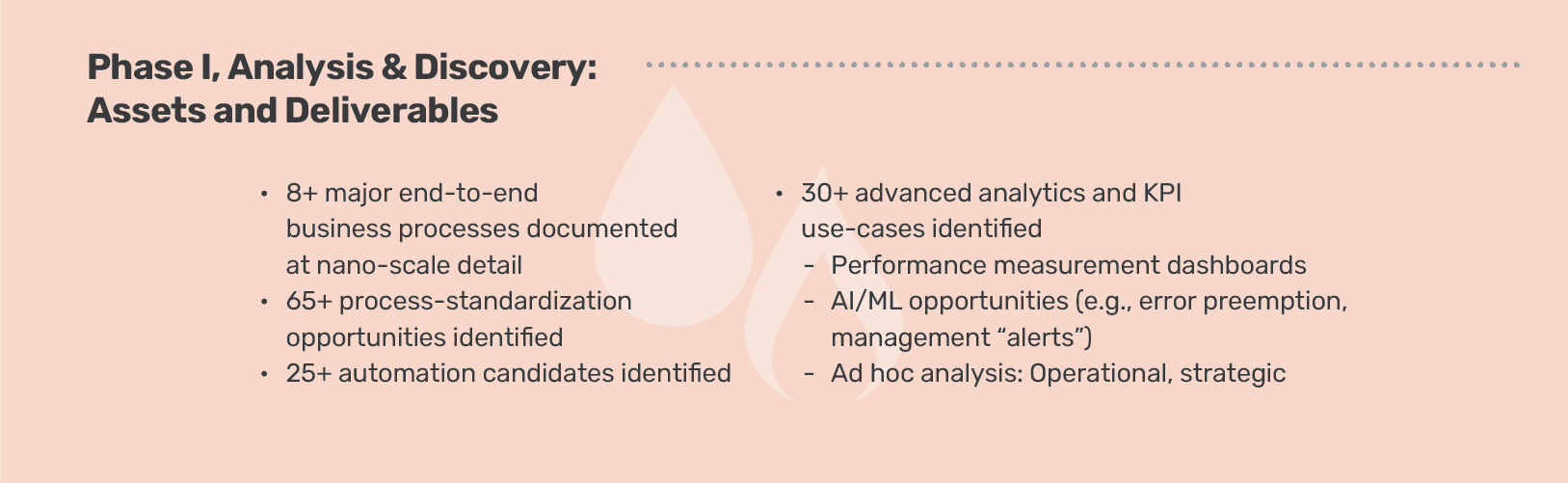

During the Phase I analytical effort, The Lab and the client’s North American internal improvement team identified over 120 activity-level improvements. Approximately 60 percent of these represented nontechnology, standardization improvements that reduced error corrections and/or enabled automation. While the remaining improvements were technology-dependent, no new systems were required. Roughly half could be automated using the existing technology after the work was standardized. The remainder were automated using robotic process automation (RPA), sometimes augmented with artificial intelligence (AI) for simple decision-making or predictive functions.

Better yet, all improvements could be implemented in eight months or less, with benefits beginning to accrue from standardization within six weeks of the start of implementation.

Phase I Findings

Although each organization and group within Corporate Services handled different activities, the improvement themes were similar across the company’s global facilities network. Methods and business processes varied needlessly to achieve identical outcomes with inconsistent service levels.

Facilities maintenance and repair. The company invested heavily in a facilities-management module for the existing global ERP system. However, adoption was not monitored, and most employees continued with local, even individual methods (essentially spreadsheets). Standard unit costs and labor factors for routine work were unrealistically high and varied by location.

Project development, management. Although the company maintained a standardized, rigorously controlled change-order process for its energy-operations assets—from design though final delivery—this discipline was not duplicated for the facilities division in corporate services. This resulted in construction delays, cost overruns, and needless variation in specifications.

Move management. Employee moves were not segmented and consolidated based on urgency, off-hour need, or similar factors. Consequently, most individual employee moves were defaulted to a “white glove” level of service to avoid employee inconvenience. These moves were implemented individually, on a short lead-time and after business hours, involving overtime and multiple trade unions.

Tax management. The business maintained standardized business processes for acquiring and managing complex leases (including taxes) for its energy-exploration and production operations. By comparison, ad valorem taxes were much simpler. However, real estate operations within the facilities-management organization treated each tax appeal as a unique event. Attorneys in the department each developed their own appeals strategies. Performance data on appeals outcome was not well documented.

Phase I, Analysis and Discovery

Phase II, Implementation

The eight-month, self-funding Phase II implementation effort succeeded in designing and installing new standards to simultaneously improve productivity, work quality, and service levels.

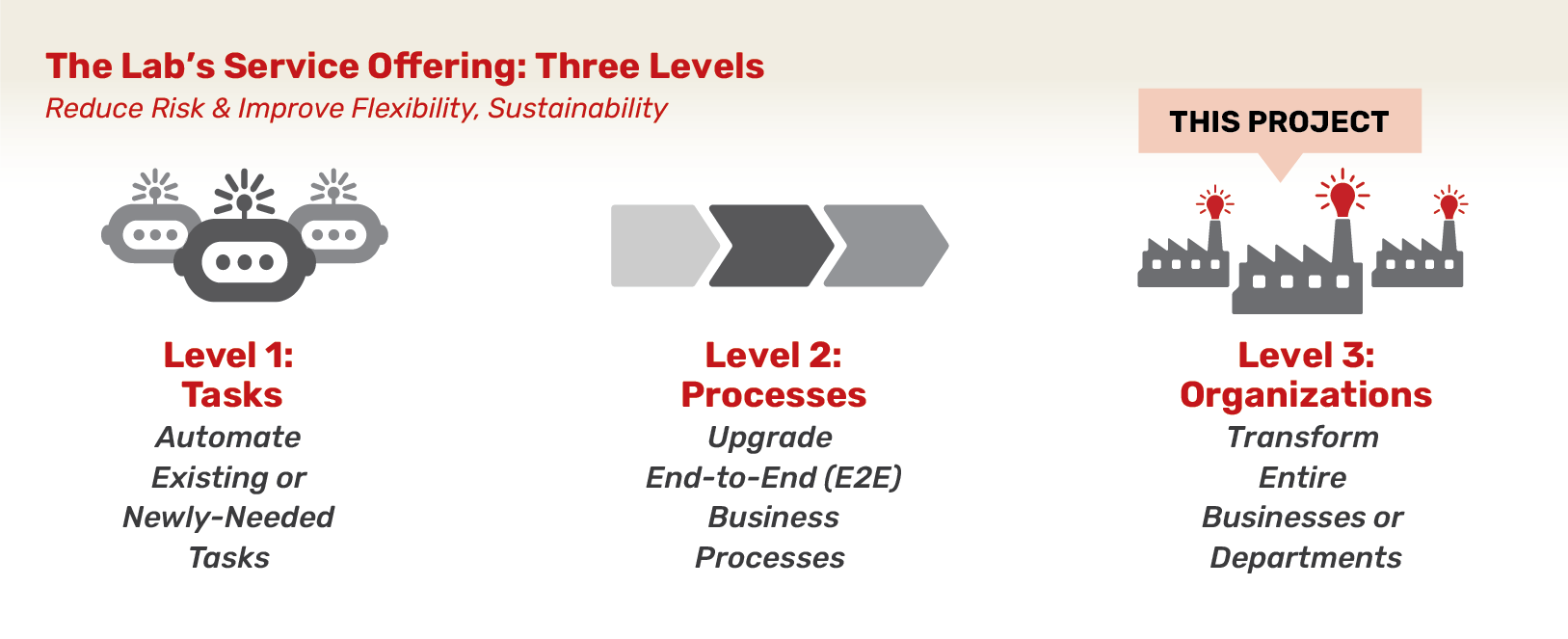

Specific, measurable improvement goals were established by each organizational area. The leaders involved could perform the work with any mix of resources they chose: internal resources, The Lab’s resources, or others. The Lab maintains a three-tiered service-offering structure (plus ongoing post-implementation support) to make this as flexible and sustainable as possible for clients:

Post-Implementation Support, Sustainability and Automation

The Lab provided hassle-free, post-implementation, hourly sustainability support for this client to maintain automations, process standardization, and operational data analytics models implemented during the Phase II engagement. If the client’s team was not up-skilled enough to perform any needed automation updates, they leaned on The Lab for Tier 3-level support. If analytics dashboards required additional views created or data connection revisions, The Lab’s team was a simple phone call away.

Improvement Examples, Service and Distribution Standardization

The Lab organized more than 120 process-improvement opportunities into manageable “work streams” for implementation. Examples:

The Lab Makes it Easy

Organization-friendly engagement design

At The Lab, we’ve spent three decades refining every aspect of our transformation engagement model. We’ve made it easy for clients—from the C-Suite to the front line—to understand and manage the initiative:

• Minimal use of client time: One to two hours each week, maximum.

• Measurable benefits: Typical 12-month ROI is 3x to 5x.

• Pre-built templates and tools: Process maps, data models, bots, and more.

• U.S.-based, remote delivery: Nothing is ever outsourced or offshored.

Designed to reduce risk, increase success

Since 1993, The Lab has led the industry in eliminating risk for our clients. Whether your engagement involves a handful of bots or wall-to-wall transformation, we make it easy to do business with us:

• Fixed pricing and clearly defined scope

• Pre-project feasibility/value assessments at nominal cost

• Early-out checkpoints and options

• Money-back guarantees

Book your free demo

The best way to learn about The Lab’s patented Knowledge Work Standardization® approach is to book your free, no-obligation 30-minute screen-sharing demo. And you’ll get all your questions answered by our friendly experts. Simply call (201) 526-1200 or email info@thelabconsulting.com to book your demo today!