Given the latest trends—and the seismic shifts—in the credit-union industry, there’s never been a better time for leaders to take a good hard look at the three “big rocks” of transformation, digitization, and cost-cutting:

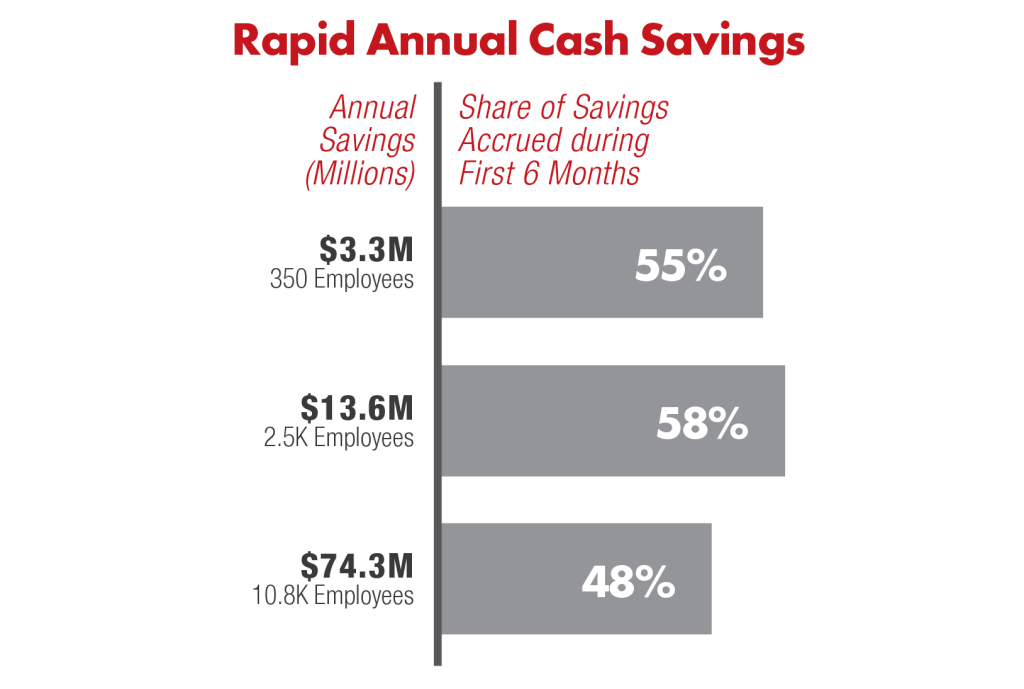

- Transformation Big Rock 1: Transform the Credit Union retail branch network. How can you use data to drive decisions? How can you stop over-serving locations and markets—without alienating your customers? Even if you don’t make a single closure, your branch network contains 40% of the total savings potential.

- Transformation Big Rock 2: Standardize Credit Union lending operations, both commercial and consumer. Your top- and bottom-quartile performers are farther apart than you think. What you also don’t know: All sales producers are by swamped by “NIGO,” or “not in good order” rework and remediation. How can you eradicate those activities without slowing down your revenue engine? Better yet, how can you improve member experience and revenue productivity at the same time? The next 35% of credit-union savings potential resides here.

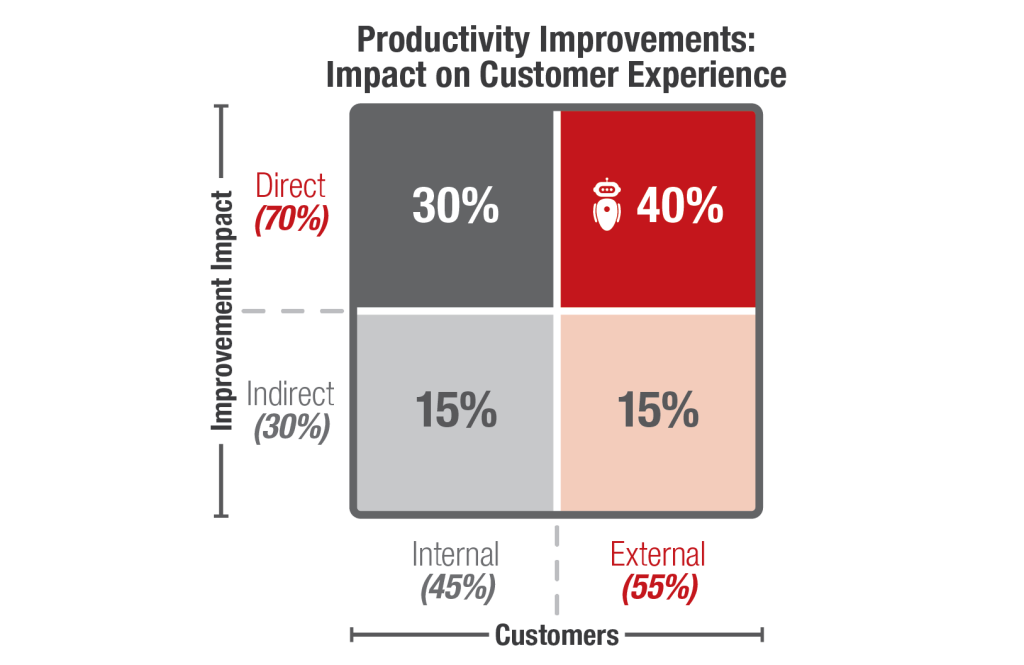

- Transformation Big Rock 3: Digitize and Automate Credit Union back-office operations. Boost efficiency and speed, while drastically slashing costs, with RPA, or robotic process automation. One-fourth of all savings reside here.

This article will give you a quick hands-on overview of all three opportunities to transformation your credit union.

What is credit union transformation?

Credit union transformation is defined as implementing fundamental changes into member facing and back office business processes in credit unions. Benefits of credit union transformation include; reduced operating cost, increased transaction processing speed, improved revenue, and improved member/employee experience.

Big Rock 1: Credit Union retail branch network cost reduction and transformation using digitized big data and analytics

There are four steps to crushing this “big rock.” They go like this:

- Map out your customer types, by branch, based on the deposits, transactions, and products purchased.

- Develop data analytics models using Business Intelligence to gauge customer losses and deposit transfers. Remember: Losing unprofitable customers to competitors is a valuable benefit, so be sure you have granular data from Step 1, above.

- Alter branch operating hours based on demand.Don’t offer Saturday hours if there are no Saturday customers. Overtime, by the way, should be zero.

- Develop a retail branch staffing model with enterprise-, division-, and branch-level views, using the branch-based transaction data from Step 1.

Once you have the data properly sourced and configured, you can really put it to use. This is a common theme you’ll find among all three of the credit-union “big rocks” in this article. At The Lab, we employ our patented Knowledge Work Standardization® methodology to eliminate wasteful redundancy and rework, eliminate “NIGO,” and uncover newfound power from data landfills in the process.

This paves the way for two groundbreaking technologies—again, for each of the three “big rocks” that credit unions must confront.

Credit Union Digital Transformation via Business intelligence (BI) analytics. Also known simply as “digitized data analysis” these allow you to crunch millions of rows of Excel data and overlay it with information such as map-based demographic data! So you can “be where the action is,” in terms of your branch network; it’s as easy as looking at a color-coded map. You can also get “branch scorecards,” based on criteria you choose, and keyed to actual core-systems data! Check out this video about branch cost-cutting thanks to BI:

Robotic process automation or RPA for Credit Unions. These are defined as digitized workers, or software “robots”, which can sit at a desk and handle the repetitive, error-prone activities which your credit unions workers must perform each day. We’ll cover these more in the following two “big rocks” in this article.

You can read more about robotic process automation transformation for Credit Unions in our “Long form explainer” here.

Big Rock 2: How to improve operations in Credit Union consumer and commercial lending – a real life example of lean standardization and digital transformation at work

If you ask any credit-union leader executive to “slash costs in their lending operation,” they’ll quickly show you the exit. How dare you touch their revenue engine!

Unfortunately, the “untouchable engine” is a misperception. It’s entirely possible to transform your credit union’s lending operation, crushing hidden costs while boosting productivity and revenue, simultaneously.

The first step in this rock-crushing exercise is to broaden your definition of “lending” to include:

- Products

- Customers

- Prospects

- Producers

Let’s quickly review each.

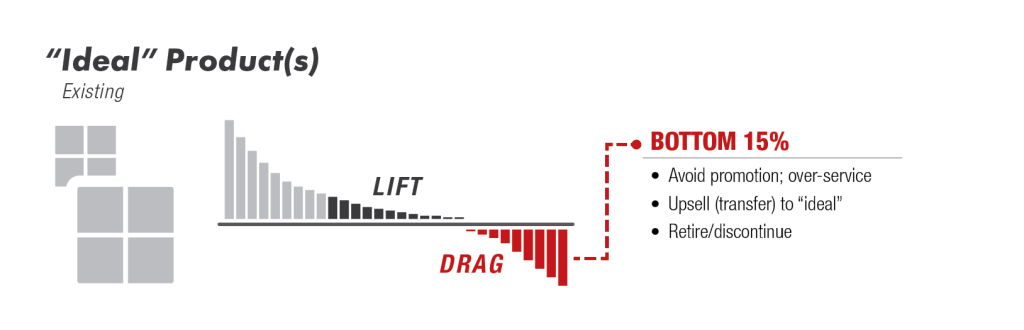

Rationalize Products. Not all products are the same. Ideal products are profitable. But there are surely mediocre products in your credit-union’s portfolio. You know where this is going… There are also products in your portfolio which sap your credit union of margin and profit.

When was the last time you scrutinized them all? Are you still promoting the “losers”? If so, stop. Retire them. And provide incentives for your customers to “upgrade” to “ideal” products.

Analyze Customers. Here’s another credit-union knee-jerk reaction: “Cut customers? Are you insane?”

Not at all. Just like products, your customers span a range of profitability. Your job is to identify the ideal customer you’d like to “clone.” You’ll want to improve the also ran’s… and examine that painful “long tail” of unprofitable customers who are dragging your lending operation down. Consider these steps for reducing this “drag” on your “revenue engine”:

- Identify, prioritize, and assign these customers to a specialized team

- Reduce your service to the unprofitable customers

- Impose fees, or increase rates for customers who demand “over-service”

- Encourage “erosion” via predictive modeling—let those unprofitable customers migrate to your competitors!

Prioritize and Centralize Prospects. The exact same logic applies. Start with existing customers. Study what they’re buying. Target these at the “moderates.” This is the lowest-hanging fruit: upsell opportunities among existing customers.

Similarly, you can “eliminate drag” among credit-union prospects by prioritizing upselling, and screening out “dead on arrival” prospects.

Analyze Producer Productivity. Again, if you map out productivity among individual producers, you’ll see the painfully long “long tail” of under-performers, whose weight is being carried by the top performers at the other end of the sale.

After you tighten up the prospecting process, “reduce drag” by:

- Measuring individual margin and documenting the variance

- Enforcing “ideal” activity-level sales processes

- Focusing on lifting moderate performers’ performance

- Offboarding continual under-performers

Big Rock 3: Automate and Digitize Credit Union back-office, deposit, and payment operations

Your credit union’s back office is staffed by highly-educated, and highly-paid, knowledge workers who, sadly, spend their days copying, pasting, comparing, and reconciling data between lots of different systems which don’t—can’t—talk to each other.

As we’d mentioned earlier, robotic process automation, or RPA, can transform this credit union back-office backlog. Software “robots” can “sit at their computer,” just like a human, and log in to servers, switch applications, click, copy, paste, etc. Unlike people, however, robots are faster, never tire, don’t take breaks, or ever make mistakes.

Learn more about RPA for credit unions by reading The Lab’s long-form explainer here.

Just imagine all the “back-office buckets” where you could “park a bot” to speed processes, recoup capacity, and eliminate errors:

- Deposit operations. Transactions, daily reconciliation, Reg. D letters, and more.

- Treasury management services. ACH setup, onboarding additional services, and more.

- Wire transfers. More than 70 percent of the activities are ideal for bots.

- Risk/compliance. Consider the manual processing of Reg. E letters alone!

- Customer contact. Includes the call center, responding to web-based requests, etc.

Take a look at one bot from The Lab in action: It processes Regulation D violation letters in the back office:

Transform the “three big rocks” of credit-union costs and efficiency gains

See how The Lab can deliver all of this “rock-crushing” power to your credit union—and how we can do it all remotely, from The Lab’s U.S. offices in Houston!

Contact The Lab at (201) 526-1200 or email info@thelabconsulting.com to schedule your free, no-obligation 30-minute screen-sharing demo today!