One important takeaway from the book The Knowledge Work Factory is that standardization is at the root of all business improvement. Working alongside standardization on the production floor has been robotics and now in the form of RPA, or Robotic Process Automation, it is moving into knowledge work.

One place where Robotic Process Automation is making waves improving knowledge work productivity is credit unions and banks. What is robotic process automation for credit unions? RPA can be used to automate routine, repeatable tasks done by bankers such as data gathering, data entry, and other low-value tasks. The applications of RPA don’t just stop there though, credit unions can utilize RPA for member onboarding, process reconciliation, underwriting, anti-money laundering, and other integral credit union processes.

Table of Contents

What is Robotic Process Automation for Credit Unions?

Robotic Process Automation Software Provider Comparison and Trends

Use Case Examples of Robotic Process Automation Bots on Common Credit Union Processes

Attended vs. Unattended Robotic Process Automation in Credit Unions

Benefits of Robotic Process Automation for Credit Unions

Implementing Robotic Process Automation in Credit Unions

The Lab’s RPA Credit Union Bot Catalog

How The Lab Can Accelerate Your Credit Union Hyperautomation Initiative

What is Robotic Process Automation for Credit Unions?

Robotic Process Automation, or RPA, can be defined as the implementation of software robots—or bots—to automate mundane, rules-based processes such as account opening or member password resets in the credit union industry. These routine and repeatable tasks are currently performed by knowledge workers, also called white-collar workers, which take up time that could be better spent on more involved tasks.

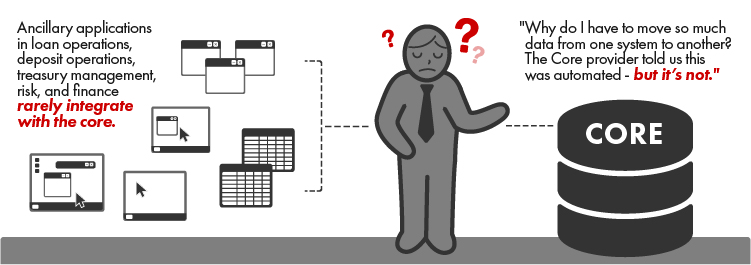

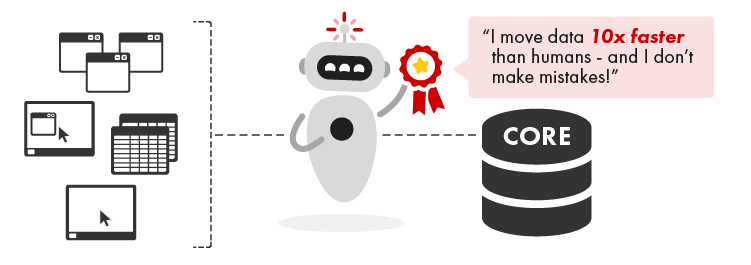

In theory, RPA can automate entire processes, but most credit unions use RPA to bridge the gaps between legacy core systems and data, email, or word-processing applications. Think of RPA as a macro that can easily and seamlessly switch between apps. It can allow employees who don’t understand computer coding to connect dissimilar applications without the assistance of trained IT professionals.

Robotic Process Automation in Credit Unions, is a subset of a bigger transformation theme, digitization, also called digital transformation. For more on Digital Transformation in Credit Unions, read our “long-form explainer” on the subject here.

Robotic Process Automation Software Provider Comparison and Trends

Google Search Traffic History:

Although its roots are in data extraction programs like screen and web-scraping tools and workflow automation and management software, RPA is not dependent upon a specific programming language or a particular application. Instead, since RPA runs at the display, or surface level, of the process, credit unions can issue commands, manage workflows, and integrate new applications with drag-and-drop simplicity.

RPA reduces costs and frees employees up spend more time servicing members or perform other value-added tasks.

Use Case Examples of Robotic Process Automation Bots on Common Credit Union Processes

Credit Union Use Cases

1. ACH Stop Payment Processing

2. Debit Card Fraud Processing

3. Regulation D Violation Letter Processing

4. Wire & ACH Processing Automation

5. Brinks & Loomis Reconciliation Automation

7. Branches, Commercial, Consumer Official Checks Daily Reconciliation

8. Time Clearing (Daily Teller Level Transaction) Reconciliation

9. Expense Account Reconciliation

11. Commercial Loan Onboarding

12. Automate CARES Act Paycheck Protection Program Loans

Transaction Processing RPA Bots in Credit Unions – 3 Examples

Credit Union RPA Use Case # 1 – ACH Stop Payment Processing

This is the human process:

Back-office staff (Deposit Operations) manually extract ACH datafrom FIS Insight. Then they process the stop-payment in FIS Vision and FIS ACH tracker. After that, they update the journal entry in Oracle Peoplesoft. This “In-Branch Payment-Processing Bot” was implemented by The Lab to automate the entire process for the back office. The bot processes the data from the ticketing system, into the general ledger, processes the correct GL accounts, and then moves that information into the credit union core. This bot successfully connects three disparate systems that had no way of previously being connected, other than with manual human effort.

Now this is how a RPA bot does it:

Working at the graphic-user-interface level, and mimicking the exact human-process flow for ACH stop-payment transaction processing, this single bot from The Lab processes more than 50 interface clicks across all four systems: FIS Insight, FIS Vision, FIS ACH Tracker, and Oracle Peoplesoft.

See for yourself:

https://youtu.be/KrrLrxzPnEM

Credit Union and Banking RPA Use Case # 2 – Debit Card Fraud Processing

This is the human process:

Debit card fraud processing is a highly manual process at this credit union, which requires that staffers review a dispute-tracking system (Centrix) on a daily basis and process those transactions into the credit union’s card-management system. The lack of integration between these systems from two different providers results in a staggering 12-percent error rate. Not only that, this error-prone work requires one entire FTE’s worth of capacity, annually, to complete.

Now this is how a bot does it:

RPA, or robotic process automation, was implemented by The Lab to support debit-card fraud processing as follows: Every night at 10 pm, the new bot navigates to the credit union’s dispute-tracking system. Once there, it selects the appropriate date range and debit card dispute reasons, and exports the selected transaction data into Excel. Next, the bot removes duplicate disputes that exist in the dispute system and proceeds to process the debit-card fraud items, one-by-one, into the card-management system. After its successful initial implementation, this bot was later expanded to also send the debit-card fraud-notification letters to customers directly.

See for yourself:

Credit Union and Banking RPA Use Case # 3 – Regulation D Violation Letter Processing

This is the human process:

Regulation D violation letters, and many other credit union letters like it, require back-office staff at this credit union to manually review the daily transactions received in one credit union system, and then process them over into the core system. It currently takes credit union staff 15 minutes to create the first letter and five minutes for each subsequent one; what’s worse is that this process suffers from a 15- to 20-percent human-error rate.

Now this is how a bot does it:

This robot was configured in just two weeks by The Lab to automate the entire Regulation D violation-letter-processing process, from the transactional movement from one system to another, to the actual sending of the letter itself. The bot first logs into FIS Acquire to find all the Regulation D violations that occurred during a given period. Next, the bot extracts this information into Excel. In Excel, the bot the formats the sheet, and calculates the number of violations the customer committed during the period, because each number requires a different letter template. The bot then saves the file to a shared drive in case Excel crashes during the process. Next, the bot opens the core credit union system to process each line item from the spreadsheet, one by one, just like a person would. It books the $15 fee into the core, and notes on the customer account what the fee is for. Next, the bot opens Microsoft Word, writes the letter for each transaction from a template, and sends it in Outlook. The bot was configured to complete this task on a daily basis.

See for yourself:

https://www.youtube.com/watch?v=Lxive03vlIE

Credit Union and Banking RPA Use Case # 4 – Wire & ACH Processing Automation

This is the human process:

Back-office staff (Deposit Operations) manually extract ACH data from FIS Insight. Then they process the stop-payment in FIS Vision and FIS ACH tracker. After that, they update the journal entry in Oracle Peoplesoft. This “In-Branch Payment-Processing Bot” was implemented by The Lab to automate the entire process for the back office. The bot processes the data from the ticketing system, into the general ledger, processes the correct GL accounts, and then moves that information into the credit union core. This bot successfully connects three disparate systems that had no way of previously being connected, other than with manual human effort.

Now this is how a bot does it:

Working at the graphic-user-interface level, and mimicking the exact human-process flow for ACH stop-payment transaction processing, this single bot from The Lab processes more than 50 interface clicks across all four systems: FIS Insight, FIS Vision, FIS ACH Tracker, and Oracle Peoplesoft.

See for yourself:

Credit Union and Banking RPA Use Case # 5 – Brinks & Loomis Reconciliation Automation

This is the human process:

This credit union uses Brinks to provide commercial credit union cash-vault services to its clients. Each day, the credit union’s finance and accounting staff must manually reconcile all accounts and transactions for the previous day’s cash-vault transactions. This entails downloading and analyzing reports from the general-ledger system, the Brinks website, and the credit union’s own document management system.

Now this is how a bot does it:

The “Brinks Website and Accounts-Reconciliation Bot” implemented by The Lab for this credit union accesses two internal credit union systems: 1) the general ledger, and 2) the document-management system. From these systems, the bot retrieves all the Brinks cash-vaults-related internal reports needed to reconcile against the Brinks website data. To do this, the bot opens a web browser and logs into the Brinks website, just as a human would, and downloads all of the cash-vault transactions that must be reconciled against the internal reports. After the bot obtains all the necessary reports, it moves the report data into a single template sheet to perform the reconciliation. Once it’s done reconciling, it saves the work on a shared drive—and notifies the credit union accounting staff that the work is complete.

See for yourself:

Credit Union and Banking RPA Use Case # 6 – ATM Network Reconciliation

This is the human process:

This credit union’s finance and accounting staff must manually reconcile ATM deposit clearing balances on a daily basis—for the credit union’s entire ATM network. Two reports were must be downloaded from the general-ledger system, and another must be downloaded from the document-management system. These reports are then manually analyzed and reconciled in Excel to determine if any mismatches exist.

Now this is how a bot does it:

In just three weeks, The Lab Consulting implemented robotic process automation, or RPA, to automate this credit union’s daily finance and accounting reporting reconciliations. The new bot automatically accesses the general ledgers at the graphic-user-interface level— just like a human would. It then pulls the two GLs that must be reconciled against the document-management system that houses all of the ATM transaction records. The bot then downloads the ATM records from the document-management system, loads the data into an Excel sheet, and reconciles the GL entries against them. Upon completion and identification of any unbalanced items, the bot notifies accounting staff of which specific line items require research in order to finalize the process.

See for yourself:

Credit Union and RPA Use Case # 7 – Branches, Commercial, Consumer Official Checks Daily Reconciliation

This is the human process:

Official (cashier’s) checks generated by the client credit union for commercial, branch, and consumer check transactions all must be reconciled, manually, on a daily basis by credit union accounting staff from one IT-generated report across the general ledger and records management systems.

Now this is how a bot does it:

Robotic Process Automation, implemented by The Lab, automatically downloads a SQL Server Report attached to a daily email containing the previous day’s official check data. The bot then compares the data from this report to the general-ledger system, as well as the records-management system, and reconciles all the checks that had processed. If the checks reconcile, the bot notifies stakeholders, via email, that the job was complete. If not, the bot will load the discrete checks that require further research into an exception queue for review by a staff accountant.

Credit Union RPA Use Case # 8 – Time Clearing (Daily Teller Level Transaction) Reconciliation

This is the human process:

Credit union staff accountants routinely download two general-ledger reports from the GL system and a daily branch teller workstation report from the document-management system. This requires navigating a total of 52 mouse clicks to complete! Only then can the accountants begin the laborious, manual task of performing the reconciliation among the three different reports to determine if GL accounts have balanced.

Now this is how a bot does it:

The “Time-Clearing RPA Bot” implemented by The Lab’s remote RPA Center of Excellence team quickly performs this exact same reconciliation, and all of the tasks required to complete it. The new bot not only accesses the GL system and navigates a myriad of screens and clicks to download the reports needed to reconcile; it also extracts the data from those reports into Excel, and completes the reconciliation on its own—exactly as a human accountant would.

Credit Union and Banking RPA Use Case # 9 – Expense Account Reconciliation

This is the human process:

At this credit union, employee business expenses are all debited (reimbursed) from a single account in the credit union. The accompanying general-ledger entries and reports thus must be reconciled on a daily basis against the document-management system to ensure that balances have tied. This general-ledger and document-management-system report-extraction activity is 100 percent manual. In addition, the data reconciliation of those three reports is also manual.

Now this is how a bot does it:

The Lab employed robotic process automation to perform the entire end-to-end reconciliation of this credit union’s employee expenses between the general-ledger entries and the document-management system. Not only that, but The Lab was able to implement this new bot in just 13 days! Now, the bot logs into both the GL and the document-management system. From here, it downloads the reports required to perform the reconciliation to identify discrepancies. Upon successful download of the PDF reports, the bot converts the PDF data into Excel, then reconciles them against each other. The bot’s final output is then saved onto a shared drive for immediate review by the credit union’s accountants.

Credit Union and Banking RPA Use Case # 10 – New Hire IT/IS Onboarding

This is the human process:

When a new employee is hired at this credit union, the credit union’s IT team must create new system profiles and access for them. Once a profile is created, an email address can then be created. The third and final step is granting the new branch employee access to all the systems (12) they will require.

Now this is how a bot does it:

A bot was implemented at this credit union by The Lab to automate the new-employee-onboarding process for IT. The bot starts by accessing a standardized new-employee-onboarding sheet on a shared drive. The bot then creates a new active-directory account for the employee, and selects which department the user will reside in. Next, the bot creates an email account for the employee and adds the user to the specific groups they will be a part of. Then comes the bulk of the work: The bot creates accounts for the new employee in the 12 different systems they will need to access: FIS Horizon, Ascend (EX), Cash Insight (Cash Recycler), Credit Card Application, EAccess, Card Wizard, First Data, InterCept EFT, LexisNexis, Primelink, Principal, Salesforce – Resource Hub, TRIPS, Velocity My Rewards – Retail, and Vision Content – Deposits.

See for yourself:

Credit Union and Banking RPA Use Case # 11 – Commercial Loan Onboarding

This is the human process:

Loan-operations staff at this credit union must spend 45 to 50 minutes per loan, loading data into the compliance system. The data itself is similar to information in the origination system—but requires additional data from the core system before they can make a complete file. Thus, credit union staff are forced to copy-and-paste information from the origination system and the core system, and then manually upload copies of documents, just to complete this routine process.

Now this is how a bot does it:

A “Commercial Loan Onboarding & Compliance Bot” was implemented by The Lab to assist credit union staff with loading all the required documentation into the system. The bot works through the core system as well as the origination system to move loan data fields, one-by-one, across systems, just like credit union staff did. This reduced the manual effort of credit union staff for this part of the process by an astonishing 98 percent.

See for yourself:

Credit Union and Banking RPA Use Case # 12 – Automate CARES Act Paycheck Protection Program Loans

This is the human process:

Underwriters at this credit union receive SBA PPP applications and supporting documentation via email. The application and any supporting attachments must be downloaded manually and uploaded to a network drive for storage. The underwriter also assesses whether the application is complete, and then updates the loan status in an Excel tracker.

Now this is how a bot does it:

The “PPP Loan Application Intake and Completion Bot” implemented by The Lab for this credit union monitors an Outlook email box for any inbound PPP loan applications. When applications are received, the bot downloads the application and supporting documentation. It then uploads this information to a network drive and tags all documentation with a unique customer identifier. The bot then rapidly assesses the application package for completeness. If the package is incomplete, the bot notifies the customer, via email, of exactly what is missing/needed.

See for yourself:

Find even more use cases in our Credit Union Bot Use Case Catalog:

Attended vs. Unattended Robotic Process Automation in Credit Unions

There are two basic categories of RPA bots: attended and unattended. While they both automate and make processes more efficient, they require different amounts of human interaction to function smoothly.

How different are they?

Attended RPA works alongside the user to incorporate automation into a specific directed task and is well-suited to tasks that require human-to-system interaction in real time. The downside is that attended bots are usually constrained to programs running on a single workstation.

For example, if an employee needs to search her in-box for emails with a specific subject and then copy and paste the details from that email into a separate program, she can simply tell the bot to “process this.” The bot would dutifully complete the entire grueling task in an instant.

Attended bots may seem small scale, but Credit unions can use attended bots on a wide scale as well. Since credit union call center and customer support employees must often quickly switch between multiple programs and screens to retrieve information while talking on the phone with members, employees can use attended RPA to retrieve data from any number of applications. Since the bots accomplish these tasks far faster and more efficiently, employees have more time to focus on the member.

Unattended RPA doesn’t require user input or attention. Once the bot is set up to execute, the only time humans need to intervene is to evaluate or change the directed task. The bot begins work on its own and runs 24/7.

Credit unions can use unattended RPA tools to optimize a multitude of manual error-prone and time-intensive tasks. However, unattended RPA is more difficult to implement for complex applications. Many credit unions use a combination of attended and unattended RPA tools. In the future, it’s likely that unattended RPA will become the norm as the technology grows and improves.

Benefits of Robotic Process Automation for Credit Unions

By allowing banks & credit unions to automate high-volume and highly repetitive tasks, RPA provides tellers and back office employees with more time to work on more value-added activities.

Here are a few of the benefits of RPA:

- Increases accuracy and reduces errors. Since RPA automates data entry, it eliminates human transcription errors. For example, an employee only has to enter the member address once when setting up a new account and RPA automatically populates the address in other systems, saving keystrokes, time, and potential errors.

- Quick installation and configuration. Implementing RPA for low-complexity processes can take less than four weeks.

- Higher productivity. Knowledge workers can spend up to 50% of their workday simply moving and reconciling data. RPA can reduce these data-movement tasks up to 80%, increasing transaction processing and freeing credit union employees for higher-value-added work.

- Improves regulatory compliance adherence. RPA follows exact commands and specifications and provides an auditable and recordable history of every step of the process. This allows for easier troubleshooting in case of an error.

- Improves employee morale. Repetitive, manual work is boring and drives down morale. Offloading these repetitive, boring tasks makes employees happier and allows them to do more valuable work, making them feel more empowered.

- Works with existing IT infrastructure and applications. Unlike traditional back-end automation, RPA works as a front-end layer across existing systems and applications.

- Reduces processing costs. Attended RPA can cut processing costs by up to 40%. Unattended RPA can reduce costs by up to 80%. Although, remember to consider the differences between the two – unattended RPA may be more complex to implement over attended RPA.

- Improves system data quality. More accurate data input increases the value of big-data investments. It also supports future predictive analytics capabilities from richer data. Stated simply, bad data in is bad data out; RPA can reduce bad data.

- Improves the member experience. RPA can increase member satisfaction with faster turnaround times. Employees can spend more time interfacing with members, increasing member satisfaction scores among peer banks & credit unions.

- Requires a low-level of technical skills. There’s no need to master a complex coding language to control software bots. Instead, employees use symbols and drop-down menus to create bots. After just a few weeks of training, employees can administer bots themselves without the need of heavy oversight.

Implementing Robotic Process Automation in Credit Unions

You might now be tempted to automate every single process, but just because you can implement RPA on a process, doesn’t mean you should. The processes best suited for RPA are human-resource intensive, repetitive, standardized, and prone to human error. Processes that don’t add significant value to the member or to the credit union are also good candidates for RPA.

Here’s a three-step process for successfully implementing RPA.

Step 1: Select the Right Processes to Automate

Determine what processes are core to your credit union, what processes are secondary, and what processes are redundant. Eliminate the redundant processes and focus on core processes that require employees to move a lot of repetitive information around such as:

- Back office reporting

- Loan underwriting

- Document and records management

- Customer relationship management

To maximize ROI, focus on processes performed by the largest number of employees.

A high number of errors or departments that struggle to meet volume or productivity goals are another indictor. Look at the data-related error rates of each department and determine if those errors involve manual data movement. These processes are prime candidates for RPA.

Step 2: Identify Individual RPA Use Cases

Never buy RPA software without first identifying the use cases that you want to implement. RPA software is expensive with year-long licenses. Some consulting firms attempt to sell as many licenses as possible–or do a million-dollar analysis project–before even looking for use cases.

Take the opposite approach and find your RPA use cases first. This is not only the more cost-effective tactic, but it also allows you to purchase only the “a la carte” bots you need.

Pro-tip – download our Credit Union RPA use case list and catalog here!

To find the right use cases, ask employees questions such as:

- What work do you do that you copy and paste data from one place to another frequently?

- Do you send the same types of emails over and over throughout the day?

- Do you repeatedly move documents or files from email to a folder or system?

Start small, successfully implement several use cases, scale up, and repeat. To build employee support, only implement a few quick-hit RPA use cases over a few weeks. Get it right, and employees will be asking for many more bots.

Step 3: Calculate the ROI of Each RPA Use Case and Build a Business Case

Identify the cost savings of implementing RPA. Don’t limit yourself to only how RPA can reduce your overhead. Instead, identify ways that RPA can impact downstream operations in other areas of your business.

To calculate the cost benefits of each RPA use case, use the following formula:

(Total number of hours per week an employee works on a process)

Minus

(Time saved by the RPA use case)

Multiplied by

(Fully loaded employee salary with benefits minus RPA software cost for one year)

=

Total savings from the individual RPA use case

Present the cost savings to your leadership team, IT team, and other stakeholders and work together to identify how to implement RPA now and map out how you plan to increase the use of bots in the next 6 to 12 months as the momentum for RPA builds in the organization.

The Lab’s RPA Credit Union Bot Catalog

Your credit union bot wish list starts right here!

Every credit union today wants to automate. That’s a given. Yet survey after survey shows that most credit unions hit a ceiling at about ten—or even five—robots. That’s tragic, because the typical credit union, right now, has opportunities for about 300 robots. You read right.

The reason these credit unions fail to capture breakthrough disruption is their approach. You need to find the use-cases. Some are bot-friendly as-is. But most others require subtle reengineering.

It can be simple: Changing a free-form field to a checkbox. Or it can be more complex: Eliminating rework and redundancy in a long-held process.

At The Lab, we employ our patented Knowledge Work StandardizationTM methodology to uncover credit-union bot use-cases, and deploy them rapidly—and remotely, from our U.S. offices in Houston. We think this catalog will whet your appetite. Every use-case in here is based on an actual robot which The Lab implemented at an actual credit union. As you page through this, you’ll recognize applications that hit close to home. And you’ll start to realize that there are tons more, just waiting to save you time, cost, errors, and risk. As we said, a good goal for any credit union is about 300 robots. So this catalog—with just over 120—only scratches the surface. Bots are cheap. They’re quickly implemented. They connect systems that weren’t designed to talk to each other—replacing the “human glue” you currently use as work-arounds. So the only limit is your imagination. And if you run dry, we can help!

Find the latest version of our bot catalog here:

How The Lab Can Accelerate Your Credit Union Hyperautomation Initiative

Now that you know (almost) everything you need to know about RPA for credit unions, there is only one thing left to tell: How we at The Lab can assist you in this critically important endeavor.

RPA bots depend on strict rules and conforming data, so the first step is to assist with mapping all important processes. Then our data scientists and RPA programmers search for areas that can be standardized, as well as for candidates for automation—that’s where we place the RPA bots later.

Now the fun starts, and our developers set up the RPA bots at your credit union, all remotely from our offices in Houston, Texas. And our services don’t end with the implementation; we can also take care of any issue or maintenance that may happen in the future. Saving the best for last: Our post-implementation service only charges by the hour, so there’s no plan or subscription needed! Also, you don’t need to change any of the software you’re using, since RPA bots can handle them all!

- Turnkey credit union RPA Bot Implementation Packages

- Strategic RPA Bot Suite Implementation

- Remote RPA Center-of-Excellence Managed Services (Outsourced) to The Lab

- Center-of-Excellence Implementation Enable Your Own Team with Help from The Lab

- Hourly Support

Contact us now to speed up your RPA analysis for your credit union. We can develop use cases and help you successfully implement Robotic Process Automation from start to finish.

Lastly, don’t forget to check out the links below, starting with our RPA Implementation Services Menu—it’s the easiest way to give your credit union’s automation initiative a kick-start!