Banks & Credit Unions

Improving efficiency, growing deposits and loans, rebalancing the branch network, and automating back-office tasks for scale and efficiency. The Lab has worked with hundreds of financial institutions to implement the most valuable process improvement, automation, analytics, and AI improvements.

Bank & Credit Unions: The Lab's Knowledge Base

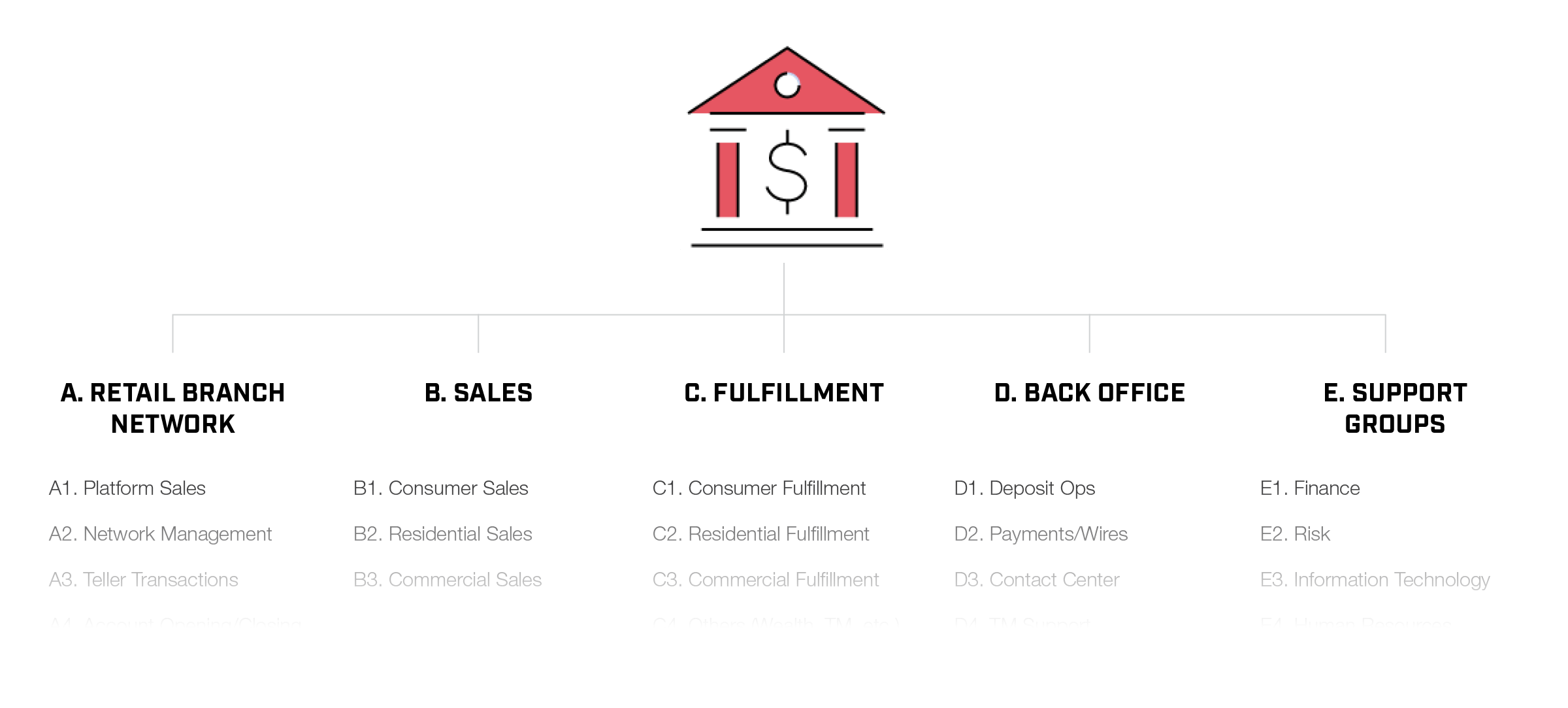

The Lab Knows Your Organization—And the Most Valuable Improvements

Findings from 30+ years of The Lab’s work with banks and credit unions—including process improvements, best practices, KPI definitions, benchmarks, and automation use cases—are neatly organized into a standard financial institution taxonomy and stored in our knowledge base. We use these assets and make them available to our clients during engagements to rapidly accelerate business transformation.

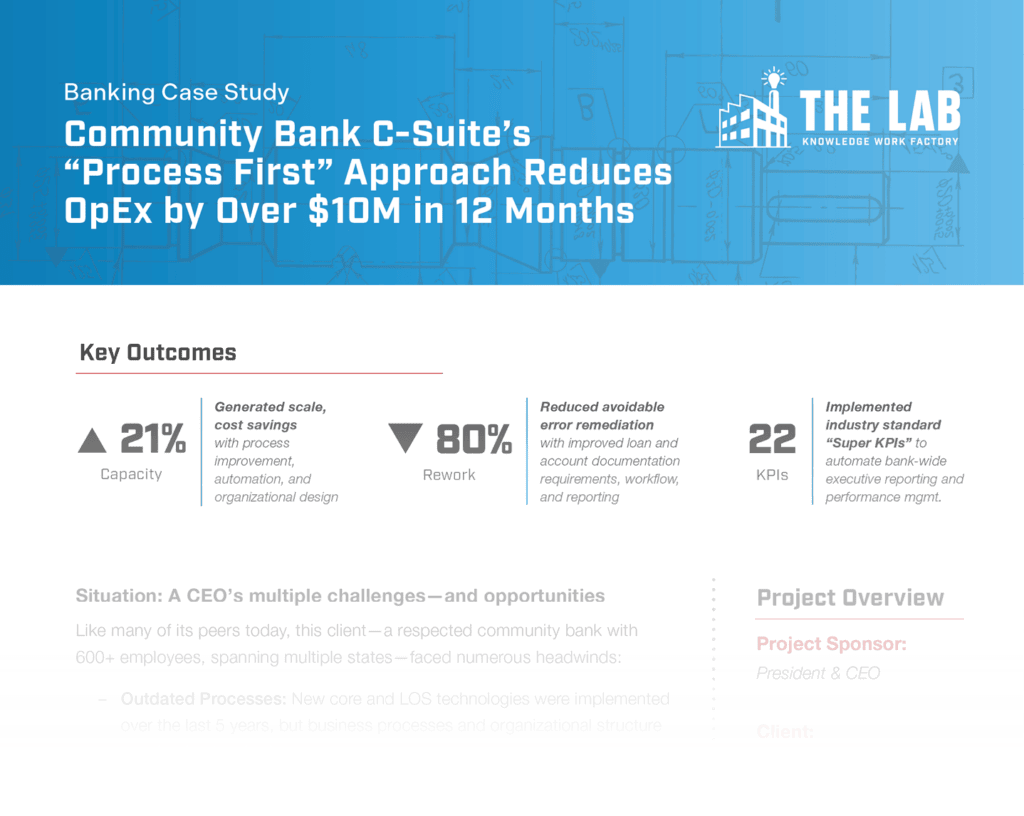

Featured Enterprise-wide Banking Transformation Case Study

Read Real-Life Bank & CU Client-Success Stories

Community Bank Recoups $10M in OpEx

The Lab helped this CEO increase scalable capacity by more than 20%, reduce avoidable “not-in-good-order” rework by 80%, and achieve an annual ROI of 4x in 12 months.

Improvements and Benefits Are Highly Predictable—and Guaranteed

Typical Benefits for Banks & Credit Unions—The Lab's "Big Rocks"™

Hit More/Miss Less

Grow Loans, Deposits

• Cross-sell existing customers, members

• Acquire new customers, members

• Expand to new markets, products

New Sales Opps: 10% to 15%

Waste Less

Improve Productivity

• Decrease errors and related rework

• Automate value-added activities

• Reduce individual performance variance

Cost Savings: 20% to 35%

Keep More

Preserve Margin

• Monitor, manage loan pricing (terms, fees, etc.)

• Reduce negative-margin products, accounts

• Manage customer/member credit quality, risk

Margin Savings: 5% to 15%

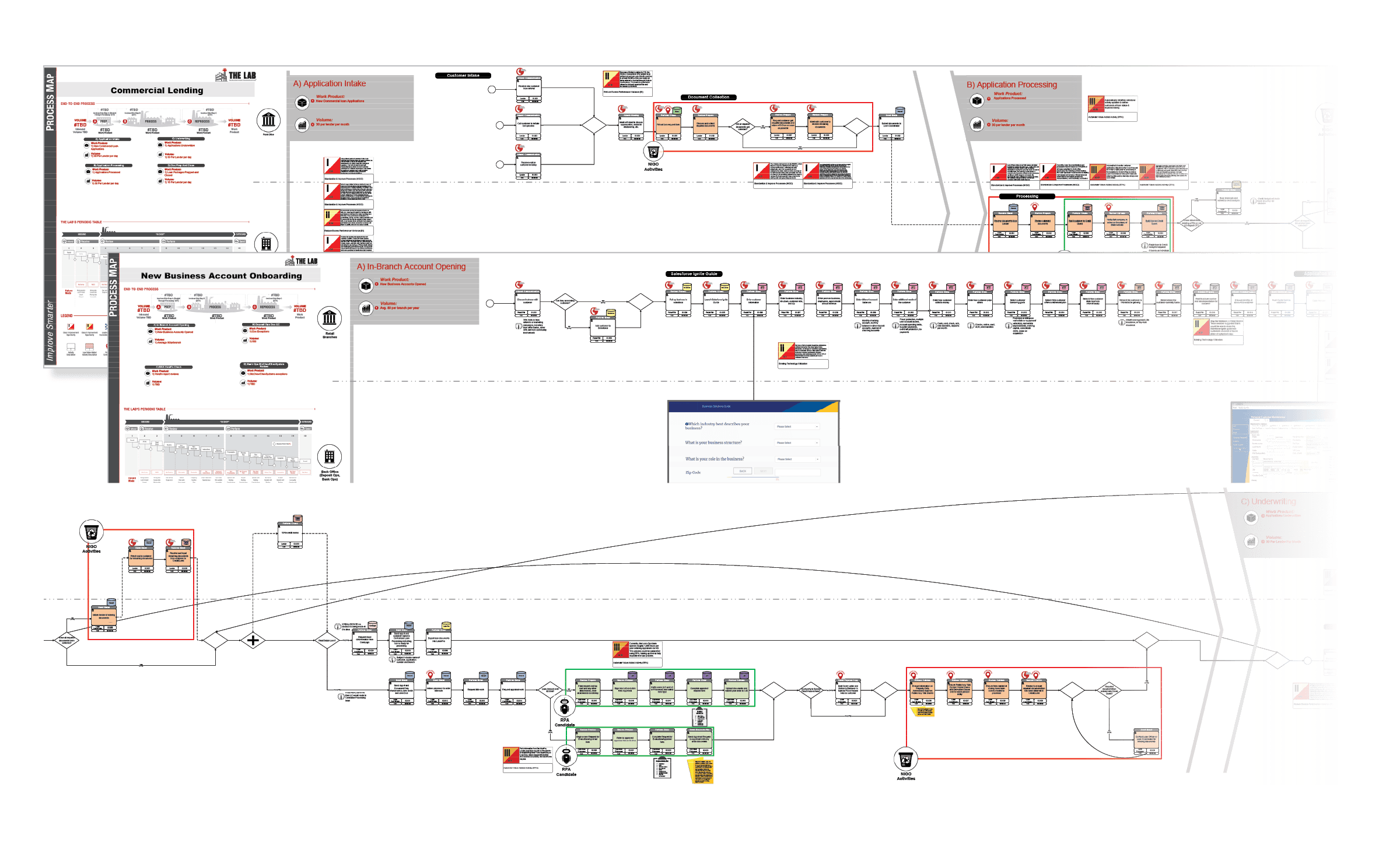

Process Mapping Services for Banks & CUs

Understand Your Major Business Processes and How to Improve Them

Rely on The Lab’s standardized process mapping experience and industry-leading process improvement team to rapidly document your current-state business processes—end to end. From consumer and commercial lending origination to servicing, to front-office and back-office tasks and fraud, we’ve mapped it all. We can do the same for your organization in less than 8 weeks.

The Lab Solves Urgent Business Problems for Clients

Tackling Fraud, Head-on, with Standardization and Automation

Adding Rapid Scale to Fraud Operations

Find out how we help CEOs and CROs reduce fraud investigator variance and hedge against turnover by implementing standardization, analytics and robotic process automation

Compare your strategic efficiency to peers, instantly.

Peer Comparison Data Analytics: The CEO Report Card

As a financial institution executive, you are constantly asking yourself:

- How am I performing relative to peers?

- Where can I improve performance—and by how much?

- Which strategic initiatives are going to get me there?

- How do I execute?

- What insights will improve value for an acquisition?

The CEO Report Card for Banks & CUs—just one part of The Lab’s proprietary Knowledge Work Standardization® (KWS) platform which is included in every Transformation initiative—does the analytical “heavy lifting” to answer these questions.

The Lab has aggregated and centralized over 20 years of FDIC/NCUA call report data—and combined it with proprietary benchmarks and algorithms—to provide a window into every bank and CU in the U.S.

More than 25 metrics—including efficiency ratio, net interest margin, ROA, and deposit growth—are comparable for over 10,000 financial institutions (FI)—all in one place, with just a few clicks. Simply select a peer group—based on total assets, geography, and other factors—and instantly review a competitive “report card” for any bank or credit union.

Visualize key information for each metric, including a letter grade (A through F) summarizing the selected FI’s performance relative to their peers. Drill-down on any metric to see performance trends and other details on peer performance.

Banks & Credit Unions: Catalogs from The Lab's Library

Preview The Lab's Financial Institution Knowledge Base

Videos: Automation, Analytics for Banks & CUs

Watch Real-Life Bank & Credit Union Innovation in Action

Hear What The Lab's Bank & CU Clients Say

“We needed to get our ROA closer to peer average. I heard about The Lab at a round table from a peer CEO. They helped us reach our goals - quickly.

“I want to thank The Lab for your partnership and hard work as we look back at what we have accomplished and look forward to what we will accomplish next year.

“Process efficiency is one of our top strategic objectives. We needed outside expertise to accelerate benefits, and The Lab has been an excellent partner.

The Lab serves Bank and Credit Union Leaders all Across North America

Financial Institutions of all Shapes and Sizes

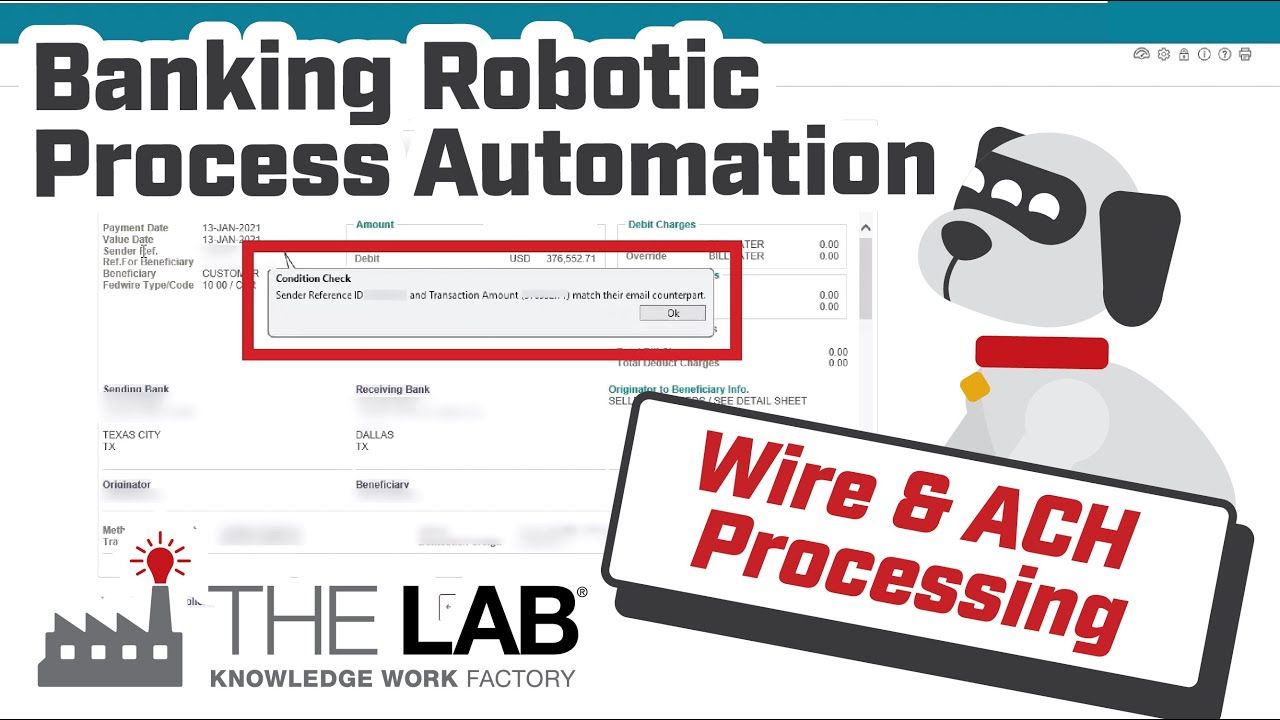

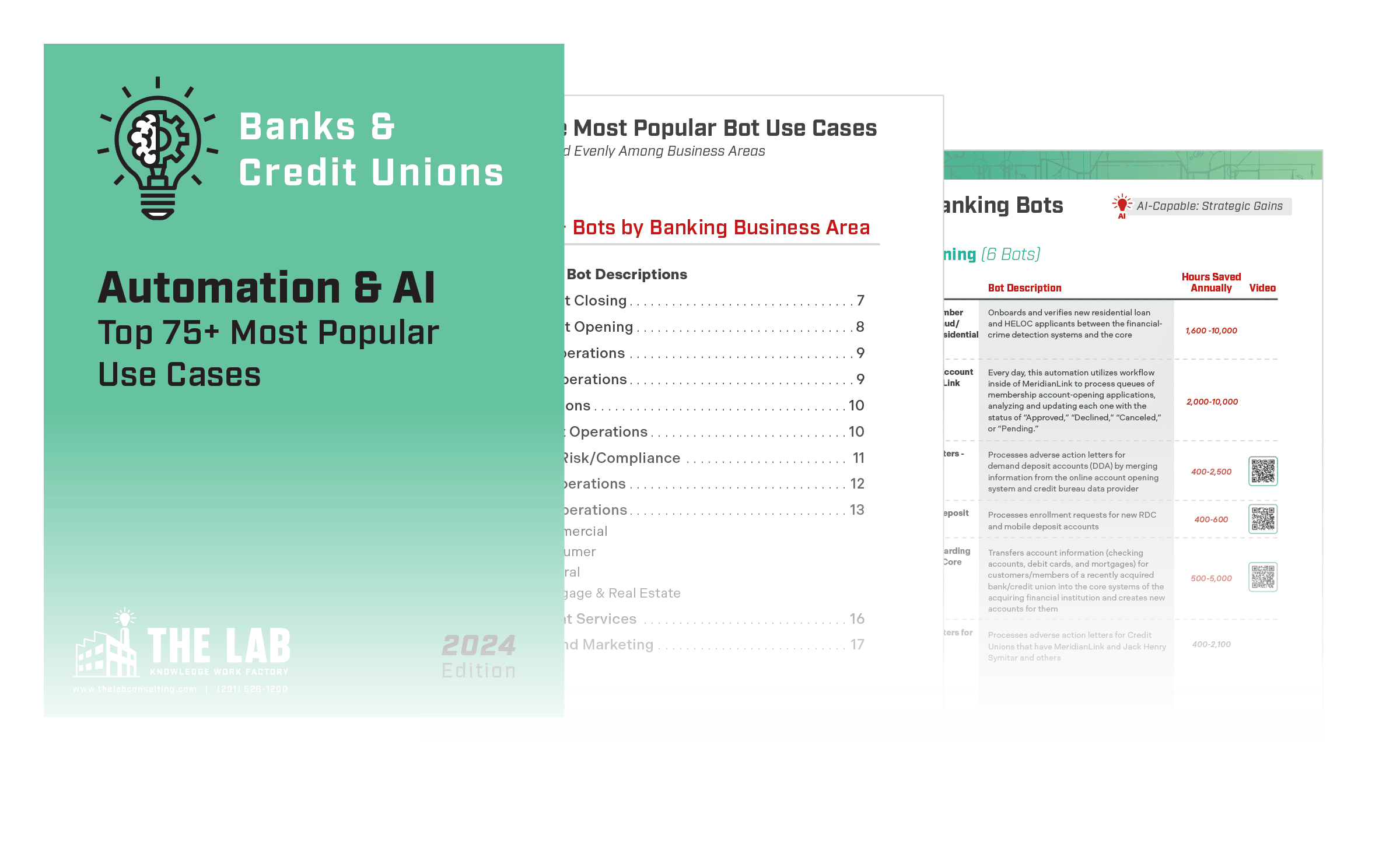

Intelligent Automation & AI Implementation for Banks & Credit Unions

Deploy the Most Valuable Automations

Quickly find the most valuable candidates and accelerate automation with The Lab’s inventory of AI-enabled banking bots. Lean on us to create entirely custom “humanly impossible” processes or engage us to help your organization pick from our shopping lists of previously implemented bank and credit union automations.

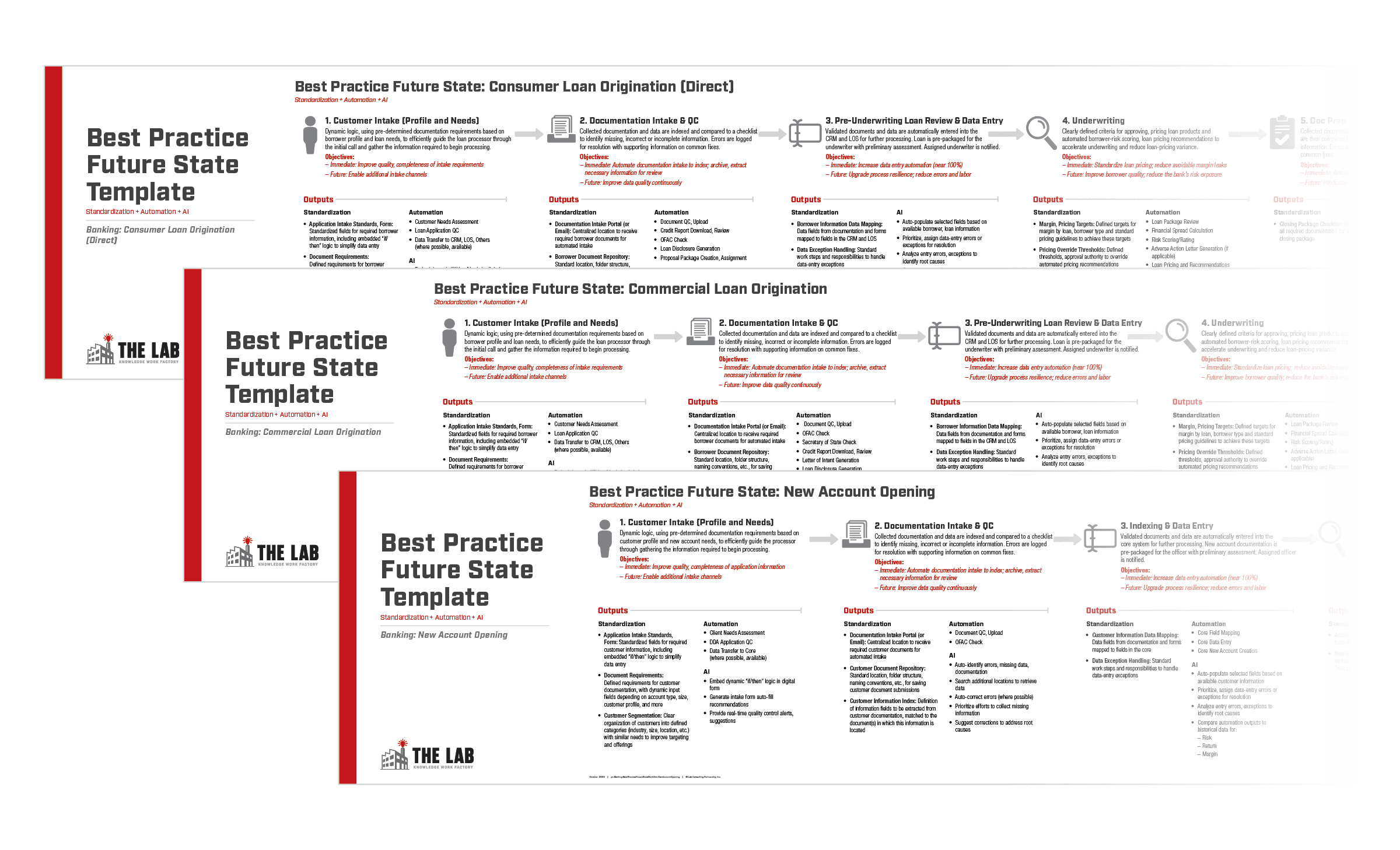

Best-Practice Future State Processes

Define the Ideal Future State for Your Bank or CU

The Lab helps financial institutions answer the question “what should this process look like?” Our bank and credit union best-practice, future-state process models are a composite of improvements—automation, AI, analytics, and process standardization—compiled over hundreds of implementation engagements. Rapidly compare current operations against these “gold standard” industry workflows to identify gaps and design your ideal future state.

Advanced Analytics

Monitor Productivity, Manage Capacity, and Improve Performance

Create a "single source of truth" for modeling capacity and managing performance by selecting standard KPIs and connecting your existing data sources to The Lab's standard data models.

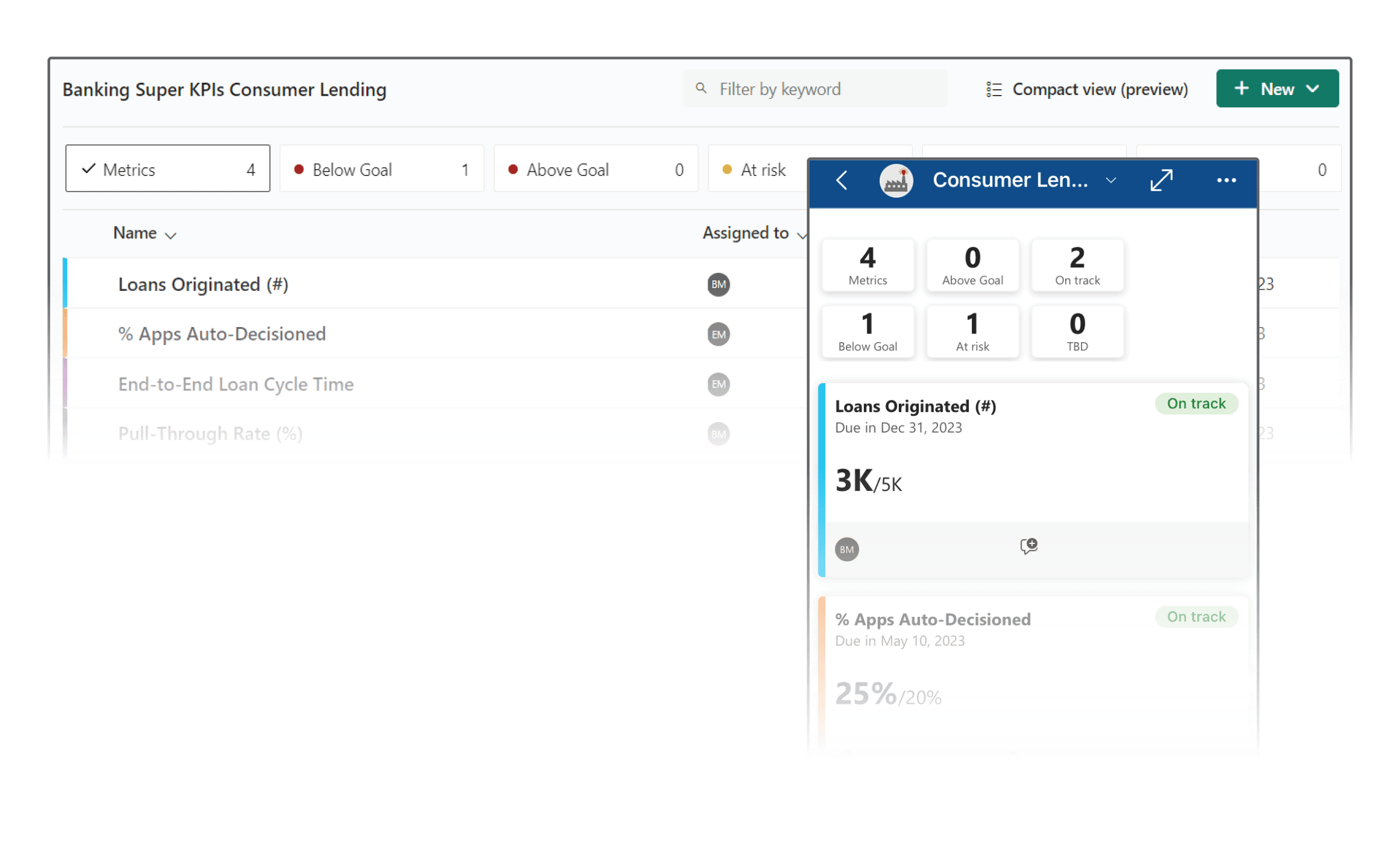

Executive Super KPI™ Dashboard

Summarizes the vital few KPIs—usually ~20—you need to manage your financial institution. A single, fully automated dashboard for executive-level measurement across your banks or credit union.

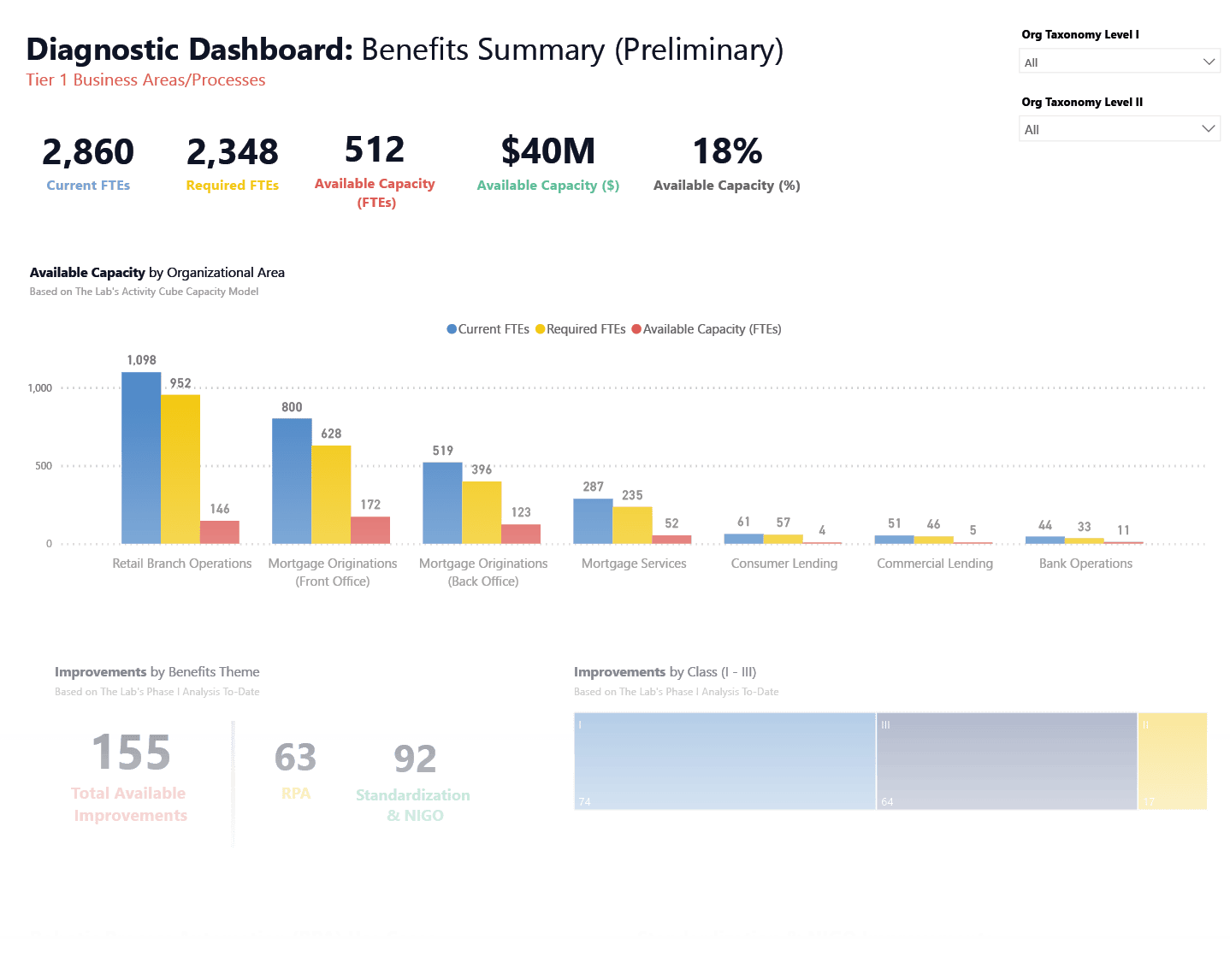

Diagnostic Dashboard

Quantify scalable capacity and navigate the most valuable improvement opportunities for your bank or credit union. This dashboard provides a summary of where efficiency can be gained and how to get there with process improvements, automation, and more.

Your Trusted Microsoft Power BI Implementation Partner

The Lab's Standardized Data Models Accelerate Analytics Implementation

Measure What Matters

Identify Vital Few Super KPIs™ for Your Bank or Credit Union

The Lab’s inventory of key performance indicators (KPIs) takes the guesswork out of performance measurement. We maintain a database of over 500 standard KPIs for banks and credit unions. That’s a lot of KPIs (too many)! Fortunately, there’s a silver lining. There are actually a limited number of “Super KPIs” which comprise the vital few for your financial institution.