COMPARE YOUR STRATEGIC EFFICIENCY TO PEERS, INSTANTLY.

Identify and improve your weaknesses—exploit your strengths

As an executive, you are constantly asking yourself:

- How are you performing relative to peers?

- Where can you improve performance—and by how much?

- Which strategic initiatives are going to get you there?

- How do you execute?

The CEO Report Card for Banks & CUs answers it all— and is just one part of The Lab’s proprietary Knowledge Work Standardization® (KWS) platform. Let The Lab do the analytical “heavy lifting” to answer these questions for you.

The Lab has aggregated and centralized over 20 years of FDIC/NCUA call report data—and combined it with proprietary benchmarks, algorithms and data models—to provide a window into every bank and CU in the U.S.

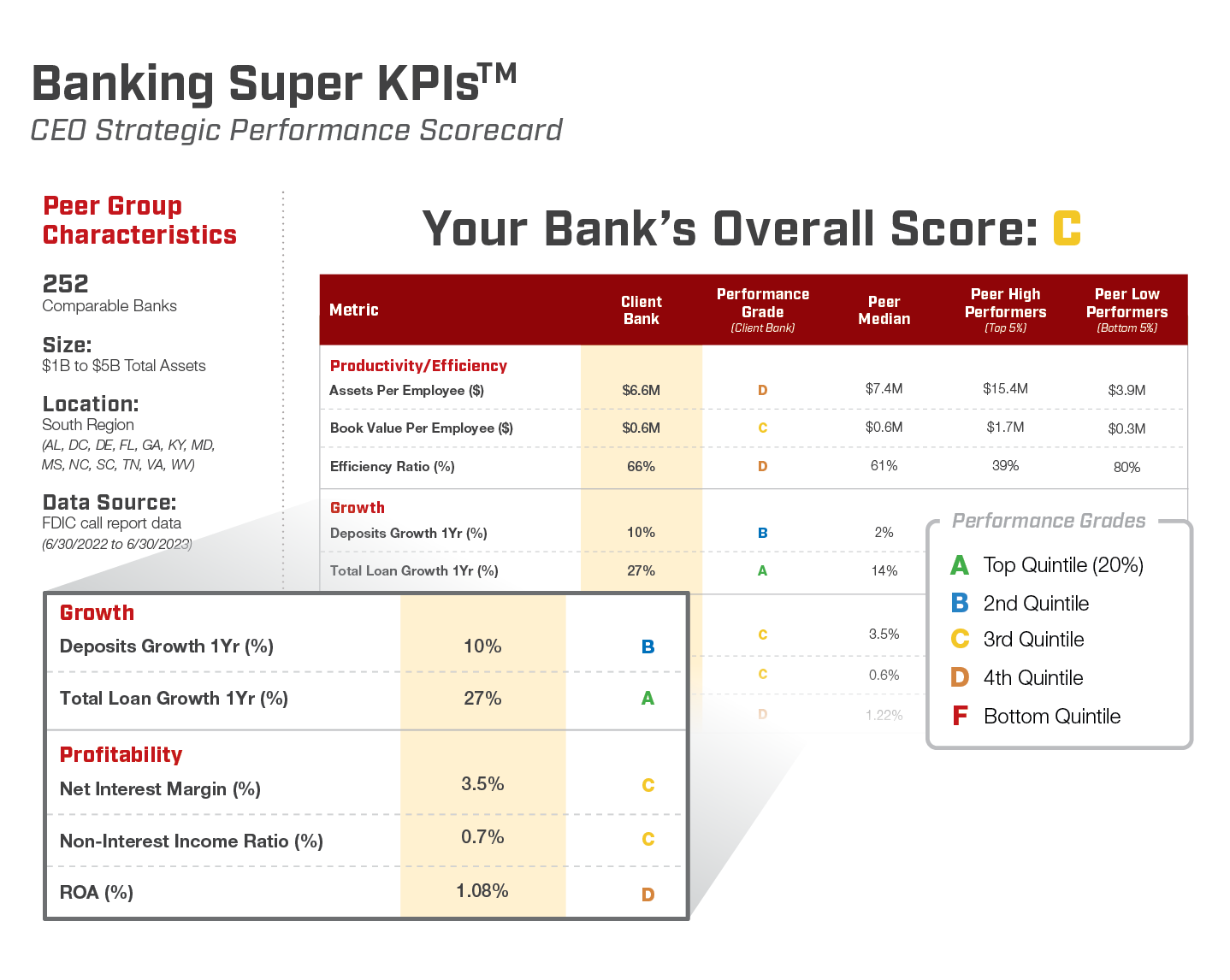

Key information for each metric, including a letter grade (A through F) are summarized for you FI’s performance relative to your peers.

Metrics including efficiency ratio, net interest margin, ROA, and deposit growth—are comparable for over 10,000 financial institutions (FI)—all in one place—and we will send your summary snapshot straight to you if you fill out this contact form.

We rank you in your peer group—based on total assets, geography, and other factors—and instantly review a competitive “report card” for any FI.

Strategic Analytics for Bank & Credit Union CEOs

The Lab can help improve your Efficiency Ratio by 3 to 10 points

The CEO Report Card for Banks & CUs, just one part of The Lab’s proprietary Super KPI Analytics, has taken care of requisite analytical “heavy lifting” to help answer these vital questions.

And it doesn’t stop there. The Lab’s Super KPIs and Analytics implementation includes standard, modular improvement work plans—each including automation (RPA, AI), analytics, and process improvement—to help you rapidly address competitive shortfalls and strategic objectives.

- Branch staffing optimization: Deploy automated data models to define branch staffing requirements and inform hiring activity.

- Low-cost deposit growth: Standardize and centralize customer data to identify and reach high potential prospects.

- Loan margin monitoring: Provide automated margin monitoring capabilities to improve pricing consistency and reduce avoidable margin “leaks.”

- Back office automation: Install “bots” to reduce manual, error-prone back office labor – e.g., wires, ACH stop pays, reconciliations, and more.