Real-world realized automation benefits for credit union execs

- Works with whatever core, systems, and processes you use!

- Indisputably valuable: Save 1,000s of hours of tedious labor every year!

- U.S.-based development. Direct, clear communication. Pays for itself ASAP!

If you’re just starting—or tried before or are trying to catch up to your peer credit unions who have been doing this for several years—you need your credit union-bot initiative to score huge.

Most initiatives don’t. They might try automating a few processes. But there’s negligible financial or operational impact. And the bots break. It can make robotic process automation (RPA) appear like a mediocre, unreliable technology—an investment that returns the “blahs.”

Nothing could be further from the truth. RPA is a strategic-imperative for credit unions. But success depends on effective use-case discovery.

If RPA has disappointed you before, it’s because the discovery was unreliable, not the bots.

RPA technology typically doesn’t fail, but credit unions routinely fail to discover and implement the right use cases undermining thousands of automation initiatives.

For three decades, The Lab’s structured discovery process has performed wall-to-wall, end-to-end documentation and improvement of credit union processes. And we’ve created bots that collectively have saved credit unions and credit unions millions of hours of manual labor to date… and growing.

So, we’ve done the discovery work for you. Thus, we’re happy to present the three top bots which provide inarguable massive productivity gains.

Ready…?

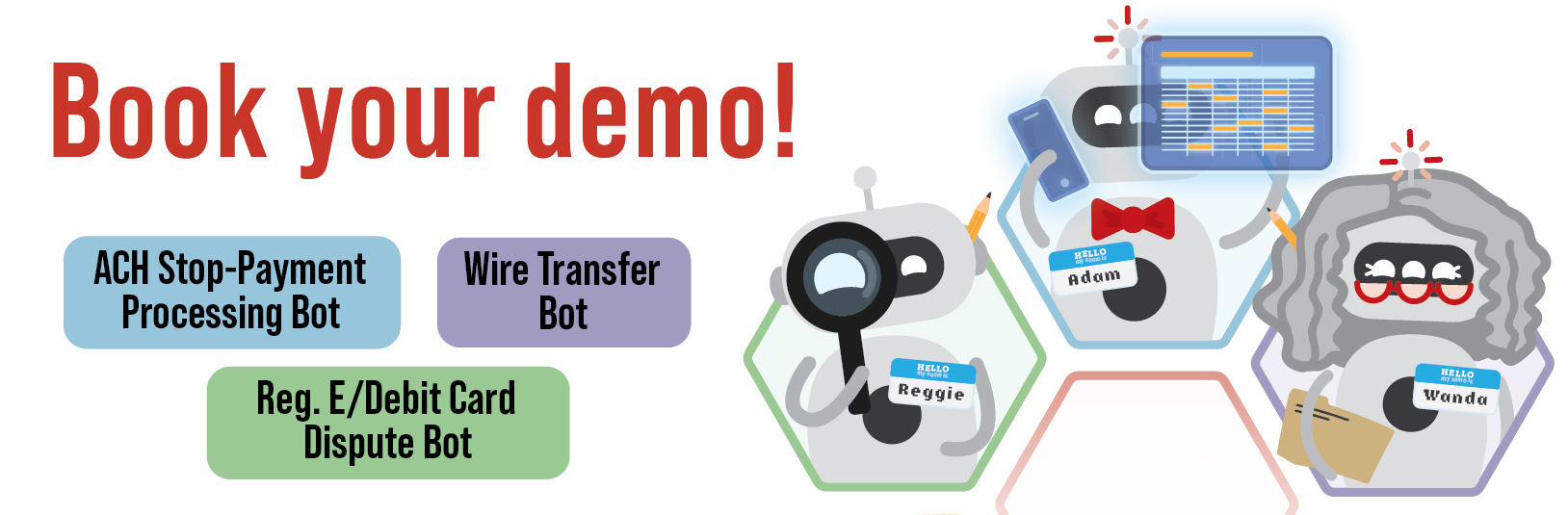

Don’t worry. We know them: ACH stop-payments. Reg. E/Debit Card dispute processing. And wire transfers.

Taken together, these sap your valued staff of thousands of hours of unfulfilling labor every year. That doesn’t just impact member experience and invite regulatory scrutiny. It also increases the risk of turnover.

But now, there’s a better way. From The Lab, North America’s undisputed credit union-automation authority.

This isn’t your fault. Your credit union, frankly, is at the mercy of its core-system provider, whose applications don’t talk to each other, and thus require “human glue” to cobble together.

Every credit union does it differently. Whether you’re using Fiserv Signature or Premier, FIS Horizon or IBS, Jack Henry Silverlake Xperience or Symitar Episys (need we go on?), you must connect systems and screens—to fit your workflow and needs.

But now, you can automate “the final mile,” with The Lab’s must-have Credit Union Bot Three-Pack.

Every credit union is saddled with thousands of ACH stop-payment requests, each of which must get processed ASAP.

Some credit unions start the process with an Excel report on a network drive. Others begin by diving into the core to get to the ACH tracker app. Some credit unions use an Oracle database; others grab screen shots of processed reversals to paper the audit trail.

Adam doesn’t care. He blasts through stop-payments in mere seconds, the way your people hate doing!

Whether the urgent member requests are pouring in from your website (“Block my debit card!”), phone (“Reverse this Zelle charge!”), or branches (“I never authorized this!”), they all funnel into the back office, overwhelming your already-stressed staff.

Turn that stress over to Reggie, the Reg. E/Debit Card Dispute Bot.

He’ll access your dispute-tracking system, then process all of the fraud disputes, one by one, into your core and card-management systems. Heck, he even creates the required customized compliance letters to members, emails them, loads them into the member secure notification platform, and sends them to your postal fulfillment company, too!

Outbound wire processing is one of your credit union’s most labor-intensive processes.

Regardless of your core system, it’s costing you anywhere from 2,000 to 25,000 hours of manual labor, year after year.

Wanda, our Wire Transfer Bot, lives for this stuff.

She patiently monitors outbound wire requests, whether from email, the web, or call center. Then she processes them all using platforms ranging from Fedwire, to Q2, to your core provider’s ancient wire-transfer system. And she helpfully emails reports of her work to your Treasury Management team.

By the way, Wanda’s cousin, Wendy, processes inbound wires!

The Lab uses the country’s best bot-development leads and teams, working from our U.S. offices in Houston, with nothing outsourced or offshored, ever.

That’s how we’re able to install bots like Adam, Reggie, and Wanda, remotely, in just weeks.

Your core provider can’t do this—even though they claim they can. They offshore and take months just to create a single bot to solve a problem that they created. And other bot vendors may know automation, but they don’t know credit unions.

The Lab knows both. We’ve been helping credit unions, nationwide, for three decades. Our approach to Knowledge Work Standardization® is so transformational, it’s patented.

There’s a lot more than three credit union bots available from The Lab. In fact, there are hundreds. Our team of automation professionals will help roadmap your entire RPA program and strategy. Most clients engage us for dozens of bots over time. Let us implement at the pace that best suits your needs.

The best way to appreciate the power and elegance of credit union bots is to see them in action for yourself.

And the best time to get started is right now, because your peers have been doing it for years. Don’t wait another minute to launch or accelerate your RPA initiative.

Book your free, no-obligation 30-minute screen-sharing demo with The Lab. You’ll see real credit union automation in action, blazing past at up to 45x human speed, error-free. And get all your questions answered by our friendly experts.

Simply call (201) 526-1200 or email info@thelabconsulting.com to book your demo today!