Transform Your Insurance Carrier, Brokerage, MGA, or MGU with Knowledge Work Transformation™

Grow premiums, reduce claims leakage to preserve margin, improve policyholder service and satisfaction, and more

Insurance executives—whether at a carrier, brokerage, MGA, or MGU—are often tasked by their boards to transform their organizations. In this long-form explainer article, we will detail how you (as well as your internal improvement teams and technology leads) can transform your insurance organization to increase premiums, reduce claims leakage, improve policyholder service and retention, and more.

TRANSFORMATION-READINESS

Transformation in insurance requires current-state process mapping of your organization from end to end

That’s the prerequisite. If you’re looking to transform your insurance business (using Knowledge Work Transformation™, as we’ll detail shortly), you need to create an end-to-end or E2E process map of everything your organization does first: Everything from prospecting and sales, to quote-to-bind, to claims processing, policyholder service, and more.

Fortunately, we have another helpful article explaining how to process-map your insurance organization about Process and Policyholder Journey Mapping for Insurance; you can read it here.

The Lab also has numerous videos to help you with transforming your insurance organization; you can see the whole YouTube playlist here.

As far as transformation in insurance goes, you’ll need to map, from end-to-end, all of your processes and policyholder journeys. As we’d noted, that’s the first thing to do before you can transform your insurance brokerage, carrier, or MGA/MGU. You’ll need that current-state process map to be detailed, right down to each activity. And when it’s time to automate via AI and digital workers, you’ll need a current-state process map that often captures individual mouse clicks and keystrokes. It’s that detailed.

With your current-state process maps in hand, you’ll now want what’s often referred to as a single source of truth; in this case, a more singular source. Your transformation will apply to everything:

- Upgrading your analytics with better (more standardized and cleaner) data

- Expanding or adding AI (artificial intelligence) and RPA (robotic process automation) in insurance

- Standardizing all of your insurance business processes to pave the way for best-practice improvement

Certainly, there are challenges to transformation in insurance brokerages, as well as carriers, MGAs, and MGUs. We’ll get to those shortly.

But first, to whet your appetite for the transformation of your insurance brokerage or carrier operation, let’s review the three key sources of benefits from that transformation.

sources of benefits

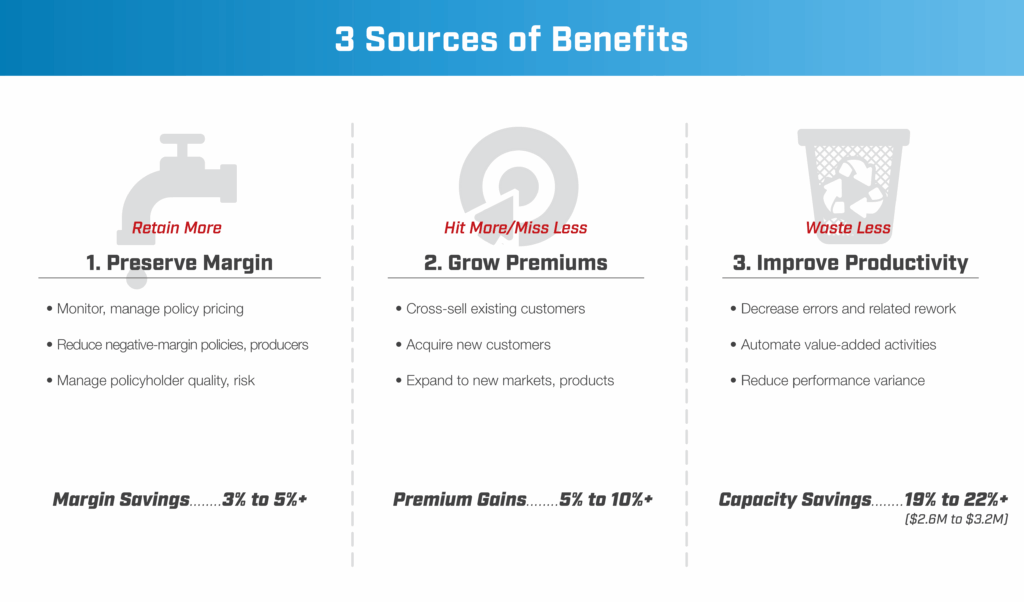

What sources of strategic benefits can be derived from transformation in insurance operations?

As an insurance executive, you know that performance and profitability are both inextricably linked to operational efficiency. Streamlining workflows to improve results will boost the bottom line, while delivering a superior policyholder experience.

As we dive deeper into this article, you’ll see clear benefits, the types of services needed to transform, and real-world examples of how The Lab has helped insurance businesses such as yours to improve efficiency, expand policyholder relationships, and increase margin… in just six to 12 months.

Later in this same insurance-transformation article, we’ll dive deeper into the specific benefits that your insurance brokerage, carrier, or MGA/MGU can obtain from an organization-wide Knowledge Work Transformation™. But for now, assuming (easily) that you want to reap the most benefits in the shortest timeframe, you’ll want to focus on these three benefit sources.

Insurance Transformation Benefit Source 1

Margin preservation

In a phrase, “Retain more of what you earn.” You’ll be helped with these “arrows in your quiver”:

- Real-time margin by line/by product/by policyholder

- Accurate pricing of new policies

- Streamlined underwriting

- Improved claims processing from FNOL through closure and subrogation

- Enhanced data intelligence

With them, you can realize dramatically reduced cycle times, increased capacity, and more. In fact, you can read about an insurance brokerage CEO who:

- Reduced commercial quote submission cycle times by 50%

- Increased policyholder service capacity by 25%

- Implemented 18 Executive KPIs brokerage-wide

Read the whole case study here.

Insurance Transformation Benefit Source 2

Increase Premium Revenue

Along with the transformation of your insurance business’ operational data and workflows, you can then harness the power of AI, intelligent automation (or robotic process automation [RPA] in insurance), and advanced analytics to help everyone from frontline staffers to upper-level management with tools such as:

- Powerful policyholder cross-sell and upsell insights and opportunities

- Newfound models for customer and market segmentation

- Assessments of leads and markets for sales teams to use in daily operations and strategic planning

Insurance Transformation Benefit Source 3

Turbocharge productivity

Every day, the different members of the different teams in your insurance organization (whether it’s a carrier, brokerage, or MGA/MGU) perform activities that can, and will, be improved via transformation of your insurance operation:

- Improvements will re-order activities.

- Improvements will re-organize activities.

- Improvements will eliminate wasteful or redundant activities—what we at The Lab refer to as “NIGO,” or “not in good order.” You know these exist, but you may be surprised to discover just how pervasive they are—another benefit of that prerequisite current-state process mapping in insurance.

These activities are also improved (and re-organized, and re-ordered) thanks to AI in insurance and RPA in insurance brokerages, i.e., robotic process automation or RPA in insurance.

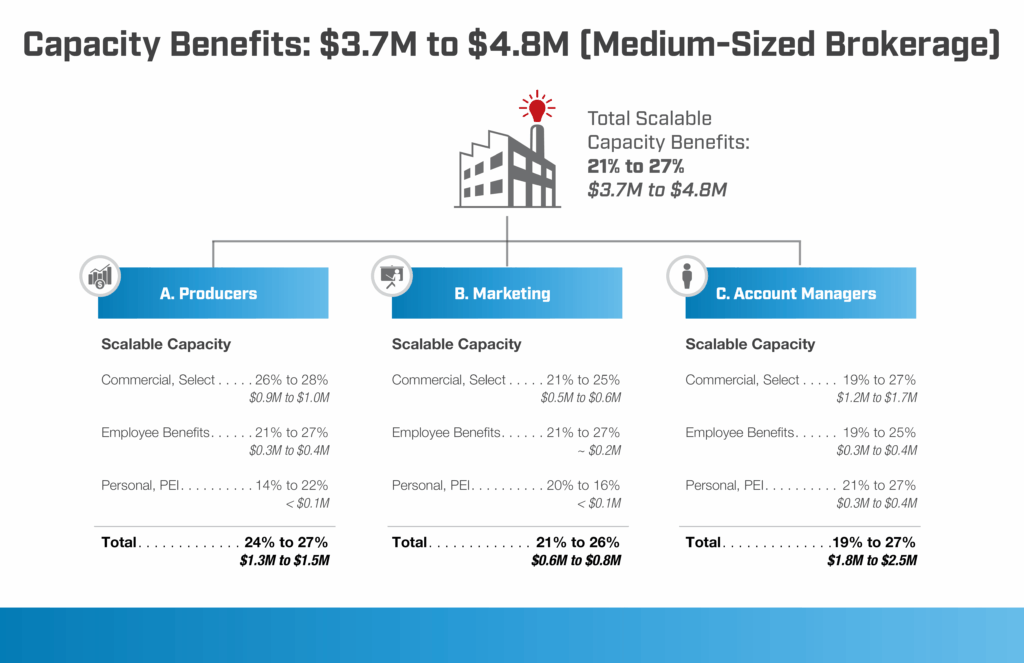

Collectively, these improvements can deliver capacity increases of 25% to 40%.

These waste-reducing productivity improvements also deliver the pleasant-surprise benefit of reducing errors. Which leads to improved compliance, and better policyholder satisfaction.

Again, the three points above are the sources of benefits to pursue in your insurance organization’s strategic transformation. There are actually more specific benefits, which we’ll detail later in this article.

But as we’d hinted earlier, you can’t reap the benefits without surmounting the challenges…

Transformation Challenges

Top 3 Challenges of transformation in insurance: Brokerages, carriers, and MGAs/MGUs

“It’s too difficult; we’ve tried, and failed, before.” Business and process transformation, as perceived by many C-level insurance leaders, is simply overwhelming. Executives perceive it as difficult, and seemingly impossible.

So much is at stake. Thus, many insurance leaders over-invest in project management via over-engineering of tasks. As a result, the benefits derived (if any) are minimal or theoretical. Many insurance executives thus end up with a form of buyer’s remorse, wondering why they’d attempted their insurance transformation in the first place.

Let’s review the actual challenges that face any insurance executive as they embark on a transformation journey. There are three:

TOP 5 BENEFITS TO TRANSFORMATION

What are the Top 5 benefits for insurance process and business transformation for carriers and brokerages?

As noted above, there are three sources of benefits from transforming your insurance operations, namely:

- Insurance Transformation Benefit Source 1: Margin preservation.

- Insurance Transformation Benefit Source 2: Increase premium revenue.

- Insurance Transformation Benefit Source 3: Turbocharge productivity.

Those are the sources. But the actual benefits themselves can be arranged into five categories; these are what your insurance operation will accrue along your business- and process-transformation journey. Note that each of these will contribute toward not only the overarching savings/revenue/productivity benefits listed above, but they will also elevate the policyholder experience:

How-to Transform (Step-by-Step)

How do you transform your insurance brokerage or carrier?

With the guidance we’ll describe below, we’ll show you how you can reap measurable transformation improvements that directly impact your KPIs and bottom line. That’s because, for more than three decades, The Lab has helped peer insurance businesses with Knowledge Work Transformation™, taking advantage of our patented approach and methodology.

Now let’s get into the details. This long-form explainer article will dive into the answers of the top questions you’ve surely been asking by now:

- What are the avoidable pitfalls as we transform our insurance business?

- Where must I start the transformation in my insurance business?

- What should I actually be transforming in my insurance business?

- How can my insurance-business transformation go beyond the academic/theoretical… and deliver true, meaningful benefits?

Let’s review each question, and its answer, in turn.

1. What are the avoidable pitfalls as we transform our insurance business?

An important tip: You don’t want to over-engineer the transformation of your insurance business, whether it’s a brokerage, carrier, or MGA/MGU. Never put technology before process. Set your pace so that it’s agile and pragmatic, with a repeatable cadence.

Avoid the temptation (common among project managers) to add too many people, too many layers, and too many overlapping reviews.

We advise to keep things simple. You really don’t need all those redundant layers, people, and reviews. They’ll only conspire to bog things down, preventing your insurance transformation from, well, transforming. You won’t get the benefits, nor achieve the goals.

2. Where must I start the transformation in my insurance business?

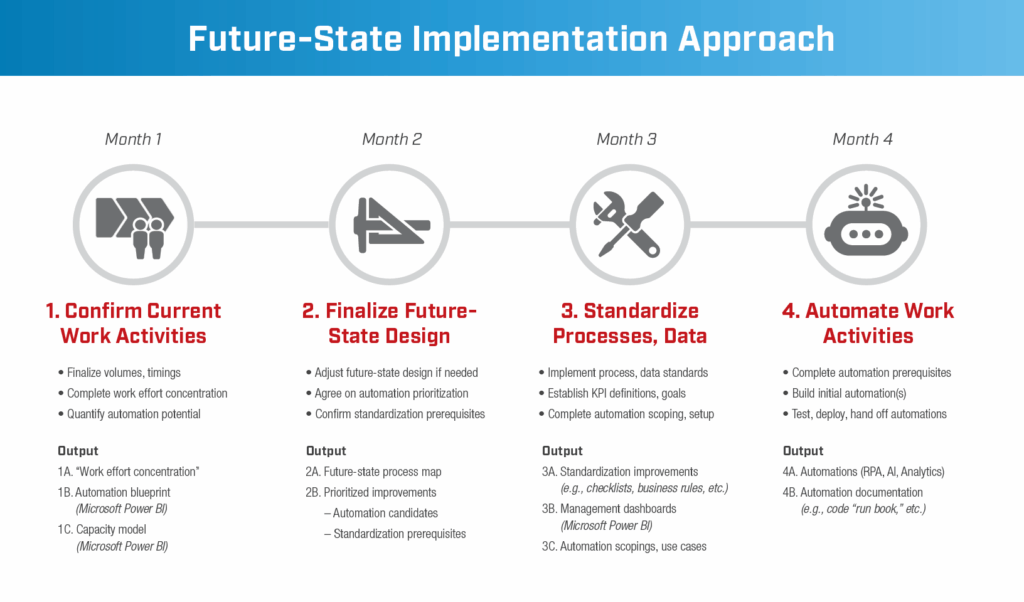

The transformation itself should follow a four step process:

Insurance Transformation Step 1:

Create your future-state process map

Remember your current-state process map? Well, now it’s time to look to the future. You’ll need a well documented and clearly outlined future-state process map. That’s the essential Step 1 of “Where should I start the transformation of my insurance business?”

Design the future-state with the ideal end-state in mind. Focus on what you want to accomplish. Don’t worry about the details of the “how” just yet.

Next, you’ll want to leverage a best-practice inventory to identify the gaps you want to narrow, or indeed close, in your desired future state. (The Lab provides such best-practice surveys as a deliverable when we perform current-state process mapping in insurance.)

This will give you a clear checklist of improvements you need to implement, tasks to standardize and automate (and even eliminate, if they’re NIGO).

The Lab offers tested, proven future-state process maps that have been template-ized; they’re ready to deploy quickly at your brokerage, carrier operation, or MGA/MGU.

Insurance Transformation Step 2:

Determine the gaps to close—and how

By this point, you’ve created a detailed list of your insurance business’ future-state goals. Now, you need to gap-test them vs. your insurance operations’ current state. Identify the prerequisites for gap-bridging:

- Tools/systems that are used

- Activities that are performed

- Who does what (work organization)

- Policies that are enforced

- Re-engineering required to pave the way for future-state automation

Here are some examples:

- Standard “shelving” (locations) and tables for all the data you’ll be collecting

- Standardized lists of documents you need to collect

- Standardized naming conventions, templates, and triaging protocols

Insurance Transformation Step 3:

Standardize and organize your data so it’s automation-ready

Identify the Executive KPIs you’ll need to manage performance in your new future state. Then “back away” from that so you can ID the data sources, tags, and fields required to make it automation-ready, and primed for data intelligence. Use that data to implement the standard data model. Don’t worry: The Lab already has a template to help you get you started .

Speaking of data analytics, be sure to check out these brief (3-minute) informative videos from The Lab, pertaining to advanced analytics and business intelligence (BI) in insurance:

- Insurance Executive KPIs: Data Standardization & Automated Analytics for Brokerages, Agencies & Carriers video

- P&C Insurance Claims Leakage Reduction Using AI, Advanced Analytics, and Business Intelligence video

- P&C Insurance Claims Payout Performance AI + Advanced Analytics from FNOL to Close video

Insurance Transformation Step 4:

Locate the support & resources you’ll need to transform your insurance business

Now it’s time to act in classic project-management-office fashion. Grab your goals and requirements list. Use it to generate an actionable work-plan, complete with all of the necessary resources (subject-matter experts [SMEs] and tools) to support it for your insurance business.

You may be surprised to learn what you won’t need, as well as what you will:

- What you will not need. Guess what? You won’t need to replace any of your systems, such as your agency management system, CRM, claims-processing systems, contact-center systems, etc. Robotic process automation (RPA) in insurance, working “downstream” of agentic AI to do the heavy lifting it requests, can work with your existing systems, platforms, and tools. That is, RPA and AI are front-end enablers that work with—and even around—your existing systems. They’ll help them accomplish what your current platforms can’t do… or do very well. The big takeaway for transforming your insurance business: No major software or hardware implementations are required.

- What you will need: Business champions. You will need the right SMEs to champion the transformation from within each section of your organization. First, identify SMEs by their line of business, along with their equivalent teammates from IT. Eventually, the addition of team members from Risk/Compliance, Marketing, and other departments, jointly reviewing the future state, is key to a successful outcome. Remember: Don’t over-engineer the process with extra layers of checks and approvals. Keep the core team within business and management. The deeper-level contributors are certainly important, but their support should be reserved for refinements/ways to make activities better.

3. What should I actually be transforming in my insurance business?

The three key strategic business areas you’ll want to transform, so you can delight your policyholders, build a more automated/resilient business, and increase your bottom line are:

- All of your Insurance Executive KPIs. The goal here is to transform your data into decision-empowering insights for leadership, management, and the front line. That means employing data intelligence, and identifying the “vital few” KPIs or key performance indicators.

- Standardization of business processes. Make all business processes consistent, simpler, and less redundant.

- Enabling automation. Your insurance business’ strategic transformation is about enabling operational excellence. You’ll thus want to unlock as much automation as you can to make human workers’ lives easier.

Plenty of insurance business processes have evolved (and certainly improved) over the years, thanks to large platforms and new technologies. Still, you won’t be surprised to learn that Humans often act as the “glue” between systems that can’t/don’t talk to each other. This is why traditional “process improvements” typically deliver minimal efficiency gains.

But when you transform your carrier, brokerage, or agency’s business processes—along with standardizing and promulgating its Executive KPIs, and with front-end automations which replace the aforementioned “human glue”—then you can actually transform your insurance organization. Remember, as we’d mentioned above, this requires that you:

- Design the end-to-end future-state process for each business and line.

- Know and detail all prerequisites for reaching this future state.

- Prepare your data for automation.

4. How can my insurance-business transformation go beyond the academic/theoretical… and deliver true, meaningful benefits?

You can’t just go through the motions of the four steps outlined in Section 2 (“Where must I start the transformation in my insurance business?”) and expect to automatically see results. If you want to realize actual benefits, you will need:

- A complete budget, detailed by target, deliverable, or capability

- Executive sponsorship

- Continuous communication across the entire insurance organization

While these may appear to be “no brainer” requirements, each needs you to devote conscious and deliberate thought to it in order to ensure success.

Here’s more detail about each:

1. A detailed and complete budget. Classify the spend according to what’s being transformed (for example, Executive KPIs, processes, and automation), not by where it’s happening (such as business area).

Creating your budget by process provides the flexibility you’ll need to go from end-to-end along with the flow—without being constrained by the specific areas of the organization that it touches. When you go from end-to-end, it touches end-to-end areas of the entire organization anyway.

2. Executive sponsorship. Keep yourself updated, before the actual updates.

What?? That certainly sounds confusing. Let us explain:

It’s not sufficient that an insurance executive acts as sponsor. The executive must also be actively engaged in the initiative. They must continually communicate (more details shortly) to deliver realize-able, measurable benefits.

The executive sponsor doesn’t have to participate in all the weekly working sessions. They don’t need to micro-manage the insurance business’ transformation. They should, by contrast, remain active in the monthly updates—and they should arrive already knowing what the update is. This way, you can spend your time not receiving the update, but directing, based on it.

Sounds great—but how? How? The answer is simple: The Lab offers what we call “previews” with our executive sponsors.

At first, it may seem counterintuitive: Instead of reporting up, from the day-to-day team members, to middle-management, and then the executive leadership, The Lab begins its update chain from the top, with the executive sponsor.

This helps in many ways. With the previews, executive sponsors get real-time details and progress highlights. They get enough details to be effective, but needn’t spend time in the weeds. So when the inevitable challenges, excuses, challenges, or other pushback arise, the executive is able to quell all resistance on the spot.

Think about that. As an insurance executive, you can walk into an update session, having already been updated. This lets you focus your time on executing. It also renders the goal, and next steps, crystal clear to the rest of the organization.

3. Continuous communication across the entire insurance organization. Use every outlet, channel, and platform to share wins with the team.

Success engenders more success. Use early wins (such as creating a robotic process automation bot that automates mortgage-endorsement change requests), and create a short demo video of the automation doing the work. Share the video across the insurance organization to build excitement at the dreaded drudgery it eliminates. Check out the examples featuring lots of insurance transformation videos from The Lab, replete with AI, advanced analytics, and RPA here.

There’s more than just video. Employ multiple forms of media to reach widely and deeply across your insurance organization:

- Quarterly town halls. Don’t create a separate insurance-business-transformation town hall. Use your existing one, and devote about 15 minutes to discuss the transformation’s progress. Have your champions share the video(s) and showcase their success stories! Be sure to remind all attendees of your bigger strategic goals, since each win is a single contributor.

- Monthly newsletters. Keep them concise. Focus content on wins. Be sure to provide generous shout-outs to all those involved.

- Planned emails from the executive sponsor. When milestones are reached (be sure to pre-determine what they are), there’s nothing quite like an email from the insurance organization’s CEO to set the tone, while preventing/reducing any unnecessary noise and pushback against change.

Check out these videos from The Lab

Want to see actual example videos of AI and robotic process automation in insurance?

Policy-Renewal and Lapse Notification Processing: Insurance Brokerage Robotic Process Automation

Specialty Insurance Coverage Application Robotic Process Automation for Insurance Brokerages

Automate Insurance Policy Cancellations

Independent Adjuster (IA) Report Processing Insurance Automation

Mortgage-Endorsement Change Requests: Automation for Insurance Carriers, Brokers, Agencies, or MGAs

The Lab Consulting Services

Transform your insurance business with help from The Lab

The Lab has helped insurance C-suite executives, internal operational-excellence teams, and business/technology leads to transform their insurance businesses & processes to deliver quantifiable results as part of their successful E2E insurance transformation initiatives.

Our proven services and solutions—backed by our proprietary Knowledge Base of 30-plus years’ worth of templatized, re-deployable client-engagement IP, along with our patented Knowledge Work Transformation™ delivery methodology—can transform your insurance business in as few as 6 -12 months.

Ready to transform your insurance business? Book your screen-sharing demo by calling (201) 526-1200 or emailing info@thelabconsulting.com today.