Process and Customer Journey Mapping for Insurance

If you want to effect transformation and the implementation of automation and advanced analytics in insurance, it doesn’t take much imagination to see that process mapping must come first. The reason: you need to understand what’s going on within your organization—and be able to compare your business to best-practice processes that other peer organizations have implemented.

Mastering Process Mapping and Improvement in Insurance

A Guide to Best Practices, Tools and Automation for Insurance: Carriers, Brokerages, and MGAs/MGUs

This detailed article will dive into all the information you need to learn how The Lab performs best-practice process mapping and improvement in property and casualty (P&C), life, benefits, workers compensation, and health insurance—and how you can, too. You’ll learn how to generate organization buy-in for process mapping. You’ll discover which pitfalls could stand in your way. You’ll find out which tools are commonly used. Importantly, you’ll learn how pave the way for automation of critical, labor-intensive activities such as quote-to-bind, policyholder services—and FNOL (first notice of loss) or FROI (first report of injury) processing, where intake errors cascade to wreak havoc downstream in all insurance businesses today.

The Critical Role of Process Mapping in Insurance Transformation

How Executive-Led Process Mapping Drives Efficiency, Automation and Strategic Growth in the Insurance Industry

Mapping processes should be the first step for any executive-led transformation and efficiency effort within an insurance business, whether it’s a carrier, brokerage, or MGA/MGU. The need for continuous improvement for streamlining operations has never been greater; three reasons help explain why:

- First, consider the waste created by hundreds of one-off work methods within each insurance organization: Up to 30 percent inefficiency that hides in plain sight, acting as a roadblock to improvement.

- Second, think of the demand for improvement created by the latest macroeconomic changes, the disruptions caused by mergers and acquisitions, the limitations of core technology such as agency-management and claims-processing systems, and the ever-changing constraints imposed by insurance regulators.

- Finally, imagine how startups might use these constraints as a major opportunity to enter this industry, rapidly transform it, and claim huge swaths of market share.

If you want to effect transformation and the implementation of automation and advanced analytics in insurance, it doesn’t take much imagination to see that process mapping must come first. The reason: you need to understand what’s going on within your organization—and be able to compare your business to best-practice processes that other peer organizations have implemented.

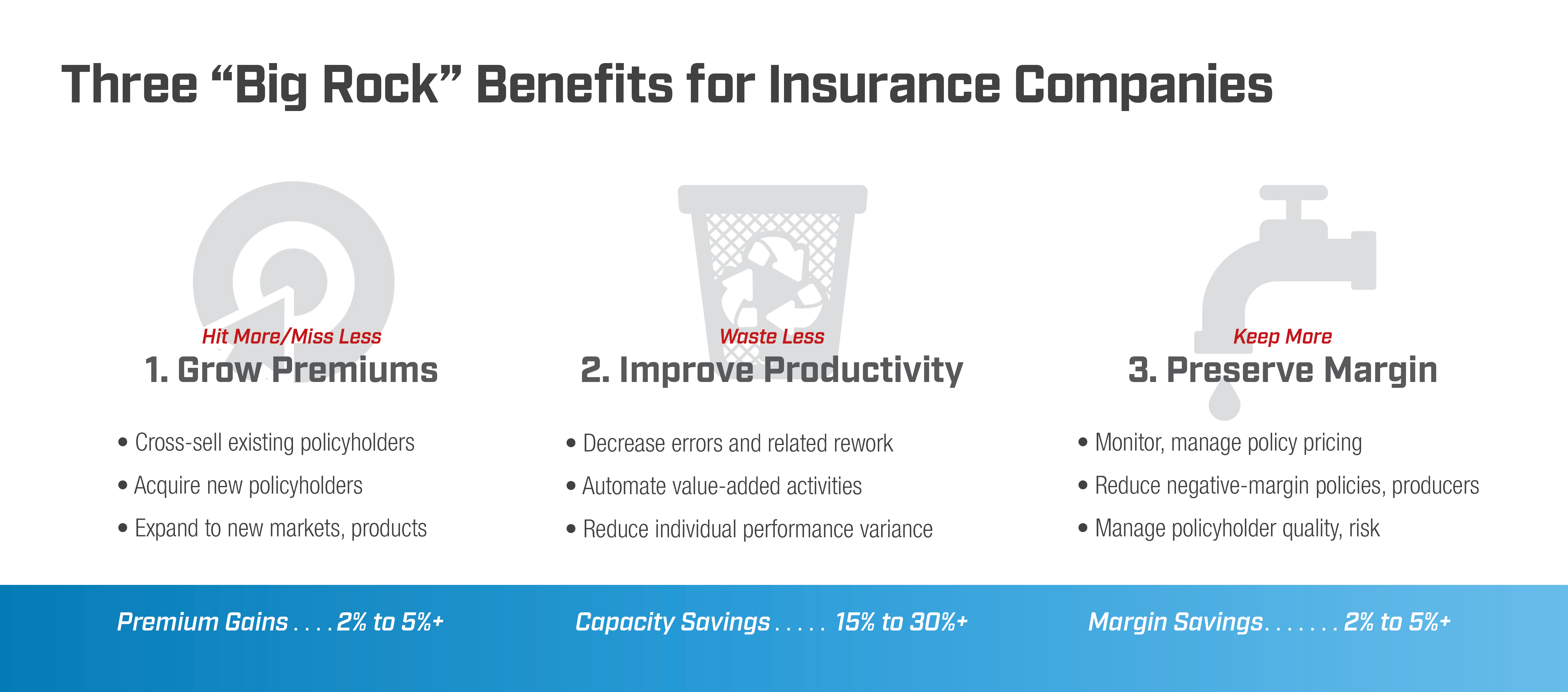

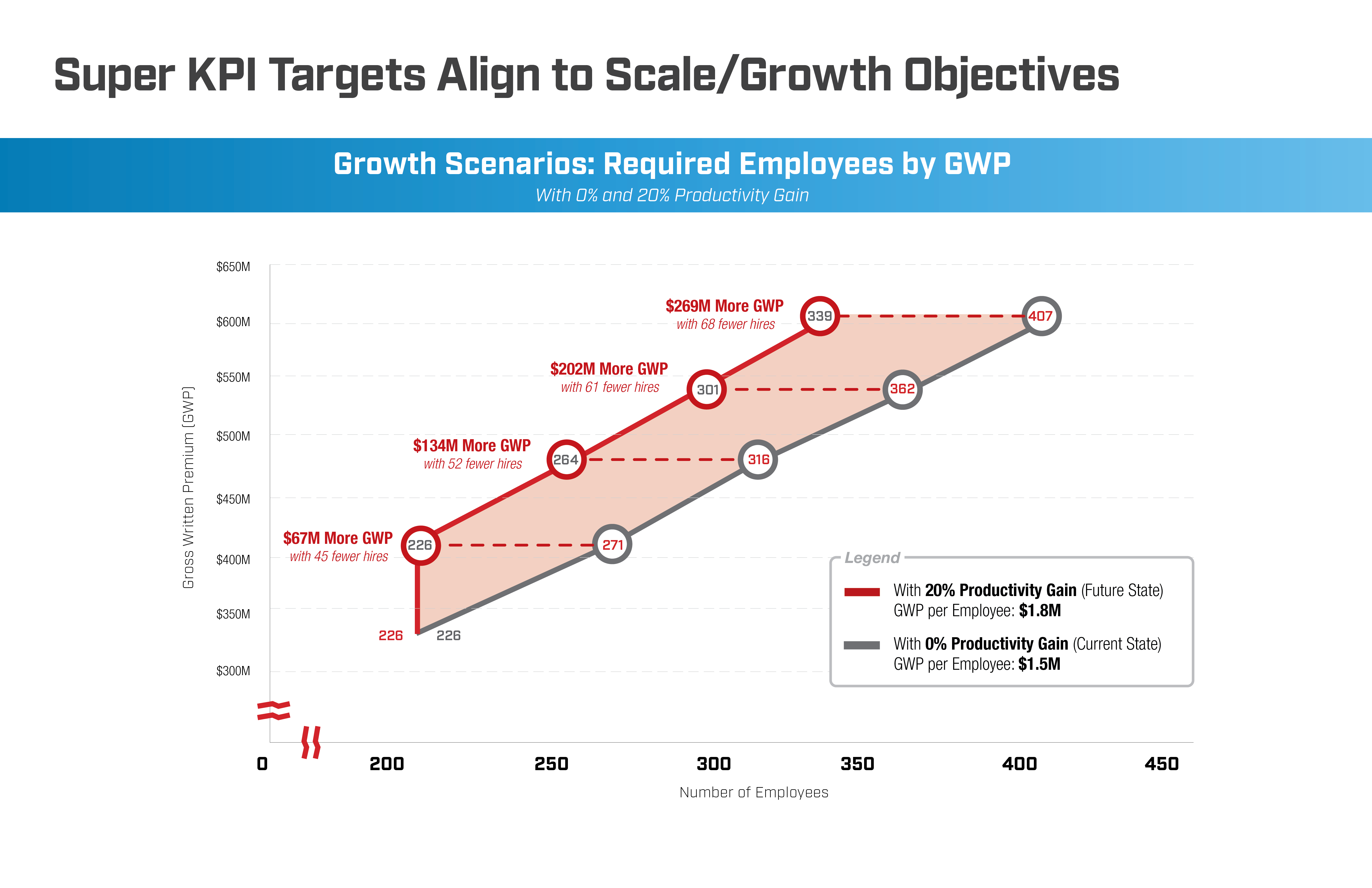

Insurance companies that have turned to The Lab as their process-improvement partner have reduced sales and claims cycle times by 50 percent, increased capacity by 25 percent, increased cross-selling across different lines, reduced claims leakage, and more. That’s because The Lab has provided process-mapping, improvement, automation, and analytics services to the insurance industry since 1993.

Cross-functional, wall-to-wall mapping of insurance processes and policyholder journeys isn’t just an exercise in documentation. To the contrary: It’s the essential first step on a strategic transformational roadmap for all types of insurance companies, regardless of the product mix. Whether implemented by a team in-house or using a third-party consulting partner such as The Lab, process mapping in insurance is powerful: It lets your organization visualize and analyze workflows. It spotlights opportunities for automation, improvement, and KPI measurement that pave the way toward a more efficient and profitable future state with maximized operational performance.

Process mapping, improvement, and transformation in insurance allow you to reduce costs, contain claims “leakage,” improve policyholder service, uncover cross- and up-sell opportunities, maximize the value of your existing core and ancillary technology investments, and ultimately lift the value of the enterprise.

Insurance Industry: Process Improvement Catalogs from The Lab's Library

The Lab's Insurance Operations Knowledge Base

Boosting Operational Efficiency in Insurance with The Lab Consulting

Leveraging Process Mapping to Maximize the Value of Your Existing Technology

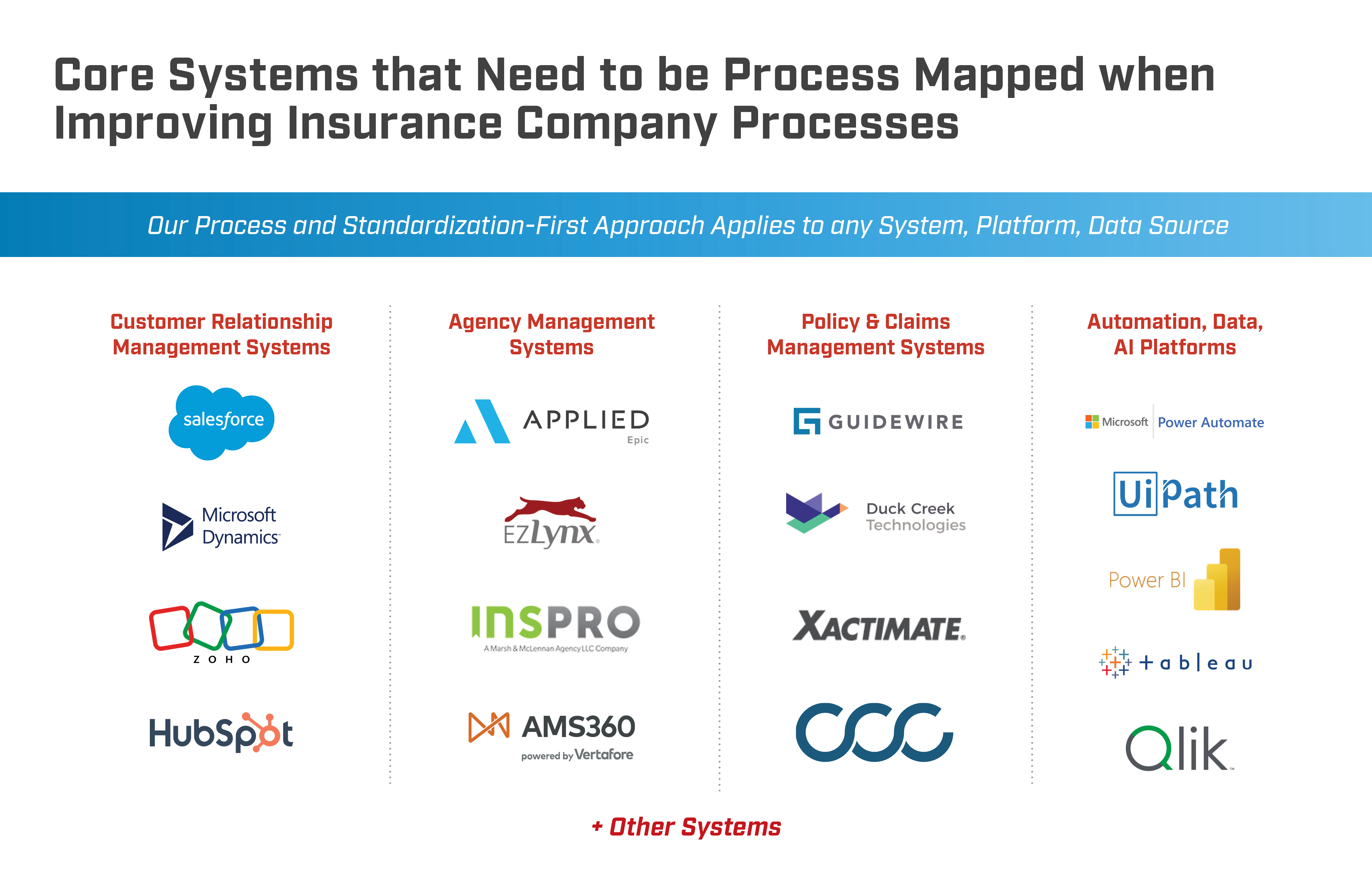

The Lab Consulting specializes in process improvement and implementation; we have for more than three decades. Our experience and expertise extend beyond insurance; we know how to “put process before technology.” In fact, that’s one of our strengths: Helping insurance companies, whether carriers, brokerages, or MGAs, to wring the maximum value from their existing technology stack without the need to rip-and-replace.

Insurance businesses already invest in technology: agency management systems, claims-processing systems, and lots more, from CRM to HRIS and data warehouses. But they typically fall short when it comes to improving operations to the point where they squeeze the maximum ROI out of all of these systems and processes. That’s where process mapping in insurance comes in.

All insurance C-suite executives, technology leads, and internal improvement teams understand that operational efficiency—which improves policyholder experience, decreases cost, and increases revenue, all at the same time—is the holy grail of transformation… and we routinely help our clients kill three birds with one stone. In this article, The Lab will show you how we can improve operations, increase upselling, improve your quote-to-bind ratio, and much more—quickly. We’ll illustrate this article with real-world examples and use-case benefits.

Who is the Right Partner for Insurance Business Process Mapping?

Identifying an Expert with Broad End-to-End Insurance Experience and an Outside Perspective

The top insurance businesses across North America typically rely on external consulting firms, such as The Lab, when it comes to improving business processes, merging organizations, or implementing automation and analytics technologies. Few dedicate in-house teams for performing organization-wide process mapping. It’s the same story for small and mid-sized brokerages, MGAs, and MGUs. Success with these business-analysis activities requires broad end-to-end insurance process experience and an outside perspective of similar organizations that a dedicated internal improvement team won’t have.

Building your own process-improvement capability in insurance

Some insurance businesses already have internal improvement teams with mature capabilities. But most of their effort, over the past years, has been dedicated to supporting system implementations—instead of focusing on actual end-to-end process improvement. The most common job title for these internal resources would be “Process Engineer” or “Business Analyst.” (Process-mapping teams rarely begin in IT.) If your insurance business already has an internal improvement team, the best place to recruit new talent for today’s data-driven strategic objectives would be among data scientists who have process experience in insurance. From there, you can employ them in the traditional business-analyst role for process improvement.

External process mapping consultants

The fastest, easiest, and most cost-efficient way to improve your process-mapping capabilities is to start with process-mapping services from an external consulting partner such as The Lab. We run these complex projects, every day, for insurance companies around the world. We’ve got the best-practice intellectual property, derived from hundreds of past insurance process-transformation engagements, to rapidly develop your maps. We’ve transformed our experience in process mapping into standardized tools and templates that accelerate process mapping for our clients—paving the way for rapid, successful implementation and automation.

Real-life insurance process improvement projects from The Lab

Insurance Transformation Case Studies: Process Mapping, Standardization, Automation and Analytics

What you should know about your organization before you start process mapping

Identify and prioritize key processes and technology to define scope of end-to-end process mapping

Regardless of the size and type of insurance business—whether it’s property and casualty (P&C), life, benefits, workers compensation, or health insurance—it turns out that most business processes in insurance are strikingly similar. For this reason, process mapping of insurance operations, procedures, and policyholder journeys becomes surprisingly straightforward.

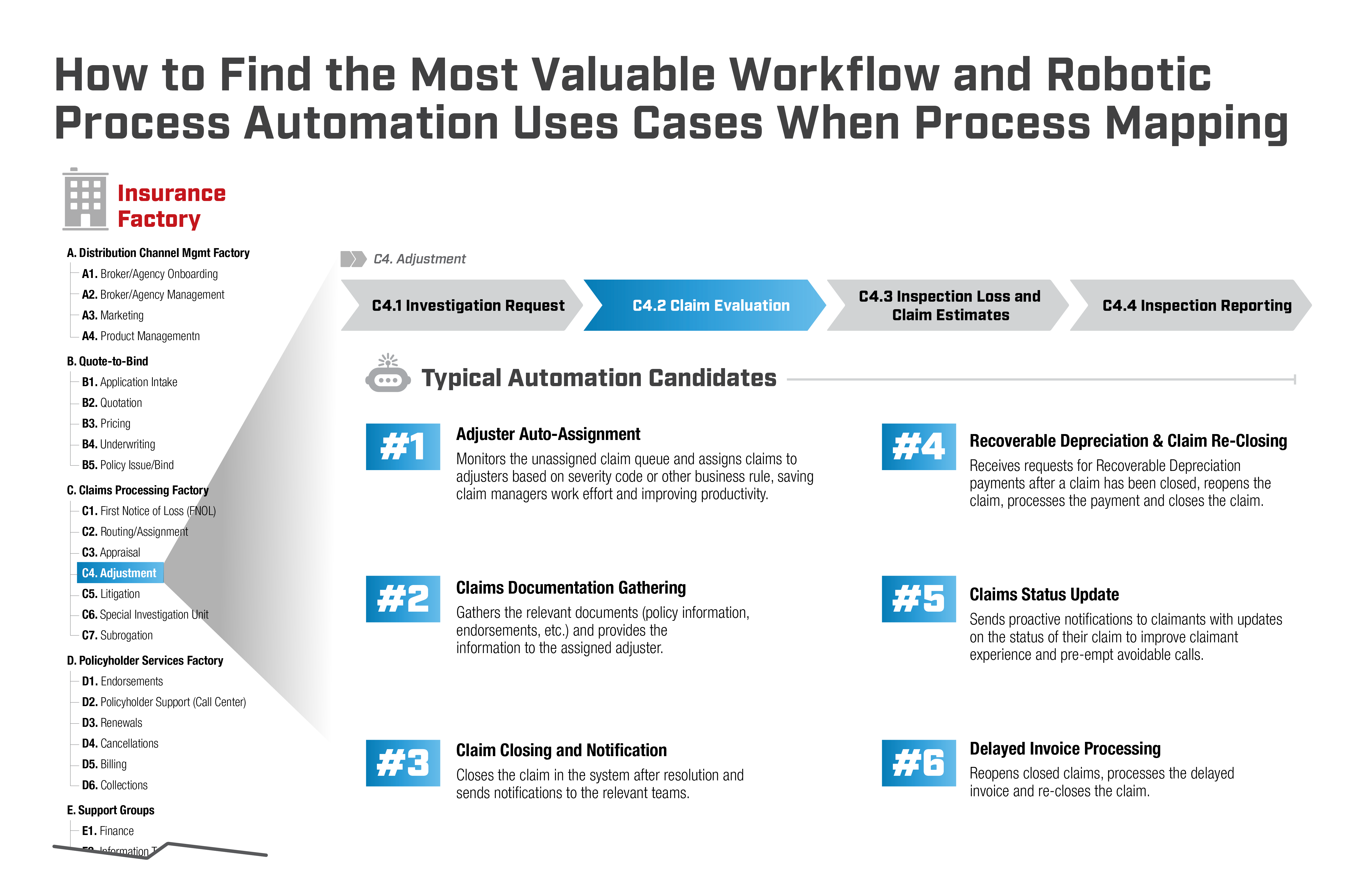

Consider the different processes that your teams perform daily. These include:

- Distribution channel management, including broker or agency onboarding, product management, and more

- Quote-to-bind, from application intake through quoting, pricing, underwriting, and policy issuance

- Claims process, from First Notice of Loss (FNOL) all the way through subrogation

- Policyholder services, spanning endorsements, call-center support, renewals, cancellation, billing, and collections

It gets detailed. The sub-processes within FNOL alone can include data intake, data QC, preliminary claim analysis and adjustment, adjuster assignment and notification, claimant notification, and more.

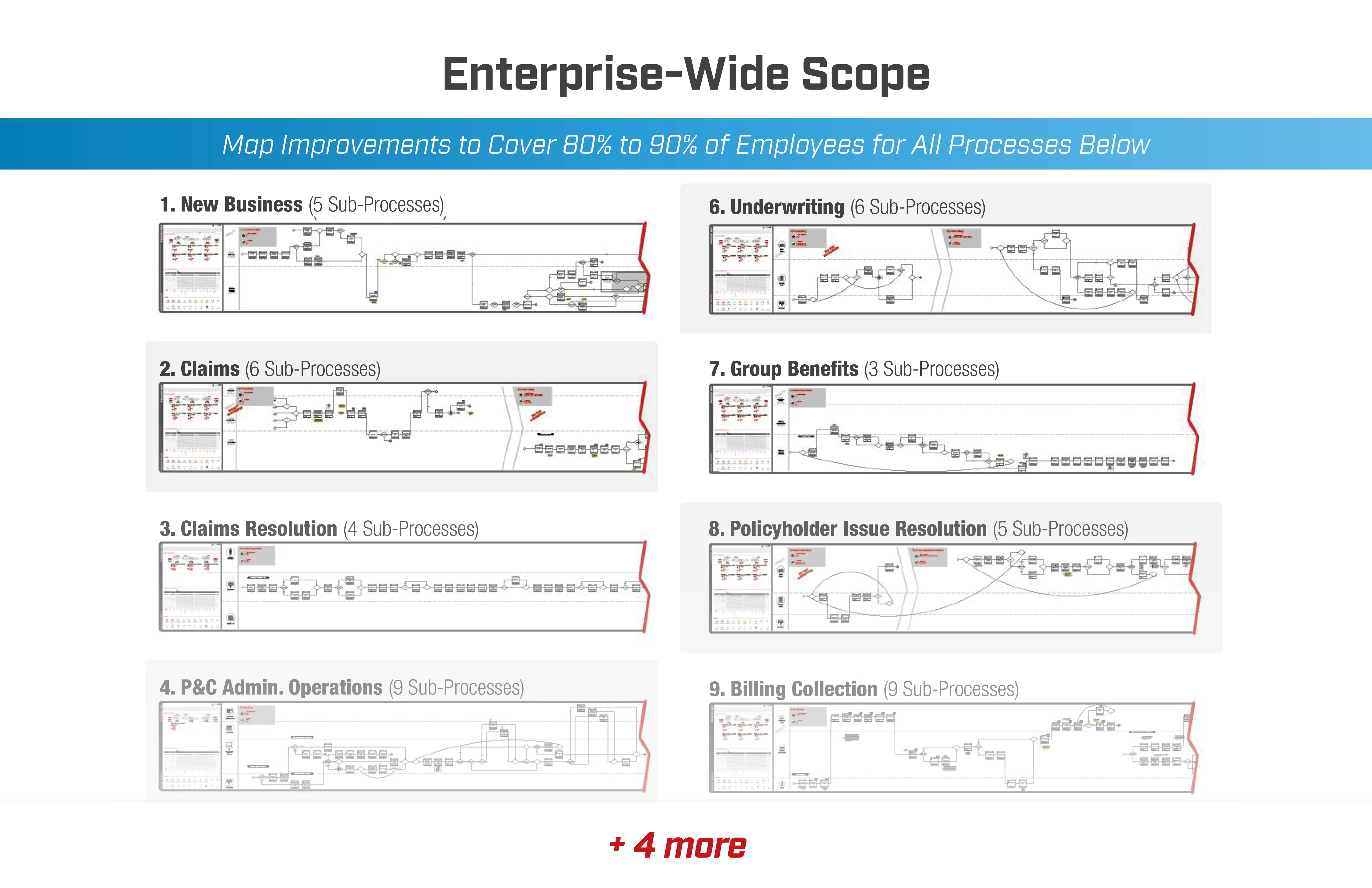

Insurance process maps naturally vary by company—but not by much; this is the heart of The Lab’s patented and proven template/IP-based methodology. A typical P&C insurance brokerage’s end-to-end scope can be seen here:

Best practices for a successful process mapping journey

Best practices for a successful process mapping journey

This should guide your process-mapping journey in insurance. Follow these best practices:

- Follow the benefits. Seek a benefits-rich, proven-ROI scope. Map across all insurance business functions and departments.

- Go end-to-end and wall-to-wall. Map every step of the way, such as:

– Prospecting and sales: From broker/agency onboarding, through marketing and lead management.

– Claims processing: From FNOL data entry all the way through adjuster assignment and even subrogation.

– Policyholder services: From renewals and endorsements through case management and settlements.

– And so on. - Avoid the silos. Be sure to document the entire sales process, the policyholder journey, the back-office operational activities, and regulatory stage-gates.

- Lead from the top. Make sure you secure executive sponsorship; without it, organizations may find excuses to opt out.

While these processes may seem unique to you, they’re hardly unique, industry-wide. For example, key elements of the quote-to-bind process at Insurance Company A will be the same as those at Company B. The real differences lie in how the systems are used, since they were all configured differently by their original implementation teams.

Expand Your View: Map Every System for a Complete Picture of Insurance Processes

Just as you shouldn’t constrain your process mapping to just one department or function, you also shouldn’t confine it to just one system. You have plenty; map them all. To gain a true wall-to-wall perspective, be sure to include the claims processing system, agency management system, CRM, HRIS, data warehouse, and others. Doing so will maximize the benefit of your insurance process-mapping initiative.

How to simplify your process mapping approach

Break down process mapping into three distinct stages

By breaking down even the most complicated strategic processes into “bite-sized” stages or sub-processes, insurance organizations can rapidly gain newfound understanding of their operations.

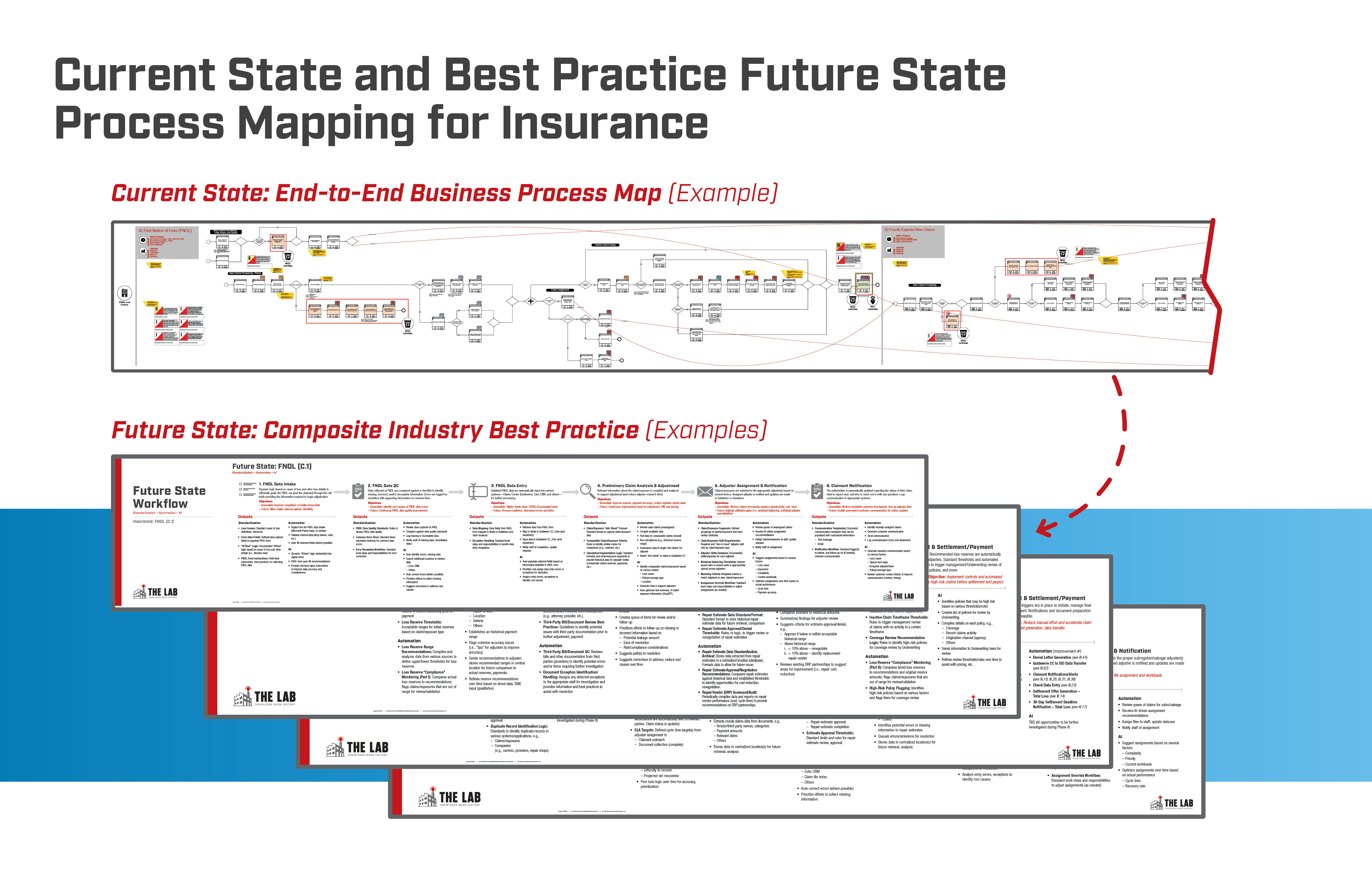

We define process mapping as the documentation and analysis of business workflows, deployed to create visual representations of every stage in a given process. The end product is a series of flow-charts or diagrams. These visual representations not only show how processes exist now; they also reveal how they can be improved and roadmap the most valuable future-state process, when done properly.

Process mapping can be broken down into three distinct stages:

- Prioritizing the strategic goals, generating buy-in, aligning business need with timing, and preparing the organization for process improvement. Clearly, that’s the hardest, most time-consuming, and politically sensitive step.

- Drafting the actual maps and documentation of all the process improvements—the obvious and fun part.

- Implementing the transformation roadmap of the prioritized improvements. This is the continuous-improvement long-haul that delivers the benefits from the business case.

Broken down into detail...

The three strategic stages for insurance process mapping

From Paper to Platform: Tools for Every Stage of Process Mapping

Explore the spectrum of process-mapping tools—from traditional methods to modern software solutions.

The most common tools range from old-school simple to common (and not-so-common) software. These include:

- Rolls of paper (typically white or brown “kraft” paper)

– Big rolls, pasted on walls, and peppered with hand-drawn diagrams and Post-It notes.

– Typically favored by traditionalist/old-school consultants. - White board

– Commonly used to quickly draw summary flow.

– Good for rapid, high-level summary - MS Visio

– Readily available c/o MS Office 365

– Ubiquitous: The most popular process-mapping application over the last decade. - IBM Blueworks

– IBM proprietary process-mapping application.

– Waning market share over the last decade - Signavio

– Cloud based

– An alternative to Microsoft Visio

The Lab Advantage: Smarter, Faster Insurance Process Mapping

Unlock rapid results, measurable benefits, and industry-leading improvements with a proven, low-impact approach.

The Lab’s unique and proven approach to process mapping and improvement in insurance offers many advantages over traditional approaches, including:

- Rapid mapping. The Lab’s process mapping service is highly efficient: It only requires an hour of client time per week, per SME, over a six- to eight-week period. This lets you—and them—focus on core responsibilities while we build the maps and validate our analysis.

- More benefits. The Lab helps you measure capacity requirements for each insurance business process or department. This leads to a detailed benefits-case that steers and supports the implementation of all identified improvements.

- Enhanced outcomes. By benchmarking your insurance operation against “gold standard” best practices from across the insurance industry, The Lab can identify competitive gaps, designing an improved future-state for your business.

- More improvements. Gain a comprehensive understanding of end-to-end processes at the activity level, identify automation and AI opportunities, weed out avoidable rework, highlight control points, and more.

Efficient by Design: Low-Impact, High-Value Process Mapping for Insurance

Minimize disruption while maximizing insight with The Lab’s streamlined, expert-driven approach.

The Lab has designed the client-facing side of our process mapping efforts to be minimally invasive. There’s no need to “shut down” your insurance business just to “map” your insurance business.

It takes only six to eight weeks. During that time, The Lab requires just one to two hours, per week, per subject-matter expert or SME. This is as much respectful as it is pragmatic: We know that you and your people are time constrained. We don’t want to add to the burden. And, frankly, given our templates, any more time is wasted effort—it won’t change the findings.

Our standardized approach to process mapping, including future-state templates that adhere to industry best practices, not to mention our process-focused team, ensure that process mapping is thorough, accurate, and fast.

We construct current-state process maps for insurance brokers/carriers by documenting all end-to-end business processes at the one- to five-minute activity-level of detail. Atop each map, we’ll layer in the most valuable operations and improvement detail. These include system usage (including technology under-utilization), policyholder touchpoints, job roles, avoidable wasted effort, use-cases for automation, standardization opportunities, and more.

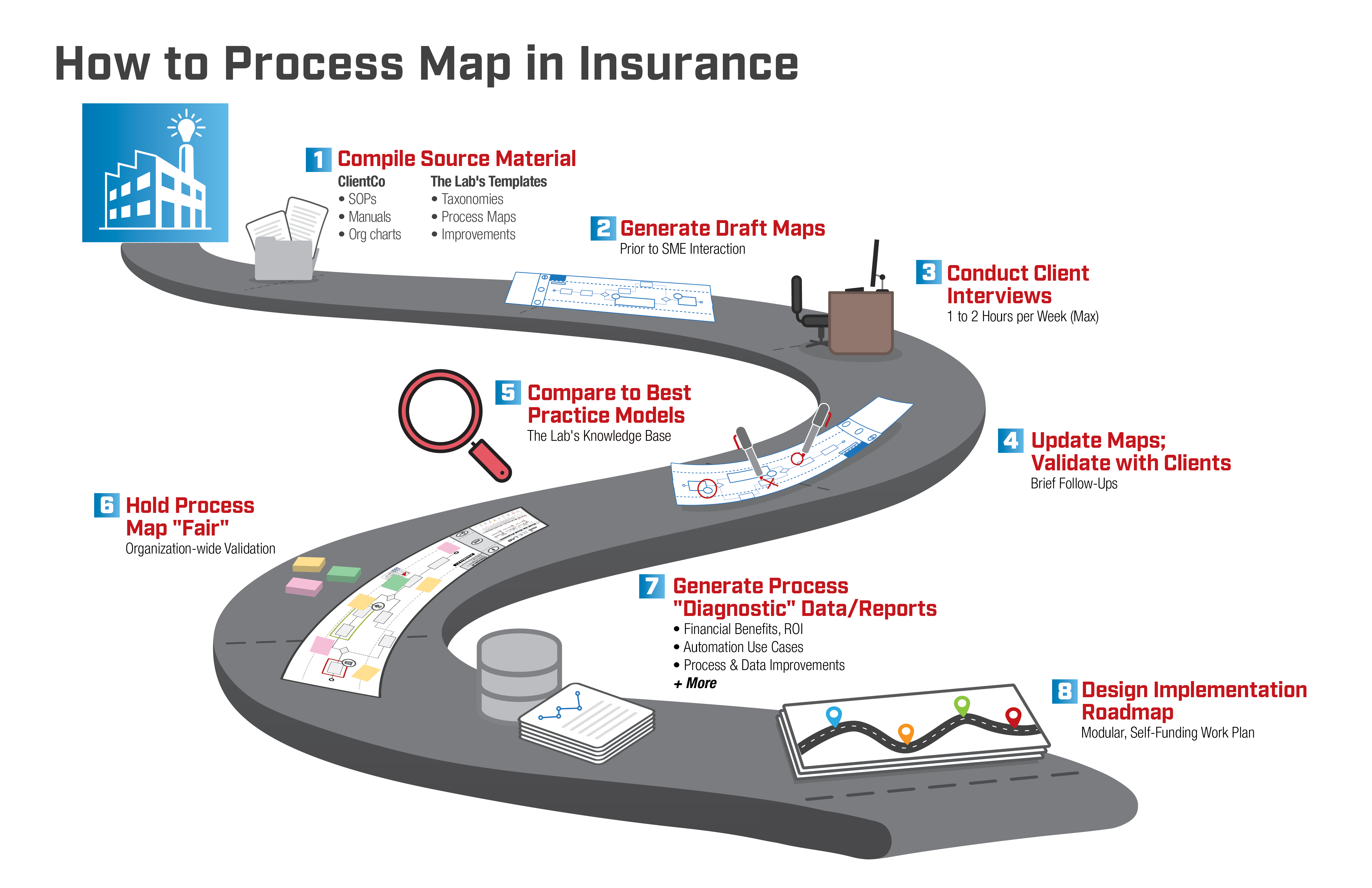

When engaging The Lab for process mapping in your carrier, brokerage, or MGA/MGU, the following best-practice methodology and cadence will be followed:

Process Mapping Step 1:

Assemble source data and documentation

“Dump-truck us.” You will never overload us. That will be the first thing you’ll hear from The Lab. We’ll want to get our hands on all existing manuals, SOPs, and process information. We don’t care if they’re a half-dozen years out of date. We don’t care if they’re 50% incomplete. The important thing is that we analyze all of your past process documentation. This can—and should—include:

- SOPs

- Manuals

- Organization charts

- Operational reporting, even if the KPIs are buried in clunky Excels or sloppy PowerPoints

This approach enables us to do our research before we engage with and interview your teams; as noted above, we want to be as respectful of their time as possible.

We also want data. Lots of it. We’ll ask for extracts from all the supporting systems you employ to run these processes. And a qualifier: We only want (and require) scrubbed data that’s devoid of personally-identifiable information—no PII or CSI. Don’t worry: this redacted information gives us all we need to identify trends in things like quote-to-bind bottlenecks, FNOL cycle times, payment-processing rework, or the volume of not-in-good-order information moving through a sales or claim process.

We then use this data, along with the process maps, to develop a capacity model of your insurance enterprise’s current state—and the quantification of a business case for improvement implementation. After all, The Lab is first and foremost an implementation firm, so we’re always targeting successful, profitable change.

We will also compare your current-state documentation with our world-leading knowledge base of previously-analyzed processes. This IP—and templates in this knowledge base—include:

- Taxonomies

- Process maps

- Improvements

– Automation use-cases

– KPIs

– Standardization opportunities

– Reorganization strategies

– Benchmarks

– Best practices

Comparing your data to the knowledge base data allows us to plug gaps—remember that your insurance operations aren’t radically different from those of your peers.

Process Mapping Step 2:

Create first version of the process maps

After performing the above research and analysis, The Lab creates the first-draft process maps. (Remember: All this work is completed prior to engaging your SMEs, to minimize their required time commitment.)

Microsoft Visio is used for all The Lab’s process-mapping work and layout; this is so we can easily hand off the completed maps, post-project, for future updating without your needing to onboard and support another software vendor. That’s because, regardless of how much our clients love our work, nobody wants consultants hanging around forever!

Process Mapping Step 3:

Interview the SME

Now that the v1 process maps are compete, it’s time for The Lab to directly engage with the insurance experts in your organization who are actually performing all of the day-in/day-out activities we’ve just mapped.

Using MS Teams or Zoom, we’ll present the Version 1 maps directly to them. We’ll pose pointed questions regarding any gaps we perceive in the process. We’ll work with them to build out further details. As noted above, this check-in/validation activity only requires one to two hours per week with your SMEs.

Process Mapping Step 4:

Iterate the Version 1 maps

After completing the initial round of fact-finding and process-mapping generation with your SMEs, we at The Lab then iterate the maps over the course of four weeks. It’s like a lather/rinse/repeat cycle for building out deeper, more valuable process-map detail.

In our 30-plus years of experience working with insurance carriers and brokerages, we have found that nobody ever remembers every step of a process in one sitting. In contrast, short bursts, spread across several weeks, are both less intrusive and vastly more productive.

Process Mapping Step 5:

Compare process maps to best-practice knowledge base

Once we complete the current-state process maps, The Lab’s team then compares them to industry best-practice models and peer comparatives. This is integral to building out the most benefit-rich future state for actual implementation.

The Lab’s knowledge base and best-practice models contain:

The Lab’s knowledge base and best-practice models contain:

- Benchmarks

- Improvements

- Job descriptions

- Automation use-cases

- KPIs

- Process and data-standardization opportunities

- Opportunities for re-organization

Process Mapping Step 6:

Conduct a “Map Fair”

This is the step at which The Lab shares all the process maps with the entire organization at in-person “Map Fairs,” conducted in common areas of the organization’s headquarters. Here, staff of your insurance carrier, brokerage, or MGA/MGU can personally contribute (at their leisure) throughout the course of a two-day period.

Map Fairs allow your team members to contribute anonymously—if they wish. They can validate the process fact-base that’s been created to date.

The Map Fair also socializes process-mapping findings. It prepares the organization for the upcoming process change. It generates buy-in by making sure that everybody has an opportunity to contribute. Organization team members are invited to mark up the printed-out maps with color-coded Post-it notes:

- Green Post-It’s: “I strongly agree.”

- Yellow Post-It’s: “Information is missing.” Or: “There’s an additional step or improvement that should be added.”

- Red Post-It’s: “I strongly disagree.”

After the Map Fair is over, The Lab analyzes all Post-it note contributions. We then reconcile them into an updated version of the workflows. At this point, the maps are considered final, for the initial analytical purposes.

Process Mapping Step 7:

Develop and report out on implementation use-cases

After the Map Fair, your insurance business will possess hundreds of validated implement-able improvements, e.g.:

- 50-100 analytics use-cases

- 100-200 automation use-cases

- 150-250 standardization opportunities

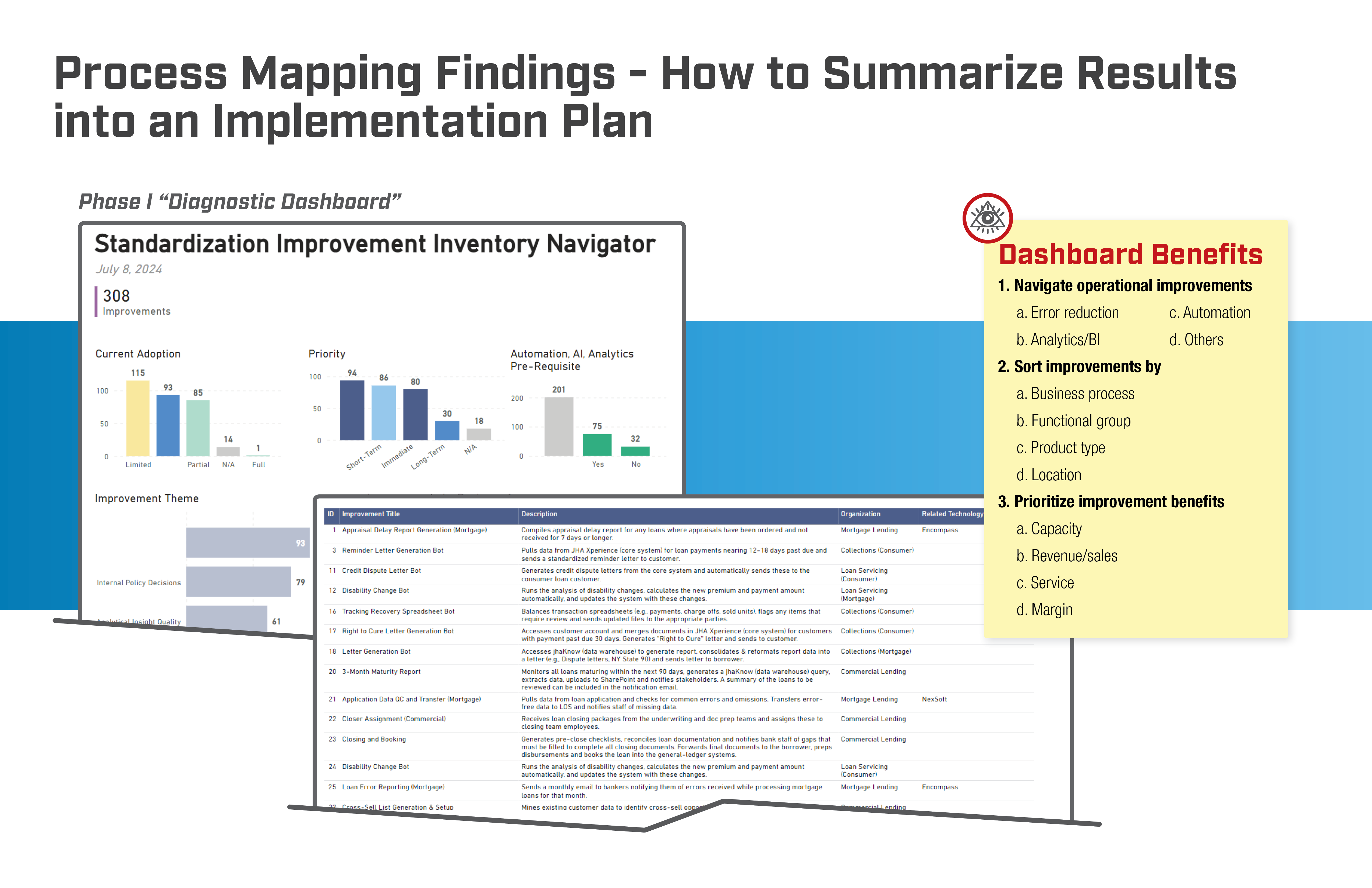

The Lab centralizes these into a navigable database, atop which is layered a Power BI dashboard that can be used to prioritize use-case implementation based on critical path dependencies.

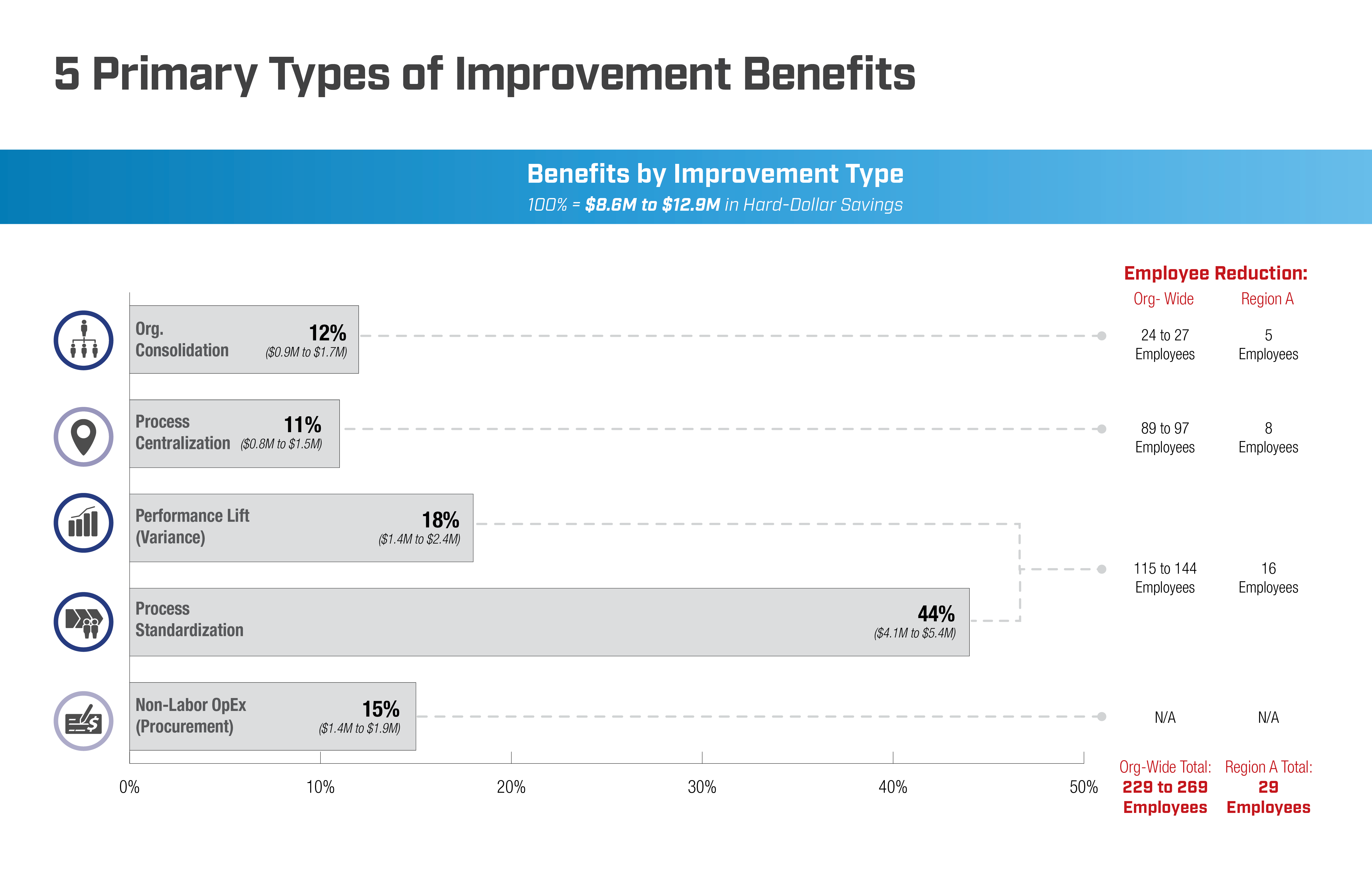

Each identified improvement and use-case will be quantified in terms of time saved, financial benefits, platform/technology under-utilization, policyholder-experience improvement, and others. After compiling and quantifying the individual improvements, The Lab generates an overall organization-capacity model which acts as a baseline for building the business case/implementation value, work plans, and modules. The outputs include:

- Automation use-cases

- Financial benefits, ROI

- Process and data improvements

- More

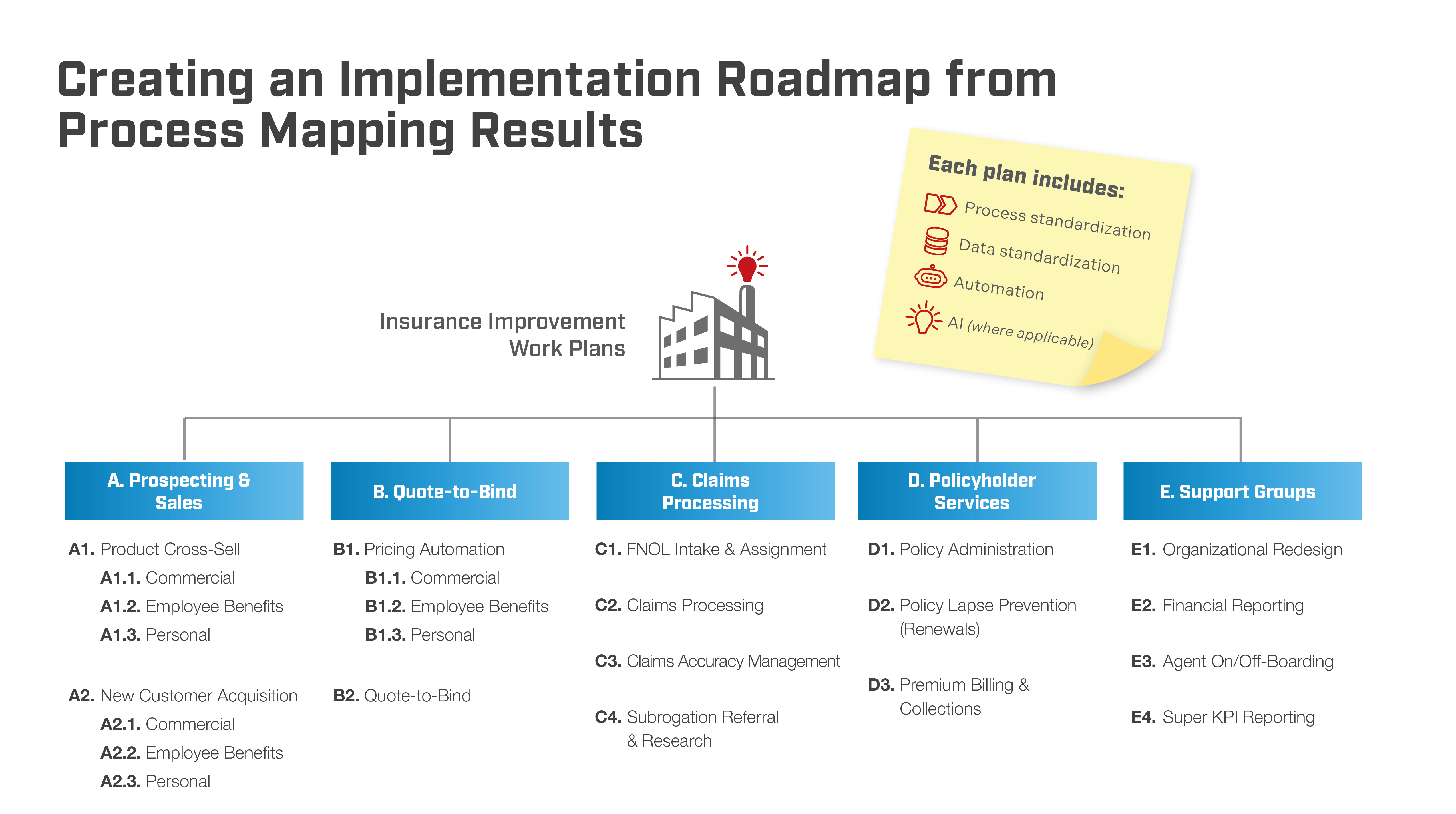

Process Mapping Step 8:

Road-map the implementation

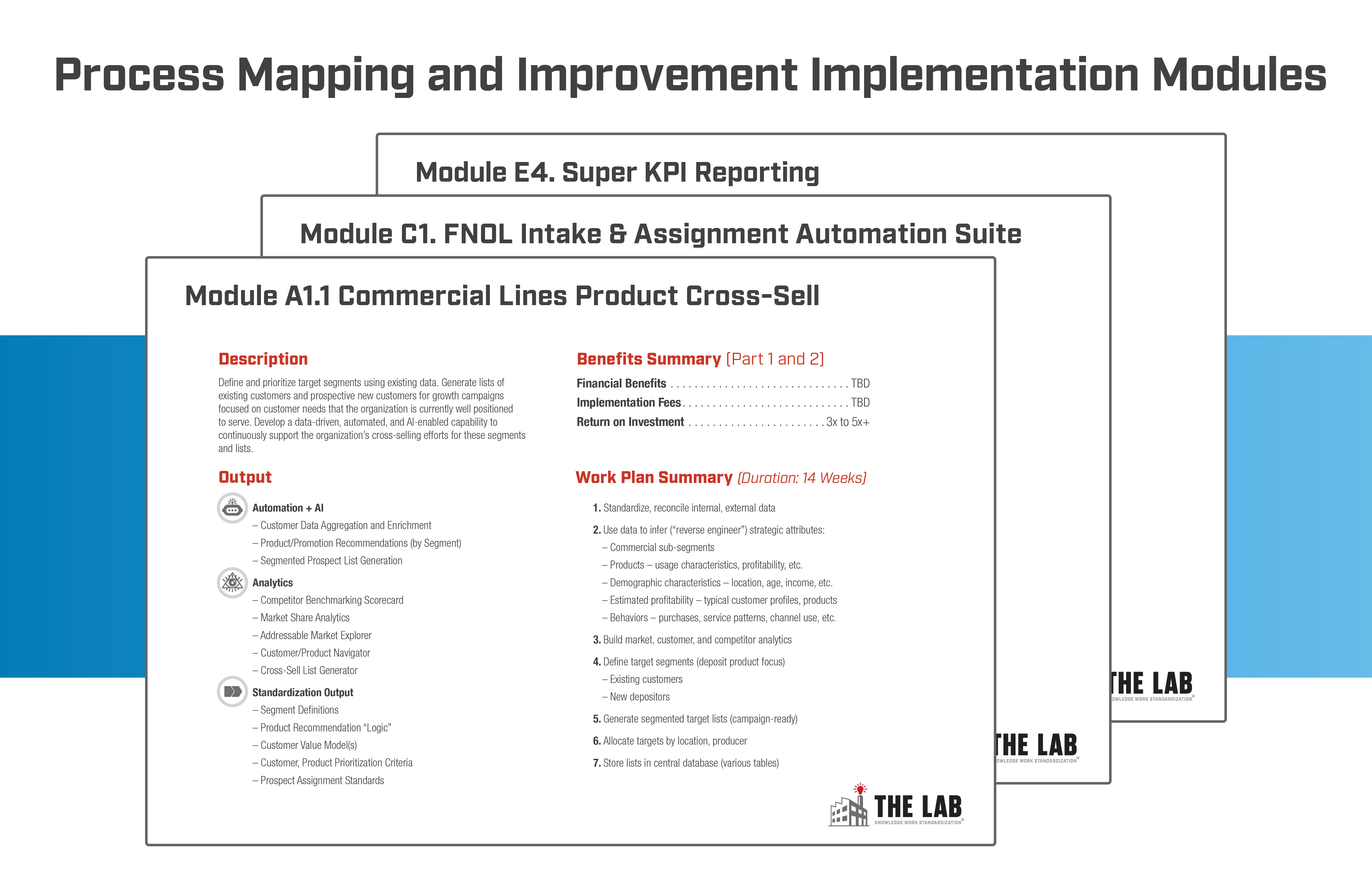

No insurance carrier, brokerage, or MGA/MGU can implement all of the improvements that have been identified, all at once. It’s far better, as The Lab has learned, to break up the implementation into smaller, more manageable modules. These can align with short, mid, and long-term strategic goals. The Lab can help with all of the implementation in the beginning; by the end, the client is able to do it on their own.

Outputs from this step of the engagement include:

Outputs from this step of the engagement include:

- Self-funding modular work plan, calendared by quarter.

- Mix of process improvements, automation, and also KPI analytics

- All this is designed by The Lab, in coordination with the client’s executive steering committee to meet the insurance company’s strategic objectives

An exception to the “don’t attempt a big bang implementation” guidance above: There are some business situations which demand nothing less than a “big bang” approach. The Lab has supported some of the world’s largest reorganizations in these challenging events when needed.

Increase operational efficiency and better serve policyholders

Benefits of Process Mapping Your Insurance Business

TRANSFORM YOUR INSURANCE BUSINESS

Contact us today to book your demo!

The Lab has helped insurance carrier, brokerage, and MGA/MGU executives, technology leads, and internal improvement teams to map their organizations’ business processes and policyholder journeys. We’ve helped them to streamline operations, enhance policyholder satisfaction, and achieve dramatic cost savings. We do this by identifying and implementing automation opportunities and advanced analytics. Taken together, these improve process resiliency, and also hedge against employee turnover. Our comprehensive solutions drive success—and deliver measurable results.