Maximize a Merger or Acquisition

Whether you’re acquiring another organization or preparing your own for purchase, maximize the efficiencies, scalability, and value of the merged entity. For 30 years, The Lab has helped executives analyze landscapes, prepare for mergers, integrate acquisitions, and drive board-level strategy via “Super KPIs”.

The Lab’s IP-based approach: Work from best-practice efficiencies and value

Accelerate M&A discovery, preparation, and integration

- Need help with merger-related org design for both the acquiring and acquired companies?

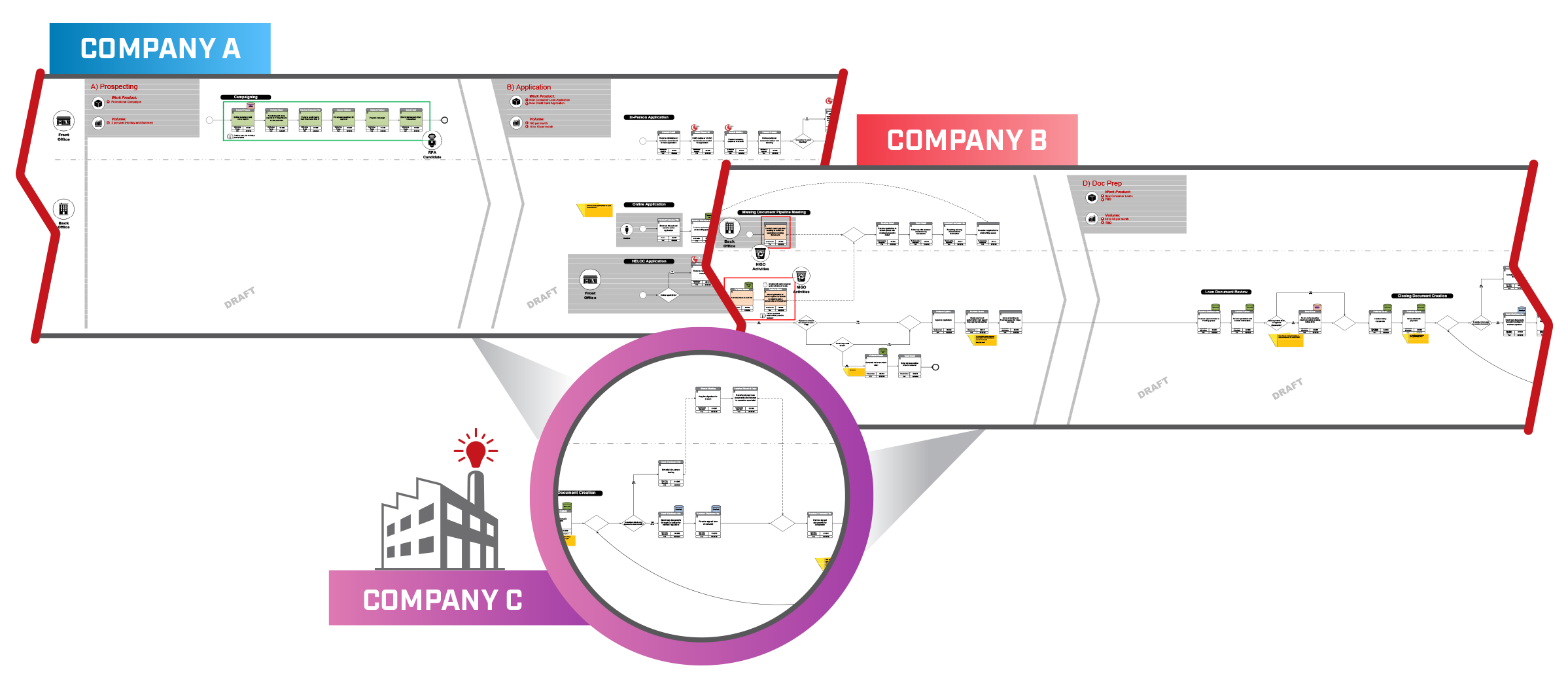

- Unsure which organization has the best-practice processes to deploy in the combined entity?

- Have you acquired multiple organizations—and still need to harmonize dissimilar operations?

- Frustrated by a core-tech provider whose data-migration timeline—and backlog—doesn’t tee up with yours?

- Are you planning to be acquired, and need rapid cost out to generate maximum value?

The Lab knows mergers. Using our patented, knowledge-based approach, we’ve helped executive teams navigate the complexities of M&A. Whether it’s strategic process integration, pre-merger preparation, or post-merger cleanup, we deliver strategic value for our client sponsors.

Merger & Acquisition Preparation

Market & Region Analysis

Uncover and discover the best-fit regions, segments, and specific company targets for your acquisition strategy. The Lab’s documentation of your current-state structure and processes, combined with our proprietary knowledge base and data-standardization strategies, give you unprecedented insight into maximum-value opportunities.

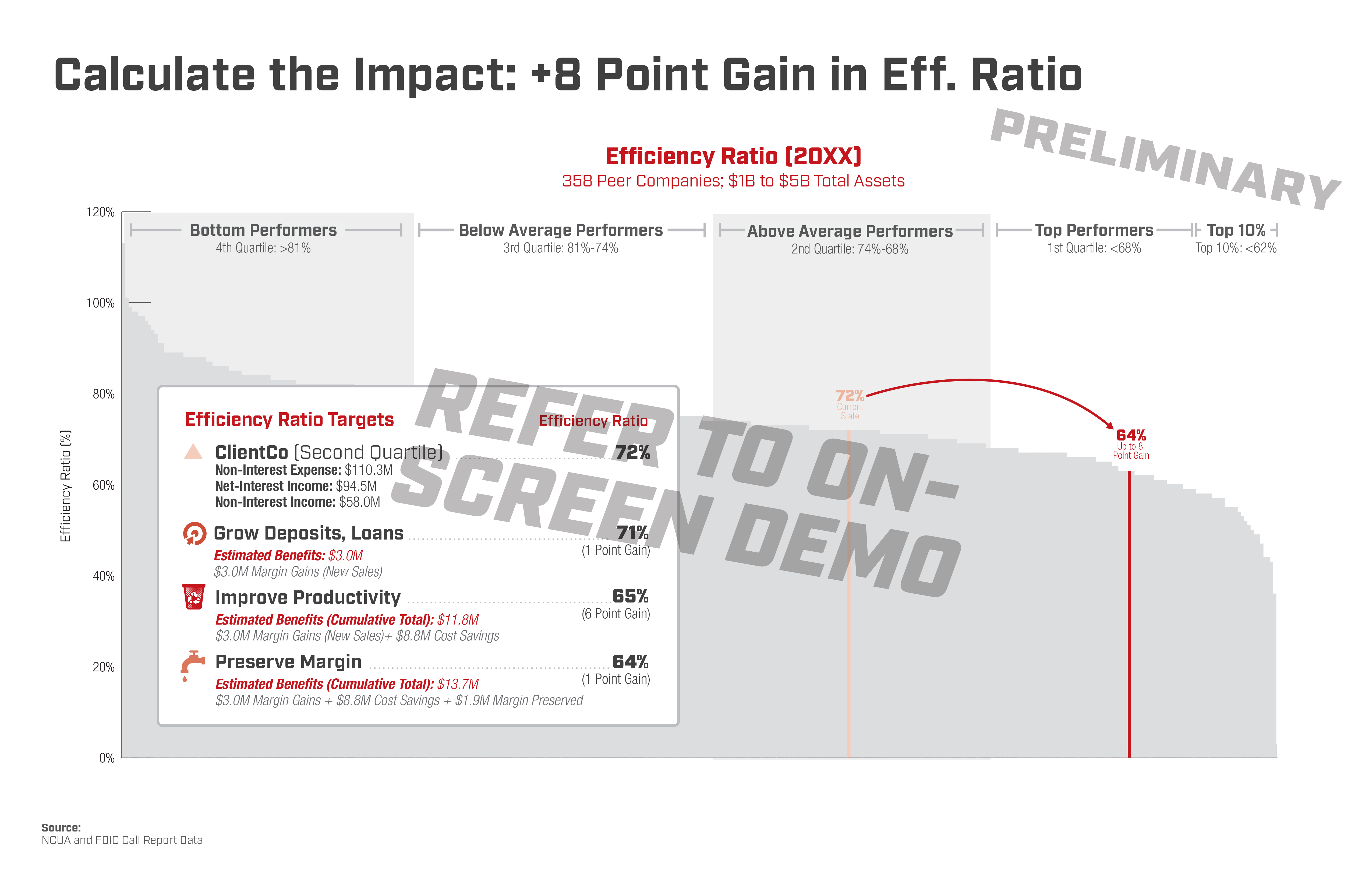

Make Confident Decisions & Data-Driven Projections

Impact Analysis

The Lab’s Super KPIs streamline the process—and the effectiveness—of determining the financial impact of a given merger candidate on the to-be combined entity. We have the latest proprietary benchmarking data and hundreds of industry-standard KPIs to help generate the input—and outputs—you need to satisfy both shareholders and the board.

Realize Maximum Value in Minimum Timeframe

Post-Merger Integration

- Rapid Process Cleanup

Didn’t take processes into account before the merger? Relax. The Lab has 30 years of experience helping executives clean up post-merger processes. - Core System Data Transfers

Don’t wait years for core-system providers. The Lab adds data science and tools like Python to rapidly automate data conversion in just four to six months. - Future-State Process Development

Let The Lab map, standardize, and automate the most valuable future-state processes and customer journeys for the combined entity. - Rationalized Org Design

The Lab will customize our best-practice, industry-specific templates to your combined organization, rationalizing regions, spans, layers, and departments to maximize business value.

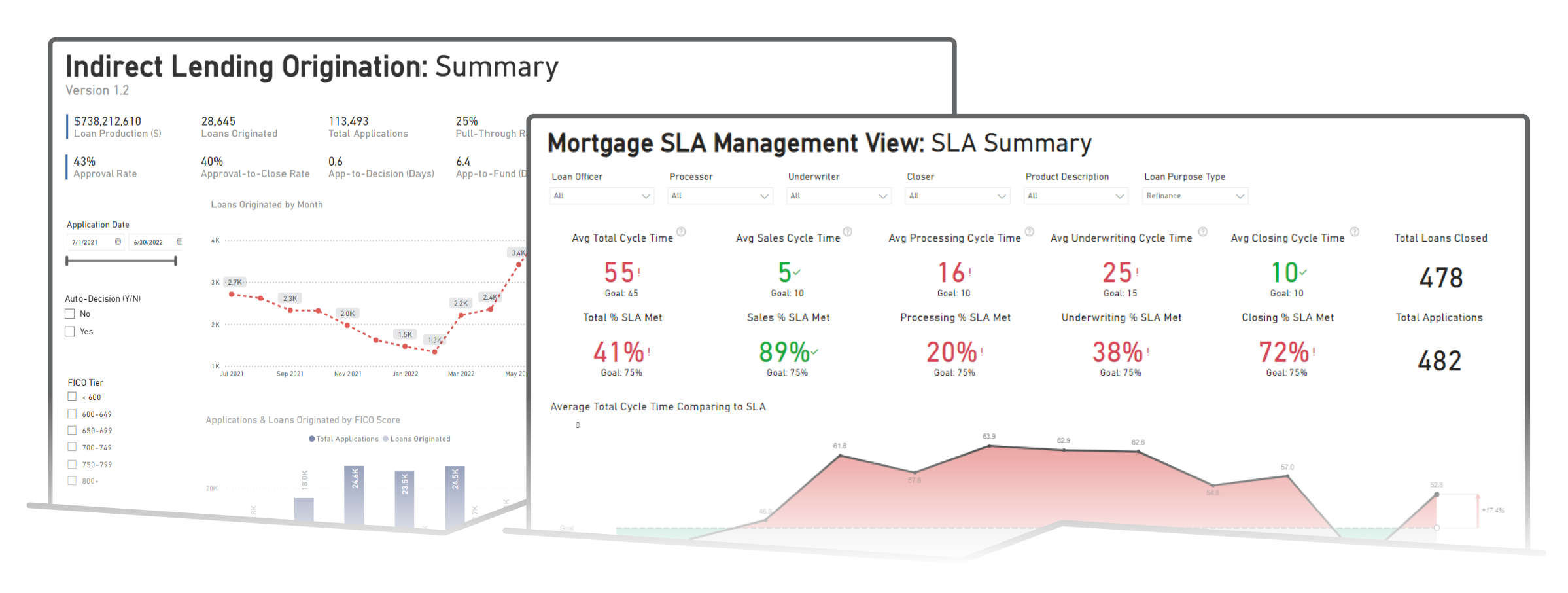

Board Reporting, Simplified

Merger Outcome Measurement & Analytics

The Lab’s Super KPIs provide dashboard-level analytics, with all of the heavy-lifting automated in the background. High-level analytics are readily accessible and continually updated. The Lab even provides produced videos of “benefits showcases” for board-level presentation.

M&A Support Benefits

Predictable Results, Guaranteed Benefits for Executives

For three decades, The Lab has successfully implemented merger and acquisition initiatives from the Fortune 1,000 down to the local credit union.

Our approach is designed to minimize client risk. The Lab’s guarantee: Financial benefits realized during the first year following implementation will, at minimum, equal the investment in The Lab’s services. If not, we’ll continue working without charge until it does or refund the difference.

The Lab’s M&A projects can pay for themselves in six to eight months and deliver 2x to 5x payback in the first year after implementation.

- Organization capacity savings…..20% to 35%

- Revenue productivity gains….……10% to 30%

- Margin leakage reduction………….…5% to 15%

- Service level improvement…….….20% to 50%