How to Implement Digital Worker Automation in Banks & Credit Unions

Automate 50% or more of your financial institution’s processes in just 6 to 12 months

The buzz is about as overwhelming as the buzzwords: Agentic AI, GPT, LLM, and countless other acronyms are swirling about the head of every bank and credit-union executive today.

It’s hard to grasp what they are or what they do, let alone figure out precisely what you can (and should) automate at your bank or credit union. After all, AI software advisory firms just talk about what’s theoretical… and try to sell you their software.

In this long-form explainer article, we will cut through the clutter and filter out the buzz. We’ll remove all the marketing jargon. We’ll demonstrate exactly what automation is possible in your bank or credit union.

By the time you finish this article, you’ll realize that you can automate at least half of your bank or credit union’s business processes. Put another way: Digital workers can perform 50 percent, or more, of your organization’s processes—and hit that stride in just six to 12 months.

Digital Workers vs. Automation

What’s the difference between a “digital worker” and AI in banking and credit unions?

Short answer: No difference.

More nuanced reply: “Digital worker” includes AI, “agentic AI,” and all the other buzzy technologies as well. In fact, one bank or credit union may define “agentic AI” differently than one of its peers. Ditto for terms like RPA, a.k.a. robotic process automation. And that’s just within banking; the same holds true across all industries.

The fact is that recent advances have delivered all kinds of business-process-automating tools that are easier than ever to implement. As you might expect by now, different banks and credit unions implement and execute them differently, too.

None of that matters for this article, nor your takeaways therefrom. We’re not going to nit-pick the differences or claim to choose the “best” one. Instead, we intend to be more pragmatic: We’re going to tell you:

- What they are.

- What they’re capable of doing.

Knowing that, the answers—and the automation path forward for your bank or credit union—will become obvious. So be sure to share this article with your internal improvement teams and technology leads, in case you haven’t already.

Types of Automation

What are agentic AI, LLM, IDP, RPA, and API in banking and credit unions?

“Agency” means being able to take action; hence “agentic.”

Agentic AI, then, refers to an optimally orchestrated execution of various automation tools, playing in concert:

- LLMs or Large Language Models can understand written or spoken input, parsing the complexities of a given task and defining next-step actions.

- RPA or Robotic Process Automation is the “bot” that actually executes the action/request/transaction, in the given banking or ancillary systems, which the LLM has tasked it with performing. LLM plus RPA is, at its core, “agentic AI in banking.” But you can layer in more:

- IDP or Intelligent Data Processing is a tool which can glean extra information from free-form text or handwritten documents, often without even “training” it to, say, recognize fields within different versions of similar PDFs, such as applications your bank or credit union might receive for indirect loans from multiple car dealerships.

- API or Application Programming Interface is basically a set of rules which make it easier for one software platform to talk to another. Imagine, for example, integrating IDP with your loan-origination system via an API, and you can grasp the kind of power that’s just waiting to be brought together in your bank or credit union.

All of these tools (and many others), then, can work together to automate and process a lot more than was previously possible in your bank or credit union. Collectively, for the purposes of this article, we’ll just refer to them all, going forward, as “digital workers.”

Just like humans, digital workers review, plan, and execute activities. Not only do they expand capabilities in your bank or credit union, but they can—and should—expand into more of your financial institution’s processes.

Individually, the tools and automation implementations have value. Taken together, digital workers can perform large swaths of work, allowing you to create and implement a future-state process that was unimaginable with human and digital workers toiling side-by-side.

The sum of the automation benefits in banks and credit unions is much, much larger than its parts.

Automation Tools

What are all the tools and technologies available for automating my bank or credit union, and what do they cost?

It’s going to cost a small fortune to purchase and install all of these shiny new tools and applications, right?

Wrong. You’ll be pleased to learn that, individually, the licenses for these tools are typically nominal fees. In fact, that many of them offer pay-as-you-go pricing, or minimal subscriptions per digital-worker seat, vs. a single, large, one-time sum.

And you don’t need to purchase a full system or architecture to begin. Instead, you simply layer the new software atop your existing architecture. And that new software is often practically free: You may already have some of these tools bundled in with your current Microsoft licenses, for example. Applications such as Power Automate are included with every e365 license from Microsoft.

Automation Readiness

What are the first three steps I must take to automate my bank or credit union as quickly and smoothly as possible?

If you’re looking to bring automation to your bank or credit union as quickly and error-free as possible, the big word for you to know first is “Standardization.” When a financial institution, such as your bank or credit union, lacks standardization, practically all of the value of its knowledge work resides within individual employees as years’ worth of tribal knowledge, rules of thumb, and gut guidance.

Sure, there may be some documentation in the form of SOPs or training manuals. But more often than not, they’ll be outdated or simply nonexistent.

Time to get to work. Time to standardize. All of that tribal information needs to get downloaded, documented, analyzed, and standardized (“automation-ready”) back into the process. The path toward accomplishing this—and paving the way for digital workers to take on the work—follows these three steps:

- Build a future-state process map

- Gap-test the future state against your current state

- Prioritize your findings

Let’s look at each step in detail.

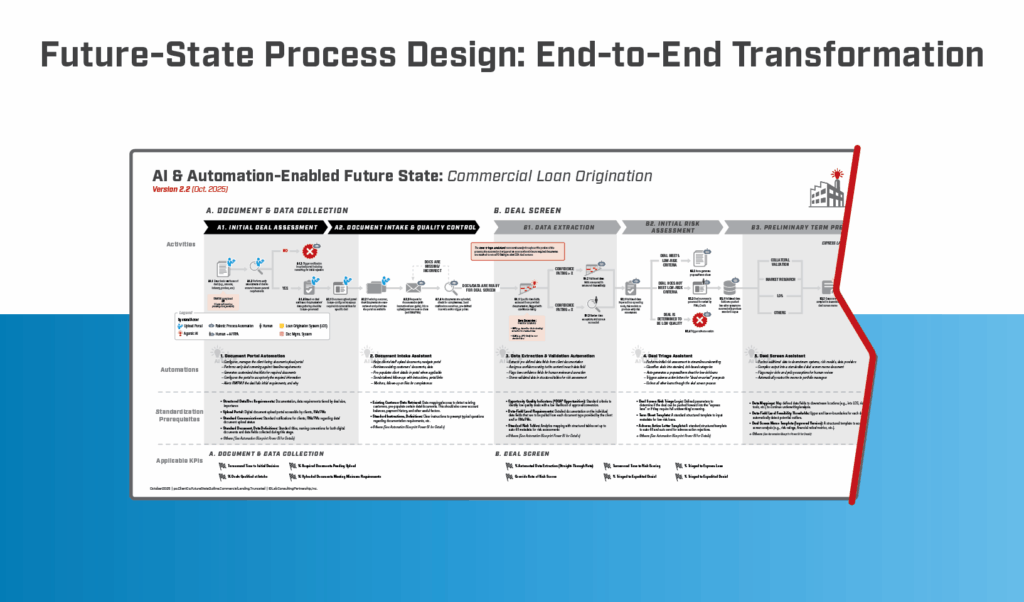

Automation Preparation Step 1 for banks and credit unions: Build a future-state process map

You may be surprised—pleasantly—to learn that this probably the easiest step in the whole process.

Here’s why: So long as you don’t worry about how you’re going to achieve the future state, and focus instead on what you want your digital workers to do, it becomes rather easy.

You’ll want to visually depict an ideal, target future-state process design, including all identified automations, analytics, and standardization improvements. For example, you’ll need to identify and document:

- Process steps and workflows

- Future automation, e.g.:

- AI

- RPA

- Extended system functionality

- Standardization prerequisites, e.g.:

- Data intake quality

- Data format, structure

- Human review, intervention

- Improved analytical capability, e.g.:

- Metrics (KPIs, KRIs)

- Thresholds, targets

- Standard actions, insights

Why, then, does future-state process-mapping often become so unnecessarily complicated? This happens when bank and credit-union executives fall into the easy trap of continually comparing future-state processes to the way they’re done today.

But that’s apples and oranges. Force yourself to compartmentalize your future-state process design without the current state in mind. Don’t worry: We’ll work on that after you’ve designed the future state.

And even then, if you find the prospect too difficult and/or intimidating, simply contact The Lab. Using our proprietary Knowledge Base, which captures more than three decades’ worth of actual client-engagement IP, we have already template-ized the ideal, best-in-class future-state process for any bank or credit union.

Automation Preparation Step 2 for banks and credit unions: Gap-test the future state against your current state

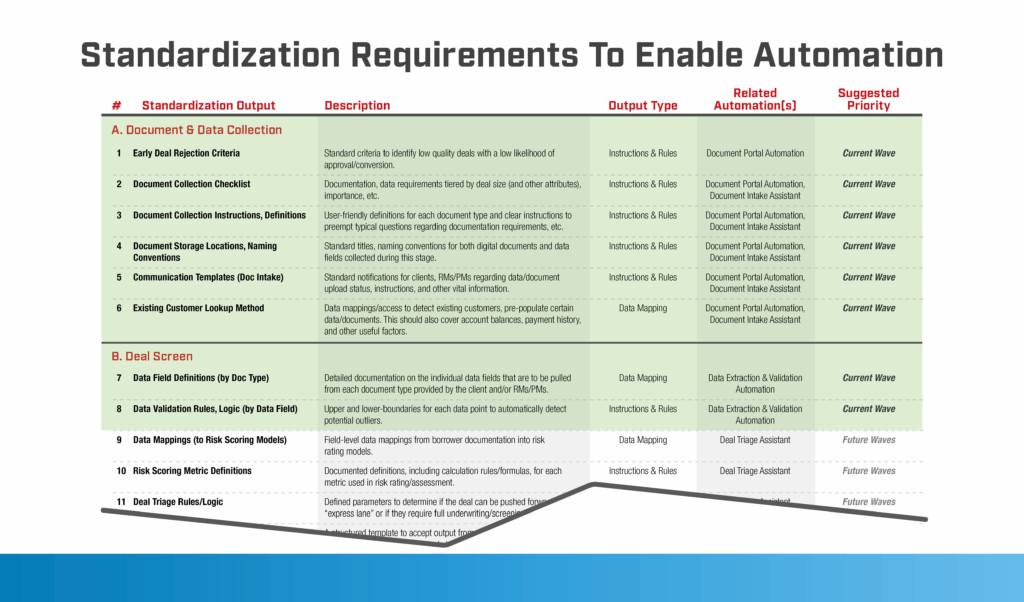

This step is all about identifying standardization prerequisites to automation in your bank or credit union.

Now that you have the ideal future state (i.e., the goals) documented, gap-test them vs. your current state to identify which tools, activities, and workflows must be modified (or introduced) in order to achieve the future state.

Approach this step in a similar fashion to Step 1. That is, don’t worry about whether or not it’s possible to bridge the gaps. Just list them. It could be something as straightforward as a checklist for the automation to review against, or for rendering your data more automation-friendly (more on this later in this article).

Your objective, then, is to compare your current-state processes to the agreed-upon future-state process design, including applicable industry best practices. This will span items such as:

- Data intake quality

- Data structure, format

- Existing automation capabilities

- Automation prerequisites

- Workflow design (e.g., exception detection, handling)

- Performance management capabilities

Automation Preparation Step 3 for banks and credit unions: Prioritize your findings—with the broadest impact first

Now it’s time to take your list of prerequisite actions and prioritize them based on the broadest impact. And when we say “broad,” we mean “Look for impact at the point of the automation itself—but also look for where the process change and/or automation yields the biggest impact, both up- and downstream.”

By doing this, you’ll end up with a list of actions required to achieve your future-state automations. Surprise! You now have a roadmap for onboarding your digital workforce.

Incidentally, the above exercise isn’t your only source of digital workers to choose from. While you design your future state to roadmap your digital workforce, you’ll also be able to take advantage of time-tested automations along the way.

The Lab’s Knowledge Base includes more than 500 proven automation use-cases to choose from. See our most popular offerings right here. With our list in hand, you’ll be able to commence your bank or credit union’s automation journey in short order.

To help you launch, scale, and execute your program, The Lab offers:

- Catalogs to help you prioritize automation use cases

- Development frameworks for scalable code

- Dashboards to monitor digital worker performance

- Template-ized standard requirements documentation

- Project management standards and tools

- Guidelines for process improvement

- Maturity models to facilitate capability development

- Recommended training courses for internal resources

Between the list of automations you’ve identified from your future-state process-mapping, and those chosen from the banking and credit union automation catalog from The Lab, you’ll save time and reduce labor-intensive effort on a bot-by-bot basis. That’s great—but the real value lies in their end-to-end implementation, where they can drive substantial value and ROI.

If all this sounds too easy, don’t worry: Your what-if concerns aren’t misplaced.

Typical Pitfalls

What are the pitfalls of automating a bank or credit union’s processes?

Broadly speaking, there are two common traps which bank and credit union executives, technology leads, and internal improvement teams can stumble into when it comes to automating their financial institutions and road-mapping the introduction of their digital workforces.

Existing Tech

What combination of core and other platforms can digital workers automate in banks and credit unions?

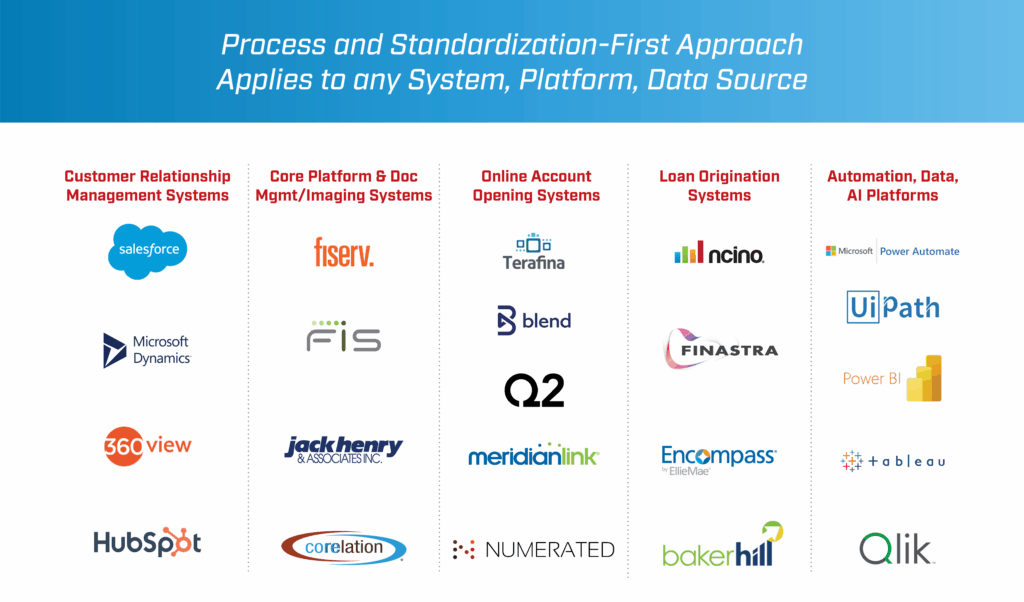

Thanks to AI and robotic process automation or RPA, digital workers can easily automate any combination of core and ancillary systems in your bank or credit union. They’re platform-agnostic, too; it doesn’t matter which vendor/provider you have installed.

Digital workers can automate what had, until very recently, been considered “un-automate-able” business processes and activities, regardless of the systems used, or even how the activities themselves are performed in your specific financial institution.

Don’t believe it? Here’s a quick example from The Lab. Look at the four YouTube videos below, in which you’ll see a digital worker performing what is ostensibly the exact same task… only in different core platforms:

- Fully Automated ACH Returns in Jack Henry Core

- ACH Stop Payments/Reversals Automation in FIS Core

- ACH Stop Payments Automation in Fiserv

- ACH Exceptions Reversals in Episys Quest

Want to see even more? Look no further than The Lab’s YouTube channel, specifically our playlist of automations for banks and credit unions, featuring actual (anonymized) footage from automations we’ve installed at peers. There are dozens of them to view, and each is only about three or four minutes long. Enjoy!

AUTOMATION BEST PRACTICE

What is the best practice for integrating digital workers, and introducing automation, into banks and credit unions?

While there are many possible approaches to developing, deploying, and managing automation in your bank or credit union, there is also a best practice. At The Lab, we’ve curated a best-in-class four-step roadmap for integrating digital workers into your financial institution in just six months.

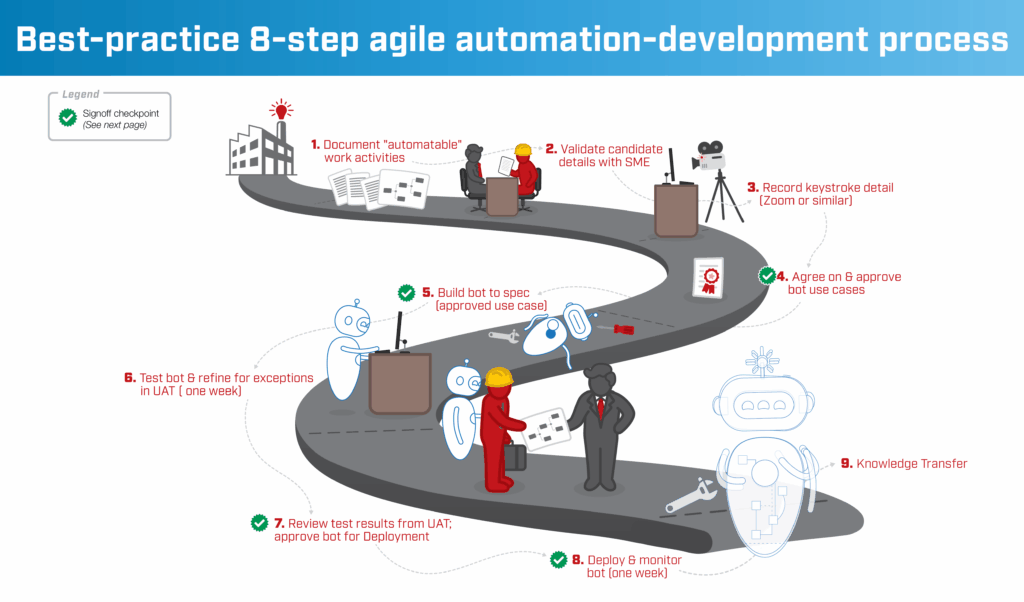

And for Step 4 (“Automate work activities”), we’ve also honed an eight-step, deep-dive agile automation-development process which not only accelerates the development of the automation, but ensures that it performs as promised once deployed.

Let’s look at the roadmap and the deep-dive agile development process.

BEST PRACTICE ROADMAP

The 4-step best practice roadmap for integrating digital workers into banks and credit unions in 6 months

BEST PRACTICE AGILE AUTOMATION

The best-practice 8-step agile automation-development process for banks and credit unions

As we’d mentioned above, we have broken down Step 4 above (“Automate work activities”) into eight detailed sub-steps. At The Lab, we don’t simply advise what to automate, we help you actually build the automation.

Bank & Credit Union Agile Work-Automation Step 1: Document “automate-able” work activities.

Perform this documentation using the future-state you’d mapped, and the automation catalog, both mentioned earlier in this article. If you’d like to identify even more “automate-able” work activities, The Lab’s Structured DiscoveryTM helps you to quickly reveal the most valuable candidates.

Bank & Credit Union Agile Work-Automation Step 2: Validate candidate details with SME.

Confirm with the subject-matter expert or SME how the work is performed today—and how it can be done within the current systems.

Bank & Credit Union Agile Work-Automation Step 3: Record keystroke-level detail.

Have the SME execute and explain each step.

Bank & Credit Union Agile Work-Automation Step 4: Agree on, and approve, use-cases.

Confirm and document details and specifications; agree on future-state requirements.

Bank & Credit Union Agile Work-Automation Step 5: Build bot to spec.

Here, “spec” means “approved use-case.” In this step, you’ll prototype the automation (“bot”) and demo it to gather additional requirements.

Bank & Credit Union Agile Work-Automation Step 6: Test and refine for exceptions in user acceptance testing (UAT).

Refine and demo the next-version bot with one-week user acceptance testing or UAT.

Bank & Credit Union Agile Work-Automation Step 7: Review UAT test results; approve for deployment.

Prior to deployment, refine how the bot handles unanticipated exceptions.

Bank & Credit Union Agile Work-Automation Step 8: Deploy and monitor.

This is the step in which you will deploy your digital worker, handing it off to IT and the business. Monitor it for one week.

AUTOMATION ACCELERATION

How can you accelerate automation in your bank or credit union?

How can you go faster? How can you get more digital workers into your financial institution’s workforce?

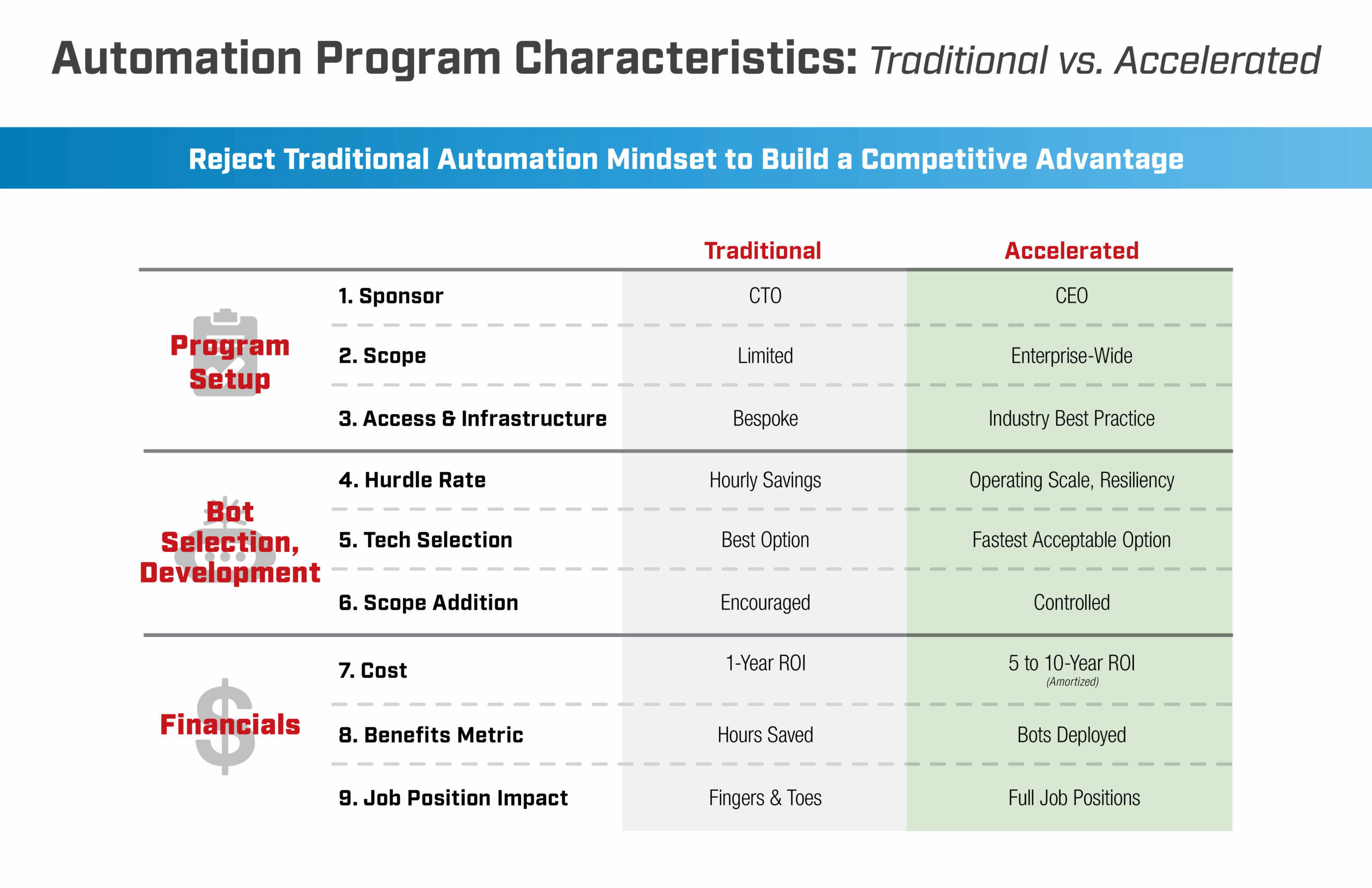

As with any implementation work, executive sponsorship and agile program management are key to any initiative’s success. When it comes to implementing automation, however, you need to take it up a notch. If you treat the initiative as “Bringing digital workers into the organization” rather than “An IT-automation project,” you’ve won half the battle.

EXECUTIVE SPONSORSHIP REQUIREMENTS

What are the four keys to executive sponsorship and agile program management in bank and credit union automation?

Reject Traditional Automation Mindset to Build a Competitive Advantage

TOP ROADBLOCKS

What are the top 3 things that can slow down the automation of my bank or credit union?

STRATEGIC AUTOMATION BENEFITS

Beyond savings, what are the strategic benefits of introducing automation and digital workers into banks and credit unions?

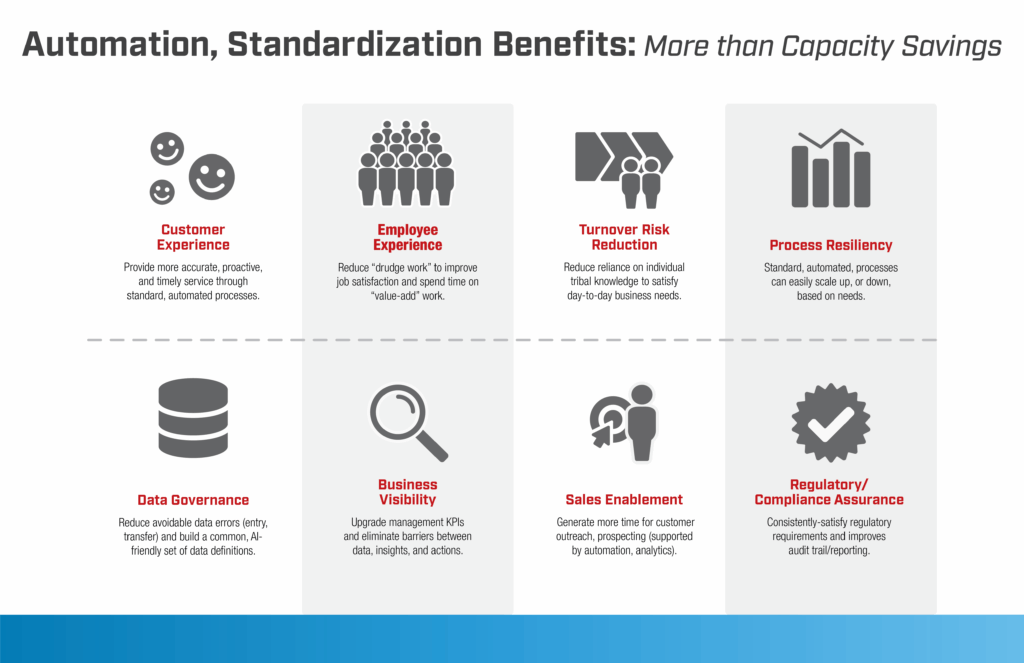

It’s a lot more than dollars saved. Introducing a digital workforce into your bank or credit union yields a wealth of wide-ranging benefits:

Automation Benefit 1: Improved customer/member experience

Standardized, automated processes yield more accurate, proactive, and timely service to your bank’s customers, or credit union’s members.

Automation Benefit 2: Improved employee experience

It’s not just the customers or members who benefit. Automation in banks and credit unions reduces “drudge work,” improving job satisfaction, since staffers will be able to devote more of their time to “value-add” work. (Just one quick case in point: Processing accounts of deceased customers or members. Do you think that anyone on your team enjoys this disheartening work? Check out this quick four-minute video of an automation from The Lab taking on all the activities of this process, all by itself.)

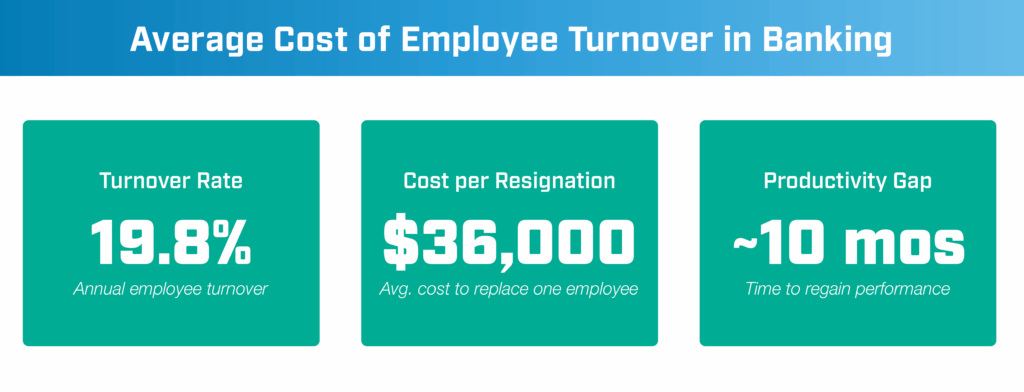

Automation Benefit 3: Reduce turnover risk

Automating your bank or credit union significantly reduces your financial institution’s reliance on tribal knowledge to satisfy day-to-day business needs.

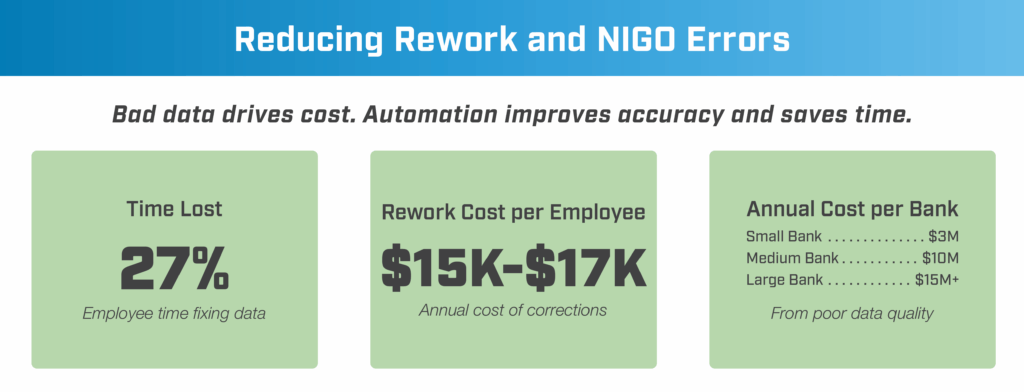

Did you know?

Did you know that replacing one $80k salaried employee can cost your bank or credit union up to $240k? It’s true. At typical turnover rates of slightly under 20%, cost-per-resignation is approximately $36k, and the typical productivity gap lasts for ten months. At these rates, the turnover costs range from 150% to 250% of your salaried human worker. Clearly, all of these factors—and costs—vanish in the case of digital workers.

Automation Benefit 4: Process resiliency

Standardized, automated processes can easily scale up or down, based on needs. No more frantic hiring or painful layoffs.

Automation Benefit 5: Better data governance

Reduce avoidable data errors (entry, transfer) and build a common, AI-friendly set of data definitions.

Did you know?

Not-in-good-order or NIGO data results in 25% to 35% of time lost—just to fix that data. On average, this equates to $15k to $17k in annual cost, per employee, just for making corrections! At a typical bank or credit union, this adds up to $3 million or more, each year, spent on remediating poor data quality.

Automation Benefit 6: Increased business visibility

When you introduce automation into your bank or credit union, you’ll upgrade management KPIs and eliminate barriers between data, insights, and actions.

Automation Benefit 7: More sales enablement

When your sales team is supported by automation and analytics, they’ll have more time for prospecting, customer/member outreach, and upsell/cross-sell activities.

Automation Benefit 8: Regulatory/compliance assurance

Consistently satisfy regulatory requirements and improve audit trail/reporting.

BENEFIT REALIZATION

How can banks and credit unions ensure the longevity of their automation benefits?

You’ll need better data to ensure that all of the aforementioned hard-earned benefits stick around. The good news: You already have it!

The data simply needs to be primed for automation. For example, when your data resides in a standardized model, defined in a glossary and tagged for clarity, you can monitor your workforce—human and digital alike—in ways that were previously impossible, if not downright unimaginable:

- See almost real-time (if not actual real-time) performance of your digital and human workers.

- Provide management and workers with clear, actionable, data-driven insights; they’re no longer forced to try and figure out what the data means.

- Prevent and mitigate risks by proactively executing against patterns and predictions.

- Automate more.

The Lab has another long-form explainer article on Data Intelligence, Analytics & Executive KPIs, which dives far deeper into this topic. Spoiler alert: The Lab’s templates can make this transformation a reality at any bank or credit union in as little as six months.

AUTOMATION SUPPORT

How can banks and credit unions support their digital workers going forward?

“I’m not sure we can maintain this on our own. What happens after you folks leave?” This is a common question posed by executive sponsors to The Lab.

First of all, The Lab works directly with your bank or credit union team throughout the project, so that they learn how to support it going forward. That said, no one expects them to have the same level of expertise as we do. So we offer multiple types of client-friendly support:

Rapid repair (break/fix).

Digital workers likely will require about an hour of maintenance per month. The Lab provides same-day fix services, with zero long-term commitment or retainers required. Just pay as you go.

Preventative maintenance

If your bank or credit union is subject to major system changes which may impact how digital workers interact with them, The Lab can quickly assesses the situation and provide guidance and even instructions for re-training your digital workers. Meanwhile, The Lab can provide regular, routine performance audits as well.

Core technology changes (ERP, bank core, etc.).

Once in a blue moon, your bank or credit union may introduce broad changes to your core or other systems which require that your digital workers be re-trained. If cores are being swapped out, The Lab can assess the impact, provide a quote, and get started working right away.

Training support

As mentioned previously, there are many training materials available for free. The Lab has selected the best of the best to recommend to your organization to up-level your skills and capabilities as quickly as possible. In no time, your own developers and team will be providing full support.

AUTOMATE WITH THE LAB

Automate your bank or credit union today with The Lab

The Lab has helped banks’ and credit unions’ C-suite executives, business and technology leaders, and internal operational-excellence teams to automate their businesses and processes to drive measurable results and deliver successful large-scale transformation initiatives.

Our proven comprehensive services and solutions—backed by our industry-leading Knowledge Base of 30-plus years’ worth of templatized, re-deployable client-engagement IP, along with our patented Knowledge Work Transformation™ methodology—can automate your financial institution in as little as six to 12 months.

Ready to automate your bank or credit union? To book your 30-minute screen-sharing demo, call (201) 526-1200 or email info@thelabconsulting.com today.