Business, Process and Data Standardization For Your Bank or Credit Union—and Improve Productivity By 25% to 40%

Learn how Knowledge Work Standardization® methodology paves the way for AI, automation, data analytics, and operational efficiency in banks and credit unions

As a bank or credit-union executive, business-unit or technology lead, or member of its internal improvement team, you know that your transformation strategy requires operational improvement.

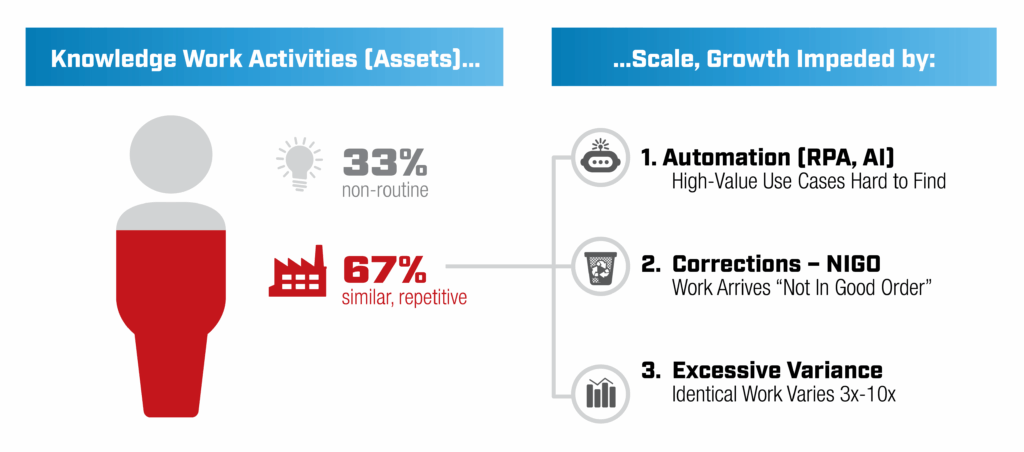

But where are improvement opportunities hiding? All too often, the answer is “In plain sight.” During the 30-plus years we’ve been building our client-engagement IP Knowledge Base at The Lab, we’ve discovered some interesting things about the way banks and credit unions operate. Our detailed review of thousands of banks and credit unions has revealed that your white-collar or knowledge workers spend more than 35 percent of their day, every day, on what we call “virtuous waste.” This refers to:

- Correcting errors

- Duplicative effort

- Over-serving customers or members

What’s worse, these workers—and their managers—genuinely believe that all of the above is simply unavoidable and necessary to help customers or members. They think it’s just one of the costs of doing business at any bank or credit union. In fact, they don’t even see it as a cost.

But just because you’ve been doing things a certain way forever, doesn’t mean that that way of doing it is best practice. Indeed, if you challenge three assumptions in banks and credit unions, you begin to edge closer to standardizing your financial institution—and re-claim earnings by 20 percent or more. These assumptions are:

- Assumption 1: “Our bank or credit union’s business is unique.” Sure that’s true… but its organizational structure, processes, and work activities are highly similar to those of your peers.

- Assumption 2: “Our bank or credit union’s knowledge work can’t be standardized.” This assumption is so wrong, that it’s the basis for this entire long-form explainer article. Spoiler alert: More than two-thirds of your bank or credit union’s activities are ideal standardization candidates. That should give you an idea of just how repetitive and inefficient most activities actually are.

- Assumption 3: “New core technology will automate the work at our bank or credit union.” This is yet another misguided belief. Unless you’ve eradicated the above-mentioned virtuous waste, you’re simply migrating bad work from one core to another. Spoiler Alert 2: Seventy-five percent of knowledge-work improvements require absolutely no new core technology.

In this article, we’ll tell you more about The Lab’s patented Knowledge Work Standardization approach. It pinpoints and reduces virtuous waste. It increases productivity. And it enables the onboarding of the latest technologies: AI, digital workers/robotic process automation in banking, and advanced data analytics and business intelligence in credit unions and banks.

Definition of Knowledge Work Standardization in banking

What is the process-first approach to standardization in banks and credit unions?

Knowledge Work Standardization in banking and credit unions is defined as “a process-first/standardization-centric approach that combines the latest technology to help bank and credit union executives to improve their organizations.” Knowledge Work Standardization paves the way for automation, AI, and advanced data intelligence/data analytics, providing C-suite leaders with large-scale strategic-transformation and process benefits across the enterprise.

Standardization empowers banks and credit unions to:

- Preserve margin: Keep more—up to 2.5 margin points.

- Improve productivity: Waste less, with productivity gains of 25 to 40 percent.

- Grow deposits and loans: Hit more and miss less. With standardization in banking and data analytics, you’ll be armed with actionable market insights. These, in turn, will help you achieve better market/customer segmentation, improving your cross-sell, upsell, and prospecting efforts.

Be sure to watch The Lab’s informative and entertaining five-minute Knowledge Work Standardization overview video.

What are the “5 W’s” of financial institution standardization?

How does standardization lead to transformation at credit unions and banks?

In order to reap all of the benefits of transforming your bank or credit union, you need to standardize first. The “Five W’s” of standardization in banks and credit unions will help you understand:

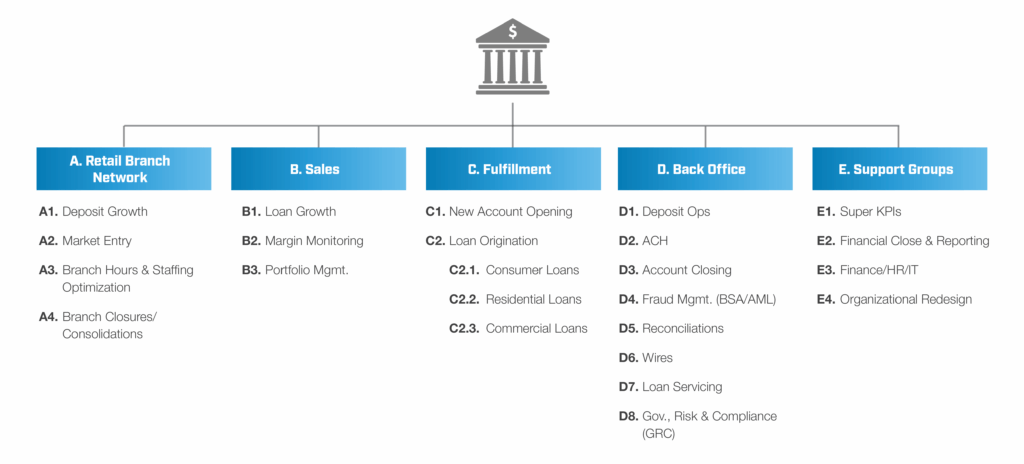

What are we standardizing?

End-to-end processes and data. More on this, later in this article.

Who is getting standardized?

Every department which the end-to-end process (and data) goes through.

Where are we standardizing?

Every system the end-to-end process and data use.

Why are we standardizing?

To help mitigate pushback in the ranks, know that standardization is the best and only prerequisite for reaping the most benefits.

When are we standardizing?

The sooner the better. With The Lab’s patented Knowledge Work Standardization approach, your bank or credit union can be standardized in just six to 12 months.

Pitfalls of standardizing banks & credit unions

What is the “false precision trap” in bank and credit union standardization?

One of the biggest pitfalls to avoid when your standardize your bank or credit union is what’s known as “false precision.” This is the unfounded insistence on more information than is required.

It’s a similar situation to what we’d discussed in The Lab’s article about process mapping in banks and credit unions: You’ll certainly need to map your current state—but not 100 percent of it. You’ll need to identify the available improvement opportunities—but you needn’t quantify every single one.

The goal, then, is to understand where the problems are, upstream, to identify what to standardize—and not “how long each process takes” or “what each problem consumes” for whatever reason the false-precision adherents believe.

What’s the meaning of E2E or end-to-end standardization in banking?

What should get standardized in a bank or credit union?

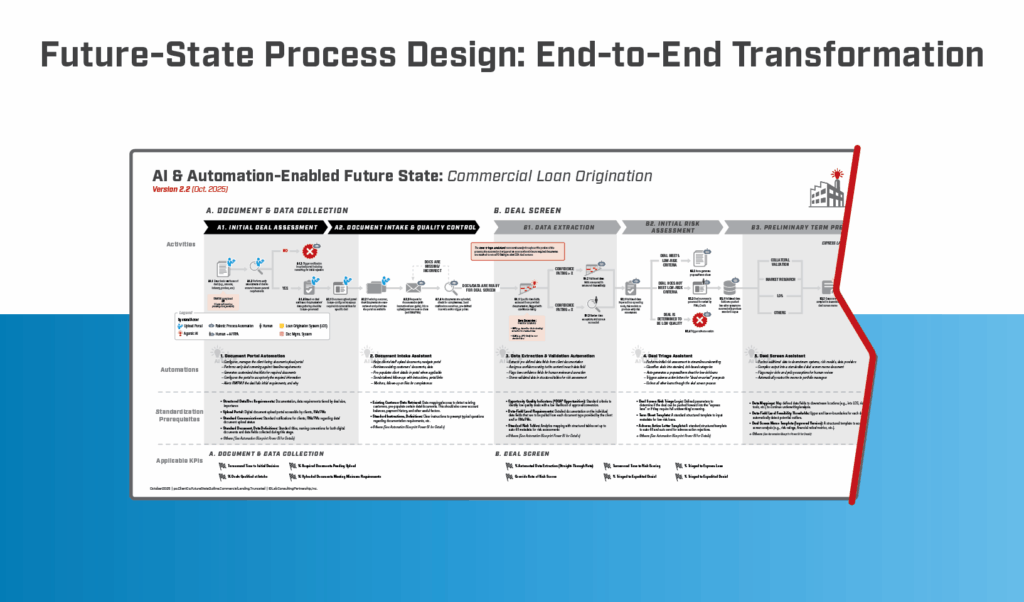

For end-to-end or “E2E” standardization, you’ll need to include not only the workflows but the “sea-bed activities” and data. Go deep down to what’s typically called Level 4—this is the three- to five-minute increment level of activity—including every bit of data that’s required, inputted, used, and developed from these activities. These Level 4 work activities are the “nuggets”; they’re not the process.

You’ll need to:

- Map the activities to understand their details.

- Identify their WEC or work-effort concentration.

- Determine their future state.

The same goes for the data that’s used in these activities. You’ll need to:

- Define it.

- Source it.

- Data-model it.

This way, it will be automation-ready—and better organized to fit the future state.

A step-by-step guide to credit union & bank standardization

What are the 6 steps for standardizing banks and credit unions?

- Step 1: Process-map your current state

- Step 2: Organize all work activities

- Step 3: Draw your future-state process map

- Step 4: Define your Executive KPIs

- Step 5: Track all data sources

- Step 6: Standardize the data

Bank/Credit Union Standardization Step 1

Process-map your current state

This includes all current-state business processes and knowledge-work activities. The Lab, incidentally, can perform E2E current-state process mapping of your bank or credit union in just six to eight weeks.

Bank/Credit Union Standardization Step 2

Organize all work activities

In parallel, you’ll want to organize all of your bank or credit union’s work activities into an enterprise taxonomy or system of classification. Tag the activities with:

- Work volume

- Who performs the work

- Time required

The Lab has templates to make this step easy.

Bank/Credit Union Standardization Step 3

Draw your future-state process map

Set aside your current-state map for now; don’t let it distract you. Just build a wish-list of what you’d like to accomplish in your bank or credit union’s future state. Then (and only then), compare it to the outputs from Steps 1 and 2, above, and you’re done.

Bank/Credit Union Standardization Step 4

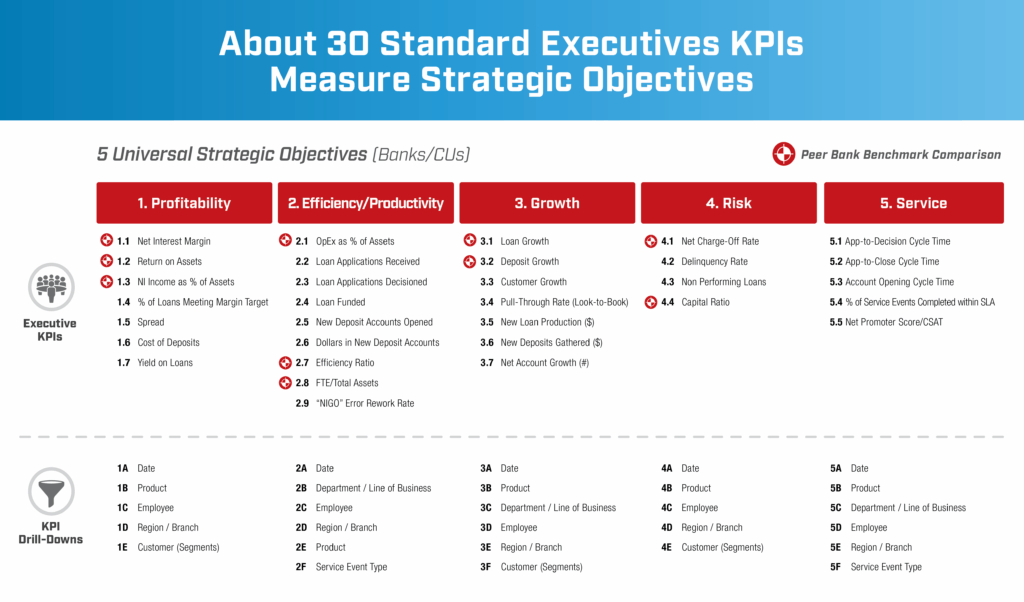

Define your Executive KPIs

In order to ensure effective process execution in your bank or credit union’s to-be future state, you’ll need to define the executive-level Key Performance Indicators or KPIs.

While there are more than 500 KPIs in The Lab’s popular KPI Handbook, you’ll need to start with the “vital few” 30 Executive KPIs.

Bank/Credit Union Standardization Step 5

Track all data sources

Each data element has multiple sources. So you’ll need to deconstruct it into its constituent parts, and identify the source of each, across all of your bank or credit union’s systems and data repositories.

Bank/Credit Union Standardization Step 6

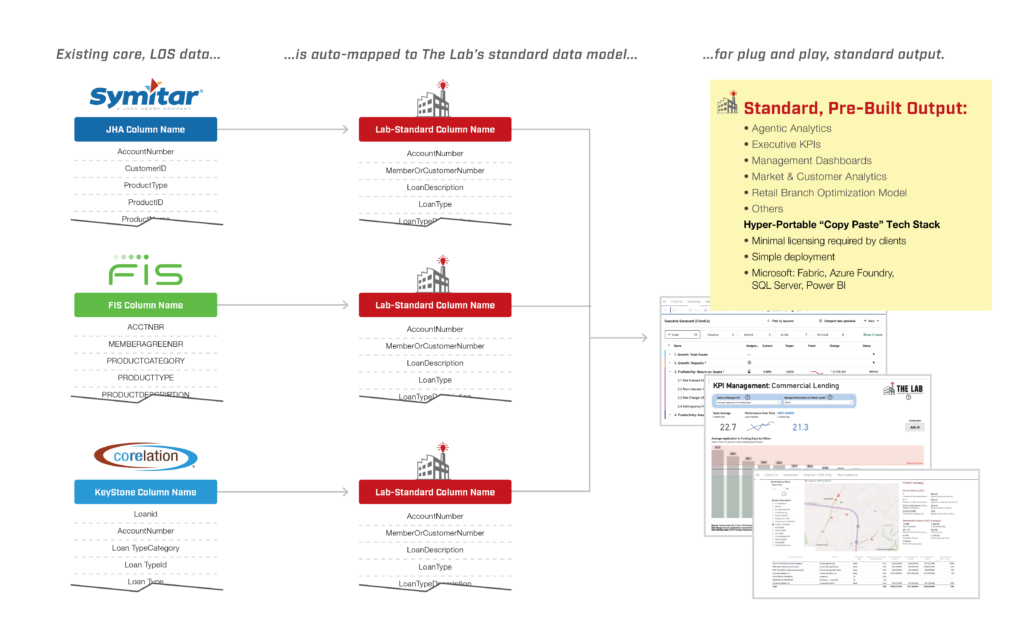

Standardize the data

Once you’ve completed Step 5, you’ll need to select, clean, and map your data into The Lab’s Standard Data Model, using the ETL or extract-transform-load process. Don’t worry: The Lab has templates to make this easy.

Standardization benefits in banking and credit union operations

What are the top 5 benefits of standardization for bank and credit union executives?

From the bottom line to the customer or member experience, there are numerous benefits to be reaped from standardization in banking or credit unions:

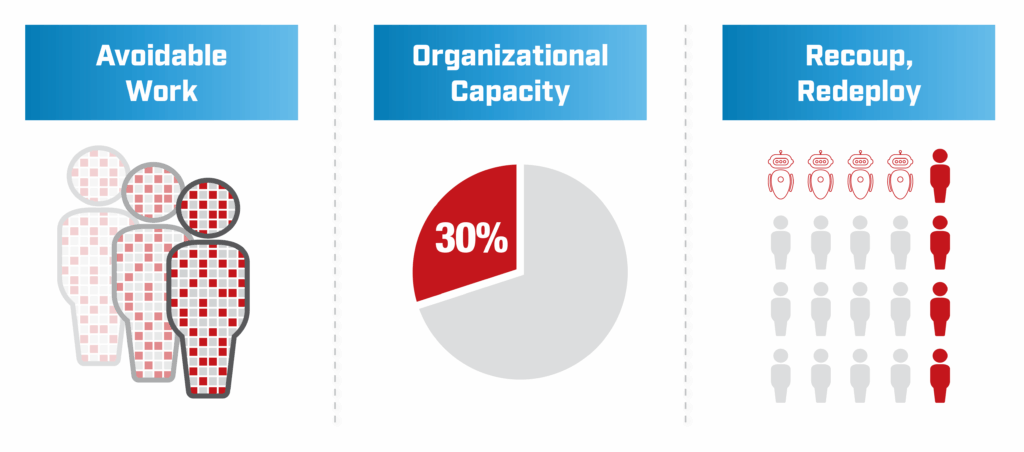

- Bank/Credit Union Standardization Benefit 1: Enable massive bank-wide automation. With standardization, you can automate 30 to 50 percent of your work—or more. Imagine autonomous digital workers, and human workers, performing their jobs side-by-side. The more automation, the more benefits you can reap.

- Bank/Credit Union Standardization Benefit 2: Chat with your data. Imagine, as an executive, if you could simply say “Hey, Siri!” to your data. With standardization, that scenario becomes a reality. You’ll have instant access to the most recent and accurate data. It can be auto-pushed to you; it can also respond to your prompts, either via text or voice.

- Bank/Credit Union Standardization Benefit 3: Surprise and delight your customers or members. Once you standardize your bank or credit union, you elevate the customer or member experience. Interactions become seamless. Relationships are improved. And points of friction—such as trips to the branch or calls to your contact center—are significantly reduced.

- Bank/Credit Union Standardization Benefit 4: Reduce risk, improve compliance. This is one of those hiding-in-plain-sight benefits of standardization in banks and credit unions. Processes will be automated and error-proofed. They’ll be predictable, repeatable, transparent, and audit-friendly.

- Bank/Credit Union Standardization Benefit 5: Unlock your workforce’s true potential. With standardization, you can finally realize the full potential of your people. You’ll enjoy higher employee satisfaction rates and retention. You’ll make your bank or credit union a sought-after destination for leading job candidates across the spectrum.

Accelerate With The Lab’s IP Knowledge Data Base

How can the organization ensure best-practice standardization across processes?

As a senior executive, you need to accelerate this margin analytics (KPIs), process improvement, automation—and put AI to work. But – you don’t want to start from scratch or a blank slate.

The Lab’s Knowledge Base – a standardized, semantic, and relational database of intellectual property – accelerates your business’ strategic-improvement objectives from automating data-driven insights to plug margin leakage to value-rich future-state process maps, and automation use-cases and code.

The Lab deploys this IP to increase our clients’ process-efficiency benefits—and goes beyond just data-driven insights to enterprise-wide Knowledge Work Transformation.

The biggest hurdle to automation implementation is use case discovery – The Lab has done this costly discovery for you

Built from more than three decades’ of actual client-engagement IP, The Lab’s Knowledge Base helps you improve and automate processes faster, turn tribal knowledge into value, and increase margin.

- Browse through our inventory of standardized bots and system-specific automations detailing technologies connected, labor saved, and new capabilities enabled.

- Select common use cases to improve efficiency, service, revenue capture, and compliance, and design your own automation and AI roadmap.

Now you can dramatically reduce the experience curve and lean on lessons learned by other organizations to transform faster.

How can you ensure that you get maximum value from bank/credit union standardization?

What are the 3 requirements for maximizing benefits of standardizing a bank or credit union?

As an executive, you’ll need to ensure that your leaders and teams don’t simply go through the motions of standardization. To ensure the most benefit, you’ll need to adhere to these three requirements:

- Make standardization one of your bank or credit union’s Top 3 strategic priorities. Standardization is a big opportunity; make it known, enterprise-wide.

- Share early wins. Create videos of standardization-enabled bots and socialize them on the bank or credit union’s intranet. Demo them in quarterly town halls. Promote them in monthly newsletters. Mention them in periodic CEO “win” emails to the team.

- Organize your standardization by process, not by business. This provides the flexibility to go where the process itself goes—and is not limited by silos, barriers, or rice-bowls within the organization.

- Designate “Process Champions.” Appoint respected peers and tribunals to ensure success of your standardization initiative.

How can The Lab help with bank or credit union standardization?

Standardize your bank or credit union with The Lab today

The Lab offers various engagement models to meet different needs of banks and credit unions; these include process mapping, data standardization, and modular, prefabricated solutions for process improvement, automation, analytics, and AI. Our approach supports and improves all levels of existing capability, with a focus on standardizing data and processes to accelerate AI and automation implementation.

Ready to standardize your bank or credit union? To book your screen-sharing demo, call (201) 526-1200 or email info@thelabconsulting.com today.