LOANS ARE YOUR CREDIT UNION’S LIFEBLOOD. Don’t let them bleed away.

Slogging through input quality-control for commercial and consumer loans. Manually updating loan interest rates in the core. Suffering through the minutiae of HMDA compliance.

Your credit union’s loan operations and servicing teams dread this work. And members don’t understand why loan turnaround times are so long. It’s jeopardizing your compliance—and the ability to process your credit union’s essential lifeline of loans on time.

Address all these issues, at once, in just a few months.

It’s possible—and surprisingly easy—with a Loan Operations & Servicing Robotic Process Automation (RPA) Six-Pack™ from The Lab, North America’s undisputed credit union-automation authority.

AN RPA BOT SIX-PACK MADE ESPECIALLY FOR LOAN OPS AND SERVICING.

We’ve found the lowest-hanging fruit for automating commercial and consumer loan chores. Our six-pack includes bots for:

1. Consumer loan input quality control

2. Commercial loan input quality control

3. Automatic loan index rate updating

4. Daily flood reporting

5. Loan exception processing

6. Fintech online loan application system processing

Each of these bots pays for itself, often in just months, saving thousands of hours of work each year. And you can’t put a price on the boost to morale, retention, compliance, and member experience they provide.

BUT WAIT, THERE’S MORE. TONS MORE.

What if those six bots aren’t exactly what you need? Not to worry: You can swap out bots from any of the hundreds available from The Lab. Here are more from our incredible RPA Credit Union Bot Catalog—and these are just some of the loan operations examples:

- Indirect loan funding application processing

- Matured loans renewal letters

- Escrow check balancing

- Mortgage loan pre-close document transfer

- Consumer loan closing document package and e-signature processing

- RESPA risk-alert processing

- HMDA compliance reporting

- Home equity loan closing and booking

- Loan payoff quote processing

- Loan escrow check balancing

- + Tons more

A TACTICAL APPROACH TO STRATEGIC CHALLENGES FACING CREDIT UNION EXECUTIVE TEAMS.

RPA bots from The Lab do a lot more than click their way through disparate systems to alleviate individual workload. They also make it easy to address your credit union’s most pressing, valuable, and challenging strategic goals, including:

- Reducing loan-processing cycle time, rework, and errors

- Improving employee experience

- Deeper integration with new fintech to improve member experience

Put The Lab to work on end-to-end loan operations: We can help you discover and map processes credit union-wide, plugging gaps and automating what wasn’t automate-able. Our standardization-based approach has been improving knowledge-work operations in credit unions of all sizes, nationwide, since 1993. We’ve even patented the process.

ANY SYSTEM, ANY CORE.

You might be running FIS. Or Fiserv. Or Jack Henry.

You’re working in Excel. Word. Acrobat. Local and shared servers. You’re logging into others’ systems, whether it’s FHLB or The Wall Street Journal for the latest published index rates or insurance carriers’ sites for flood-coverage status.

Offload this disconnected mess to bots. They love it. And your staffers will love you for freeing them up for higher-value activities.

ROBOT MISPERCEPTIONS… SHATTERED.

- RPA vendors will tell you this is DIY. It’s not, for at least a year. Little wonder most credit union RPA initiatives hit a wall, fast.

- Any automation vendor can handle this. They might know bots, but they don’t know credit union. The Lab knows both

- People are threatened by bots. Not with The Lab’s grassroots approach. We get frontline workers’ input, and buy-in, from the get-go. They invariably show off their bots to their peers!

- Your core provider has an RPA offering. In fact, they offshore 100 percent of their RPA work, take seven months just to make two bots, and can’t start on your project until two quarters from now. Not to mention that they’re using someone else’s software to solve a problem that they created.

- IT wants to own this. They might, but they can’t: They have their hands full just keeping the lights on. Credit union CIOs actually love bots from The Lab; just ask them about our “New Staff Onboarding Bot for All IT Systems,” for example. Let The Lab maintain everything RPA-related for you—or let us enable your team over time.

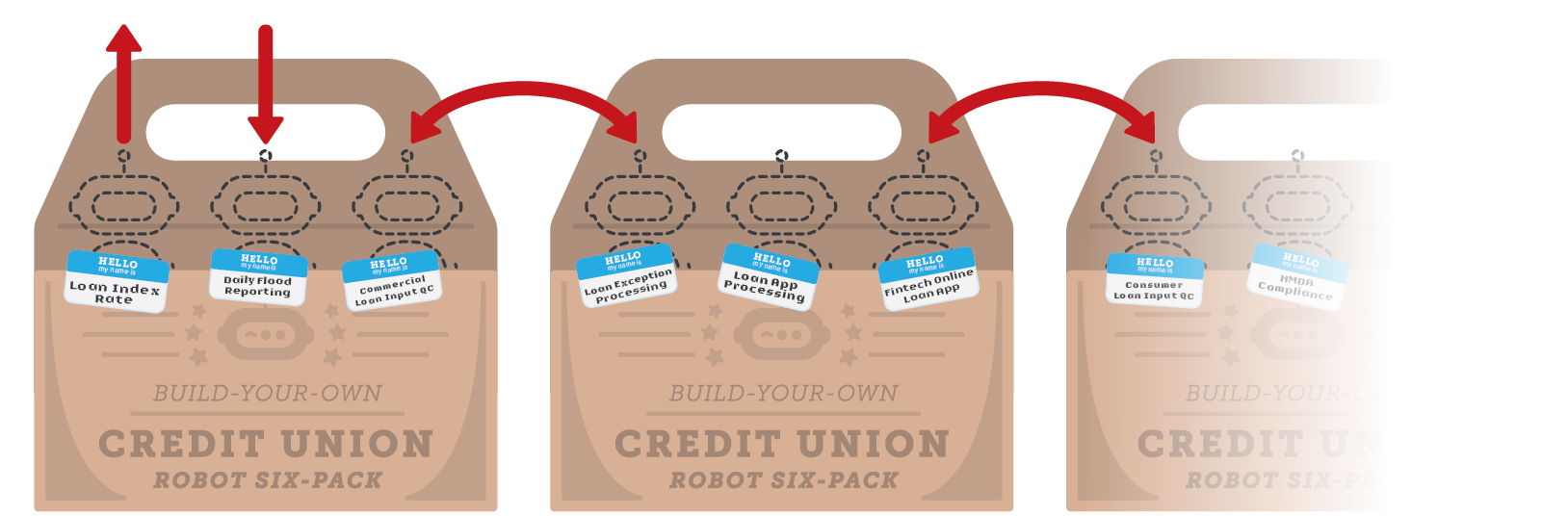

SIX-PACK YOUR WAY TO GROWTH AND RESILIENCY.

Mix-and-match your RPA Six-Pack as you see fit. Concentrate in just one organization for maximum impact. Or spread them, Johnny Appleseed-style, across the entire credit union, to give multiples functions and/or regions a taste. Double up for a 12-pack, if you like. It’s entirely up to you.

https://thelabconsulting.com/credit-union-rpa-robot-six-pack-combination/

https://thelabconsulting.com/credit-union-reconciliations-rpa-six-pack/

https://thelabconsulting.com/risk-and-compliance-rpa-six-pack-for-credit-unions/

THE LAB MAKES IT EASY.

Executive- and organization-friendly engagement designs

At The Lab, we’ve spent three decades refining every aspect of our engagement model—from strategic RPA implementation to org-wide digital transformation. We’ve made it easy for clients—from the C-Suite to the front line—to understand and manage the initiative:

- Minimal use of client time: One to two hours each week, maximum.

- Measurable benefits: Each bot’s ROI exceeds its implementation cost.

- Pre-built templates and tools: Process maps, data models, bot automation sequences, and more.

- U.S.-based, remote delivery: Nothing is ever outsourced or offshored.

Designed to reduce risk, increase success

Since 1993, The Lab has led the industry in eliminating risk for our clients. Whether your engagement involves a handful of bots or wall-to-wall transformation, we make it easy to do business with us:

- Fixed pricing and clearly defined scope

- Pre-project feasibility/value assessments at nominal cost

- Early-out checkpoints and options

- Money-back guarantees

The best way to appreciate the power and elegance of RPA loan bots is to see them in action for yourself.

Simply book your free, no-obligation 30-minute screen-sharing demo with The Lab. You’ll see real credit union bots in action, blazing past at up to 45x human speed, error-free. And get all your questions answered by our friendly team.

Simply call (201) 526-1200 or email info@thelabconsulting.com to book your demo today!