THE PAIN OF UNDER-STANDARDIZATION

You’ve been tasked with bringing your credit union into the future—or even the present—and you have the latest and greatest systems and digital technologies at your fingertips…

Systems, Software:

• Cores: Fiserv, JHA, FIS

• LOS: nCino, Encompass

• CRMs: Salesforce, 360 View

• Others: Fraud, Wires, OAO

Digital Technologies:

• Robotic process automation (RPA)

• Artificial intelligence (AI)

• Workflow (new accounts, loans)

• Data warehouses, data lakes

….but discovering new opportunities to use and expand these tools has stalled. And benefits are hard to come by, and even harder to measure. You’ve realized that you’ll hit a big fat wall unless you standardize first.

Standardize what? Everything.

• Data intake

• Business rules

• End-to-end processes

• KPIs

• Decisions

• Job roles

• Source data

• SLAs

+ More

Your credit union’s competitive position—not to mention all of today’s newest technology—depends on standardization, requires it, before you can get past square one.

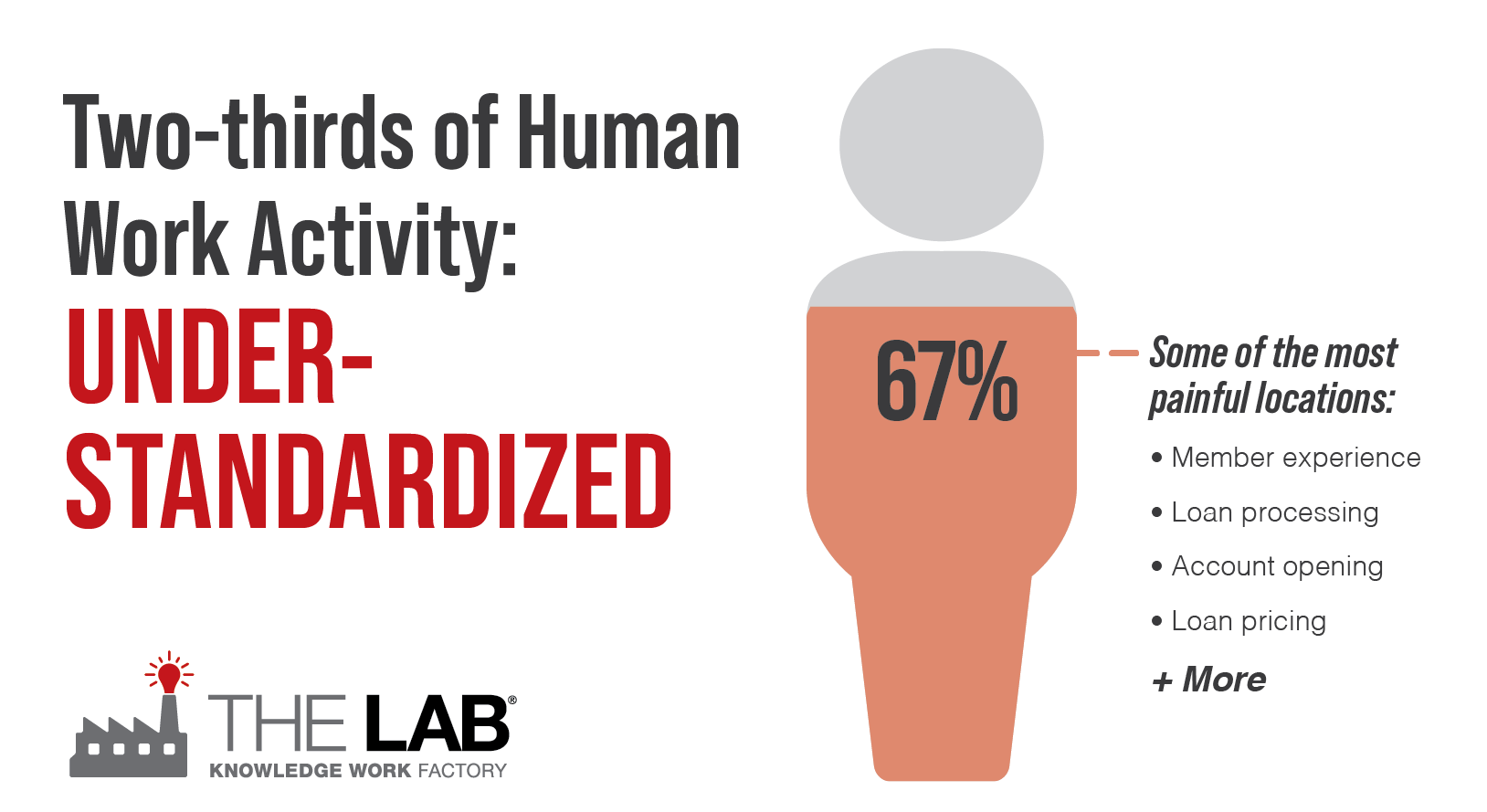

Without rigorous “reference-grade” operations and measurement, individual credit union knowledge worker productivity can vary by 100 percent to 700 percent—for the exact same activities.

Think of what that’s doing to things like end-to-end loan processing, account opening, and member experience!

Standardize To Automate: That’s What The Lab Does

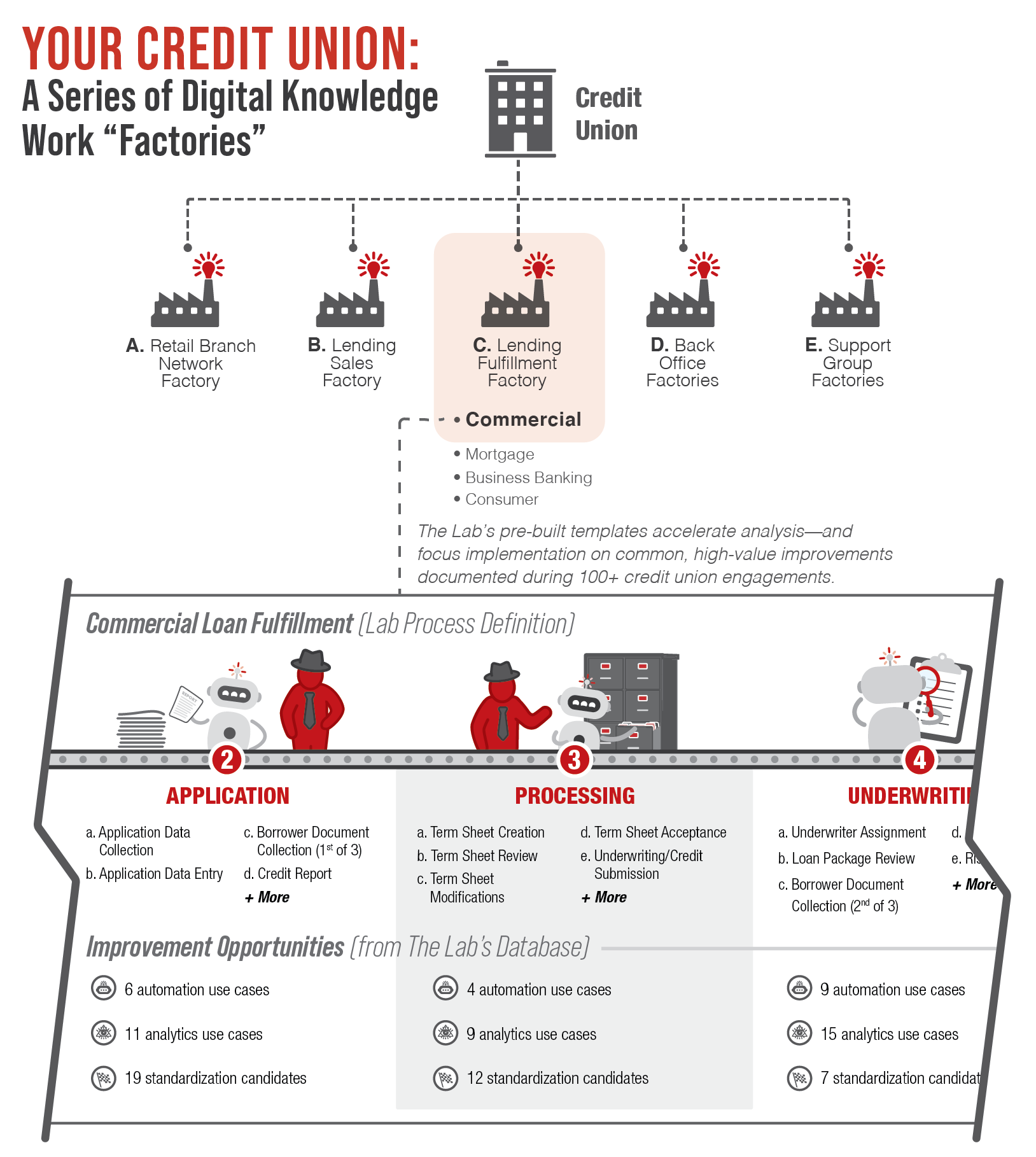

For nearly 30 years, The Lab has helped credit unions—from global to regional to local—standardize their knowledge-work operations, wringing out new efficiencies, uncovering newfound capacity, and discovering opportunities to effectively apply the latest digital automation technologies.

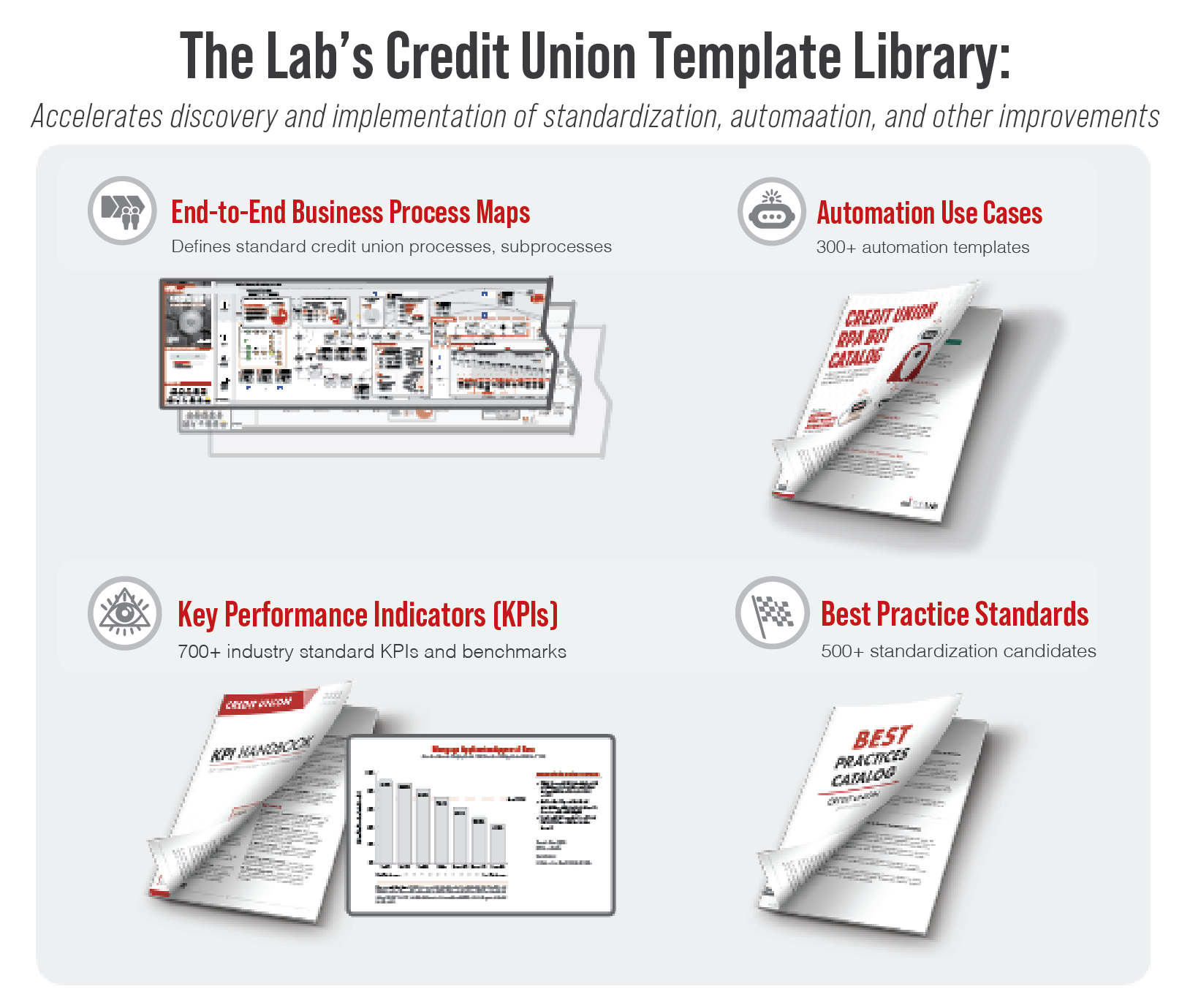

We’ve even standardized the process of standardization. We boast the world’s largest repository of credit union KPI definitions, benchmarks, best practices, pre-built dashboards, process map templates, and automation use cases. So we can, and do, make it happen fast.

The Opportunity: Credit Union Standardization Enables Breakthrough Gains

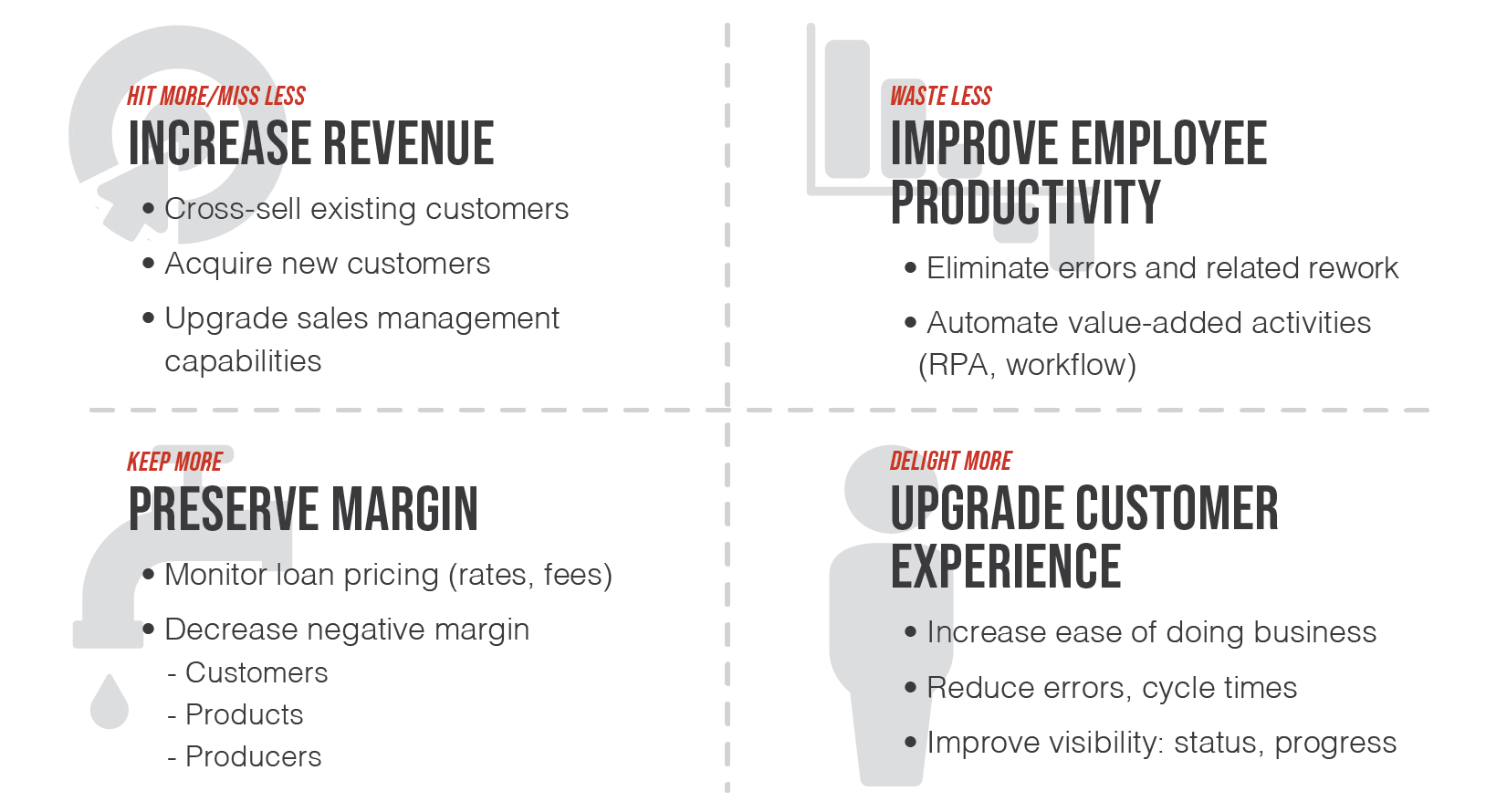

Why standardize?

Markets Demand Standardization

– Member expectations (“Amazon Effect”)

– Offerings “as a service”

Reduce Costs 30% (Pre-Automation)

– Preempt rework

– Reduce variation

Automate 40% of Knowledge Work

– New digital automation (RPA, AI)

– Better use of existing data, systems, software

The Gains

The Lab Makes It Easy: Three Engagement Levels

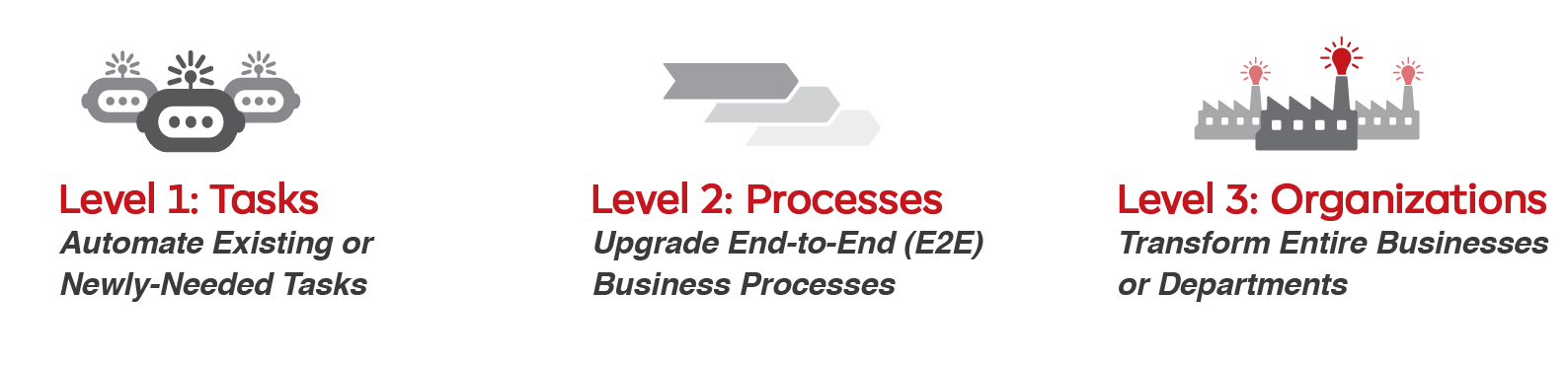

The Lab offers three standard engagement “levels” to support every type of digital transformation initiative. Each is designed to limit risk. All are standard and modular, enabling coordination into an integrated whole—no matter where you begin.

Organization-friendly engagement design

At The Lab, we’ve spent three decades refining every aspect of our transformation engagement model. We’ve made it easy for clients—from the C-Suite to the front line—to understand and manage the initiative:

• Meaningful benefits: Typical 12-month ROI is 3x to 5x.

• Template-driven speed: Process maps, data models, bots, and more.

• Minimal use of client time: One to two hours each week, maximum.

• U.S.-based, remote delivery: Nothing is ever outsourced or offshored.

Designed to reduce risk, increase success

Since 1993, The Lab has led the industry in eliminating risk for our clients. Whether your engagement involves a handful of bots or wall-to-wall transformation, we make it easy to do business with us:

• Fixed pricing and clearly defined scope

• Pre-project feasibility/value assessments at nominal cost

• Early-out checkpoints and options

• Money-back guarantees

Book Your Free Demo!

The best way to learn about The Lab’s patented, standardization based approach is to book your free, no-obligation 30-minute screen-sharing demo. And you’ll get all your questions answered by our friendly experts. Simply call (201) 526-1200 or email info@thelabconsulting.com to book your demo today!