The Lab has helped to automate countless work activities, for scores of processes, at tons of banks worldwide. So we have really deep domain expertise when it comes to both robotic process automation (RPA), and the core systems that need automating.

We need to be delicate here. This article is an anonymized mashup of different stories, all true, about banks that have succeeded in RPA, using The Lab… and have had, well, different, er, “suboptimal” experiences when they tried to go elsewhere—particularly the core providers themselves.

The painful truth about core banking systems

We don’t need to tell you this, but we’ll say it anyway. Today’s banking core systems—the ones you’re forced to rely on to run your business—are an agglomeration of lots of different, disparate modules that don’t talk to each other. If you want to do something as simple as an account address-change or an ACH stop-payment, you need to log into multiple different systems, from the same company, and perform ridiculously repetitive work: copying, pasting, side-by-side reconciling.

And by “you,” we mean your bank’s highly-paid banking operations knowledge workers. You think they enjoy this drudgery?

Robotic process automation allows The Lab to “park a bot” on top of these tedious chores, mitigating the problem and turbocharging productivity. The bot acts just like a person, with its own log-in’s and passwords, able to type, click, copy, paste, compare, and so on. Unlike a human, the bot can work 24/7, does its chores at blinding speed, and never gets tired, takes breaks, or makes mistakes. It’s little wonder that human knowledge workers love them so much; bots take all the low-value drudge-work off their plates.

Even more important: When volume skyrockets (acquisition) or plummets (recession), bots deliver the “operating leverage” to handle this volatility—without the need to either add or release employees.

Who you gonna call?

We know of banks that have either used, or considered using, The Lab’s services for automating their core-system chores—effectively replacing the “human glue” they currently use to keep things running.

Some of these banks have shopped around for similar services. Who can blame them? Everyone wants the biggest bang for their buck. And is The Lab truly the best-value option out there?

Here’s where it gets interesting. We’ve learned, firsthand, from several different banks, of their “shopping” experiences:

- The world is not enough. Some banks have shopped all across the globe for core-system-mitigating RPA services. That’s not hard to do these days, given the connectivity of the internet and the apparent pricing gains from offshoring. But there’s been a problem. These other players may know some of the parts, but not enough to construct a viable solution. They may be able to program a bot, but do they understand banking core systems, let alone the banking business processes they’re intended to support? Good luck finding one of these resources to help you build your own automation center of excellence (COE), if you’re so inclined. As one bank CIO told us (and we’re paraphrasing to protect identities), “We thought you were expensive, until we shopped around. But you’re not.”

- Local project managers are limited. There are U.S.-based “RPA experts” who may know RPA pretty well. But, as our banking clients have discovered, and told us, these are generalists, strategists, or advisors. They can’t find the use-cases in banking—which is the essential prerequisite. What’s worse is that, despite their “U.S.” claims, these firms source their configuration “knob-turning” overseas, simply looking for low-priced talent from third-party sites for gig-development, and seeking to mark it up. One of The Lab’s COO clients recently said, “It’s no good to have a low price and then not be able to deliver a single bot after months of effort.”

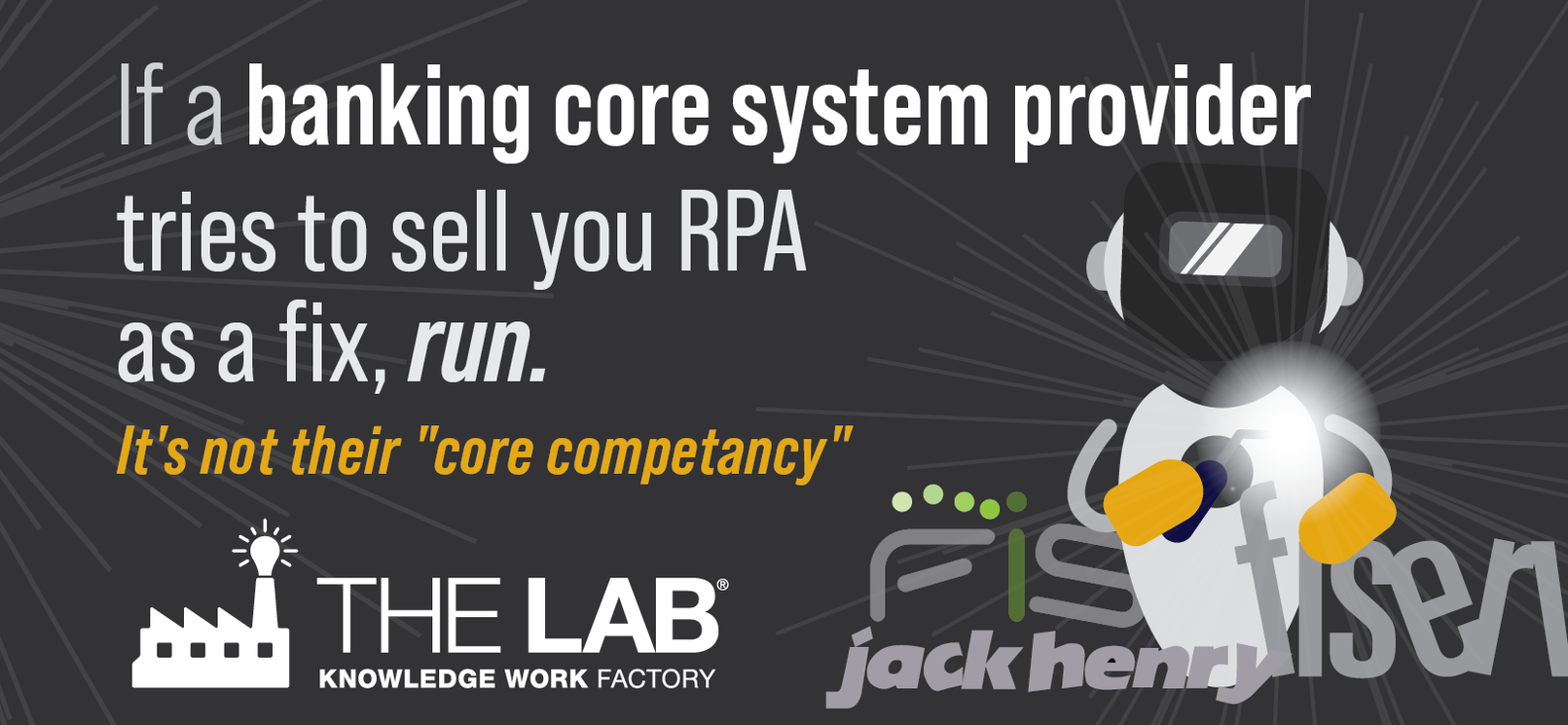

- Core providers make a core mistake. Here’s a growing trend: Some of the core providers themselves are trying to sell “RPA” to their captive banking audiences. “Let us fix your problem with our new offering!” Wait. “Problem”?? The problem is the lack of interoperability between the core system modules themselves. So that’s not an “upgrade.” That’s “a bug that the provider should fix.” And by the way: If that automation bolt-on only exists within the costly, proprietary ecosystem of that particular core app, then it’s not RPA. As you know, you also rely on Excel, Outlook, web portals (SBA for PPP, anyone?), and more. True RPA spans, and automates, all of that.

The bottom line

All of these stories have had a happy ending for the banks involved: They turned to The Lab. And you should, too. We can get you automated, and score quick wins, in just a matter of weeks. And we do it all remotely, from our U.S. offices in Houston. Nothing is outsourced or offshored, ever.

Want to learn more? It’s easy. Simply call (201) 526-1200 or email info@thelabconsulting.com to book your no-obligation 30-minute screen-sharing demo today. You’ll see real Lab-built banking bots in action, and get all your questions answered by our friendly experts. Book your free demo now!