Powerful “Top-20” use-case bot blazes through credit-card and ACH exceptions reversals in one pass, saving banks and credit unions 200 to 2,300 hours!

We can’t overstate how much time your bank or credit union is spending—monopolizing the time of valued staff members—on ACH-related chores. They are absolutely the most resource-draining activity you face, every single day. That’s why these are always among the “Top 20” automation use-cases that we see, and implement, here at The Lab, North America’s banking-automation, process improvement, and standardization authority.

Consider these painfully-familiar back-office chores that are either directly or indirectly ACH-related:

- ACH Stop Pays

- ACH Stop Pay Suspect

- ACH Returns

- ACH Exception Reversals

- ACH Recons

- Check Stop-Pay

In this article, we’re going to drill down to one of the most onerous chores on that list: ACH exception reversals. In fact, we’re going to talk about two flavors of those reversals—both credit-card and ACHs—because this “killer use-case” bot from The Lab handles both of them in a single pass.

We’ll walk you though how the bot performs this magic, below. But know that we’ve also created an informative and entertaining two-minute video showing this bot doing its work, which you can view right here:

Processing ACH exceptions reversals is defined as employing robotic process automation or RPA platforms—such as those offered by bot purveyors like Microsoft Power Automate, UiPath, and Blue Prism—to take over what had traditionally been the manual process of diving into various platforms, systems, databases, and screens to reverse selected transactions, based on their associated reason codes and dollar amounts.

When you think of a bot that’s automating a process at a bank or credit union, you naturally think of it toiling with bank-or-credit-union platforms, such as the core.

That’s certainly the case, but here at The Lab, we’d like to invite you to broaden your perspective, and your thinking, when it comes to banking automation.

This bot is certainly a great case in point. For its very first chore, it navigates to a folder on the bank’s shared drive, and accesses a report. Simple as that.

What it does next is not so simple—not for a person, that is. The bot takes this report—in this case, it’s the daily “ACH Exceptions Report”—and then memorizes the entire thing. For a computer-based bot, that’s easy. For a human, the prospect of memorizing scores of account numbers, reason codes, and dollar amounts is impossible.

For the bot, it’s not only easy. It’s fast. It memorizes the entire report in the time it basically takes to “copy the contents to its clipboard.”

Now the bot is ready to log in to the core. Just like a person, the bot doesn’t really care which core provider is being used; it can be trained to use any of them, including:

- Fiserv Signature

- Jack Henry Silverlake

- FIS Insight

- Others

The bot—and bank—in this example are using Episys Quest. The bot logs in, with its own user name, password, and permissions, just like a person.

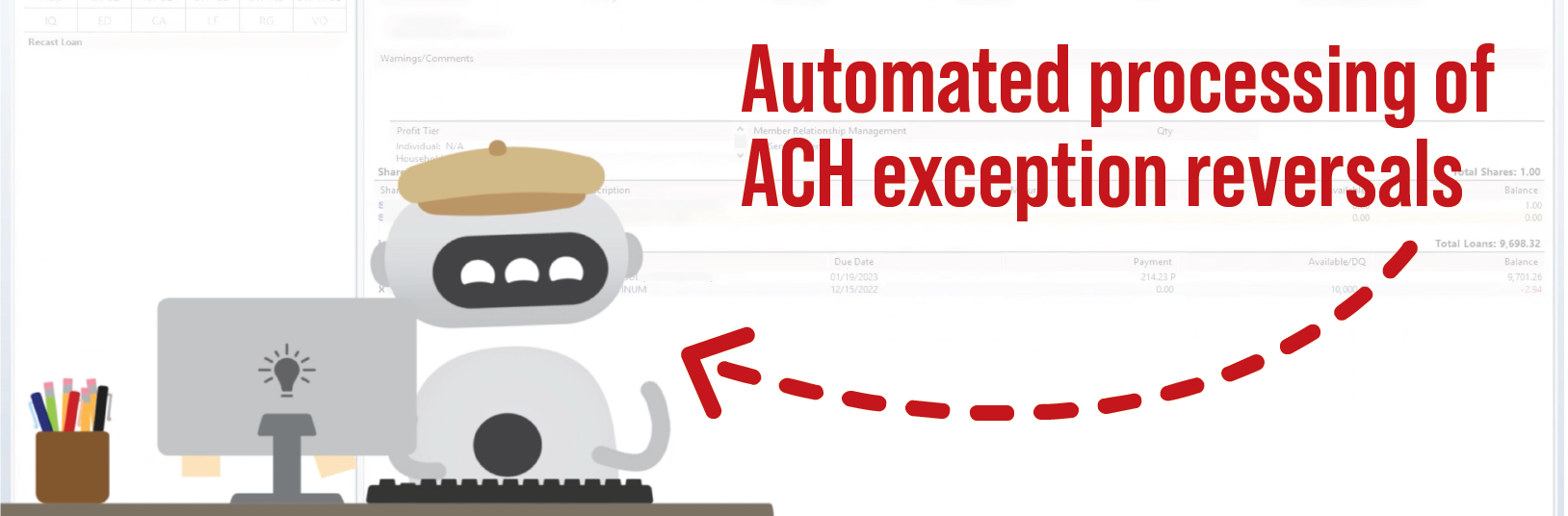

Now it dives into the details. It selects the proper sym. It navigates to the “Teller Transactions” section of the core, where it calls up all of the recently-accessed accounts.

Now it’s decision time. For each one, the bot determines—automatically—whether the transaction is a credit-card reversal or an ACH exception reversal. And it proceeds with each one accordingly.

The first transaction encountered by the bot, in this example, is an ACH. And what the bot does, at this point, is as detailed as it is amazing:

First, it checks to see if the exception matches the trace number and dollar-amount from those in the “ACH Exceptions Report” it had already memorized.

In this case, it does. So it keeps on moving. Next it checks the “reason codes” from the report, to make sure the loan is ready for processing. These reason codes include, for example:

- Insufficient Funds

- Account Not Found

- Account Closed

- Payment Stopped

- Account Frozen

- Originator Not Known

- Unauthorized Debit

- And many more

Again, this loan is ready for processing. Now the bot launches the Correction Wizard in Episys, where it selects the account with the incorrect or missing transaction. It then grabs the last good-payment date, and recasts the loan from that date. It even types in the comment for “Return ACH Payment” in the Correction Wizard. Once it’s done, it zips back to the “recent accounts” and moves on to the next transaction.

But what if things like the trace number, amount, or reason codes don’t match what it had memorized? Not a problem: The bot simply logs those few items it can’t handle in an Exception Report, which it will email to the team when it’s done.

For any credit-card reversals, the bot is programmed to handle them differently. For these, the bot logs into the core’s payment system—in this case, QuickAssist—using the credit-card number it had memorized from the original “ACH Exceptions Report.”

Once it finds it, it continues to the “Payment History,” where it searches for the amount and reverses the payment. The bot even uses the application’s pull-downs to choose the proper “reversal type,” such as “Reverse Payment With No Fee.”

Again, in the rare instances where the bot can’t find what it’s looking for, it adds that item to the Exception Report it will email to the team for human intervention.

In your bank or credit union, it takes a person eight to ten minutes to process a single reversal. And, depending on the size of your institution, you must process anywhere from dozens to thousands of these, every day!

The bot, in contrast, does them in just seconds, fully automated. That means faster service for your customers, improved security and process flexibility, and most importantly, more time for your valued team to handle higher-value activities.

Banking and credit union executives are turning to The Lab to accelerate automation/AI readiness, lay the groundwork for strategic end-to-end process/product innovation, and implement Robotic Process Automation (RPA) “bots” to automate dozens of processes. With as few as three RPA bots from The Lab, you, too, can begin implementing on your company-wide strategic innovation roadmap—and start seeing hard-dollar benefits within weeks.

The best way to appreciate the speed and game-changing power of the automation suites installed by The Lab is to see it for yourself. Schedule a free, no-obligation 30-minute screen-sharing demo with The Lab, and you’ll see RPA bots in action. You’ll learn how we do all this from our U.S. offices in Houston, with nothing outsourced or offshored, and get all your questions answered by our friendly experts. Hedge your company against employee turnover, eliminate errors, and put your organization on a roadmap to accelerate your automation and AI initiatives.

Simply call (201) 526-1200 or email info@thelabconsulting.com to book your demo today!