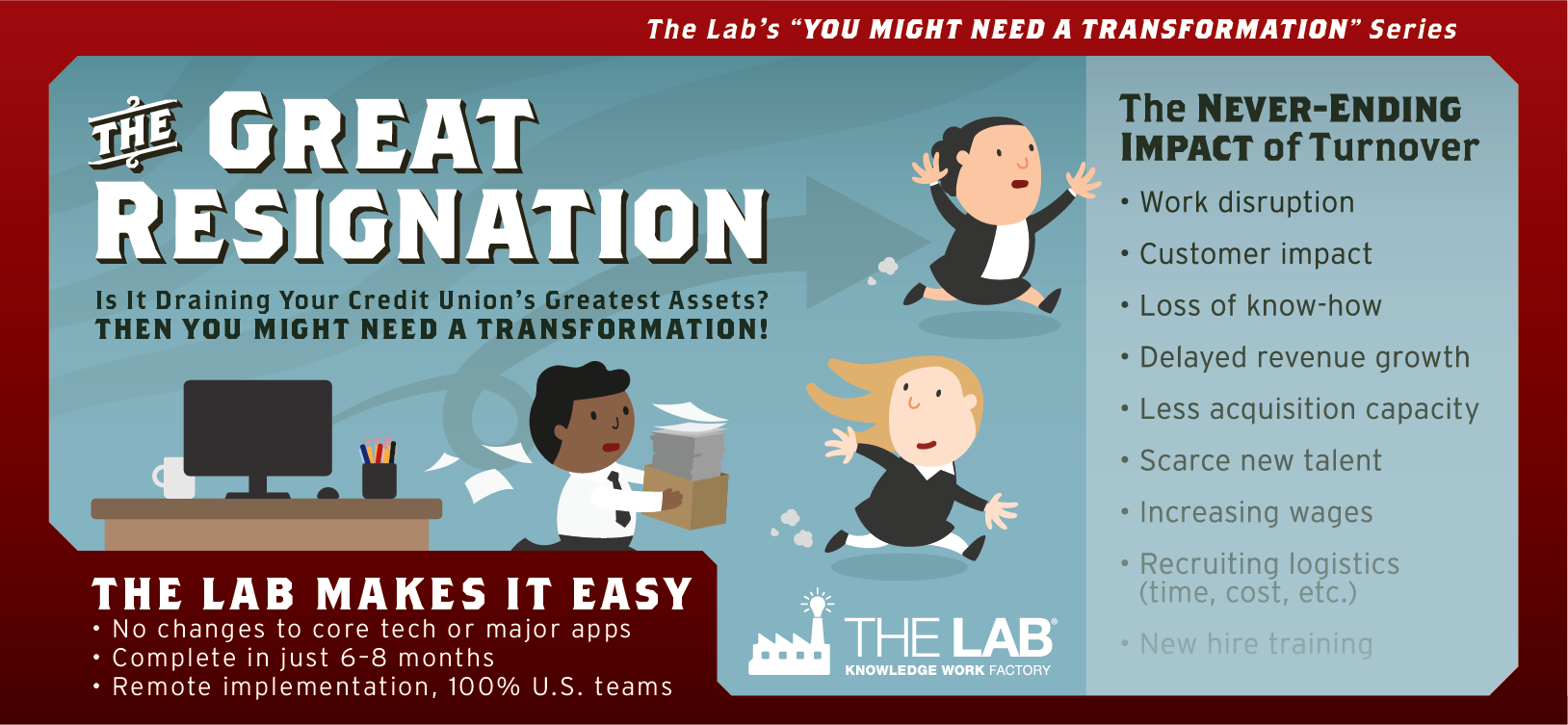

Your credit union’s employees are its greatest assets. Yet the Great Resignation is testing operations resilience like never before. You need to leverage every person-hour of capacity. You need to weed out every wasted keystroke. You need to automate every task that can be automated. And you need to make each worker’s job higher-value and more fulfilling, to retain your high performers. The Lab cannot change what’s happening in society.

But we can help you achieve all of the above. In just months. And we make it easy for you.

You might need a transformation… once you begin answering some un-asked questions

Transformation triggers hide in plain sight. You just need to know where to look. Ask yourself the following never-asked-questions or NAQs.

NAQ 1: How much knowledge-worker time is spent correcting not-in good-order or “NIGO” errors?

ANSWER: An average of 30 percent of their day. Every day, organization-wide.

By ignoring the upstream root causes of NIGO, you’re squandering nearly a third of your most valuable, hard-to-replace assets: Your workers.

The Lab’s Counter-NIGO Bots can preempt these corrections at the root cause.

NAQ 2: How much knowledge-worker time is consumed by needless variance, i.e., performing identical tasks via one-off, less productive methods?

ANSWER: An average of 20 percent of organizational capacity.

You need to narrow the needlessly wide, unmeasured gap between your highest and lowest performers.

The Lab’s Anti-Variance Bots constantly measure and help management narrow the gaps from one-off work methods.

NAQ3: What percentage of knowledge workers’ tasks could be automated, right now?

ANSWER: About 20 percent of knowledge work activities can be automated, right now—after basic standardization.

So automate now! Stop your brightest employees from fleeing the embarrassingly mindless chores they resent, such as reconciliations and other “stare-and-compare” activities.

The Lab’s catalog of Chore Bots for Credit Unions includes more than 200 of the most common use-cases across the enterprise. Begin deployment in days!

NAQ 4: How can you get the data to grow revenue?

ANSWER: Today, you have all the data needed. (Yes, actually you do.) It’s just fragmented across lots of disconnected systems.

The Lab’s Data-Wrangling bots continuously compile and reconcile inconsistent data elements into a single source of truth—for profitability.

Let The Lab unlock the power of all your data…wherever it’s hiding.

…How The Lab makes it EASY … On Your Organization

Organization-Friendly Engagement Design

We spent three decades refining every aspect of The Lab’s transformation engagement model. We’ve made it easy for all clients—from the C-Suite to the front line—to understand and manage the initiative. Examples below:

Minimal, Concise Use of Client Time

• Process maps: 3 hours each in 30-60 minute intervals

• Weekly debriefs: 30 minutes each with “flash report”

• Executive updates: 60 minutes every 2-3 weeks

Meaningful, Measurable Transformation Benefits

• Capacity gains: 20% to 40% or more

• Margin gains: 5% to 10% or more

• Typical ROI: 3X to 5X (12 months)

Checkpoints, Guarantees to Reduce Risk

• Transformation guarantee: “self-fund” in 12 months

• 3 week checkpoint: cancel by week 3 for full refund

• Fixed-price proposals: pricing fixed based on labor costs

Domestic, Remote Delivery

• Based in Houston, Texas

• No travel costs or down-time

• Nothing outsourced or offshored

…How The Lab makes it EASY… Using THREE Decades of Data & Tools

The Lab’s Nano-Scale Standardization™ methodology is so powerful, it’s patented. It’s the key that unlocks extensive digital automation opportunities (use cases). And it makes short work of previously impossible or unfeasible tasks—like mapping an enterprise wall-to-wall. The Lab’s standardization templates are maintained at four levels of detail:

Enterprise & Organizational

• Publicly available data (FDIC, FINRA, etc.)

• Direct competitors, out-of-market peer comparisons

• Market demographics, share of wallet

End-to-End Business Processes

• Thousands of process map templates to start with

• In-house RPA bots to speed up map layout, edits

• Templates connect to process mining technologies

Process Work Activities (Avg. Time: 2 Min.)

• Common NIGO locations, root causes, solutions

• 20 standard “universal” work activity types

• Operational benchmarks to set targets

Nano-Scale Detail: Keystrokes & Mouse Clicks

• RPA use cases: >200 cataloged

• RPA configuration library

• All cores, CRMs, loan apps covered

Book your free screen-share demo!

The best way to appreciate the power of The Lab’s transformation service offering is to see for yourself.

We invite you to book your free, no-obligation screen-sharing demo. In just 30 minutes, we’ll show you how we’ve helped to transform other credit unions just like yours. You’ll see real credit union bots in action. And get all your questions answered by our friendly experts. Don’t weather another day of the Great Resignation alone.

Call (201) 526-1200 or email info@thelabconsulting.com to book your free demo today!