Save 1,400 to 5,000 hours of intense manual labor, with RPA banking bots

It happens every day—in fact, at the bank in this story, it happens 50 times a day. We’re talking about processing customer deposits that need to be either denied or have their holds extended, since they get flagged by your bank’s fraud-detection software.

This involves a lot of intensive, detail- and error-prone steps that your bank’s Deposit Operations team must take to deal with each and every one. Regardless of the fraud-detection and core systems that you use, you must:

- Find the suspicious deposits

- Update them in the core

- Process holds or denials for each

- Notify the customer of issue

- Maintain an audit trail of your actions, in both the fraud-detection platform and your core system.

The good news is that, regardless of your bank’s core system and fraud-detection platforms, this entire process can be automated, in just weeks, by The Lab. Based in Houston, The Lab is North America’s undisputed leader for banking automation, with 30 years of experience in helping banks with everything from mapping and standardizing processes to configuring and installing bots, all from our U.S. offices.

We’ll walk you through the steps that one of these bots “walks” in just a minute. But first, know that we’ve created a little two-minute video about it, which you can view here:

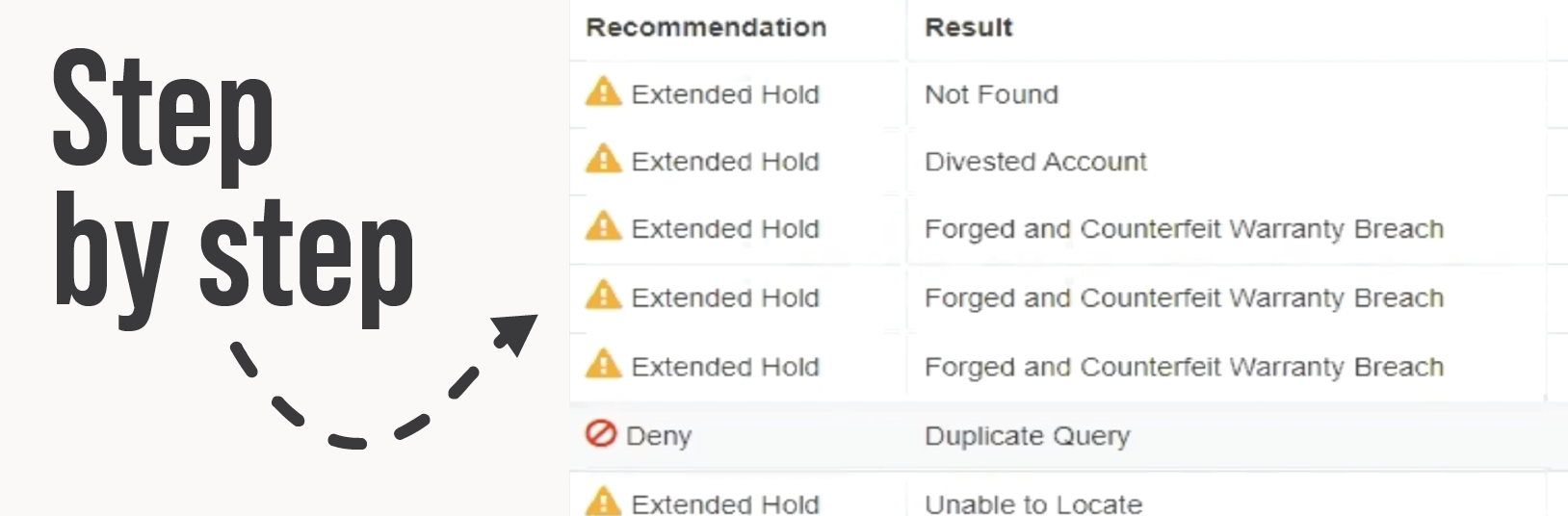

Regardless of the systems you’re using, there’s a ton of reasons that a customer’s recently-deposited check might not be ready for payment now—if ever. Among the reasons are:

- Extended hold

- Divested account

- Forged check

- Warranty breach

- Duplicate query

- Unable to locate

- Dormant/inactive

- Overpayment

That’s why you need to rely on a fraud-detection system, and its continually-updated database, to flag the suspicious entries for human follow-up.

This is where robotic process automation, or RPA, “bots” can come to the rescue. It’s because all of the tasks we’re about to describe—performed by bots—were performed, until very recently, by overworked staffers at the bank in this example.

When we say that bots from The Lab can handle any system that a person can, we mean it. They have their own log-in’s and passwords, just like a person. When it comes to core systems, we’ve configured bots to use:

- Fiserv Signature

- Fiserv DNA

- FIS Horizon

- Jack Henry Silverlake

- Symitar

And when it comes to fraud detection, we can configure the bots to use any popular platform, such as:

- Verafin

- Jack Henry Yellow Hammer

- Fiserv Fraud Detect Solution

- FIS FraudSight

- NICE Actimize

- And more!

The bot in this example starts by logging in to the bank’s fraud-detection platform; in this instance, it’s Advanced Fraud Solutions or AFS. Once inside, it performs a batch-search—filtering (by clicking the appropriate check-boxes in the interface) solely for deposited checks that either need to be denied or require an extended hold.

As you can imagine, a broad search like this turns up a lot of suspects. In the example video, there are actually 74 hits from this one search. And each one requires investigation. That takes an all-too-fallible human about 20 minutes.. for each one. Remember that number; we’ll revisit it later.

Now, with its report “in hand,” the bot logs into the bank’s core. In this example, it’s Fiserv Precision; but remember, bots from The Lab can work with any core, such as those we’d listed earlier.

Once inside, it starts on the first questionable deposit from the filtered list that was flagged in the AFS fraud report. It types in the date of the transaction, the dollar amount, the account number, the routing number, and check number. Think of how many fields and digits that represents—and one single human typo would derail the entire process. But the bot, unlike a human, never makes typos.

The bot drills down to the screen that has the actual image of the suspicious check.

And then, faster than a person can type—faster, indeed, than you can read this sentence—the bot moves back to the core to process the hold.

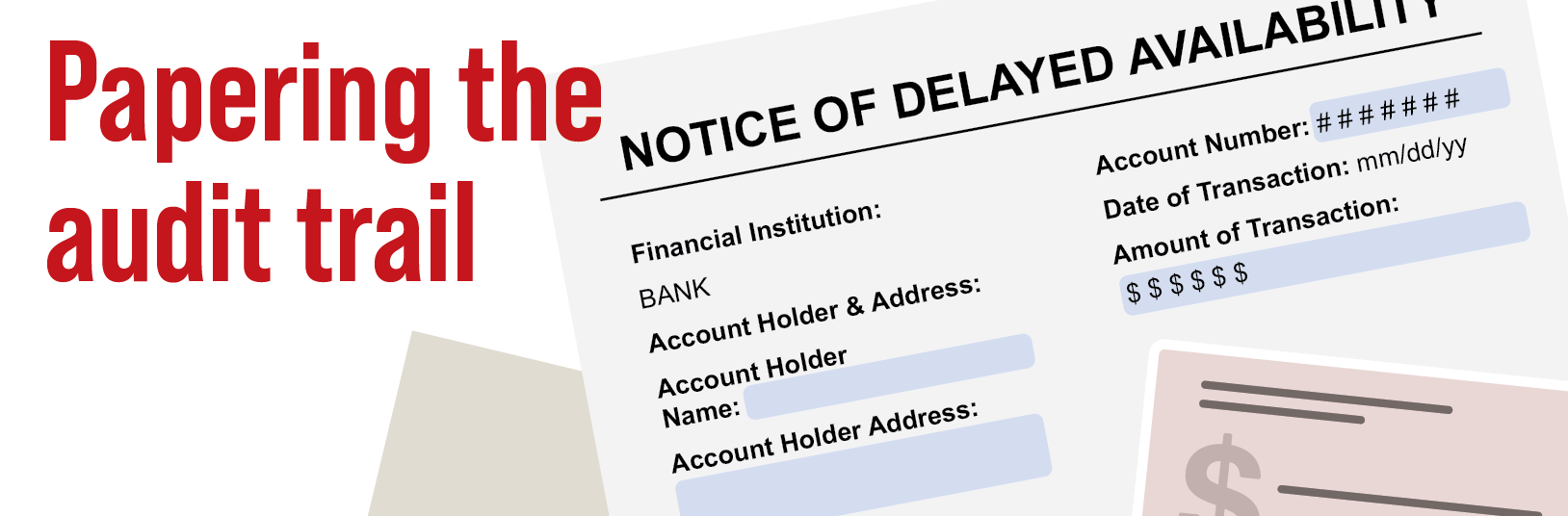

In the core, the bot brings up the Hold Form—effectively a template for a letter to the customer—and fills out all the requisite fields:

- Account number

- Transaction date

- Amount of transaction

- Account holder name

- Account holder address

In this case—informed by AFS—the bot selects a seven-day Exception Hold, checking the boxes for

“We believe a check you deposited will not be paid for the following reason

—and the subsequent

“We have confidential information that indicates that the check may not be paid.”

The bot then converts the letter to a PDF, giving it a proper filename, and saving it to the appropriate destination drive and folder on the bank’s network.

Finally, the bot switches back to AFS (the fraud-detection platform), where it marks that transaction as “Held,” and gets ready to move on to the next one from the list.

Remember how we’d mentioned, earlier, that it takes a person—errors and all—about 20 minutes to process a singe hold like this one? Well, the bot does it in just 120 seconds—that’s 10 times faster!

Consider this: At the bank in this example, they must process 50 of these a day. That’s more than 16 hours of work, every day. All told, this one bot saves the bank 4,400 hours of tedious labor, every single year. And since it eliminates this thankless drudgery, it also reduces the odds of employee turnover. The people are, finally, freed for more valuable and fulfilling tasks.

See for yourself

Banking executives are turning to The Lab to accelerate automation/AI readiness, lay the groundwork for strategic end-to-end process/product innovation, and implement Robotic Process Automation (RPA) “bots” to automate dozens of processes. With as few as three RPA bots from The Lab, you, too, can begin implementing on your company-wide strategic innovation roadmap—and start seeing hard-dollar benefits within weeks.

The best way to appreciate the speed and game-changing power of the automation suites installed by The Lab is to see it for yourself. Schedule a free, no-obligation 30-minute screen-sharing demo with The Lab, and you’ll see RPA bots in action. You’ll learn how we do all this from our U.S. offices in Houston, with nothing outsourced or offshored, and get all your questions answered by our friendly experts. Hedge your company against employee turnover, eliminate errors, and put your organization on a roadmap to accelerate your automation and AI initiatives.

Simply call (201) 526-1200 or email info@thelabconsulting.com to book your demo today!