Finance Group & Procurement: Retailing

01/05/2023

Project Background

This company operates a chain of more than 500 luxury department stores and off-price designer outlets, as well as a direct-to-consumer ecommerce division. The “new” CFO was a longtime employee recently promoted from within—after a brief stint in IT as part of a management rotational program. From this IT assignment, he learned that the company’s technology was as modern as practical without crossing the line into unproven, bleeding-edge applications.

He also discovered that valuable technology features were under-utilized due to a lack of data standards. Everything from intake forms to data fields, event log definitions, and workflow sequences were designed differently—if designed at all. The inconsistencies caused the internal robotic process automation (RPA) team to struggle to find use cases for “business processes.” Even that term was defined differently, depending on the organizational location. These insights shaped the “standardization” agenda for his new job assignment.

Whenever technology failed to meet the business organization’s expectations, they pushed for upgrades. The CFO felt differently. He was confident that the technology was up to date; standardization was needed to unleash its potential.

For example:

• Ever since the deployment of a new “automated” reporting app, management reporting had grown more cumbersome, not easier.

• A new “auto-reconciling” feature in the general ledger system required so much preparatory effort for each auto-rec that it was just as easy to perform the task manually—which many employees still did.

• A recently installed accounts-payable technology was supposed to process over 85 percent of invoices with “zero touches” from finance employees. After 18 months of effort, they achieved less than half of that target. Once again, the organization clamored for new technology. Technology sales reps encouraged this misperception.

But the CFO knew that the current technology’s under-performance resulted from his company’s lack of capabilities in two, related areas: standardization and automation use-case discovery. He also knew that it was unrealistic to expect already-swamped employees to develop these capabilities. He needed outside help—and contacted The Lab.

Client Description, Project Scope, Objectives

Over a period that spanned generations, this retailer maintained a storied reputation for customer service by means of a large, well-compensated employee base. However, like all other traditional retailers, its business model was challenged by decades of unrelenting, structural change in the industry. Now, “storied service” would require “storied automation”—doing radically more with less.

The CFO wanted the finance group to lead the way. Its structure was typical of its peers. Over 80 percent of the headcount in finance was concentrated in accounting, reporting, A/P, A/R, and internal audit. Additionally, the CFO position included operational responsibility for the non-merchandise procurement group, which handled everything from real estate and store fixtures to IT assets and supplies of all types. This organization managed a $3 billion annual spend, served more than 3,000 vendors, and operated across 20 purchasing sites.

The project scope included both the finance and procurement groups.

In addition to massive productivity gains, the CFO had another, aggressive strategic objective for the initiative: He wanted to stealthily initiate transformation across the entire business by upgrading the finance group’s margin analysis and management reporting to unprecedented levels of highly-visible operational detail.

The Lab’s “Super KPIs” promised to document where value was made and lost in the business, i.e., “leverage points.” The objective was to provide executive visibility of inarguably-valuable opportunities with obvious improvement actions. Examples within finance and non-merchandise procurement:

• The costs of under-managed, “drop-everything” analytical requests for finance staff

• Non-merchandise suppliers with high “costs to handle”: unexpected delays, charges, and risk

The CFO planned to pilot Super KPIs in his organizations for possible expansion across the business.

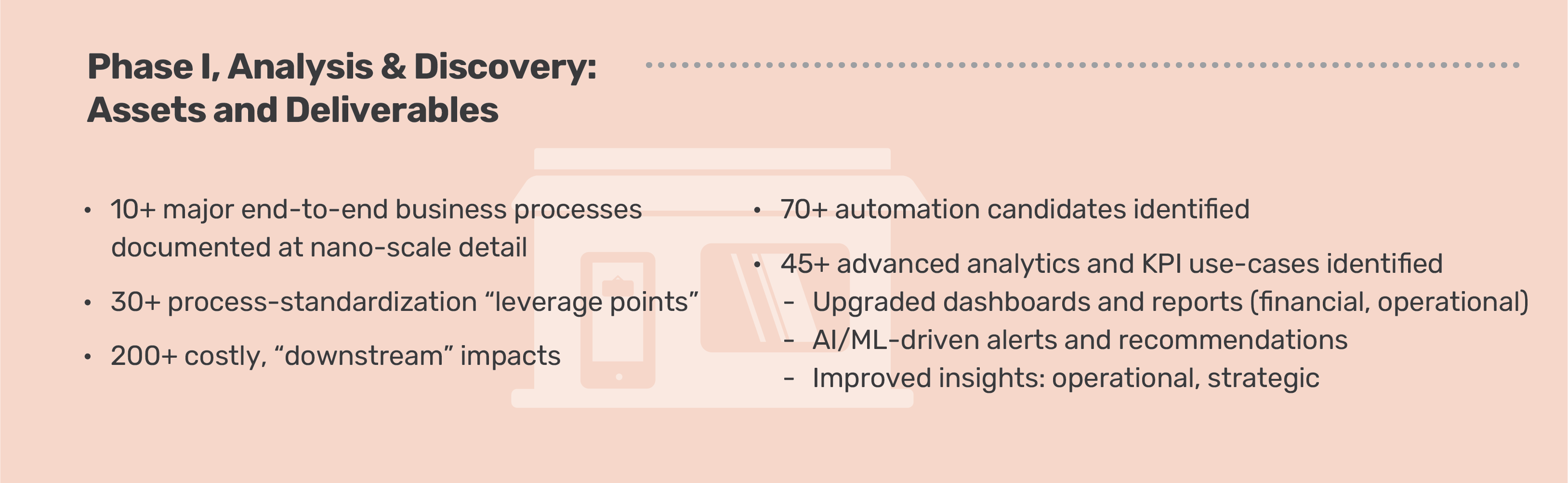

Overview: Phase I, Structured Discovery

The initiative began with a six-week Phase I Structured DiscoveryTM analysis covering all major end-to-end business processes, including:

• Finance

– Accounting

– Reporting

– Accounts Payable

– Accounts Receivable

– Internal Audit

– Fixed Assets

• Procurement

– Supplier Relations

– Supplier Services

– Purchase Order Issuance

– Rebates

– Incident Management

The Lab’s database of patented standardization tools, analytical models, and documentation templates enables an approach that we call Structured Discovery. It takes advantage of the high level of similarities found across all businesses and industries.

First, we gather clients’ business data—directly from systems—and load it into The Lab’s pre-structured data models to generate preliminary insights. Next, we use our database of templates to rapidly create business process maps that identify the most valuable “leverage points” in the business, where standardization can reduce rework and variance while enabling automation—using existing technology or robotic process automation (RPA).

Finally, we select the most valuable automation use cases from The Lab’s catalog of RPA bots.

Spoiler alert: These leverage points are highly similar across businesses and even industries. But that’s also the beauty of Structured Discovery—less mystery means less uncertainty. Structured Discovery identifies the usual, proven opportunities and fine-tunes these to your business.

It is also:

• Economical. Performed remotely, worldwide

• Efficient. Frugal use of client time, subject-matter experts (SMEs)

• Effective. Captures 85 percent of work activities (approx. two minutes each)

• Valuable. Automation use cases, customer-experience gains, increased margins

• Incremental. Do as much as you like: an enterprise, a process, an organization

For the finance organization, The Lab documented and analyzed current-state operations, from journal-entry recording to routine reporting—management, financial, tax, and regulatory. Non-routine or ad hoc reports were inventoried, sampled, and analyzed for content accuracy, integrity, and redundancy with other reports. The procurement organization was analyzed concurrently, using the same approach.

Findings: Phase I, Analytical Insights

During the Phase I analytical effort, The Lab identified roughly 30 leverage points. Problems at these points generated over 200 costly impacts further down the business process. For example, in finance, additions to the general ledger often increased complexity, errors, and workload without adding insights. Many management reports did the same. Within procurement, errors, and omissions in master data during new supplier onboarding created rework tasks that could last indefinitely.

Most leverage-point-related issues translate to non-technology standardization improvements that boost operational effectiveness, reduce avoidable rework, and enable automation. For this client, just over 60 percent of the improvements were non-technology.

For the remaining 40 percent of technology-dependent improvements, no new IT systems were required:

The necessary technologies were already deployed in the business. After initial automation, most of the technology-dependent leverage points could be further augmented with artificial intelligence (AI) for simple decision-making and proactive, real-time notifications.

Overview: Phase II, Standardization Implementation

Working with management across both finance and procurement, The Lab designed a 30-week, “minimally invasive,” self-funding implementation program to increase standardization and automation.

Although work proceeded simultaneously across all segments of the two organizations, The Lab sequenced the emphasis to reduce disruption and ensure early documentation of results. Data standardization, KPI implementation, and operational reporting were the primary focus of the early weeks.

Once operational tracking and reporting capabilities were functional, work standardization increased in scope and intensity. The goal was to reduce or eliminate the causes of rework and needless variance. As each leverage point was standardized, as much work activity as possible was configured for processing by existing technology and/or RPA bots.

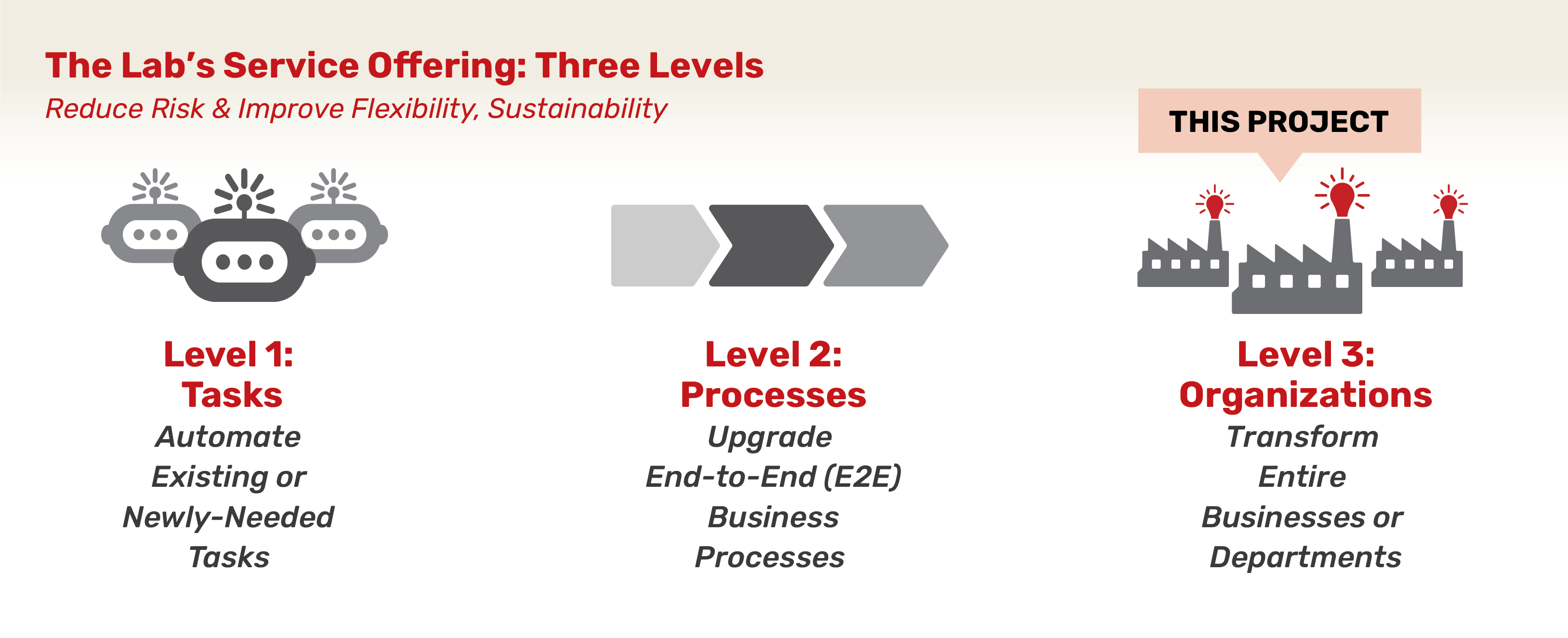

The Lab maintains a three-tiered service-offering structure (plus post-implementation support) to make implementation flexible and sustainable for clients:

Improvement Examples, Finance Group & Procurement – Retailing

The Lab worked to improve all 30 leverage points. Some improvements applied to all, while others were specific to each. However, greater emphasis was invested in the top 12 leverage points, which accounted for more than 70 percent of the total available benefits.

Post-Implementation Support, Sustainability, & Automation

The Lab provided hassle-free post-implementation, hourly sustainability support for this client to maintain automations, process standardization, and operational data-analytics models implemented during the Phase II engagement. If the client’s team was not up-skilled enough to perform any needed automation updates, they leaned on The Lab for Tier 3-level support. If analytics dashboards required additional views or data connected, The Lab’s team was a simple phone call away.

The Lab Makes It Easy

Organization-friendly engagement design

At The Lab, we’ve spent three decades refining every aspect of our transformation engagement model. We’ve made it easy for clients—from the C-Suite to the front line—to understand and manage the initiative:

• Minimal use of client time: One to two hours each week, maximum.

• Measurable benefits: Typical 12-month ROI is 3x to 5x.

• Pre-built templates and tools: Process maps, data models, bots, and more.

• U.S.-based, remote delivery: Nothing is ever outsourced or offshored.

Designed to reduce risk, increase success

Since 1993, The Lab has led the industry in eliminating risk for our clients. Whether your engagement involves a handful of bots or wall-to-wall transformation, we make it easy to do business with us:

• Fixed pricing and clearly defined scope

• Pre-project feasibility/value assessments at nominal cost

• Early-out checkpoints and options

• Money-back guarantees

The best way to learn about The Lab’s patented Knowledge Work Standardization® approach is to book your free, no-obligation 30-minute screen-sharing demo. And you’ll get all your questions answered by our friendly experts. Simply call (201) 526-1200 or email info@thelabconsulting.com to book your demo today!